Moonwell DeFi Staking Skyrockets 120%—Is WELL Token Next to Moon?

DeFi just got hotter. Moonwell's staking numbers are on a tear—up a staggering 120% in recent weeks. The protocol's TVL is swelling, and liquidity miners are piling in. But here's the billion-wei question: When does the WELL token catch up?

Staking frenzy or smart money play?

The yield farmers know what they're doing—or at least pretend to. While TradFi bankers still debate "blockchain utility," DeFi degens are quietly stacking gains. Moonwell's surge suggests either brilliant protocol design or another case of "APY chasing" before the music stops.

WELL's make-or-break moment

Tokenomics 101 says staking growth should fuel token demand. But crypto markets have a habit of ignoring textbooks—just ask the "fundamentals matter" crowd from last cycle. If WELL doesn't mirror this staking explosion soon, someone's going to start asking uncomfortable questions.

Bottom line: Moonwell's metrics are flashing green, but in DeFi, today's darling is tomorrow's dead protocol. Watch that WELL chart like a hawk—and maybe keep one finger near the exit button.

WELL Crypto Soars 12%, Breaks Above a Key Liquidation Level

On Sunday, WELL3 (No data), the governance token of the DeFi protocol, was among the top performers in the platform and DeFi as a whole.

WELL crypto prices soared by nearly 12%, ending the week on a high note. The surge above $0.028 meant the token broke through last week’s local resistance and the second half of June 2025.

WELL3PriceWELL324h7d30d1yAll time

If buyers maintain momentum today, the trend will likely continue, lifting WELL prices to $0.035 and back to May 2025 highs of around $0.045.

Currently, the candlestick arrangement from the daily chart favors buyers. Notably, the close above $0.028 on July 5 confirmed the bullish momentum from June 23.

At this pace, WELL crypto is within a bullish breakout formation above the bull flag, and on the path of becoming the next crypto to explode.

Staking Activity Jumps

Behind this surge are encouraging developments.

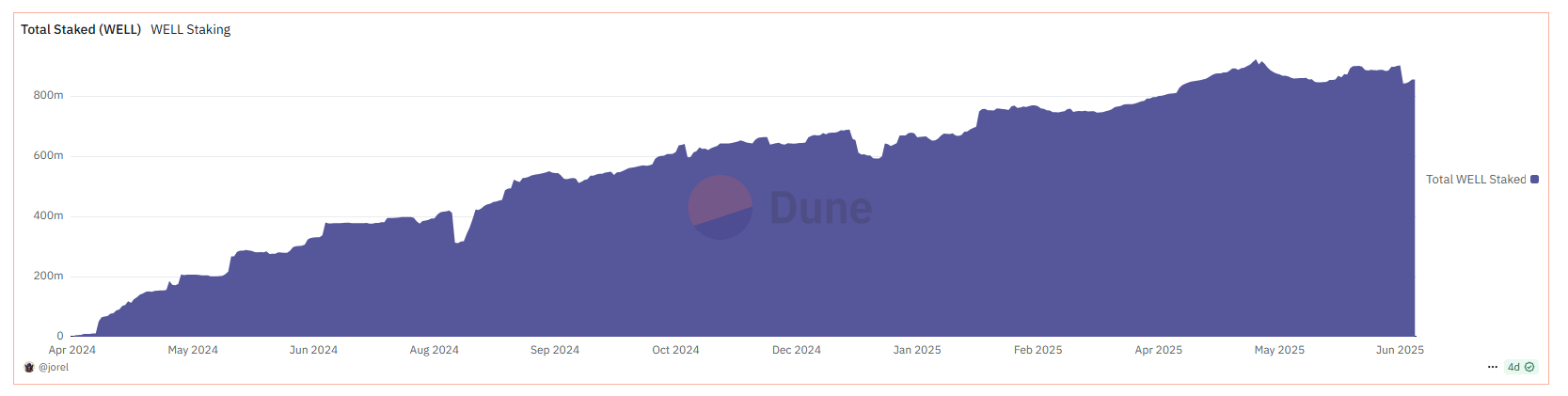

After the implementation of the MIP-X21 proposal in Q2 2025, the number of WELL stakers has risen sharply.

As of April 1, 782.6 million WELL had been staked, but this number quickly jumped to 922.3 million WELL by May 10.

Although it fell to 845.4 million WELL by May 31, over 50 million more WELL were staked during this period.

On average, staking activity spiked by 120% on Optimism and Base.

This increase was driven by a key change to Moonwell’s reserve factors. By default, this mechanism channels borrowing interest into reserves. A portion of the interest earned from borrowers goes into the protocol’s reserve.

Impact of MIP-X21

After MIP-X21, the interest, charged in USDC, was used to accumulate WELL.

As a result, automated reserve auctions allowed the protocol to buy more WELL from a portion of interest payments.

The WELL tokens purchased were used to enhance rewards for its Safety Module, a mechanism designed to secure the protocol.

![]()

![]()

![]() Last month, 8.4M WELL was acquired through reserve auctions.

Last month, 8.4M WELL was acquired through reserve auctions.

Thanks to the successful passage of MIP-X21, staking rewards on @Base and @Optimism Mainnet have increased.

Approximately $114K in excess market reserves has been allocated for the next round of auctions. pic.twitter.com/GAH6IrxvdC

— Moonwell (@MoonwellDeFi) May 23, 2025

Over the months, MIP-X21 has created a virtuous cycle in which increased borrowing activity generates larger reserves, fueling more auctions, primarily via Aerodrome.

In turn, with more auctions, stakers receive higher rewards.

Moonwell is Capital Efficient, Captures 99% of Liquidation Value

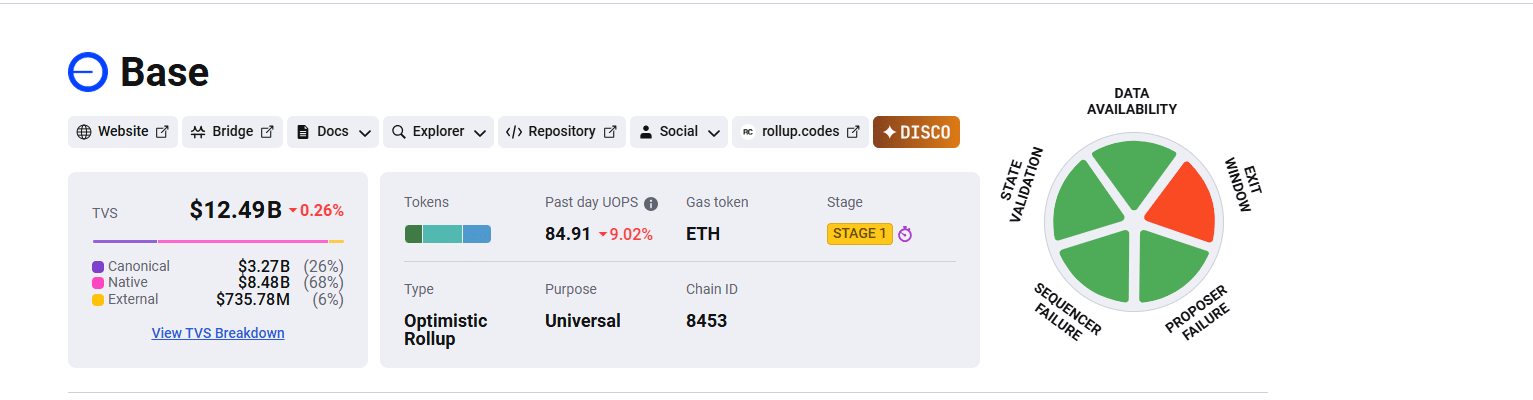

Besides its staking success, Moonwell has quietly established itself as one of the most capital-efficient decentralized money markets on Base and in DeFi, outperforming Aave.

The protocol captures 99% of liquidation value, ensuring minimal leakage during liquidations.

This boost came in February 2025 when Moonwell introduced an MEV tax on liquidators.

Enabled by OP Stack’s transaction ordering guarantees, the protocol could capture a portion of the value generated during liquidations rather than letting it FLOW to external searchers.

(7/10) Moonwell's smart contracts can now charge a MEV tax on liquidators, ensuring that the protocol (not just external searchers) can benefit from the competition.

This is the first-ever successful onchain OEV (Oracle Extracted Value) auction on OP Mainnet and it is only… https://t.co/54u20C1m2H

— optimism.eth (@Optimism) February 3, 2025

This efficiency marked the first successful on-chain OEV auction on the Ethereum layer-2 OP Mainnet, surpassing traditional MEV systems that relied on off-chain relays.

By capturing nearly all of a borrower’s liquidation value, Moonwell’s revenue has grown, strengthening its business model.

7 High-Risk High-Reward Cryptos for 2025

Moonwell WELL Crypto Explodes, Staking Up 120%

- Moonwell DeFi protocol on Base is trending

- WELL crypto prices surged 12% on July 5

- Moonwell staking activity shoots higher after MIP-X21

- DeFi protocol captures 99% of the liquidation value