Solana’s $1B Institutional Surge Fuels Ecosystem Frenzy

Wall Street finally discovers crypto’s speed demon—with nine figures and zero subtlety.

Solana just got the institutional nod it’s been craving. A cool billion floods in, validating its ’Ethereum killer’ claims while hedge funds pretend they always believed in Web3.

The ecosystem reacts like it’s mainlining Red Bull. Developer activity spikes. Memecoins multiply. VC wallets bloat. Same old story—just faster (and with fewer outages this time).

Meanwhile, Bitcoin maxis grumble about ’real decentralization’ between sips of their $10k blockchain coffee.

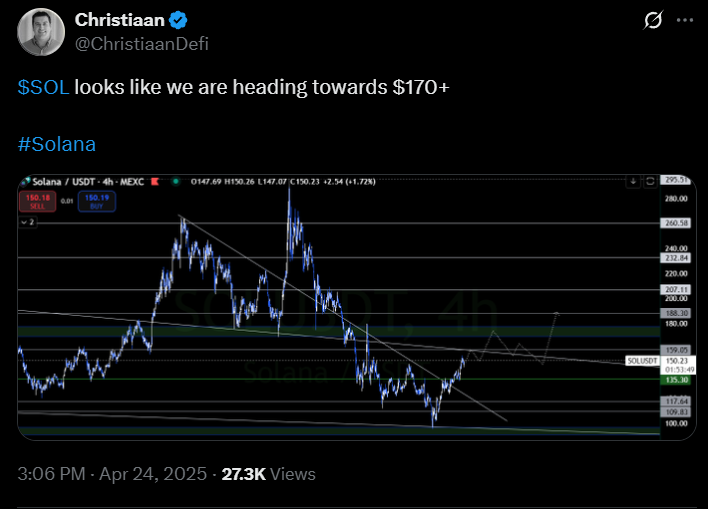

(X)

(X)

The money wave on SOL continued to build throughout April. On April 21, Galaxy Digital, led by Michael Novogratz, quietly swapped $100 million worth of Ethereum for Solana tokens on Binance. By April 23, SOL Strategies secured up to $500 million from ATW Partners, with the first $20 million scheduled to hit by May 1. The plan is to load up on SOL and stack staking rewards.

Not to be left out, Prague-based RockawayX dropped a $125 million fund on April 24, aimed squarely at Solana developers.

What These Investments Mean for Solana

With fast transactions, low fees, and scalable infrastructure, Solana is positioning itself as a real platform for DeFi, gaming, and decentralized apps—not just promises on a whiteboard.

Partnerships like Helium’s collaboration with AT&T to build wireless networks through Solana hint at a future where blockchains aren’t just financial toys but actual infrastructure.

The Next Big Thing For SOL

While Solana’s price saw some turbulence in recent weeks, these institutional investments provide long-term stability and growth potential. The combined $1 billion infusion will amplify Solana’s capabilities, supporting the next generation of apps and use cases.

The broader takeaway is that Solana is attracting attention for its token performance and ecosystem development.

Key Takeaways

- A US Bitcoin Reserve is on its way. Michael Saylor, MicroStrategy’s fierce Bitcoin advocate, wants the U.S. to own the crypto game.

- In the White House meeting, Saylor called Bitcoin an ally of the dollar, not its rival, and dubbing it “digital gold.”

- For now, the debate about cryptocurrency’s place in America’s financial future is just beginning.