Arab Bank Switzerland’s Digital Assets Chief Declares: ‘1 BTC = 1 BTC – Everything Else Is Losing Ground’

Bitcoin isn’t just holding its ground—it’s exposing the weakness in everything else. According to Arab Bank Switzerland’s Head of Digital Assets, traditional assets are quietly crumbling against BTC’s dominance.

Here’s why the king crypto keeps winning.

While fiat currencies play musical chairs with inflation targets, Bitcoin’s scarcity model is doing the heavy lifting. No bailouts, no printer go brr—just a predictable supply schedule that makes central bankers sweat.

The verdict? Your portfolio’s ‘diversification’ might just be a fancy way to lose value. (But hey, at least the Wall Street sales brochures look pretty.)

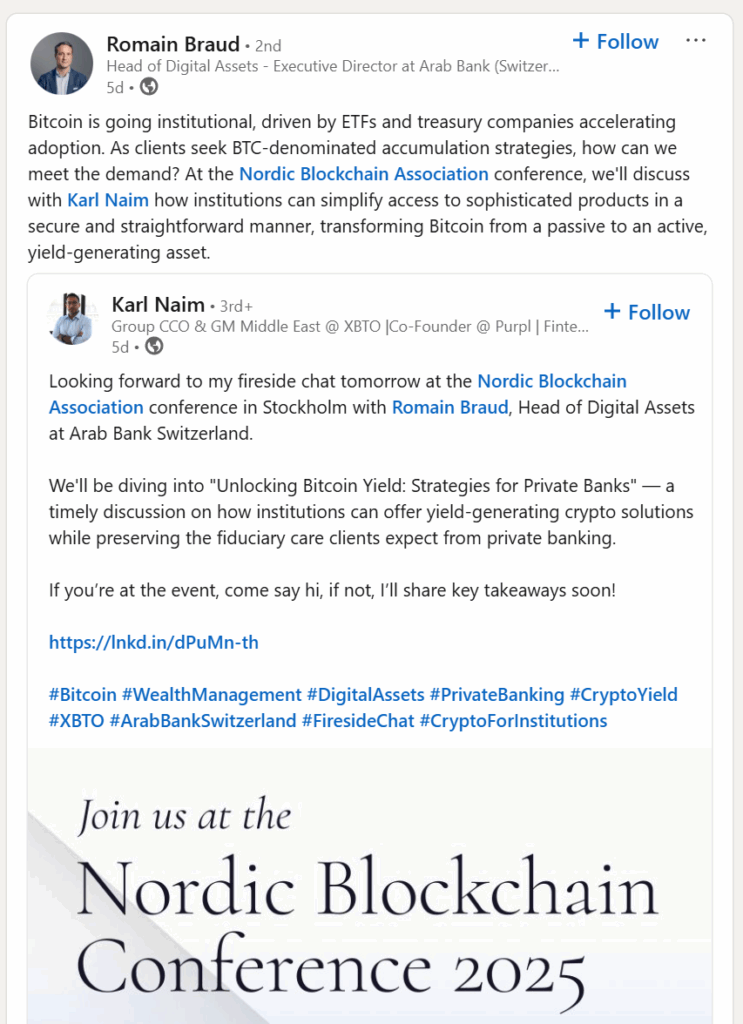

Arab Bank Switzerland Partners With XBTO To Launch BTC Yield Product For Institutional Clients

We’re partnering with @arabbankCH to launch a Bitcoin yield product, powered by our Diamond Hands strategy.

Institutional-grade

Yield, not just custody

Fully regulated

TradFi meets crypto, the right way.https://t.co/73Gq0L4ePN#Bitcoin #Yield #DigitalAssets pic.twitter.com/HZoxJoXqMz

— XBTO (@xbtogroup) June 20, 2025

Institutional digital asset management company, XBTO, announced a strategic partnership with Arab Bank Switzerland on 19 June 2025. This will enable the Swiss private bank “to launch a sophisticated Bitcoin yield product for its wealth management clients.”

“We have seen growing demand from our wealth management clients for ways to generate yield on their Bitcoin holdings within a properly managed risk framework,” said Braud.

The collaboration leverages XBTO’s proprietary “Diamond Hands” strategy to provide Arab Bank Switzerland’s clientele with an actively managed approach to generating yield on their Bitcoin holdings.

Karl Naim, Chief Commercial Officer and General Manager for UAE at XBTO said, “Arab Bank Switzerland’s six-year digital asset infrastructure development, combined with direct client demand for Bitcoin yield products, created the perfect foundation for this collaboration.”

“When we talk about Bitcoin yield, it’s simple, put your assets to work in a very safe controlled audited environment, right? And this partnership is all about it.”

“On the bank perspective, it’s really important to to step back and look at what we are,” said Braud. “We protect assets, we protect execution and also we protect the privacy of our clients. And these are the three pillars basically of the whole offering.”

“Financial institution adopting Bitcoin, it’s a no-brainer now. We saw the ETF success last year.”

“We have to do our duty and we have to make sure that we build in a very secure stable environment, and especially in Switzerland when the legal framework is already there since 2014,” the head of digital assets at the Arab Bank Switzerland said. “We have segregated assets, off balance sheet – digital assets that are fully protected because they are off balance sheet. So basically, client can audit the assets directly on chain or they can look at it as they can look at the blockchain.”

Explore: Zodia Markets Co-founder Nick Philpott Says, “If you wait for the regulator, you’ll have no innovation at all”

Key Takeaways

-

Institutional digital asset management company, XBTO, announced a strategic partnership with Arab Bank Switzerland, to launch a sophisticated Bitcoin yield product for its wealth management clients.

-

The partnership is part of a broader trend of banks integrating structured BTC yield products into wealth management services.