PPI Report Timing and CPI Data: The Key to Unlocking September Fed Rate Cuts

Markets hold their breath as two economic indicators threaten to make or break the Fed's September decision.

The Inflation Countdown

Producer Price Index data drops first—the canary in the coal mine for consumer inflation trends. Then comes the Consumer Price Index report, the heavyweight numbers that historically move Fed policy needles. Timing couldn't be tighter with the September meeting looming.

Behind the Scenes at the Fed

Powell's team watches these metrics like hawks. Cooler numbers could justify the first cut in months; hotter data might push tightening talks back on the table. Either way, traders are already positioning—because nothing says 'stable economy' like betting the farm on monthly government spreadsheets.

The Bottom Line

Forget earnings reports or geopolitical drama—this week belongs to economists and their spreadsheets. When central bank policy hinges on decimal points in inflation data, maybe we're all just speculators in suits.

PPI Report Time: Will Inflation Be a Dealbreaker for Fed Cuts?

The next 48 hours will reveal how severe stagflation has become.

PPI tonight / CPI tomorrow. pic.twitter.com/pCs3NdpF4p

— The Great Martis (@great_martis) September 9, 2025

The most impactful releases this week will be the Producer Price Index (PPI) on Wednesday and the Consumer Price Index (CPI) on Thursday. Both reports will test whether Trump’s tariffs are pressuring the Fed to cut rates.

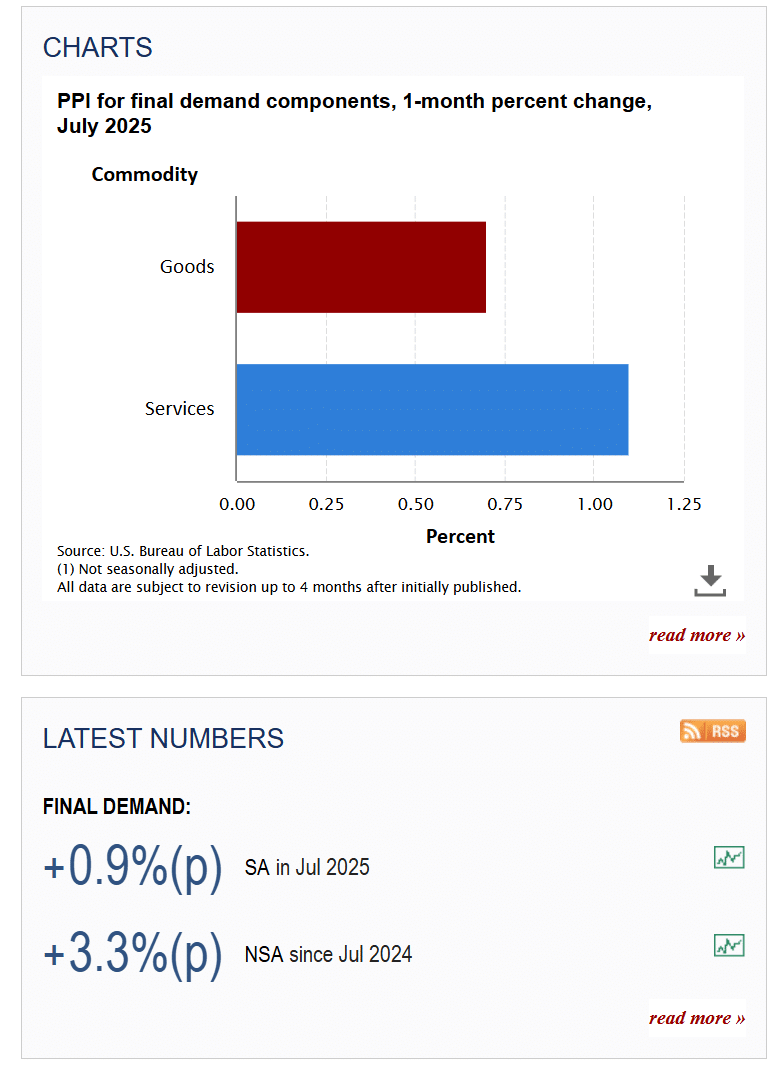

Year-over-year CPI is expected at +2.9%, up from +2.7% in July. Core CPI is projected at +3.1%, matching February levels and still well above the Fed’s 2% target. On the wholesale side, PPI is forecast at +3.3% headline and +2.8% core, also trending higher.

According to Dow Jones, economists see 0.3% monthly increases across the board. That WOULD put headline inflation at its highest point since January.

On the surface, a 3-handle on both CPI and PPI should spook markets. Not to mention the recent weak jobs data gives the Fed cover to act on its other mandate: boosting employment.that rate cuts remain on the table despite inflation because policymakers see more risk in labor market deterioration than in a short-term inflation uptick.

Bond yields pulled back after last week’s JOLTS data showed job openings at 7.18M, the lowest since 2021.

Meanwhile, some other important macro to keep track of:

- Gold surged past $3,670/oz, setting new ATHs

- Silver slipped below $41/oz

- WTI crude hovered above $63/barrel amid talk of new Russian sanctions.

Bottom Line: What CPI and PPI Mean for Bitcoin and Markets

The rising supply of government debt, combined with sticky inflation, has strained bond demand worldwide. As Vanguard’s Roger Hallam noted: “It’s almost a perfect storm of concerns over fiscal policies becoming inflationary, potentially more global issuance, and not enough demand.”

Even if inflation comes in hotter than expected, it may not derail Fed cuts this month. Yet all this negative economic data should be worrisome for the average middle-class American.

Key Takeaways

- The PPI report time for August 2025 is scheduled to be released on Wednesday, September 10, 2025, at 8:30 a.m. Eastern Time.

- Year-over-year CPI is expected at +2.9%, up from +2.7% in July. Core CPI is projected at +3.1%, matching February levels.