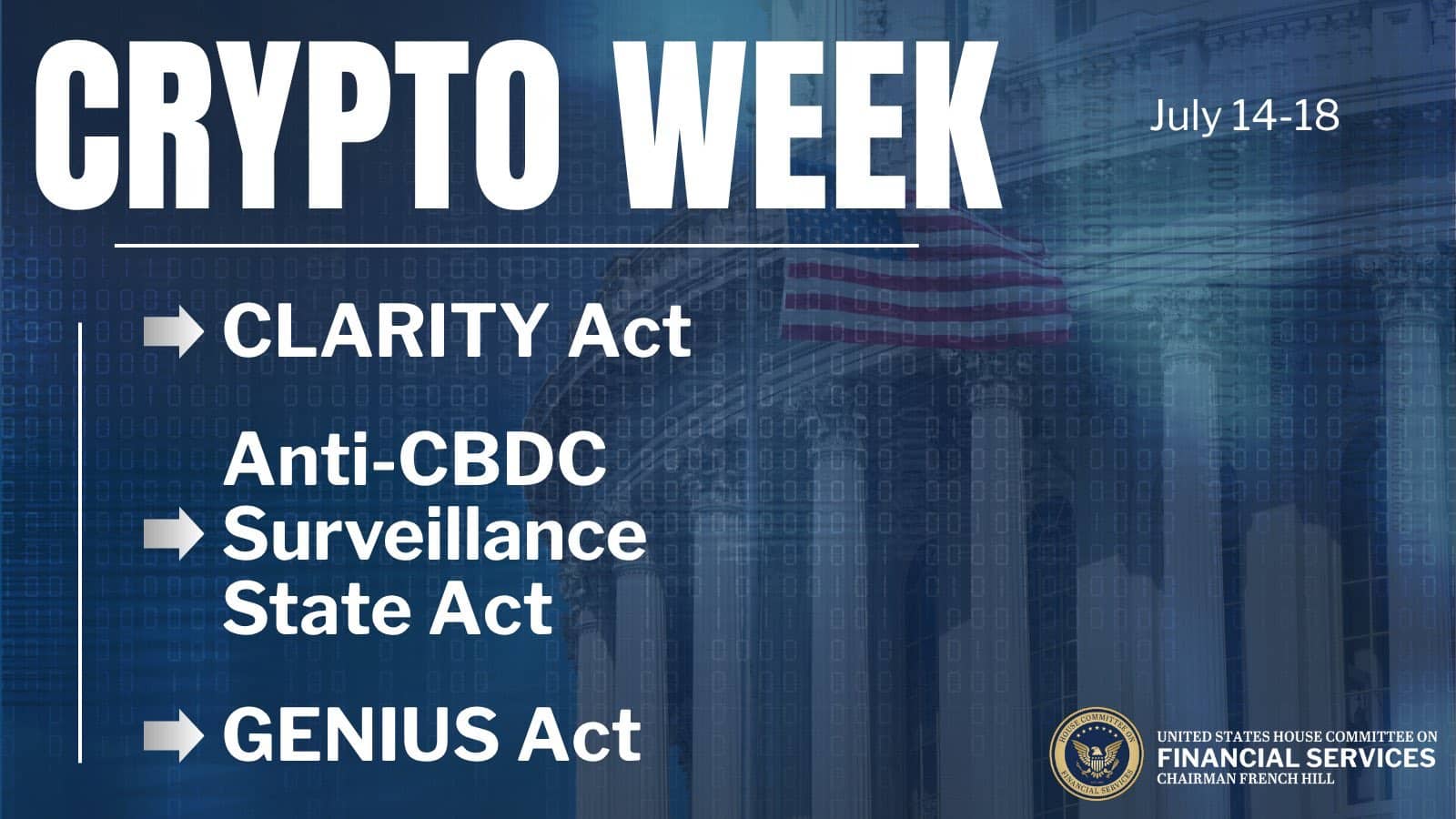

US Lawmakers Go Full Bull: Crypto Legislation Blitz Starts July 14

Washington's playing catch-up—with style. A bipartisan squad of lawmakers just dropped the ultimate crypto flex: a dedicated 'US Crypto Week' kicking off July 14 to bulldoze through stalled digital asset bills.

Behind the scenes: This isn't some regulatory side-hustle. We're talking full-throttle hearings, markups, and floor votes on at least three major bills that've been gathering dust. The House Financial Services Committee's even clearing its schedule—because when Congress actually moves fast, you know Wall Street's about to get disrupted.

The stakes? Clarity on stablecoins, custody rules for exchanges, and that eternal DC classic: 'Is ETH a security?' (Spoiler: The SEC's lawyers are already billing overtime.)

Bonus cynicism: Nothing unites politicians like the smell of fresh campaign donations—and crypto PACs just opened the firehose. How convenient that regulatory urgency spikes during an election year.

US Crypto Week: CLARITY Act Brings Long-Awaited Regulatory Certainty

Washington is finally trying to stop playing Calvinball with crypto law. The CLARITY Act proposes a simple fix to carve digital assets into three categories: commodities, securities, and stablecoins, and assign each to the right agency.

It’s a strategy meant to kill the ambiguity that’s made the U.S. a regulatory minefield for crypto firms.

For instance,BTC ▲0.84%, classified as a “digital commodity,” WOULD come under the CFTC’s jurisdiction, while tokens resembling traditional securities would remain with the SEC.

Additionally, a dual-track registration system is set to provide more flexibility for crypto platforms to register with the relevant agency.

GENIUS Act Caters to Stablecoin Innovation

Passed by the Senate, the GENIUS Act is set to bring stablecoins under federal command. It sets the ground rules for who can mint them, how they’re backed, and what oversight looks like when things go sideways.

The upshot is:

- Makes stablecoins legally legitimate as long as they do things like proving reserve backing.

- There will be less of legal barriers to making your own legally compliant stablecoin.

Once the GENIUS Act is signed into law, various entities will begin to replace legacy systems with stablecoin-based systems wherever it is economical to do so. Ideally, soon, someone will offer international payments that arrive in seconds instead of days. This is going to force everyone else to adapt or die.

Framed as a firewall against financial surveillance, the Anti-CBDC Surveillance State Act would stop the Fed from distributing a digital dollar to individuals.

Crypto Week Standout: TOKEN6900 Raises $220K as Crypto’s First Non-Corrupt Token

One token set to go viral during Crypto Week is TOKEN6900, which is seven days DEEP into presale and already has $220,000 in the bag. It claims to be the first Non-Corrupt Token (NCT), and unlike most projects, that might actually mean something.

No mint button. No insider stash. No angel round. 80% of TOKEN6900 goes to public presale, and when they say the price jumps in two days, it does.

While central banks hide behind policy jargon and print cash into oblivion, TOKEN6900 is a pure distillation of internet HYPE and irony, priced at $0.00645… for now.

There’s no mystery here. TOKEN6900 isn’t building the next LAYER of civilization. It’s not disrupting finance. It’s a meme, and it says so proudly.

In a world where central banks rewrite reality while the numbers rot, that kind of blunt-force honesty is the rarest asset of all.

Key Takeaways

- U.S. Congress just circled the week of July 14 and slapped “Crypto Week” on it.

- One token set to go viral during Crypto Week is TOKEN6900, which is seven days deep into presale and already has $220,000 in the bag.