🚀 Polygon Lands Major Indian Exchange Listing as ’Pig Butchering’ Crypto Scams Wipe Out Millions Overnight | August 30 Crypto Pulse

Polygon storms India's premier trading platform—bullish momentum meets brutal crypto crime reality.

Market Moves & Massive Heists

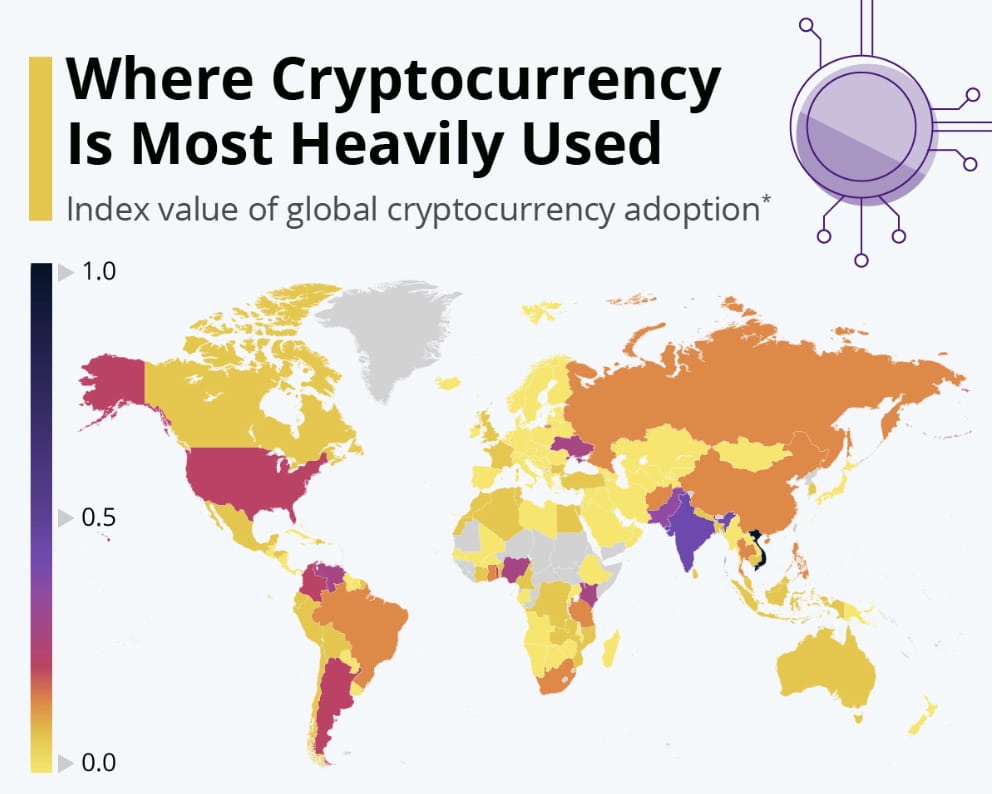

Polygon's MATIC token grabs a flagship listing on one of India's top exchanges, fueling institutional adoption hopes while retail traders scramble for position. Meanwhile, so-called 'pig butchering' scams obliterate millions in digital assets overnight—sophisticated frauds that lure victims with fake investment platforms before slaughtering portfolios.

Finance's Darkest Joke?

Another day, another exploit. While regulators draft memos, criminals cash out. Classic decentralized finance—where the only thing truly distributed is risk.

Stay sharp. Trust nothing. Verify everything.

(Indian crypto market, source –)

Meanwhile, the Philippines has notarized public funds via BayaniChain, a platform on Polygon. One of the senators, Bam Aquino, has been pushing for national budget tracking using Polygon, citing the need to prevent falsification as his reason.

These data show Polygon crypto strength, especially in regulated finance.

(POLUSD, source –)

Polygon Catalysts and The Global Crypto Sentiment

Today, Polygon saw a 10% monthly gain, a bump to $0.25. The jump is driven by Courtyard NFTs, which stand at the #1 spot in 24-hour sales, with a volume of 826 million POL crypto tokens. Bull is thinking about the potential 53% rally to $0.90 once the $0.58 resistance level is breached, although it is far from its Polygon MATIC all-time high. Polygon crypto POL was MATIC before being rebranded as POL.

Grayscale is another catalyst as the company decided to add Polygon to its spot ETFs.

Grayscale updated S-1 filings for spot $ADA and $POL ETFs, moving closer to offering regulated investment products for Cardano and Polygon. This signifies growing institutional interest beyond $BTC and $ETH, aiming to provide broader access and diversification for investors.

— Yeti Fi (@YetiFAi) August 30, 2025

However, the crypto market is experiencing a big decline this week, with the total market cap falling from $4 trillion to $3.77 trillion after a big $900 million in liquidations.

Cronos saw a big spike to multi-year highs, although it cooled down afterward. Trump’s DJT surely was the catalyst.

Pig Butchering: Crypto’s Darker Side

On the darker side of things, pig butchering scams wreaked havoc this week, with authorities in the APAC region freezing $47 million in USDT linked to fraudulent schemes. Victims is lossing millions through fake romance scams and farudulent crypto investment. One of the victim is woman from Virginia, which in the end lost her $1.3 million.

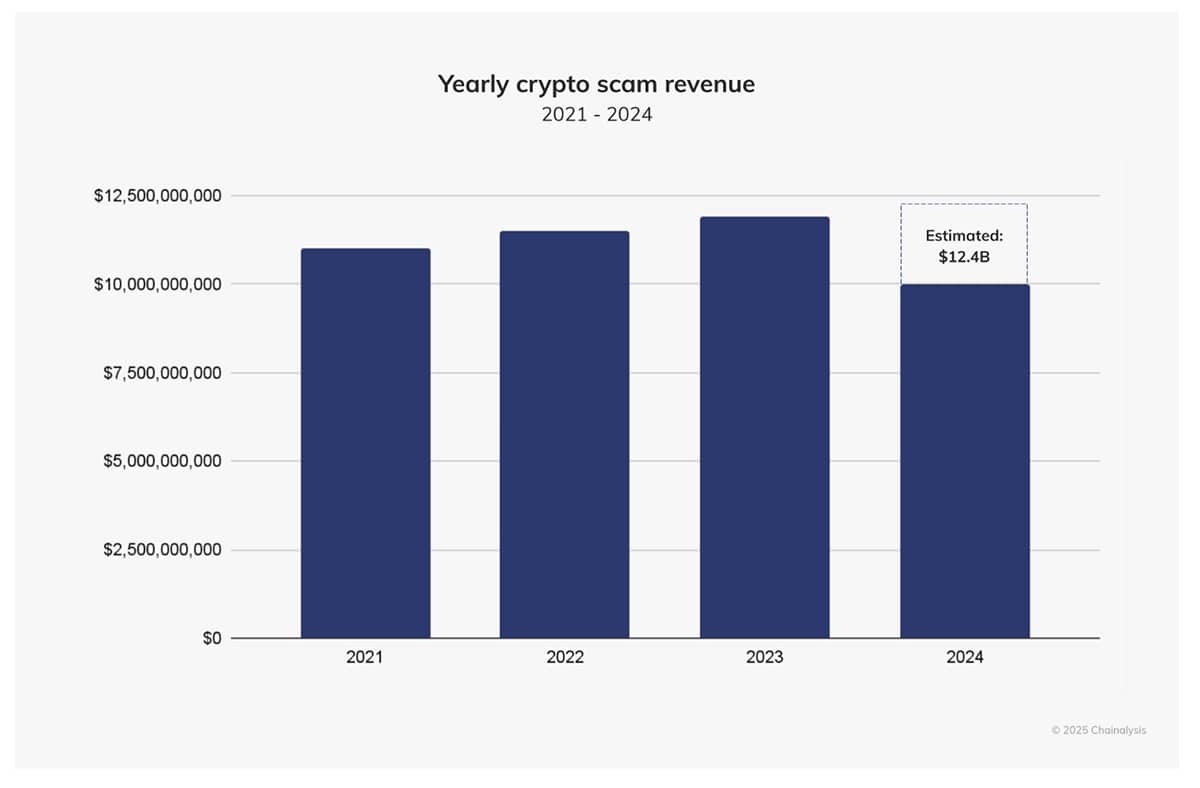

(Crypto scam revenue, source –)

The US Department of Justice has also seized $225 million from a stablecoin investment fraud scheme, part of a larger $5.8 billion in losses projected for 2024. Scammers are continuing their playbook by refunding small amounts to build trust before disappearing. Along with these scams, ransomware and “wrench” attacks are also on the rise. It contributed to an illicit market volume that ranged between $45 billion and $51 billion last year.

Crypto crime may have dipped to a smaller percentage of total transactions. It was recorded at around 0.14% to 0.4% of the $10.6 trillion in crypto transactions volume. However, absolute numbers are still climbing as the market grows.

Will crypto recover? Follow us live here.

There are no live updates available yet. Please check back soon!