Ripple’s African Expansion Accelerates as Nigeria Grapples with Crypto Regulation Amid Soaring Adoption

Africa's crypto revolution hits hyperdrive—Ripple doubles down on continental expansion while Nigerian regulators scramble to keep pace with adoption rates that are blowing past traditional finance.

Regulatory Whiplash

Nigerian authorities pivot between embrace and restraint as digital asset usage explodes across demographics. The central bank's dance with crypto frameworks continues—one step forward, two steps back—while citizens increasingly bypass crumbling local currency for borderless alternatives.

Infrastructure Gold Rush

Ripple's aggressive corridor expansion mirrors continent-wide infrastructure builds. Payment processors and exchange platforms proliferate despite regulatory gray zones—because where traditional banking fails, crypto fills the vacuum at lightning speed.

Adoption Tsunami

Peer-to-peer trading volumes smash records monthly. From Lagos merchants to Kenyan farmers, asset diversification isn't some theoretical portfolio strategy—it's survival against inflation that makes traditional savings accounts look like financial self-sabotage.

The real regulatory miracle? Watching legacy institutions suddenly discover 'innovation' when their monopolies start bleeding users. Too little, too late—the genie's out of the bottle and trading 24/7.

Ripple Crypto News: Ripple Partners With Fintechs, Pushing For RLUSD Adoption

Ripple has expanded the reach of its RLUSD stablecoin on the African continent through partnerships with Chipper Cash, VALR, and Yellow Card.

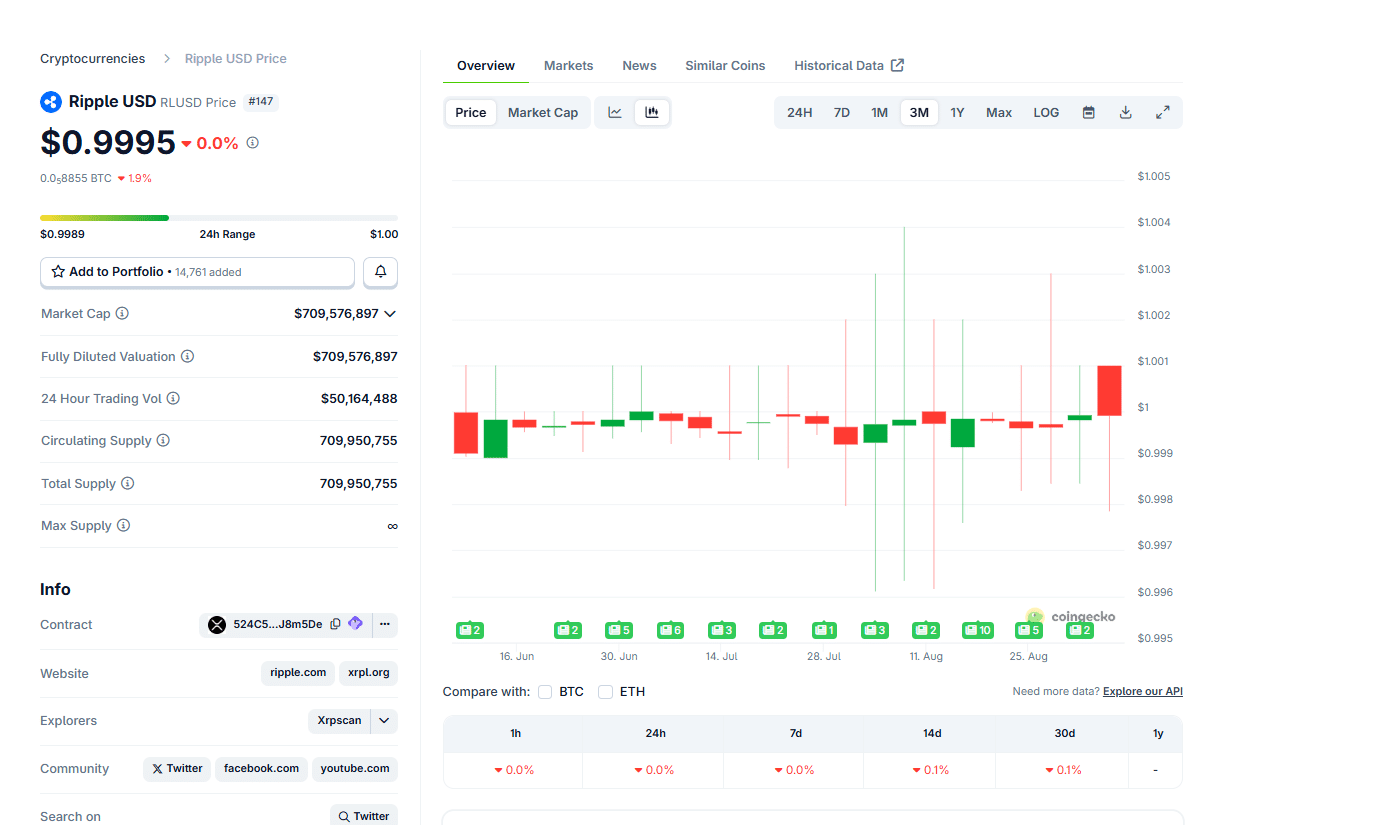

RLUSD has a market cap of $709M and intends to make cross-border payments efficient and provide a medium for humanitarian efforts.

(Source:)

Senior Vice President of stablecoins, Jack McDonald, said they are excited to begin distribution in Africa, noting the expanding adoption across the globe.

“We’re seeing demand for RLUSD from our customers and other institutional players globally and are excited to now begin distribution in Africa through our local partners….We also recently enabled RLUSD in Ripple Payments, extending the breadth of stablecoins available in our cross-border payments solution to better serve our customers worldwide.”

The local partnerships open up local markets where these payment platforms have achieved impressive growth rates.

(Source:)

Ripple is still trying to capture its full potential years after the problematic clashes with regulators in the United States, which slowed down the adoption of its solutions, including use ofXRP ▲0.79%.

XRPPriceMarket CapXRP$168.97B24h7d30d1yAll time

Nigeria Crypto News: Senate Seeks To Create A Regulatory Framework For Exchanges

The Nigerian Senate Committee on Capital Markets and the country’s blockchain association collaborate to create a better framework for regulating crypto exchanges.

Nigeria passed legislation on capital markets generally at the start of the year. Still, more work is necessary to fine-tune the regulatory landscape. When done, this MOVE may boost flow to some of the best meme coin ICOs.

The blockchain association’s president, Obinna Iwuno, talked up the need for Nigeria to seize the moment in his presentation to the Committee:

“Here in Nigeria, we can not afford to take the back seat after ranking second globally in cryptocurrency adoption…..In Africa, we take the lead. We contribute over 60 per cent of Africa’s adoption and activities on the blockchain.”

Nigeria has had a love-hate relationship with this industry in the past few years.

I remember when Binance P2P was king in Nigeria,

Then came the restrictions.

We jumped to Bybit and others,

And P2P became hell;![]() Frozen funds

Frozen funds![]() Scammers

Scammers![]() Outrageous middleman fees

Outrageous middleman fees

For months, trading crypto felt like punishment.

Recently, I got to find out about… pic.twitter.com/dkSN5ydh3u

— Defi Bee![]() (@DefiBee1_) August 21, 2025

(@DefiBee1_) August 21, 2025

That said, the gradual emergence of regulatory clarity provides Optimism for certainty in the future.

Africa Crypto News: Chainalysis Report Points To Surging Crypto Adoption

Crypto usage in the sub-Saharan region grew by +52% in the 12 months ending June 2025.

This finding was the work of blockchain analytics firm Chainalysis. Asia and Africa had some of the most impressive usage increments and were pull factors for the global uptick.

The spike was fueled by increases in remittance and everyday payment use of leading assets, including some of the best cryptos to buy. Most countries in Africa have unstable currencies. As such, informal crypto usage has grown steadily over the past decade to fill the gap.

The opportunity is evident for crypto stakeholders like exchange operators. They can fill the gap in a timely manner by providing low-cost transaction media for users across the continent.