Nike’s NFT Backlash: Can Angly Web3 Collectors Sink the Swoosh?

When Nike dove into NFTs, it bet on brand loyalty overriding crypto’s cutthroat culture. Now, disgruntled holders of its .Swoosh tokens are mobilizing—flooding forums with complaints about locked utility, broken roadmaps, and that classic Web3 feeling of buying the hype but not the product.

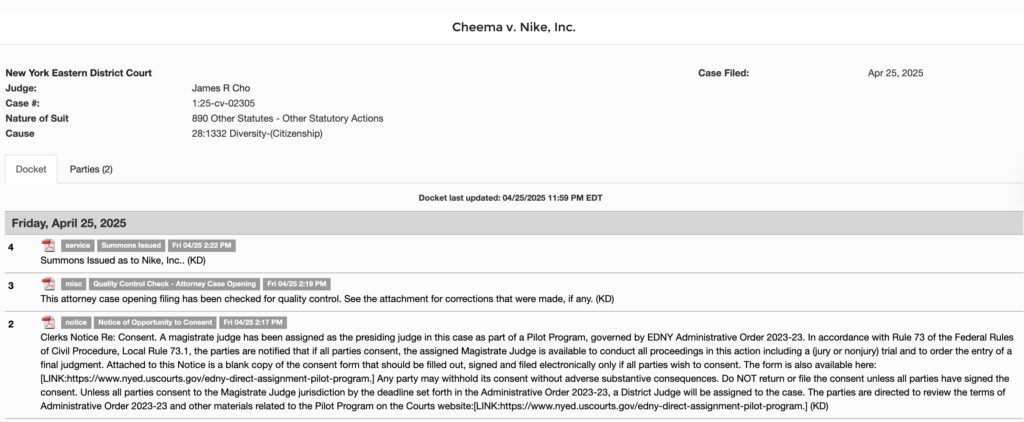

Legal threats loom as token prices stagnate 78% below mint. Meanwhile, Nike’s Q2 earnings call didn’t mention Web3 once—probably too busy counting those $49 billion in legacy sneaker sales. The playbook’s clear: when your metaverse pivot flops, just quietly reallocate the marketing budget back to reality.

NFT Holders Vs. Nike

Remember NFTs? That got memory-holed quickly.

I think NFTs’ original intent was to create digital property deeds by showing that you can “make it like a coin” or make it a transferable asset. Now, NFTs are the most sinister meme since being “Rick Rolled.”

NFTs be like pic.twitter.com/mhvGRMb7cE

— charker (@therealchaseeb) April 27, 2025

At the heart of the lawsuit is the claim that Nike hyped RTFKT’s sneaker-themed NFTs to attract investors, only to shut down operations in January 2025, leaving buyers with devalued or even “worthless” tokens. The plaintiffs argue Nike broke consumer protection laws by failing to disclose that the NFTs could qualify as unregistered securities under federal law.

The suit states, “Because the Nike NFTs derived their value from the success of Nike and its marketing efforts, investors purchased this digital asset with the hope that its value would increase in the future.”

Rug Pull Accusation Stirs Controversy

When Nike pulled the plug on RTFKT, it didn’t just close a platform—it wiped out the CORE features that once made it valuable. Heck, Trump hasn’t even done that to his NFT holders… not yet at least.

Challenges, quests, and rewards tied to NFTs vanished overnight.

The fallout has been brutal. Nike’s “CryptoKick” NFTs, once trading at 3.5 ETH (about $8,000) in 2022, are now scraping the floor at 0.009 ETH—roughly $16.

The plaintiffs say Nike ran a textbook rug pull—cashing in on hype, then ditching investors when the market cooled.

OpenSea, the top NFT marketplace, has already lobbied the SEC to keep NFTs out of securities law. However, lawsuits like this show the issue is anything but settled, and the uncertainty is choking both creators and buyers.

Meanwhile, the broader NFT market is crumbling. Global sales dropped 63% year-over-year in Q1 2025, collapsing from $4.1 billion to $1.5 billion. Nike’s RTFKT gamble, launched with fanfare in 2021, ended in closure just three years later—another casualty in a shrinking pile of garbage market that NFTs have become.

What’s Next in the Nike NFT Lawsuit?

With $5 million in damages on the table and allegations of shady trade practices across New York, California, and Oregon, the stakes are high—not just for Nike, but for the next theoretical wave of NFTs.

The case could carve out new legal ground, forcing companies to rethink how they run NFT projects and what real obligations they owe the people buying in.

Key Takeaways

- Nike is facing a class-action lawsuit in Brooklyn over the collapse of RTFKT, its high-profile NFT venture.

- The $5 million damages sought by the plaintiffs underscore the scale of losses they believe were driven by Nike’s actions.