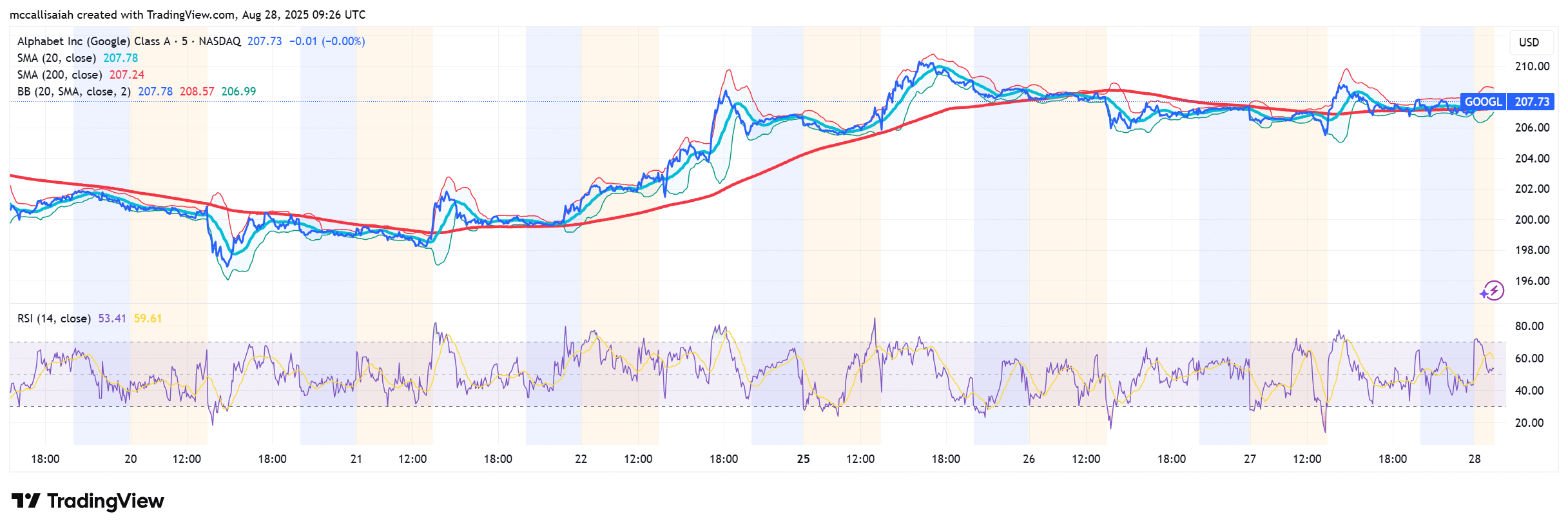

Google Blockchain Just Dropped - Time to Buy Alphabet Stock Before It Skyrockets?

Google just entered the blockchain arena—and Wall Street's already recalculating its spreadsheets. The tech giant's move into distributed ledger technology signals more than just another product launch; it represents a fundamental shift in how Big Tech views digital assets.

The Infrastructure Play

Unlike crypto pure-plays betting on token appreciation, Google's approach focuses on enterprise blockchain solutions—B2B services, cloud integration, and developer tools. They're not chasing memecoins; they're building the rails.

Market Impact

Traditional finance analysts keep asking 'but how will this affect quarterly earnings?' while completely missing the long-game: dominance in Web3 infrastructure isn't about next quarter's revenue—it's about owning the next decade of digital transactions.

Investment Outlook

Alphabet stock might get a short-term bump from crypto enthusiasts, but the real value lies in enterprise adoption. As one fund manager quipped—'They're not selling shovels to gold miners; they're building the entire mine.'

Just remember—while Google's playing chess with blockchain, most Wall Street analysts are still trying to figure out how the crypto knights move.

Is Google Building a “Planet-Scale” Blockchain? Should You Invest in Alphabet Stock?

The blockchain wars among fintech giants are heating up. Stripe is building Tempo, a payments-centric chain tied to its $1.4 trillion processing rails, while Circle has launched Arc, designed around its USDC stablecoin.

Google’s pitch is different: rather than locking adoption to a single corporate ecosystem, GCUL is meant to be shared plumbing—much like ethereum or Polkadot—and a ledger financial institutions can adopt without being tied to a competitor’s core business.

That positioning could be key to adoption, particularly if banks, fintechs, and payment providers are unwilling to rely on rivals’ blockchains.

According to Widmann’s post, GCUL aims to be “planet-scale,” supporting billions of users and bank-grade functionality.

- Stripe’s Tempo: focused on merchant flows.

- Circle’s Arc: stablecoin-native chain with FX and settlement tools.

- Google’s GCUL: open infrastructure with Python smart contracts and institutional-grade tokenization.

If Google is able to capture even a portion of Web3, that’s $4Tn market that they can play with. Maybe it’s time to load up on Alphabet stock?

The timeline also matters. Circle’s Arc is already in the pilot stage, Stripe plans a 2026 rollout, while GCUL is now in integration testing with broader trials in 2026.

Here’s What Comes Next for GCUL

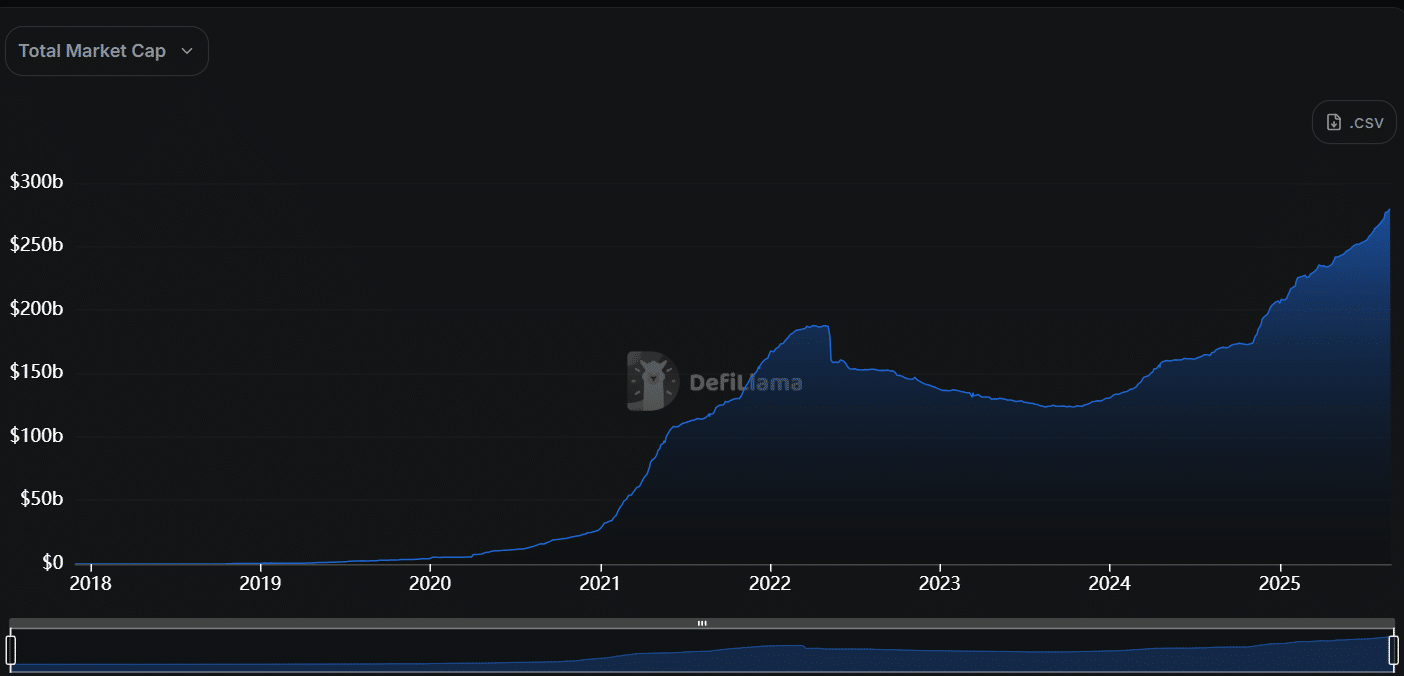

Stablecoins remain above $200 billion, underscoring the demand for trusted settlement rails. Layer-1 DeFi activity has grown 35% YoY, even amid broader market volatility. If GCUL can position itself as a neutral base for these flows, it could capture a meaningful share of tokenization and settlement volumes.

Google plans to release technical detailsas it works toward a full-scale rollout with CME and other partners.

The big question is whether institutions will embrace Google’s claim of neutrality or if reliance on a tech giant will simply replace one FORM of centralization with another.

Key Takeaways

- Google blockchain is here, and it’s looking to dominate the market. Rich Widmann, head of Web3 strategy at Google, revealed new details.

- If Google is able to capture even a portion of Web3, that’s $4T market that they can play with. Maybe it’s time to load up on Alphabet stock?