Stablecoin Market Soars to $252B in H1 2025 – Defi’s Safe Haven Outpaces Traditional Finance

The stablecoin market just ripped past every analyst’s projections—again. With supply surging to $252 billion in the first half of 2025, these crypto-anchored assets are eating traditional finance’s lunch.

Why the explosion?

Institutions finally woke up. While banks fiddle with fractional reserves, stablecoins offer instant settlements, transparency, and yield that doesn’t require begging a wealth manager for access.

The irony?

Traditional finance’s 'stable' instruments now look volatile by comparison. Meanwhile, DeFi’s dollar-pegged tokens quietly became the plumbing for global crypto liquidity—proving, yet again, that innovation doesn’t wait for permission.

One hedge fund trader put it best: 'Turns out, the real 'risk-free asset' was the stablecoin we minted along the way.'

USDT, USDC, PYUSD Boom: Supply Exceeds $252 Billion in H1 2025

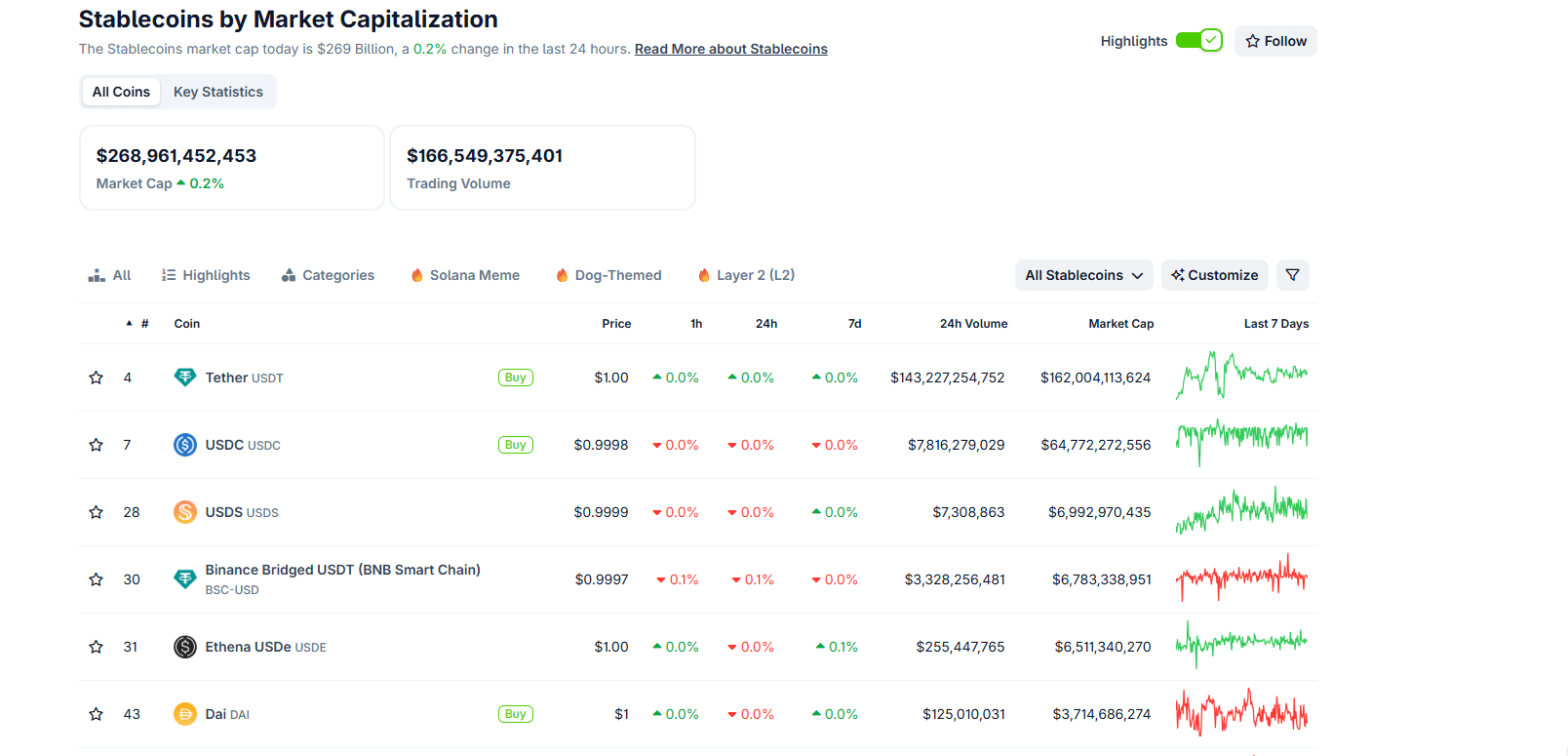

A CertiK Skynet report found that in H1 2025, the total stablecoin supply grew from $204 billion to $252 billion.

With increasing supply, the stablecoin monthly settlement volumes reached $1.39 trillion, channeling capital to some of the hottest crypto presales to buy.

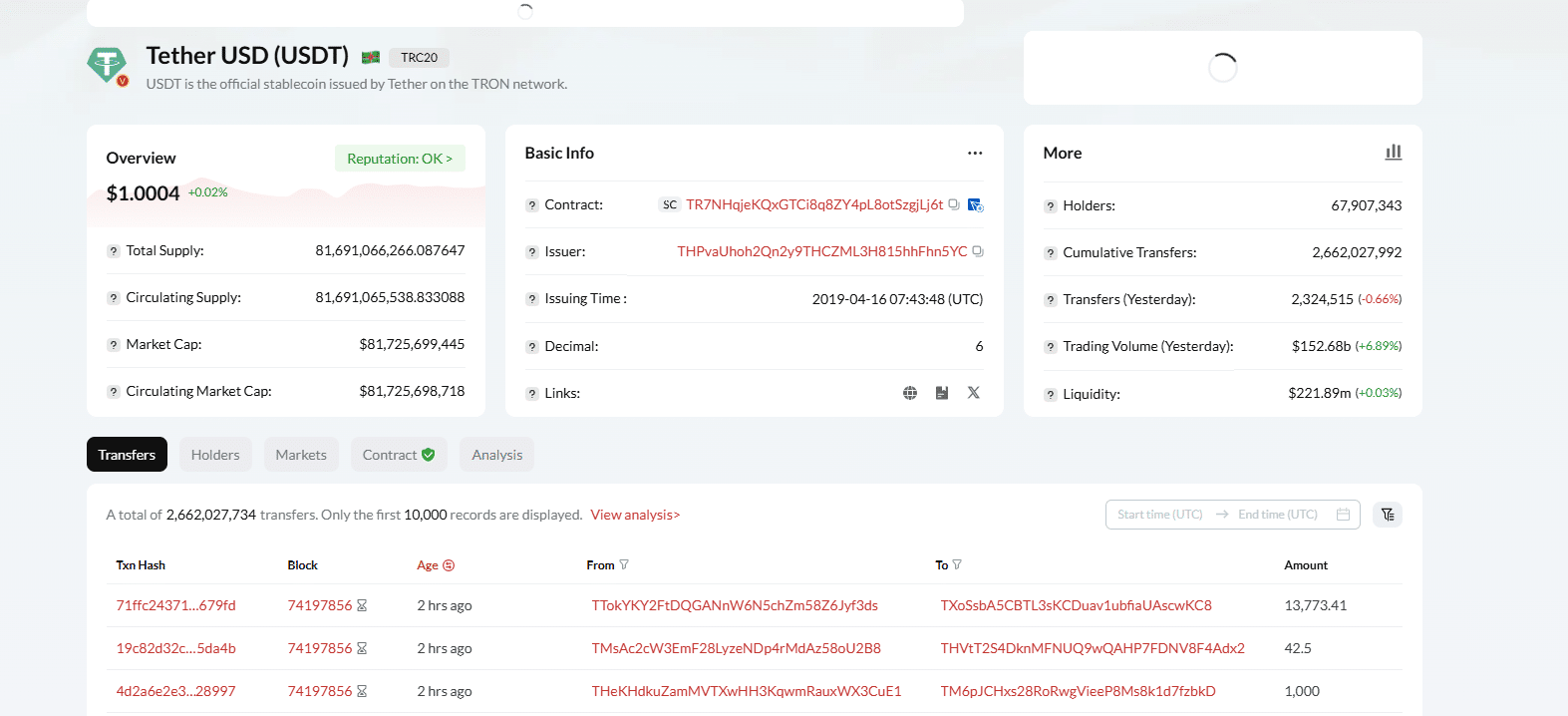

USDT is still dominant, particularly on Tron.

Tronscan data shows that over $81 billion of USDT is in circulation on TRX ▲1.71%, with more than 67.9 million USDT holders making over 2.3 million transfers in the past 24 hours, generating over $152 billion in trading volume, up nearly 7%.

CertiK notes that USDC is closing the gap in second place, bolstered by its MiCA license and a highly successful IPO. In H1 2025, USDC’s supply increased to $61 billion.

Meanwhile, PayPal’s PYUSD is gaining traction, driven by its integration on Solana, which doubled its float, and a 3.7% reward program that has solidified its market position.

Ripple’s RLUSD, focused on institutional use, has also increased its market share. CertiK highlights RLUSD’s perfect security record, supported by continuous audits, as a key differentiator.

Stablecoin Boom Driven by Supportive Regulations

Stablecoin supply will only grow, even breaking above the $1 trillion level in the coming years.

In H1 2025, the United States took steps to regulate stablecoins by passing the GENIUS Act, which Donald TRUMP signed into law last week.

The Act mandates that issuers be chartered by the OCC or affiliated with banks, maintain 1:1 reserves in cash or Treasury bills, and provide monthly attestations for transparency. These measures aim to protect consumers, ensure financial stability, and foster innovation.

In Europe, the enforcement of the MiCA regulation by June 2025 marks a significant step forward. Under MiCA, stablecoins are classified as Asset-Referenced Tokens (ARTs) or e-Money Tokens (EMTs).

Issuers must hold an EMI license and maintain full reserves, complying with real-time attestation and audit standards.

Non-compliant stablecoins like USDT and EURT were delisted from European crypto exchanges, prompting Tether Holdings to exit the Euro stablecoin market and invest in compliant issuers like StablR, which issues EURR and USDR.

13 Best Crypto Presales to Invest in July 2025 – Top Token Presales

USDT, USDC Stablecoin Market Soars to $252B in H1 2025

- Stablecoin supply jumps 23.5% to $252 billion in H1 2025, per CertiK Skynet

- USDT dominates with $162 billion market cap

- USDC grows to $61B, boosted by MiCA license and NYSE-listed CIRCL stock

- GENIUS Act and MiCA regulations drive stablecoin adoption globally