SEC Greenlights In-Kind Redemptions for Crypto ETFs—A Game-Changer for Digital Asset Liquidity

The SEC just handed crypto ETFs a nuclear option—and Wall Street's old guard is sweating.

In-kind redemptions unlock a liquidity endgame for Bitcoin funds. No more cash-only bottlenecks. No more arbitrage gaps wide enough to drive a hedge fund through. Just pure, unfiltered exposure to crypto's volatility—exactly what ETF investors craved.

Why TradFi Should Be Nervous

This isn't your grandfather's ETF structure. By allowing share redemptions via actual Bitcoin (not cash equivalents), the SEC tacitly admits crypto's plumbing works. Even after a decade of bankers calling it a 'glorified spreadsheet.'

The Fine Print That Matters

Authorized participants get new flexibility, but the real win goes to institutions wanting direct crypto exposure without custody headaches. Of course, the usual suspects will still charge 1.5% management fees for the privilege—some things never change in finance.

One step closer to mainstreaming crypto. Five steps closer to exposing how bloated traditional fund structures really are.

Why In-Kind Matters for Institutions

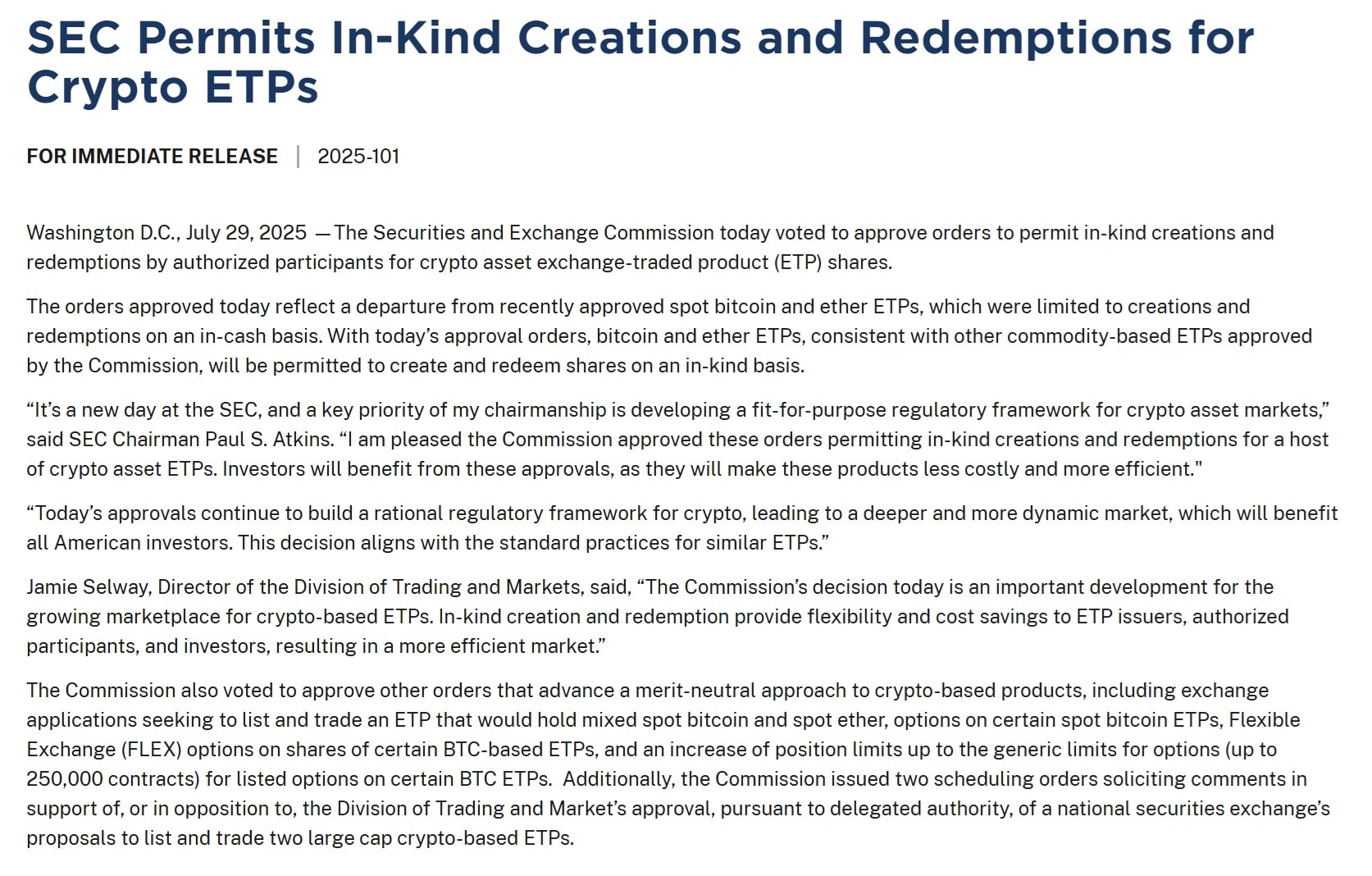

For institutional traders, this update simplifies the process. Instead of selling crypto for cash or converting fiat into tokens during each ETF transaction, they can deal directly with the assets themselves. That saves time, reduces taxes, and cuts down on unnecessary trading costs.

At the same time, the SEC has raised the position limits for Bitcoin ETF options to 250,000 contracts. That’s a big jump from the previous limit and gives institutions more room to build and manage large hedging positions. It also means more flexibility for advanced strategies without needing to split trades across multiple funds.

A Shift in Regulatory Approach

This is one of the first major moves under SEC Chair Paul Atkins, and it stands out. Rather than fighting the structure of crypto ETFs, the agency is adjusting its rules to accommodate them. That includes not only Bitcoin and Ethereum ETFs, but potentially future products as well. Analysts believe this could pave the way for altcoin-based ETFs to enter the market with fewer hurdles.

Behind-the-Scenes Mechanics Get an Upgrade

From the outside, most investors won’t notice much difference. ETF shares still trade on the stock exchange just like before. But the behind-the-scenes process for creating and redeeming those shares just got a lot more efficient. Instead of having to unwind cash positions or go through third parties, authorized participants can MOVE crypto directly in or out of the fund.

This lowers the operational burden on ETF issuers and makes arbitrage faster, which should help keep the ETF price close to the actual value of its underlying crypto assets.

Broader ETP Changes Accompany the Update

The SEC also gave the green light to funds that hold both bitcoin and Ethereum in a single product. It approved listed and flex options for those ETPs too. This makes the current generation of crypto ETFs feel more complete and more like the traditional products institutions are used to dealing with.

Firms like BlackRock, Fidelity, and Ark Invest had been pushing for these changes since the original approvals went through. The SEC’s decision shows it’s listening and adapting as the market matures.

Market Reaction and Institutional Outlook

Reactions have been mostly positive. Traders expected this change, but that doesn’t make it any less important. With in-kind redemption now live, institutional players have fewer excuses to stay on the sidelines. The new options limits also remove a major constraint for desks that want to scale up exposure or manage larger client flows.

So, What Comes Next?

With infrastructure in place, ETF issuers may start to explore broader offerings, possibly including other crypto assets. Regulators will be watching how firms handle these tools, especially in volatile markets. But for now, the structure is stronger, and that’s good news for any institutional investor looking to take crypto more seriously. By allowing direct transfers of Bitcoin and Ether, the SEC ETF rule brings crypto products closer to traditional commodities.

Key Takeaways

- The SEC now allows in-kind redemptions for spot Bitcoin and Ethereum ETFs, letting issuers directly move crypto instead of using cash.

- Institutional investors benefit from fewer taxes and lower friction, as they can now transfer Bitcoin and Ether directly in ETF transactions.

- Position limits for Bitcoin ETF options jumped to 250,000 contracts, giving large trading desks more room for strategies and hedging.

- The change reflects a more flexible stance from the SEC and may open the door for ETFs based on other crypto assets like altcoins.

- The move improves ETF pricing efficiency and reduces operational costs, while funds holding both BTC and ETH also received SEC approval.