AVAX Price Outlook: Assessing the Potential for a Major Rally

As of April 2025, Avalanche (AVAX) has shown notable price action, prompting market participants to evaluate whether a sustained upward trajectory is imminent. This analysis examines key technical indicators, on-chain metrics, and ecosystem developments to assess AVAX’s potential for reaching new highs. With growing institutional interest in layer-1 solutions and Avalanche’s recent protocol upgrades, the token’s fundamentals appear strong. However, traders should carefully monitor resistance levels and trading volume patterns to confirm bullish momentum. This report provides a data-driven perspective on whether AVAX is positioned for significant appreciation in the current market cycle.

(@el33th4xor) May 16, 2020

(@el33th4xor) May 16, 2020

In 2019, Emin founded Ava Labs and started to build Avalance using the whitepaper published by Team Rocket. The mid-2020 first testnet launch happened; it was called Denali. Developers had, for the first time, the opportunity to test network capabilities and smart contract deployment.

Not long after that late 2020 mainnet followed. Ava Labs officially launched the Avalanche mainnet. AVAX token went live, and users could trade, stake, validate, and build decentralized applications (dApps). In early 2021, Ava Labs launched Avalanche Rush which was a huge play for DeFi projects.

They announced a $180 million liquidity mining incentive program that attracted big players like AAVE and Curve. That throws visibility into the DeFi sector, which up to that moment was kinda hidden from retail people. Ignited the DeFi season, and many devs started creating new projects, attracting not only fresh money from retail but also institutional players.

1/ Couple of quick stats on the Avax ecosystem:

– TVL has just peaked ATH at $2.6b since the parabolic run-up when Avalanche Rush was announced

– TVL has increased ~10x since the announcement and continues to climb. pic.twitter.com/WMyZ2h4Csl

— Wangarian (@0xWangarian) September 16, 2021

Afterward, they introduced Subnets, which allowed devs to customize crypto networks under the Avalanche network. In 2023, AVAX partnered with Amazon Web Services (AWS), which accelerated crypto adoption and injected fresh money into the crypto world.

Avalanche Against Other Crypto Competitors.

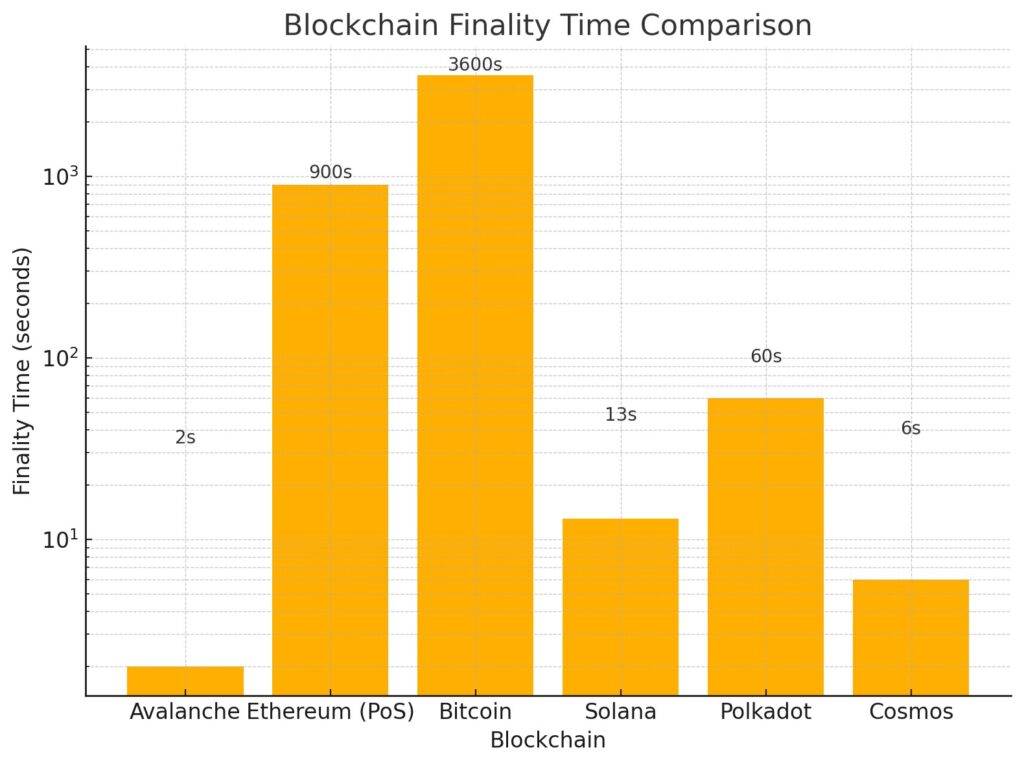

One of the best improvements that AVAX has is the consensus design. Probabilistic metastable consensus that uses repeatable subsampling and “gossiping” between nodes. In other words, that resulted in almost instant transaction finality (~1- 2 seconds).

In addition, transaction per second (TPS) is also the highest of all, amassing more than 4500 compared to only 30 for Ethereum. To put it differently, they came up with something that nobody else came up with at this time. They divided their chain into 3 pieces. Tri-chain architecture concluded in X-Chain, C-Chain, and P-Chain.

X-Chain was responsible for asset creation and transfers. It was the exchange on which people could achieve those speedy transactions. C-Chain was Ethereum Virtual Machine (EVM) compatible, allowing developers to create ETH dApps on Avalanche without hassle. Also, it was based on Solidity, which allowed developers to copy and paste code with little to no changes in the code. P-Chain was responsible for staking, validators, and subnet creation.

Not only did this architectural design bring transaction fees for a fraction of a cent but also manage to achieve high TPS.

AVAX Price Prediction and Technical Analysis

Right after the announcement of Avalanche Rush and DeFi summer in November 2021, AVAX hit an all-time high of $146.

()

()

Somehow that didn’t last long, and when the bear hit the market 2022 price went to one of the lowest points of around $18-$20 per token. Nevertheless, that didn’t bother true believers, and after a long year of consolidation price went almost 3x up.

Right now, the price is sitting comfortably at one of the biggest supports in the weekly timeframe. Forming a descending triangle pattern, which usually ends up with breaking out of resistance and pumping big time.

That would lead a rally to the next resistance, which is at ~$6o mark. Also, RSI 14 looks like it has bottomed out, furthermore solidifying our thesis that AVAX is preparing for a pump.

)

)

On lower timeframes, things stay the same, waiting for some catalyst to induce the beginning of the next pump. With the recent geopolitical situation, this is a really hard job, but that doesn’t discourage crypto enthusiasts. When the time comes, traders who secured their bags will sit back and watch how numbers grow.

Join The 99Bitcoins News Discord Here For The Latest Market Updates