Crypto Crushes Wall Street: 21.72% Q2 2025 Rally Redefines Market Dominance

Crypto just schooled traditional finance—again. While Wall Street hedge funds scrambled to explain their single-digit returns, digital assets posted a blistering 21.72% gain last quarter. No bailouts, no Fed put, just pure decentralized momentum.

Here’s how it happened.

The institutional FOMO is real. After years of dismissing crypto as a 'fraud' (thanks, Jamie Dimon), legacy players now face a brutal choice: adapt or get rekt. Bitcoin ETFs? Old news. The real action’s in altcoins and layer-2 protocols that actually scale.

Meanwhile, Goldman Sachs is still charging 2-and-20 for subpar returns. Cue the tiny violin.

This isn’t a fluke—it’s math. Blockchain doesn’t sleep, doesn’t take weekends off, and couldn’t care less about your S&P 500 index fund. The 21.72% surge proves decentralized networks outperform bureaucratic middlemen every. Damn. Time.

Wake up, Wall Street. Your investors are voting with their wallets—and they’re all going onchain.

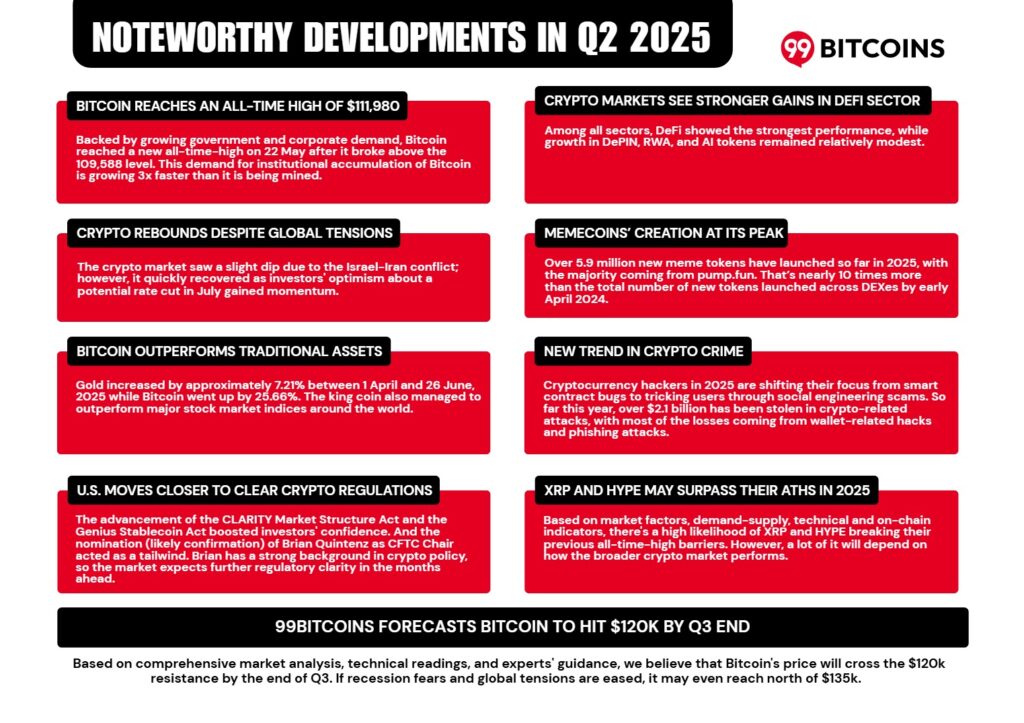

Interestingly, the crypto industry saw a 18% drop in Q1 2025. Hence, the Q2 rebound is a notable recovery. The crypto gains of the second quarter of 2025 surpasses its performance in previous years, reversing a 14.44% fall in Q2 2024.

So, What Drove Crypto’s Outperformance?

What helped propel Bitcoin’s dominance to a four-year high of 63%? Institutional investor interest stood out. While retail traders shifted focus towards altcoins, institutions favored Bitcoin.

According to the 99Bitcoins’ report investors’ interest in crypto picked up in Q2.” In April, blockchain-related mentions in SEC filings hit a record high of 5,830, likely due to the TRUMP administration’s pro-crypto approach,” the report stated.

Furthermore, the US government provided much-needed regulatory clarity, passing key laws and executive orders that broadly support the crypto market. Notably, the removal of IRS reporting rules for DeFi platforms and relaxed requirements for banks engaging in crypto activities boosted confidence across the sector.

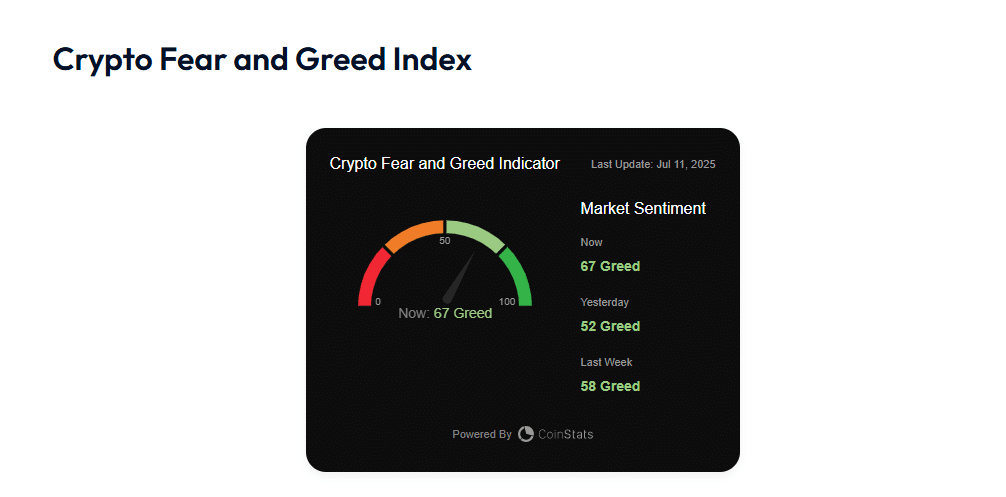

After hitting a low in March 2025, the crypto Fear and Greed index rebounded into “greed” territory for over 60 days, buoyed by positive policy signals.

Just yesterday, Bitcoin -the world’s most valuable crypto -soared pushing above $117,000, only for buyers to aggressively step in today, lifting BTC ▲6.76% to an all-time high of $118,409. The Fear and Greed Index from 99Bitcoins shows a reading of “67.”

Chris Wright, Global Head of Marketing at 21Shares weighed in. “We believe that bitcoin ETFs will attract 50% more inflows this year compared to last year,” he said. “This would result in net inflows of approximately $55 billion in 2025, representing an increase of around $20 billion year-over-year. If this trend continues, the total assets under management could nearly double from just over $110 billion currently, to over $200 billion by the end of the year.”

Stablecoins Steal the Spotlight

The Web3 sector saw a surge in job openings for June 2025. While Ripple, Arbitrum Foundation, Stellar, and Ava Labs are among the firms actively recruiting for various roles, OKX, and Kraken have announced an expansion of their Web3 teams. “Hiring surges like this are typical during bull markets and reflect strong belief in the industry’s growth potential,” the report said.

But, stablecoins led sector-wide demand. According to the report, 81% of small and medium businesses (SMBs) familiar with crypto are interested in using stablecoins for daily operations.

Moreover, the number of fortune 500 companies planning to use stablecoins has triples since 2024.

Circle’s successful IPA- where the company’s stock price soared 168% on debut – is proof od stablecoin related appetite and exposure.

16 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis