🚀 Ethereum ETFs Skyrocket Past $4B—Here’s Why Traders Are FOMOing In

Wall Street's latest crypto crush just hit ludicrous speed. Ethereum ETFs—once the underdog of institutional crypto plays—have blasted past $4 billion in assets under management. And no, your broker didn’t see this coming.

The surge no one predicted

These aren’t your 2021 meme-coins. The ETF inflows suggest something darker brewing: Traders are panic-buying exposure to smart contracts before the SEC changes its mind—again.

Why ETH, why now?

While Bitcoin ETFs hogged headlines, Ethereum’s quietly been building a derivatives market that makes CME traders drool. The real kicker? Half these inflows arrived after BlackRock’s ‘accidental’ tweet hinting at staking yields. Classic.

So grab your ledger—the suits are finally playing our game. Just don’t expect them to understand gas fees.

Source: @coinphoton on X.com

Source: @coinphoton on X.com

The funds launched in July 2024, so they’ve been live for just under a year. Until recently, inflows were steady but modest. Then, sometime in late May, capital started coming in faster. The recent surge accounted for a full quarter of all net inflows, packed into just a small slice of the total trading days.

Who’s Pulling in the Cash

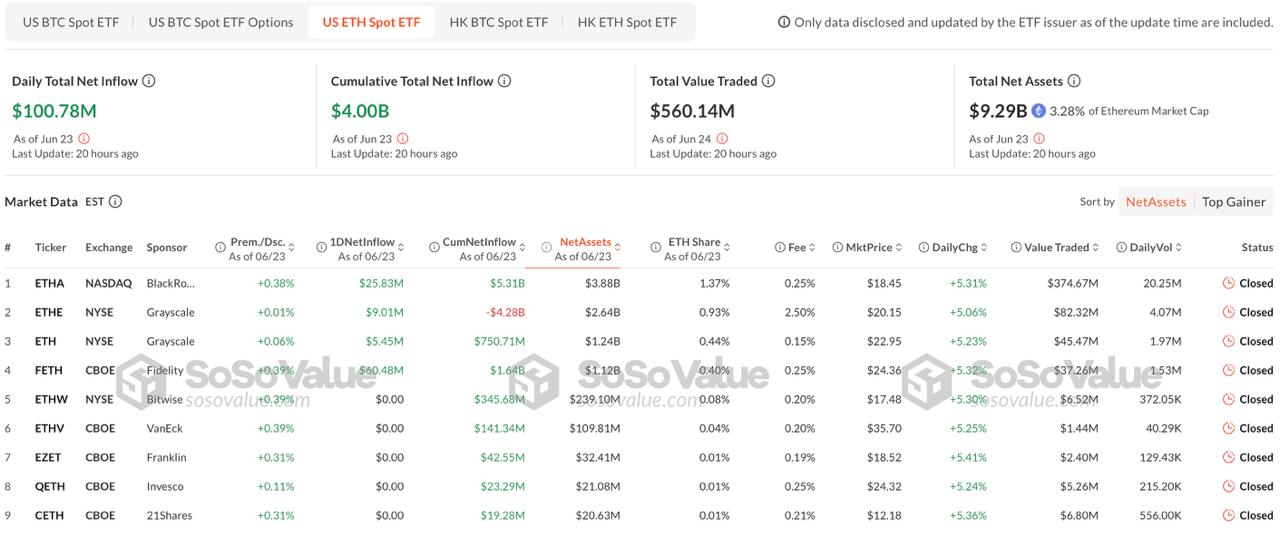

BlackRock is still leading the charge. Its iShares Ethereum Trust has pulled in over $5.3 billion in gross terms. Fidelity’s fund has done well too, attracting around $1.6 billion. Meanwhile, Grayscale’s older ETHE trust has seen outflows of more than $4.2 billion.

Spot Ethereum ETFs in the U.S. have surpassed $4 billion in net inflows just 11 months after launch, with $1 billion added in the past 15 trading days alone. BlackRock’s ETHA leads with $5.31 billion in inflows, followed by Fidelity’s FETH and Bitwise’s ETHW. Meanwhile,… pic.twitter.com/cE2ib1ylMv

— CoinPhoton (@coinphoton) June 25, 2025

That’s not a coincidence. Grayscale’s product charges a 2.5 percent fee, which is significantly higher than the 0.25 percent fees charged by both BlackRock and Fidelity. With that kind of gap, it’s not hard to see why investors are moving their money. Costs matter more than ever now that Ethereum ETFs are becoming a long-term play rather than just a bet on price swings.

Why the Timing Makes Sense

Part of the recent momentum comes down to a few key developments. Ethereum’s price has started to recover concerning Bitcoin, which tends to draw attention. Also, new IRS guidance helped clarify how staking rewards are treated inside these ETF structures. That removed a lot of uncertainty that had been keeping wealth managers on the sidelines.

Another piece of the puzzle is that asset managers are rebalancing portfolios. That sounds technical, but it often means big institutions are adjusting their exposure and taking crypto more seriously as a slice of broader investment strategies. Instead of waiting to see what happens, some are starting to treat Ethereum as a real asset class worth including.

Retail Is Leading for Now

Most of the flows so far appear to be coming from retail investors and smaller wealth advisory firms. As of March 31, institutional holdings made up less than one third of the total ETF balances. That leaves room for much more growth, especially once the next batch of quarterly disclosures comes out in mid-July. If we start to see more large firms entering the picture, the pace of inflows could shift again.

Bigger Picture Is Taking Shape

Ethereum ETFs are not the only ones seeing action. Spot Bitcoin ETFs also posted strong inflows around the same time, suggesting that investor interest in digital assets is broadening. And now that both asset classes are available in regulated, low-fee formats, some investors may be comfortable going beyond Bitcoin and building out more diversified crypto exposure.

The question now is whether this interest in Ethereum can keep building. With fees dropping, guidance clearing up, and performance bouncing back, the pieces are falling into place. If larger institutions follow retail into these ETFs, $4 billion might not be the ceiling for long.

Key Takeaways

- Ethereum ETFs in the U.S. crossed $4 billion in net inflows, with the final billion added in just 15 trading days, showing a sharp uptick in investor demand.

- BlackRock and Fidelity are leading the pack with lower fees, while Grayscale’s ETHE continues to see major outflows due to higher costs.

- New IRS guidance on staking rewards and a recovering Ethereum price are helping drive fresh inflows, particularly from wealth managers.

- Retail investors are still dominating flows, but there’s growing potential for institutional adoption in the coming quarters.

- With both Ethereum and Bitcoin ETFs gaining traction, crypto is becoming a bigger part of diversified investment portfolios.