Ethereum Primed for $4,700 Retest: Is Dark Money Flooding Into ETH?

Ethereum's gearing up for another run at its previous all-time high—and this time, the momentum feels different.

Whispers of institutional accumulation are getting louder. Large, off-exchange buys have been stacking up, suggesting something bigger might be brewing beneath the surface.

Is it dark money? Maybe. Or just smart money positioning before the next leg up. Either way, ETH looks poised for a significant move.

Timing a crypto top is like trying to catch a falling knife—except the knife is also on fire and trading 24/7. Good luck with that.

Ethereum Price Analysis: How High Could ETH Go If the $4,700 Neckline Breaks?

Ethereum is showing renewed strength, with technical signals pointing to a possible breakout that could send prices toward $5,500.

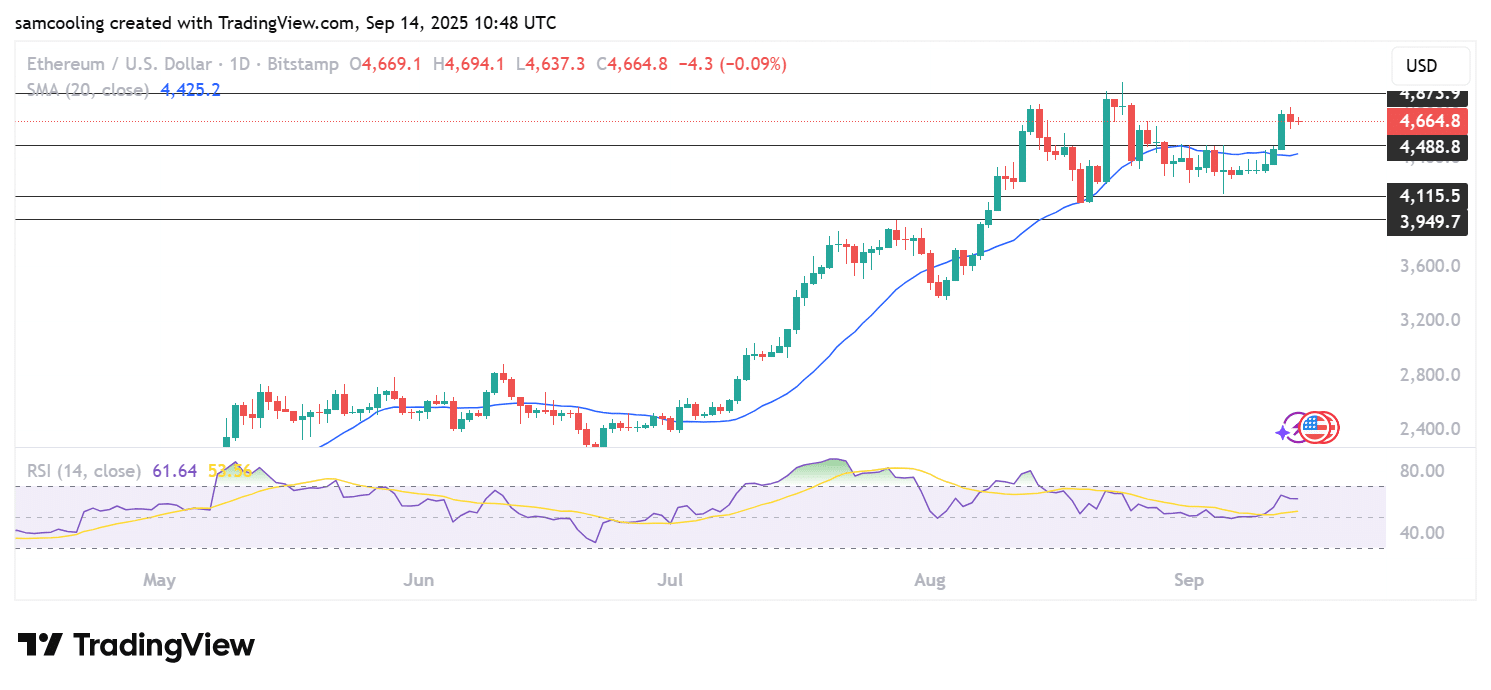

As per Tradingview data, ETH trades NEAR $4,660, holding above its short-term moving averages on the 4-hour chart.

(Source – ETH USDT, TradingView)

The 50-EMA sits at $4,462 and the 100-EMA at $4,421, both trending upward. This setup suggests buyers remain in control despite minor pullbacks.

Recent sessions have also seen higher volume, supporting the MOVE that lifted ETH from the $4,300 range to above $4,650 in just a few days.

The broader structure shows a recovery trend after weeks of sideways action. Short-term candles reveal brief dips followed by fresh buying, a sign of steady demand.

If ETH holds support above the 50-EMA, momentum may continue. If not, price risks sliding back to the $4,400-$4,300 zone, where both moving averages converge.

Analyst Titan of Crypto pointed to an Adam & Eve double-bottom pattern on the daily chart.

(Source – X)

The formation combines a sharp “V”-shaped low with a rounded base, signaling a potential reversal. The neckline lies just below $4,700, close to current levels.

A confirmed breakout above that neckline would project a measured move target of $5,500, in line with historical resistance. This adds weight to the view that ethereum could be setting up for a more substantial rally if buying pressure holds.

What Are Derivatives Telling Us About Ethereum’s Next Move?

If Ethereum breaks above the neckline, traders could turn bullish, with $5,500 as the next target. But if it fails, the price may pull back to test how solid the recent rally really is.

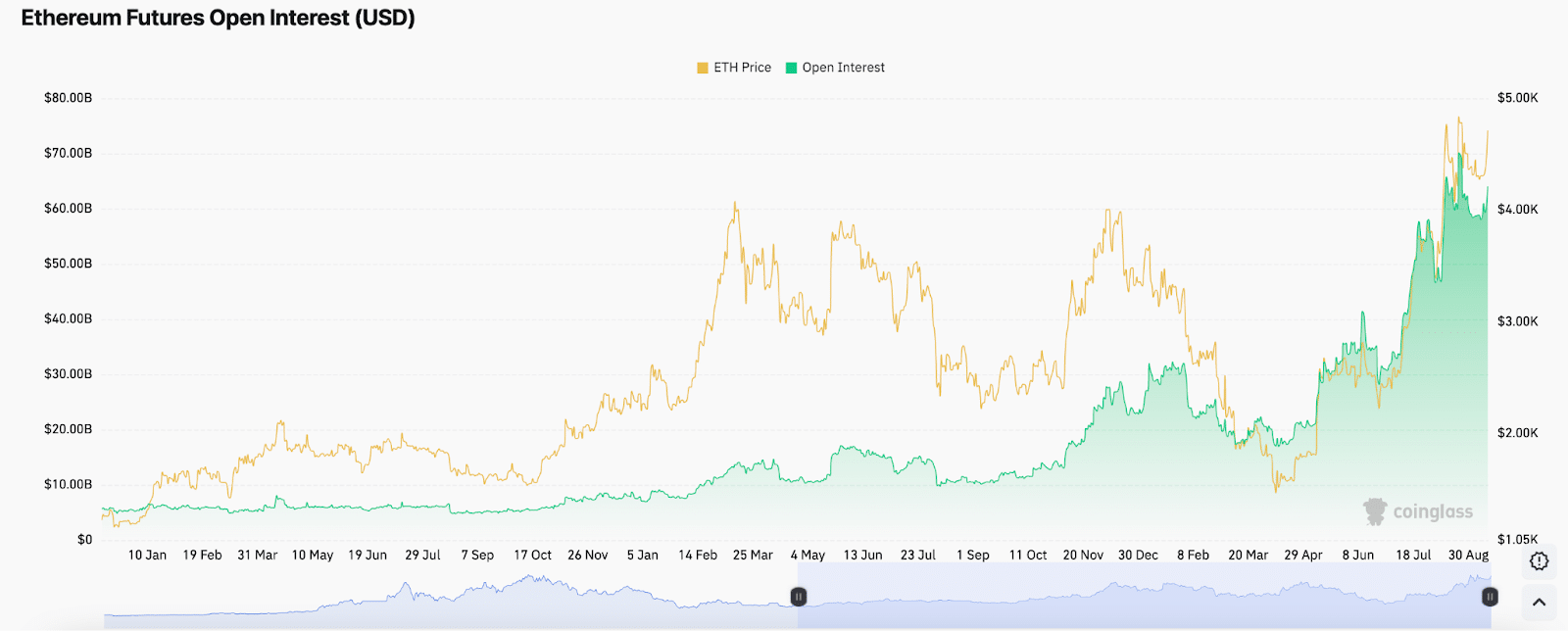

Derivatives activity shows elevated positioning. CoinGlass data puts ETH futures open interest near $64Bn, while funding rates last session hovered around 0.01% across major exchanges, steady, but not excessive.

(Source – Coinglass)

Spot ETF flows have also improved. On Sept. 12, after several days of outflows, Farside Investors reported net inflows into US ETH funds, pointing to fresh institutional demand.