Oil Prices on the Brink: How the Iran-Israel Conflict Could Fuel Bitcoin’s June Rally

Geopolitical tensions are boiling over—and oil markets aren’t the only ones feeling the heat. As Iran-Israel clashes escalate, traders are bracing for a potential energy shock. Here’s why Bitcoin might be the unexpected beneficiary.

Black Gold vs. Digital Gold

When Middle East instability flares, crude prices typically spike. But this time, crypto’s hedge narrative could steal the spotlight. Bitcoin’s historical inverse correlation with oil during crises makes June a high-stakes experiment.

The Inflation Wildcard

Rocketing energy costs traditionally sink risk assets. Yet Bitcoin’s 2024 performance suggests it’s rewriting the playbook—just as Wall Street ‘experts’ were drafting its obituary. How’s that for timing?

Flight to Digital Safety

With traditional safe havens like gold carrying 20th-century baggage, Bitcoin’s borderless nature becomes its killer feature. Institutional flows into BTC ETFs suggest the smart money already knows.

As oil markets tremble, Bitcoin’s June could defy gravity—proving once again that in a world of petrodollar wars, code sometimes cuts deeper than missiles.

Oil Prices Slow To React To The Ongoing Conflict In The Middle East

While many were expecting oil prices to spike on opening at 6 pm ET, just 30 minutes into trading, oil was up by barely 3%, following the US military’s overnight strikes on Iranian nuclear facilities on Sunday.

This type of attack, coupled with the continuous threat that the Strait of Hormuz will close at any time, has led many investors to buy crude oil stocks in anticipation of a huge upside move.

However, at 6:27 p.m. ET on June 22, Brent crude was trading up 3.17% at $79.45 per barrel, while the US crude benchmark, West Texas Intermediate (WTI), was trading up $3.18 at $76.19 per barrel during the early New York trading session.

Previous incidents of this level have triggered far bigger moves in crude markets. A few examples include when Iran-linked militants struck Saudi Aramco’s Abqaiq facility in September 2019, temporarily halting 5% of global oil output, Brent futures spiked nearly 20% in a single day, marking the largest one-day price jump in history.

Another such event came following the US drone strike on Iranian Military Officer Qassem Soleimani in early 2020, prices surged a around 4% amid fears of regional retaliation. Today’s lukewarm response further highlights how much more insulated markets have become from geopolitical events.

The coordinated US airstrikes hit Fordow, Natanz, and Isfahan overnight, inflicting visible damage on enrichment and research infrastructure. Tehran has promised retaliation, but energy markets are betting that escalation remains limited.

President TRUMP had announced that all three nuclear sites had been completely wiped out; however, it has since come out that Fordow wasn’t destroyed, and the Iranians may have even moved the Uranium deposits before the attack.

No significant MOVE in oil prices will likely come until the Iranians decide on the Strait of Hormuz. If they decide to disrupt or close the Strait, barrels of crude oil could run toward $100, a price not seen since the Russian invasion of Ukraine began in 2022.

Oil Not Spiking Like Many Believed As Bitcoin Reclaims $100,000 – Is BTC The WW3 Hedge?

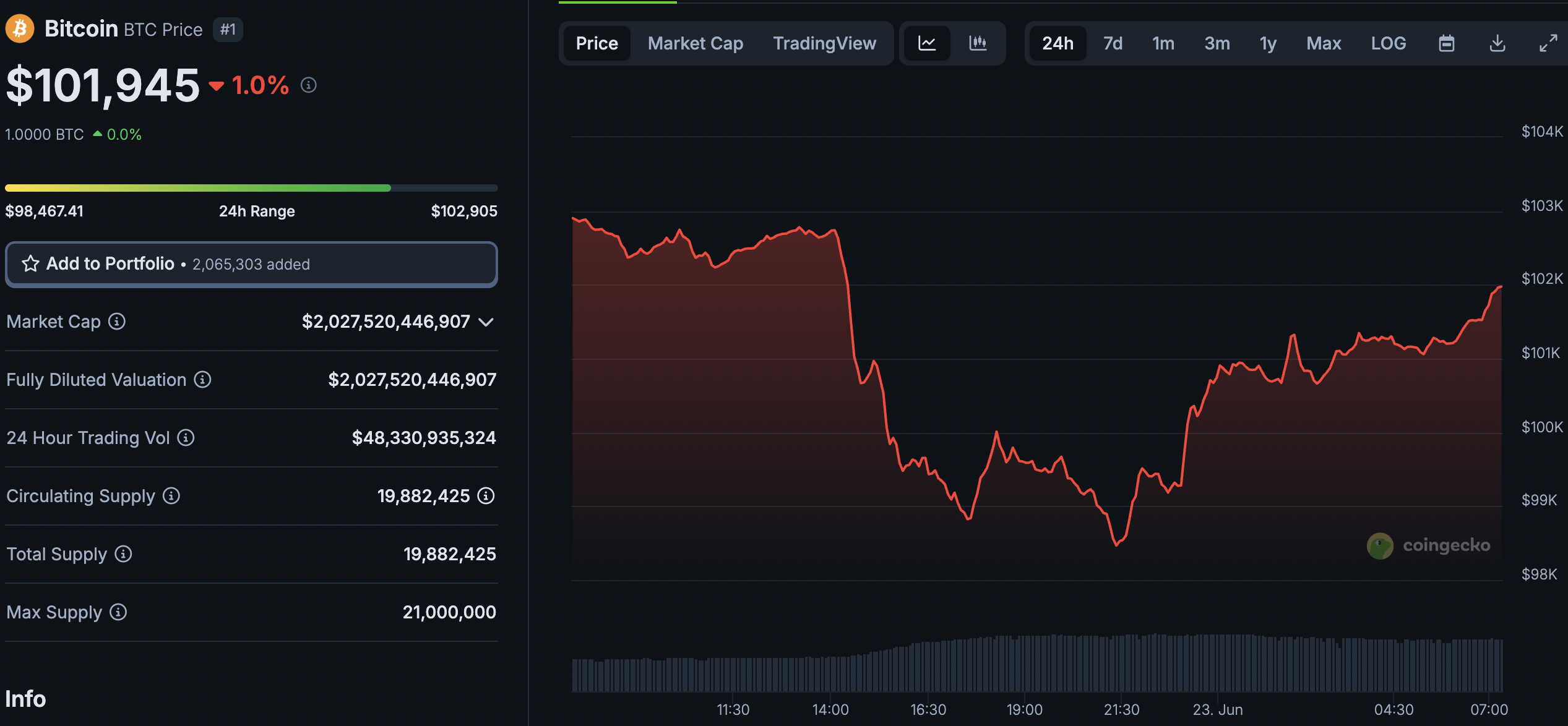

(COINGECKO)

Late yesterday, Bitcoin dropped to $98,500, leading many to believe that a slide toward $80,000-85,000 was coming. However, less than two hours later, BTC quickly reclaimed $100,000, and is now trading at $101,900.

This continued strength from Bitcoin, compared to Oil prices not reacting reasonably as market participants had assumed they would, is making the leading digital asset stand out as a go-to investment during this period of conflict in the Middle East.

Previously, Iran and Israel entering heavy conflict against one another, with the added caveat of the US getting involved, would’ve acted as a black swan event in crypto, and bitcoin would have crashed, dragging the rest of the market with it.

However, BTC’s refusal to settle below $100,000 is incredibly bullish, which is also buoyed by BlackRock’s continuing to post positive net inflows into its Bitcoin ETF. Other asset managers, such as Fidelity, have also been experiencing healthy inflows into their own BTC ETF.

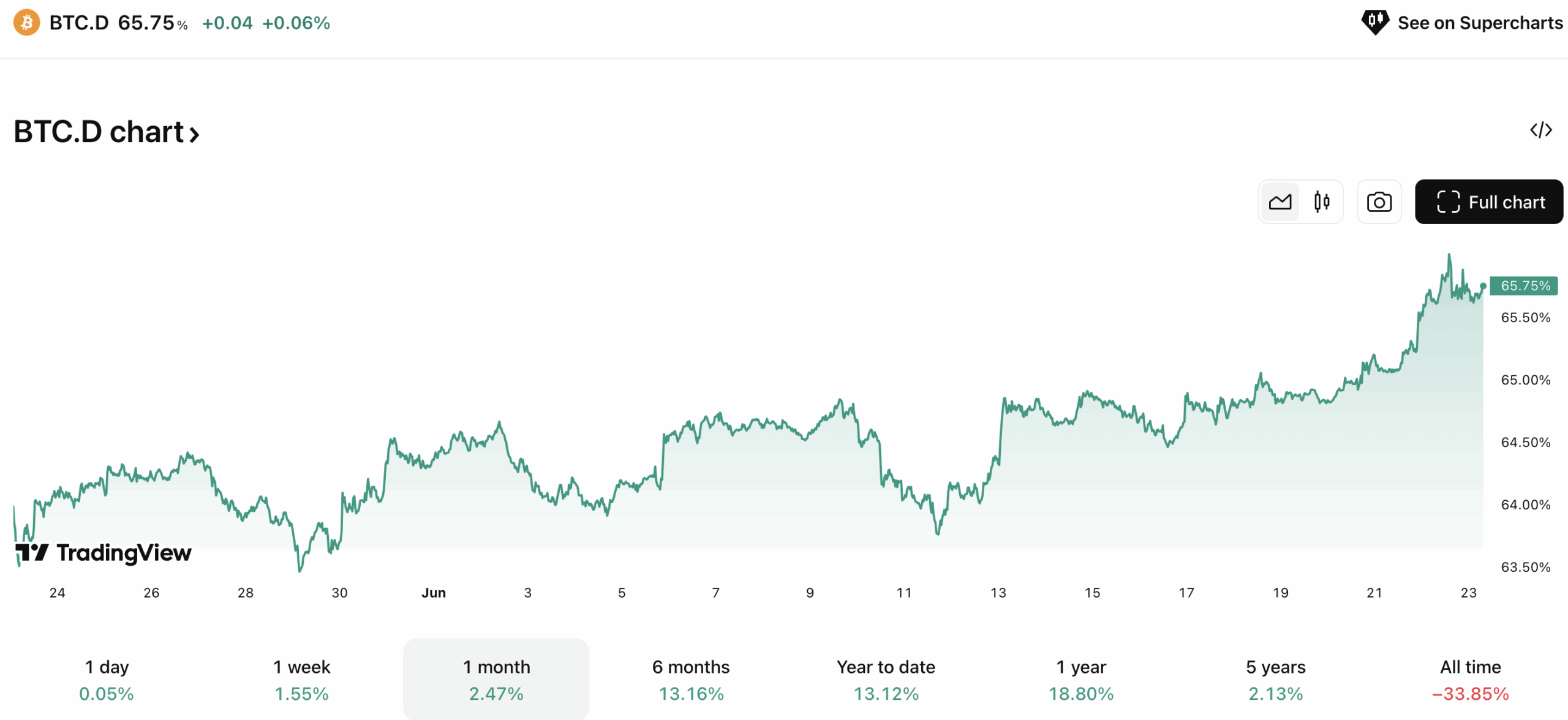

Another signal that Bitcoin is the leading investment asset right now is the continued rise of BTC dominance (BTC.D), which measures its share of the total crypto market cap. As most altcoins continue to bleed and Bitcoin holds steady, BTC.D has risen from 64.8% to 65.8% in the last three days alone.

(TRADINGVIEW)

While the rise of BTC.D highlights the weakness in altcoins right now, it also demonstrates the strength of Bitcoin and its newfound status as a hedge on the pending war.

All eyes will now be on the US TradFi markets opening today and any fresh announcement from President Trump on the US’s plans regarding the Israel/Iran conflict.

There is Optimism that the conflict could be drawing to a close after no reported missile attacks from Iran overnight and Israel stating they do not wish to be drawn into a war of attrition.

Any news of a ceasefire or outright end to this bloody conflict in the Middle East will likely see a huge surge across the crypto market, which could catapult Bitcoin to fresh highs, finally turning the $110,000 level into support before beginning the long-awaited run toward $150,000.