Crypto Strategy Skyrockets: $472.5M Bitcoin Buy Sends YTD Yield Soaring to 20.2%

Wall Street's playing catch-up—again. A bold Bitcoin accumulation strategy just dropped half a billion dollars on the orange coin, and it's paying off big time.

Yields that leave traditional finance in the dust

While your bank offers 0.5% APY (with strings attached), this crypto play booked 20.2% returns before Q3 even heated up. The $472.5 million purchase—executed when weak hands were doubting—now looks like another masterclass in asymmetric bets.

Finance dinosaurs will call it reckless. The numbers call it winning.

With 601,550 BTC locked in at a $71K average, Saylor now presides over $73 billion in digital gold, cementing his role as Bitcoin’s corporate overlord. Here is other whale activity to look out for:

Bitcoin Whale Activity July 2025: A Corporate Treasury Strategy Built Around BTC

This is no short-term trade for Saylor and company. Strategy’s bitcoin purchases are part of a longer play that has come to define its corporate identity as much as its core analytics business.

“We view Bitcoin as a dependable store of value and the Core foundation of our treasury strategy.” – Michael Saylor, Executive Chairman, MicroStrategy

![]() The BITCOIN 100 List

The BITCOIN 100 List![]() 7/14/2025 pic.twitter.com/dAMKIfz8PE

7/14/2025 pic.twitter.com/dAMKIfz8PE

— HODL15Capital![]() (@HODL15Capital) July 14, 2025

(@HODL15Capital) July 14, 2025

The firm has funded much of its Bitcoin war chest by selling securities and liquidating other assets, allowing it to steadily accumulate BTC during market dips and rallies alike.

Wall Street Reaction: Bitcoin Exposure Lifts MicroStrategy and Coinbase

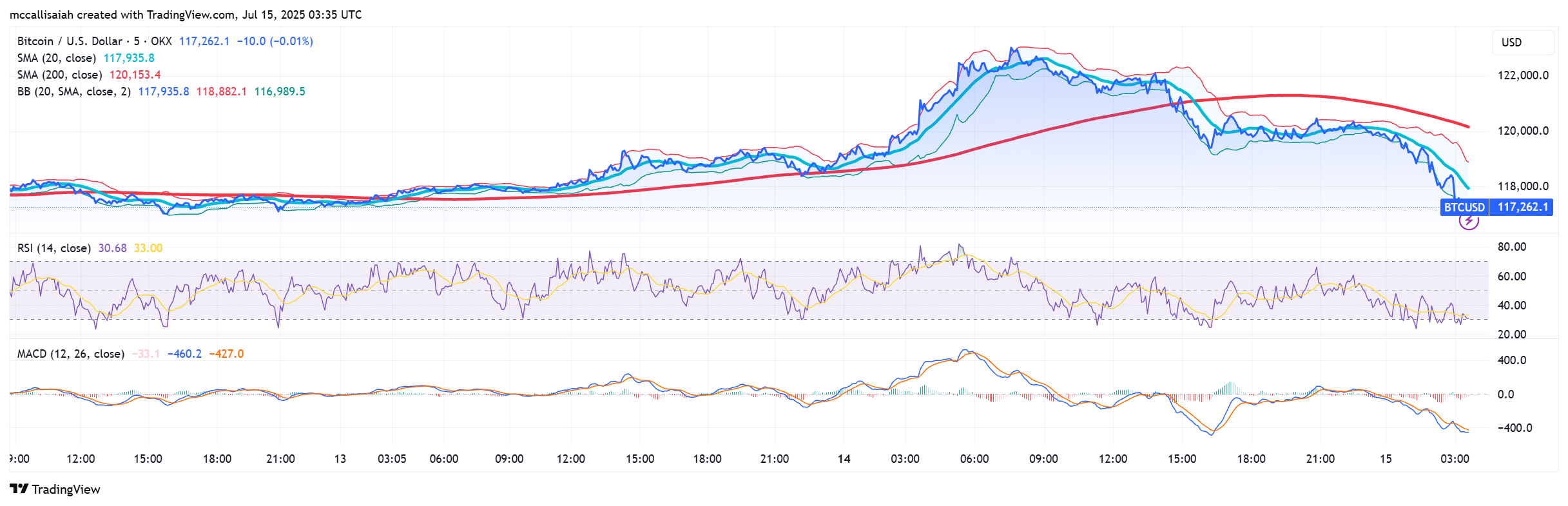

Markets are responding to BTC’s new ATHs. As Bitcoin climbed to a new intraday high of $123,193, Bitcoin-linked stocks followed suit:

-

MicroStrategy (MSTR) rose 4% on the day

-

Coinbase (COIN) gained 1.8%

-

Robinhood (HOOD) up 1.6%

Institutional money still treats Bitcoin like the canary in the fintech coal mine, but it’s quickly becoming a finance staple.

Critics Still Caution: Volatility, Regulation Remain Headwinds

While Bitcoin’s rise has supercharged MicroStrategy’s market cap, not everyone’s convinced. Some TradFi analysts continue to warn about Bitcoin’s historic volatility and the lack of clear regulatory guidelines in the U.S.

Still, the company’s conviction remains unchanged. Its approach has inspired other public firms to explore digital asset exposure as a hedge against fiat depreciation and inflationary risk.

Elsewhere in the market, tech giants responded in kind.rose, while, despite a brief dip, is eyeing future growth catalysts tied to possible China-related updates.

Strategy’s Bold Bet Keeps Paying Off… For Now

Strategy’s Bitcoin accumulation has been one of the most aggressive and polarizing strategies in public markets. Now holding more BTC than most countries, the company’s long-term conviction is being rewarded by market momentum.

If Bitcoin breaks above the $125,000 level with sustained volume, Michael Saylor might increasingly be seen as the new Warren Buffett.

Key Takeaways

- The Bitcoin whale activity July 2025 is heating up. Michael Saylor’s Strategy resumed its buying habit.

- Elsewhere in the market, tech giants responded in kind. Tesla rose 1.1%, while Nvidia, despite a brief dip, is eyeing future growth catalysts tied to possible China-related updates.