Bitcoin Eyes $131K: The 4-Year Cycle That Could Trigger a Monster Rally

History doesn’t repeat, but it often rhymes—and Bitcoin’s 4-year halving pattern is screaming a bullish chorus. Here’s how the next 12 months could play out.

The Halving Halo Effect

Past cycles show BTC tends to peak 18 months post-halving. If the pattern holds, we’re staring down a potential 3x from current levels. Cue the institutional FOMO.

The $131K Target

Technical analysts point to logarithmic growth curves and miner capitulation cycles. Meanwhile, Wall Street’s latecomers are still trying to explain ’blockchain’ to their compliance departments.

The Wild Cards

ETF flows could accelerate the timeline—or geopolitical chaos might slam the brakes. Either way, hodlers win. Just don’t tell the ’efficient market’ academics.

(X)

(X)

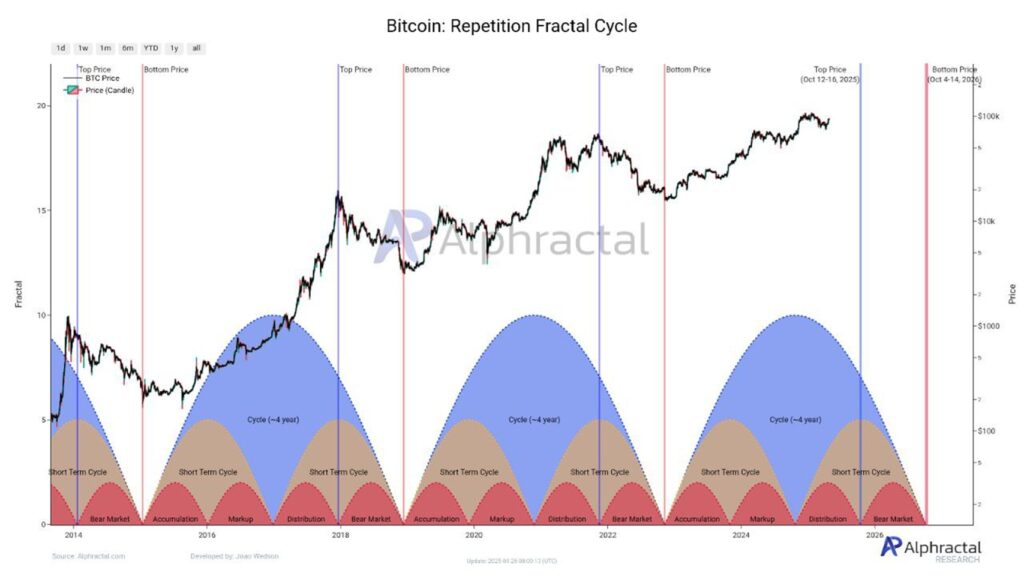

What Is the 4-Year Bitcoin Fractal Cycle?

Alphractal’s track record on Bitcoin’s 4-year cycle continues to hold up. This is hard to believe because these charts often end up like busted March Madness brackets.

The firm’s latest report confirms what long-time watchers have seen: the Bitcoin price has hit its cycle tops and bottoms with near clockwork precision for almost a decade. This time, the next peak is expected to land between October 12 and 16, 2025.

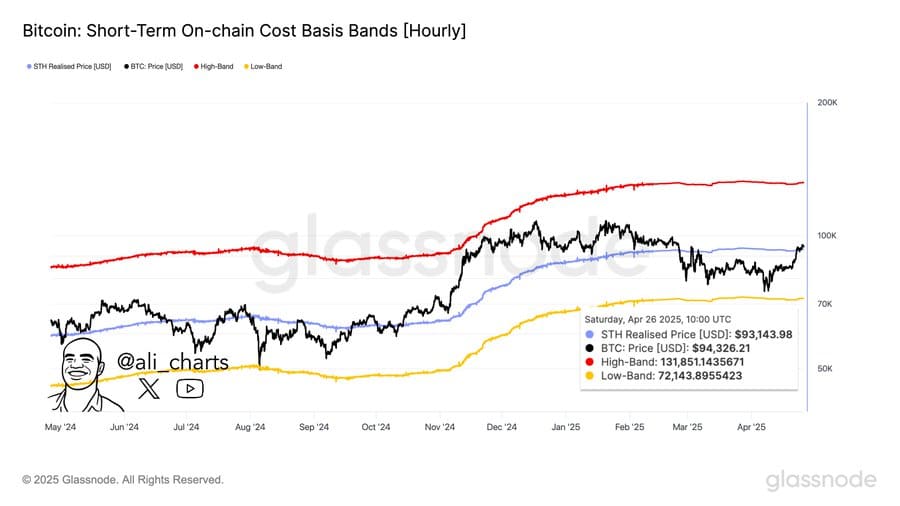

So far, it’s holding key levels like the Short-Term Holder (STH) Cost Basis, a technical marker that often distinguishes real momentum from hype.

The STH Cost Basis, which recently crossed the $93,145 mark, is a key indicator for predicting market trends. Staying above this level is crucial for maintaining upward momentum.

Bitcoin Price: Accumulation Fuels Optimism

Fresh buying pressure is fueling Bitcoin’s price. In the past 48 hours, about 20,000 BTC—worth roughly $1.86 billion—has changed hands, according to Santiment data. Heavy accumulation like this often primes the market for stronger rallies, and Bitcoin’s current move is no exception.

Right now, two key price zones are in play: $131,800 as a potential local top, and $71,150 as critical support. Bitcoin hovers NEAR the midpoint, and a decisive break higher would send a clear bullish signal.

Can The Bitcoin Price Sustain Its Momentum?

On the technical front, Bitcoin recently rebounded off a long-standing ascending trendline that has supported market rallies since 2018. 99Bitcoins analysts suggest breaching resistance at around $102,000 could open the gates for Bitcoin to achieve new all-time highs.

Many believe Bitcoin is primed for continued annual gains with momentum strengthened by accumulation and the STH Cost Basis holding firm.

Key Takeaways

- Bitcoin’s 4-year fractal cycle is back in focus, and the pattern says we’ll soon hit a $131,000 Bitcoin price.

- The STH Cost Basis, which recently crossed the $93,145 mark, acts as a key indicator for predicting market trends.

- On the technical front, Bitcoin recently rebounded off a long-standing ascending trendline.