Bitcoin Plummets to 3-Week Low as Trump Tariff Chaos Triggers $630M Mass Liquidation

Markets reel as Bitcoin takes a nosedive—political shockwaves meet crypto volatility.

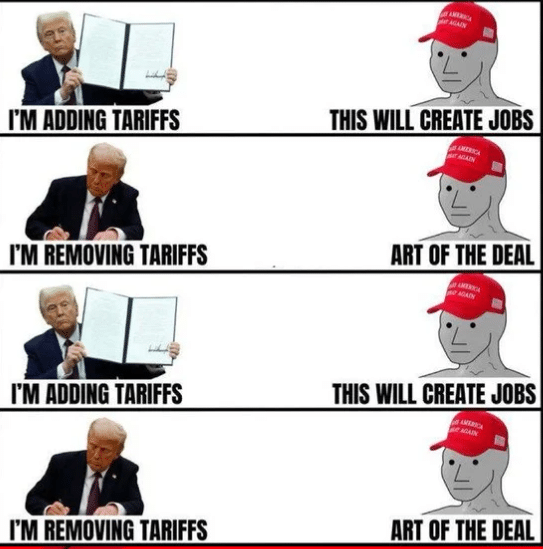

Trump's latest tariff bombshell didn’t just rattle traditional markets—it sent Bitcoin into a tailspin, liquidating half a billion faster than a Wall Street bailout.

Here’s the wreckage:

The Tariff Domino Effect

One presidential policy tweet, and suddenly BTC’s playing limbo with a 3-week floor. Classic case of ‘macro meets crypto’—with leverage as the sacrificial lamb.

Liquidation Bloodbath

$630M vanished quicker than a crypto VC’s promises. Longs got steamrolled while exchanges raked in fees—some things never change.

Silver Lining Playbook

Volatility is Bitcoin’s brand. Every crash is just a fire sale for the diamond-handed crowd—assuming they survived margin calls.

Bottom line: When Trump sneezes, crypto catches pneumonia. But let’s be real—the market’s bounced back from worse. Just ask the ‘stablecoin’ investors from 2022.

(X)

(X)

This liquidation trauma reflects pre-emptive risk reduction. Spot crypto holdings saw $110 billion withdrawn in the 12 hours preceding Trump’s tariff announcement, underscoring heightened market anxiety.

President TRUMP lit the fuse with a tariff blitz of 35% on Canada and up to 39% on non-allied economies. Countries without trade pacts got the worst of it; here’s how lowBTC ▼-2.82% can go.

“This week’s dip reflects tariff deadline fear and broader macro uncertainty… it was likely exacerbated by profit-taking after recent ATHs.” — Nick Ruck, LVRG Research

Will There Be a Trump Tariff Pause, Or BTC Crashout?

Trump’s tariff blitz came amidst deadline drama over a pending trade deal. The U.S. president also sharply attacked Canada’s foreign policy shift, linking it directly to its new pledge to recognize a Palestinian state at the UN.

On Truth Social, he wrote: “Wow! Canada has just announced that it is backing statehood for Palestine. That will make it very hard for us to make a Trade Deal with them. Oh’ Canada!!!”

The oddity: Gaza had nothing to do with tariffs orcross-border commerce, yet Trump made it central to negotiations. Countries like China, India, Laos, Switzerland, Syria, and South Africa have also been singled out for high tariff rates, with some exceeding 40%.

Despite the sharp dip, July closed as Bitcoin’s strongest monthly candle ever, ending at $115,784 only weeks after hitting its all-time high of $122,800.

Meanwhile, DeFi activity continues unabated. Total Value Locked (TVL) across decentralized finance protocols surged from $86 billion in April to over $126 billion by mid-July, a 46% gain.

OnETH ▼-5.83% specifically: ethereum TVL climbed from $44 billion to over $72 billion in the same period, indicating robust on-chain demand and institutional trust.

What’s Ahead: Support, Sentiment, and Policy Risks

If Bitcoin reclaims lost ground quickly, it would reinforce resilience. However, a sustained dip below $111K could trigger deeper downside, especially if equities remain fragile.

Boosting sentiment hinges on trade progress, especially a potential U.S.–China deal. Without clarity, profit-taking may deepen, and broader risk assets could remain under pressure.

Key Takeaways

- The Trump tariff news is wrecking the crypto and equities markets. Bitcoin’s floor gave way in Asia cracking to $114,250 and marking its lowest level since June 11.

- A sustained dip below $111K could trigger deeper downside, especially if equities remain fragile.