Robinhood Tokenized Stocks Soar to New ATH: Why HOOD Could Be the Ultimate HODL for 2025

Robinhood's tokenized HOOD stock just smashed its all-time high—again. The trading app's crypto pivot keeps paying off, but is this rally built to last?

Tokenized stocks go mainstream

HOOD's blockchain iteration gained 37% this month alone, outpacing both its traditional stock counterpart and most blue-chip cryptos. The token now trades at $147—up 290% since Robinhood first minted it on Ethereum in Q1 2024.

Wall Street's worst nightmare?

Traditional brokers scoffed when Robinhood bridged equities and DeFi. Now they're scrambling to launch competing products while HOOD keeps eating their lunch. "It's like watching Boomers discover Venmo," quipped one crypto trader.

The HODL calculus

With zero fractional share restrictions and 24/7 trading, tokenized HOOD offers perks no traditional brokerage can match. But skeptics warn the token's 90-day correlation with meme coins might give conservative investors pause.

One thing's certain: in the race to tokenize everything, Robinhood just lapped the competition—again. Whether that justifies its valuation remains Wall Street's favorite parlor game.

Robinhood Tokenized Stocks: Blockchain Meets Traditional Finance

Stocks on-chain, futures in your pocket, and SpaceX tokens for breakfast. TradFi is quickly integrating with crypto.

By launching tokenized U.S. stocks in a partnership with ETH-based DEX Arbitrum, Robinhood is among the many TradFi institutions diving headfirst into crypto.

The rollout includes private share tokens for giants like OpenAI and SpaceX, letting retail investors access assets usually locked behind VC gates. And with staking, futures, and a MiCA-compliant framework, Robinhood is unleashing what brokerage apps can be.

Robinhood CEO Vlad Tenev demonstrated a successful mock transaction of OpenAI stock during the launch event in Cannes, underscoring the viability of tokenized securities.

Macro strategist Raoul Pal described the MOVE asapplauding the elimination of barriers between public and private markets.

“The end of public vs. private markets is beginning. Capital formation too is more efficient in crypto markets. This is democratization of finance and it’s only going to accelerate from here.” – Raoul Pal

Raoul Pal: Impacts on Robinhood, Crypto, and Financial Markets

Robinhood’s tokenized stock trading could generate significant revenue through potentially higher-margin trading fees.

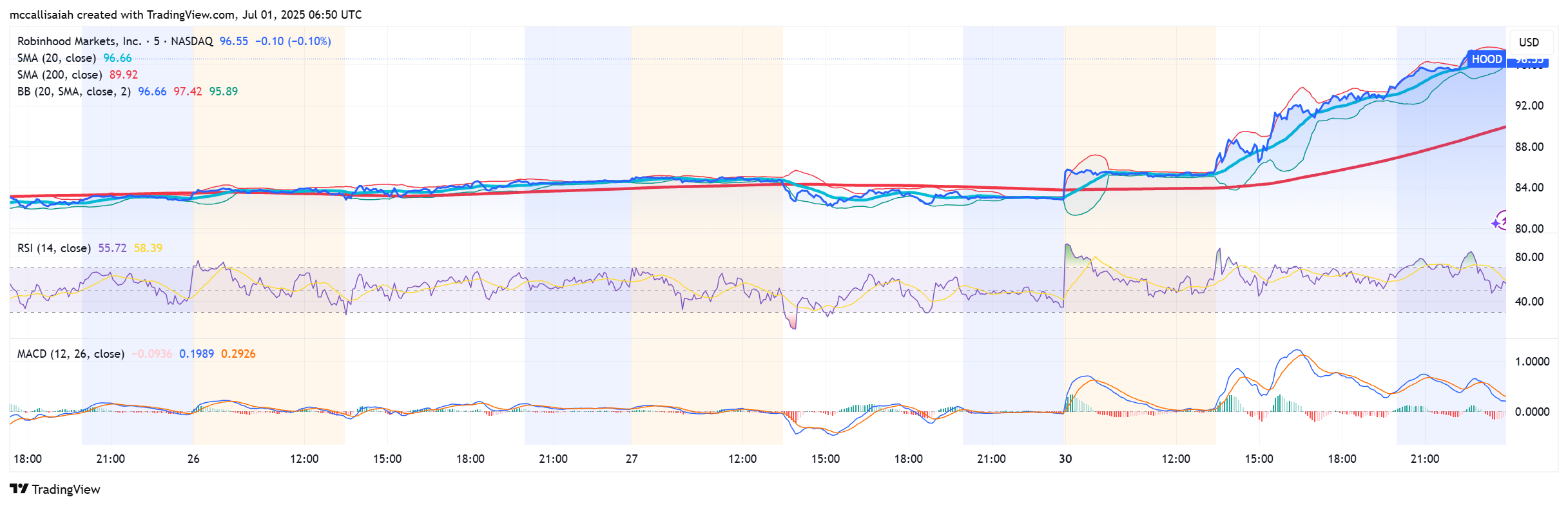

Analyst Ed Engel from Compass Point sees this innovation as a major driver for Robinhood’s growth, raising the company’s price target to $96 while reiterating a “Buy” rating. It’s a modest bump, but could be the catalyst that allows Robinhood to break into the S&P 500.

Moreover, Robinhood’s crypto revenue is exploding, now valued at $252 million in Q2, up 100% from last year.

As Robinhood folds tokenized stocks, staking, and crypto futures into one system, the firm is betting big on a redefined market structure. Others may dabble, but Robinhood is building the new financial rails that Millennials and Gen Z will use for decades.

Key Takeaways

- Robinhood’s crypto revenue is exploding, now valued at $252 million in Q2, up 100% from last year.

- As Robinhood folds tokenized stocks, staking, and crypto futures into one system, the firm is betting big on a redefined market structure.