SOL USD Primed for Explosive Rally? $300 Target in Sight as Corporate Giants Raise Billions for Solana Acquisition Spree

Wall Street's latest obsession isn't stocks or bonds—it's Solana. Major public corporations are mobilizing unprecedented capital reserves specifically targeting SOL acquisitions, signaling a potential paradigm shift in institutional crypto adoption.

The Corporate Gold Rush

Investment committees that once dismissed cryptocurrencies now scramble to allocate billions into Solana's ecosystem. The fundraising frenzy mirrors early Bitcoin institutional adoption—but accelerated tenfold. Traditional finance veterans suddenly talk validator nodes and delegated stakes over martini lunches.

Technical Breakout Imminent

SOL's chart structure suggests consolidation below critical resistance could precede explosive upside. Market technicians note diminishing sell pressure coinciding with massive OTC accumulation—classic breakout precursors. The $300 price target represents not just psychological resistance but a key Fibonacci extension level.

Ecosystem Momentum Accelerates

Developer activity across Solana's network hits new records weekly. From DeFi protocols to NFT marketplaces, the infrastructure expansion supports sustained organic demand. Meanwhile, Ethereum's gas fees have investment bankers expense-reporting their blockchain interactions—again.

Institutional FOMO Reaches Fever Pitch

Hedge funds that missed Bitcoin's early rallies now overcompensate with aggressive SOL positioning. The same analysts who called crypto a 'fraud' in 2018 now publish price targets with more decimals than their compliance departments can count.

When corporate treasury committees start yield farming between board meetings, you know we've either entered financial nirvana or the final speculative bubble—and Wall Street never cares which until after the fact.

(Source:)

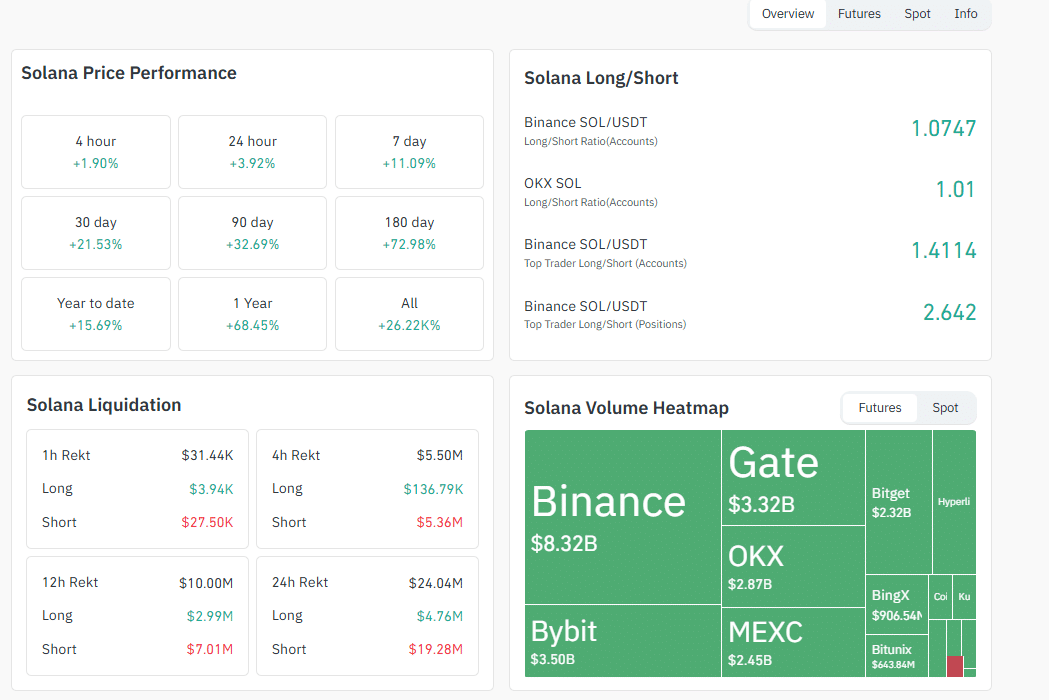

Scanning Coinglass data shows that sentiment is shifting in favor of bulls. On Binance, the largest exchange by trade volume, top traders are aligning their positions and betting for bulls. The long/short ratio is 1.4 when looking at accounts and even higher, at 2.6, when looking at positions. This skew suggests that more traders are confident that SOL USD may extend gains, soaring above $220 towards all-time highs.

(Source:)

DISCOVER: 9+ Best High-Risk, High-Reward crypto to Buy in 2025

Is SOL USD Ready To Rip? Time For Solana Buyers To Target $300?

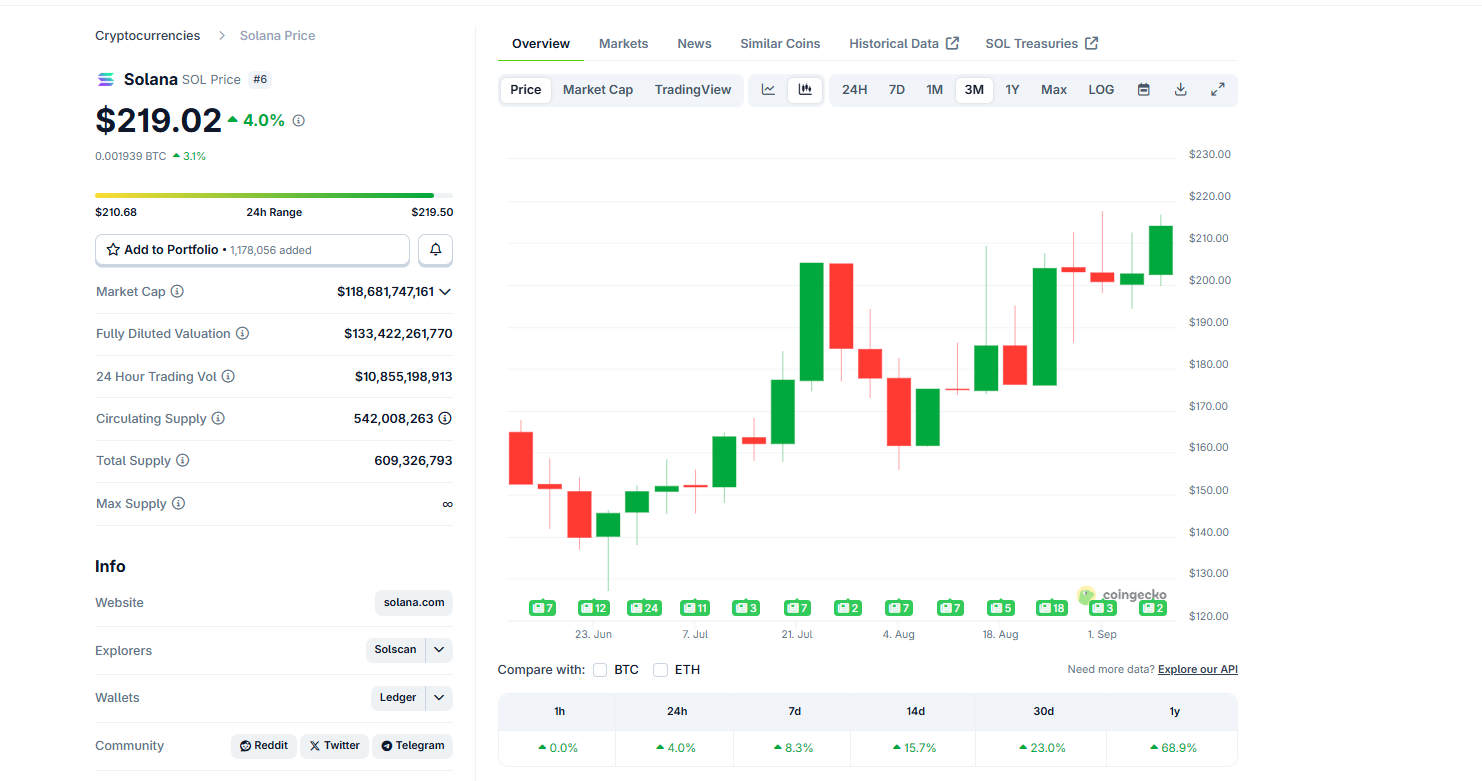

From the SOL/USDT daily chart,SOL ▲4.52% is trading at a key resistance level.

Despite losses in early September, the rejection of lower prices on September 7, and the build-up of demand yesterday, SOL USD is on the cusp of closing above August highs of around $220 in a buy trend continuation formation.

SolanaPriceMarket CapSOL$118.86B24h7d30d1yAll time

If the close is with surging volume, there is a high possibility that Solana crypto will easily breeze past $300, setting new all-time highs and lifting top Solana meme coins in the process.

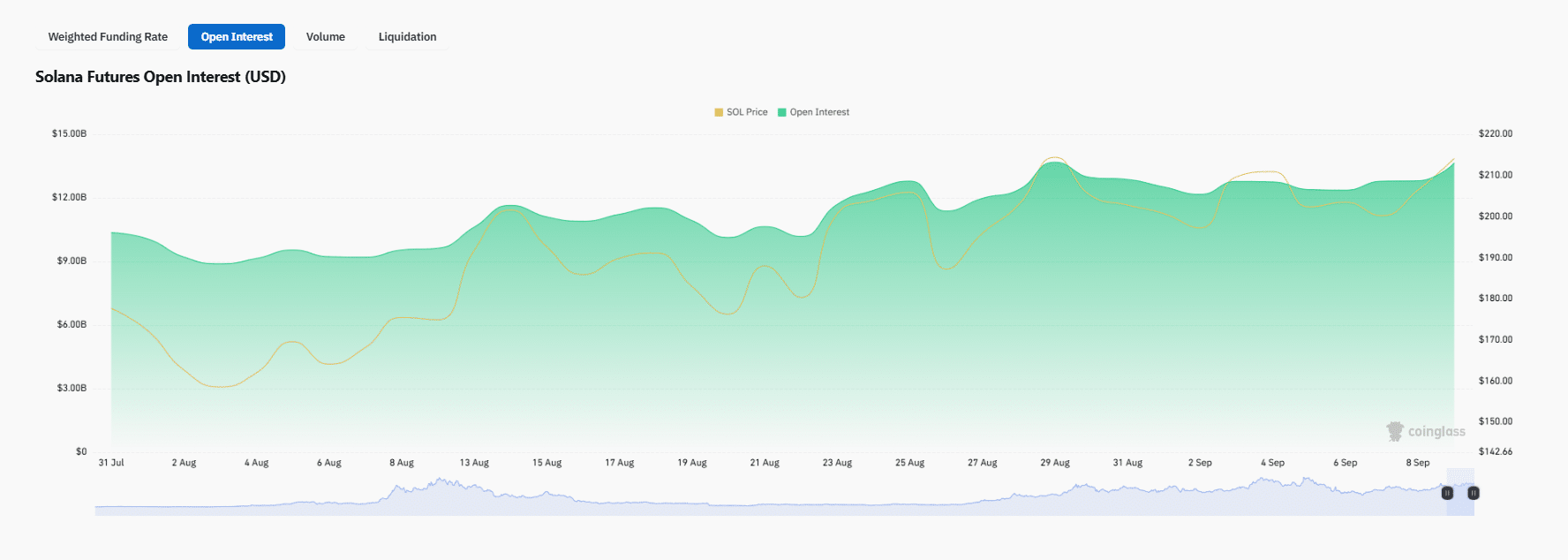

In anticipation of this welcomed breakout, Coinglass data reveals that open interest is rising. As of September 6, it stood at around $12.36 Bn, and as of September 8, it had risen to $12.80 Bn. During this time, SOL USD prices ticked higher, suggesting that buyers likely opened up more positions.

(Source:)

Interestingly, the leg up on September 8 was accompanied by a flush out of Leveraged shorts. Over $14 million of leveraged short positions were closed, the highest in over ten trading days. This development is typical with bulls preparing to push higher, as leveraged shorts are often liquidated, fueling the leg up, which may see SOL USD break above $300.

On X, one trader said it was time for some “Solana exposure”, cementing its position as one of the best cryptos to buy. In his outlook, the analyst expects the breakout to lift SOL USD to as high as $260 before a retest of all-time highs.

(Source:)

The breakout is from the rising wedge, where the resistance is at around the $215-$220 level.

What will Drive The Solana Price? Time To Dive In?

While the SOL/USDT technical candlestick arrangement might hint at where the solana price is headed, fundamental factors play a key role.

In a post on X, Ryan Watkins, the co-founder of Syncracy Capital, formerly Messari, thinks the incoming Solana crypto boom is thanks to public companies raising billions to buy SOL.

People watched $ETH go from $2.8K —> $4.9K purely off the strength of DATs, yet are somehow still skeptical of the $SOL DAT setup despite them raising proportionally way more cash to start.

Already $2B between $FORD, $STSS and soon another $1B+ from upcoming rumored $SOL DATs.… https://t.co/84WsvfJjHQ

— Ryan Watkins (@RyanWatkins_) September 8, 2025

Compared to the expansion of ETH USD from $2,800 to nearly $5,000 in August, Watkins said Solana digital asset treasuries (DATs) have raised even more capital. When these public companies begin buying Solana in September, SOL USD will shoot higher.

On September 8, Forward Industries raised $1.65 billion in private investment in public equity (PIPE) to fund a Solana buying strategy. Galaxy Digital, Jump Crypto, and Multicoin Capital, some of the crypto’s well-known venture capitalists, led the funding round.

New @solana DAT NASDAQ: FORD files 8-K with SEC announcing their $1.65 raise to transition Forward Industries Inc into a Solana Treasury Company.

"Forward Industries, Inc. Announces $1.65 Billion Private Placement in Cash and Stablecoin Commitments Led by Galaxy Digital, Jump… pic.twitter.com/bAnZs9MtlE

— MartyParty (@martypartymusic) September 8, 2025

In a press release, Michael Pruitt said they believe in Solana’s long-term potential. Their plan is to “build an active Solana treasury program” and add value to their shareholders.

As Forward Industries plans to buy SOL, it will follow others, including Upexi Inc., which currently owns more than 2M SOL, and DeFi Development Corp, which owns over 1.9M SOL.

According to Coingecko, the top Solana DATs currently control more than $974M of SOL, of which a sizable chunk has been staked, earning passive income.

Will Solana Crypto DATs Pump SOL USD Above $300?

- Solana crypto bulls confident of more gains

- SOL USD breaks above a key resistance level

- Solana analysts target $300

- Forward Industries joins other Solana crypto DATs, raises $1.65 Bn to buy SOL