Bull Run Busted? Rate Cuts Crush Crypto Markets - Here’s Why Digital Assets Are Tumbling

Central banks pull the liquidity plug - and crypto markets feel the squeeze.

The Taper Tantrum 2.0

Rate cuts aren't the stimulus crypto bulls hoped for. Instead, they're triggering a classic risk-off rotation as traditional finance wakes up to inflation realities. Money's fleeing speculative assets faster than a miner selling at peak profitability.

Liquidity Drainage

When central banks reverse course, the cheap money that fueled crypto's explosive growth evaporates. No more free capital sloshing around seeking 100x returns. The party's over when the punch bowl gets taken away - though Wall Street still gets to keep their glasses.

Institutional Flight

Hedge funds and ETFs are dumping digital assets first. They've got compliance departments to answer to - and right now, risk management screams 'reduce exposure.' Retail gets left holding the bags as always.

Technical Breakdown

Key support levels shattered like a hard drive during a bear market. The charts don't lie - and they're painting a ugly picture for momentum traders who forgot what a 50% correction feels like.

This isn't the end of crypto - just another reminder that when traditional finance sneezes, digital assets catch pneumonia. The technology continues building while speculators panic sell. Smart money's already accumulating at these levels, because nothing creates buying opportunities like forced liquidations.

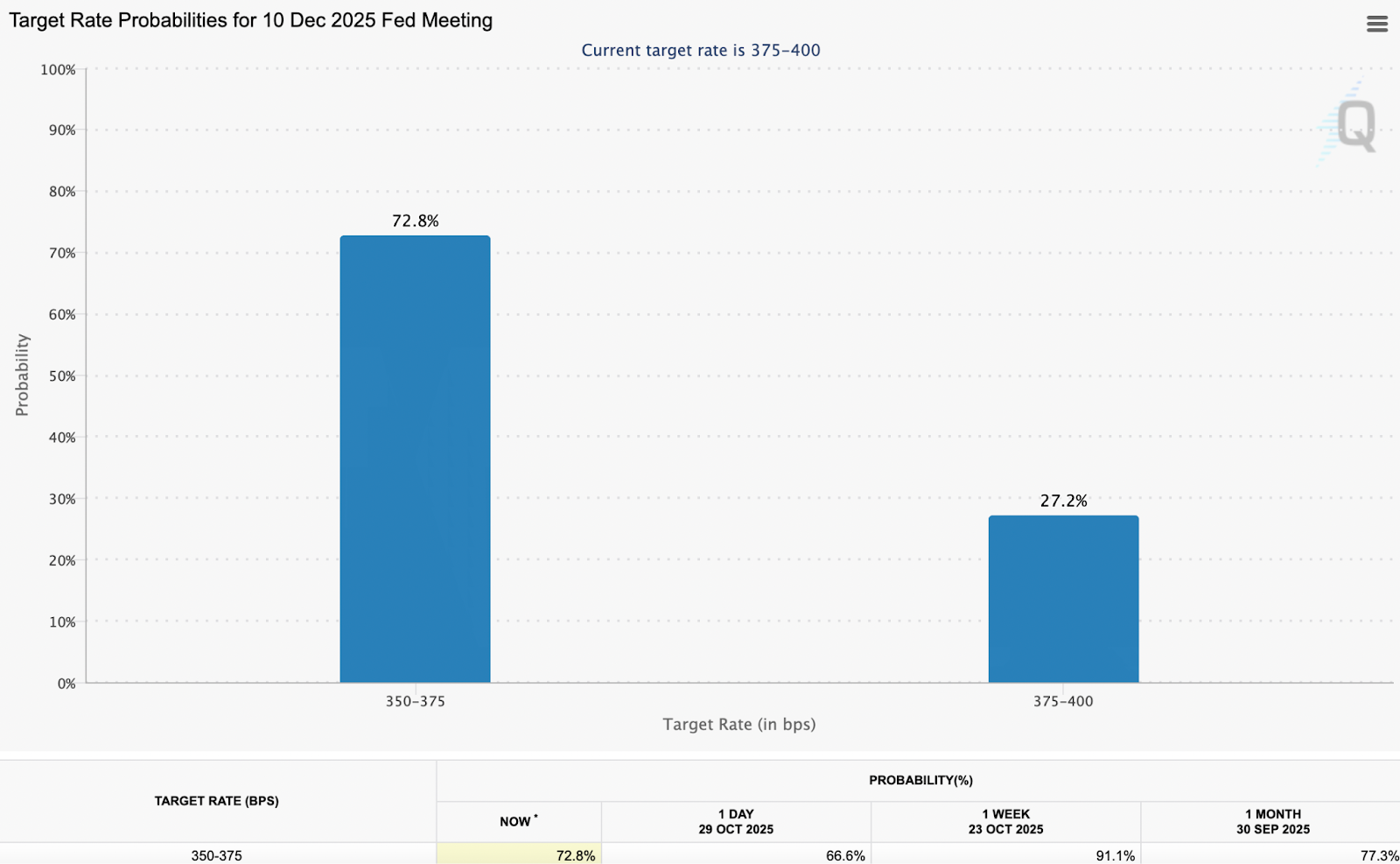

(Source: CME’s FedWatch Tool)

That shift pushed investors to unwind positions, weighing on crypto prices.

Bitcoin briefly climbed toward $110,000 before slipping, as traders reacted to the Federal Reserve’s latest signals.

The MOVE erased more than $80 billion from the total crypto market value. Altcoins took a harder hit, with coins like XRP and SOL among the weakest performers.

Data from both spot and derivatives markets showed heavy liquidations, mostly clustered NEAR the $109,000 area.

Stocks tied to the sector also cooled. Coinbase and Strategy (formerly MicroStrategy) pulled back alongside the rest of the market.

Bitcoin Price Prediction: Will November Bring Stronger Momentum for Bitcoin?

Crypto Fear and Greed Chart All time 1y 1m 1w 24hThe Fed’s statement confirmed a 25-basis-point cut. It also noted an operational change set for Dec. 1, when the central bank will stop quantitative tightening by reinvesting principal into Treasury bills.

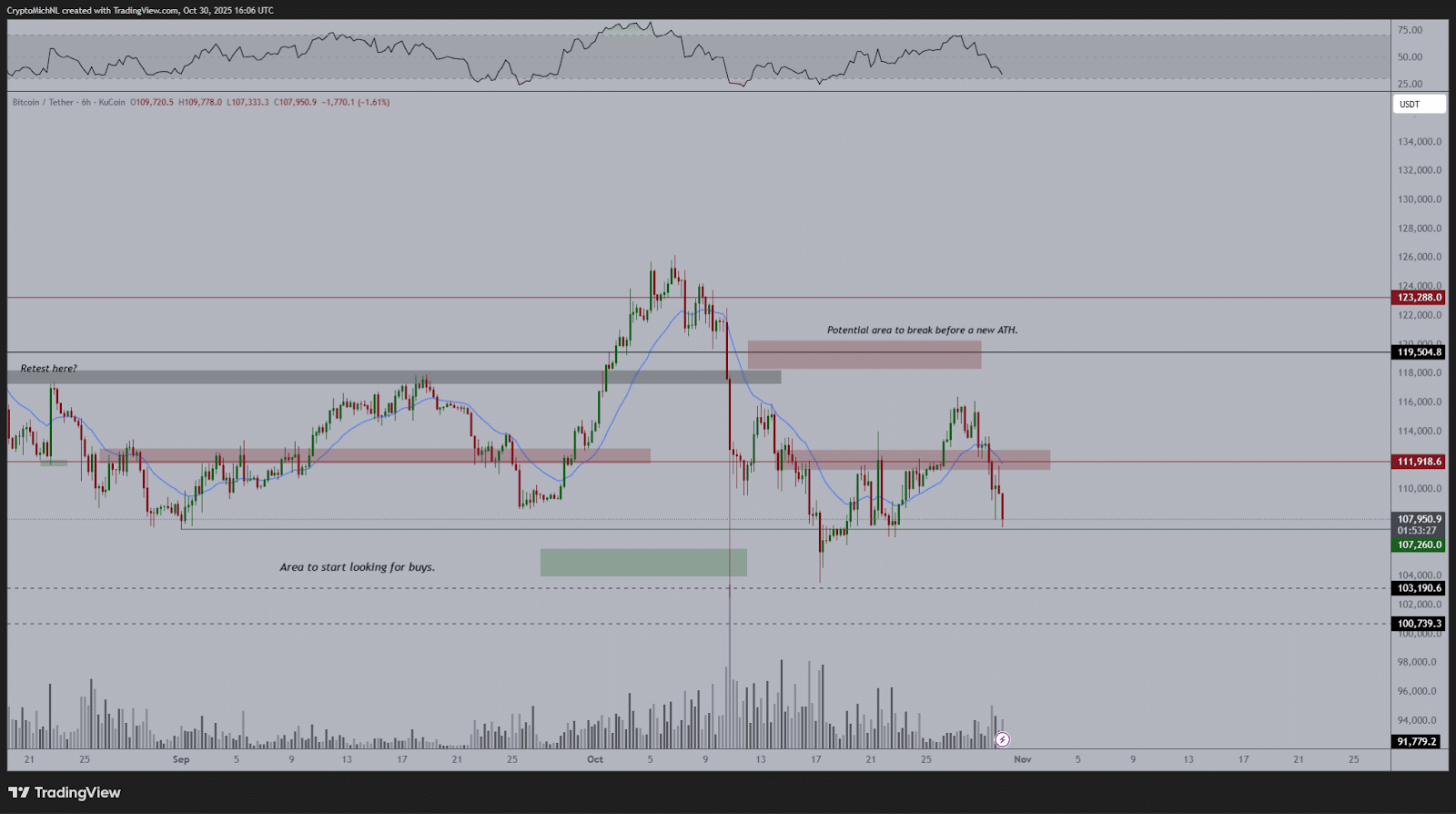

Bitcoin price is trading near $108,000 after another pullback. Analyst Michael Van de Poppe shared a six-hour chart showing key price zones.

He said the latest move stalled at the $111,900-$112,000 range, which remains the main roadblock before Bitcoin can attempt a new all-time high.

He noted that this level is still the point at which the trend must break to continue moving higher.

The chart shows price drifting toward support near $107,000, an area where buyers have stepped in before.

If this level slips, Van de Poppe points to a wider demand zone around $103,000–$104,000. A move into that region would likely come from a liquidity sweep. The downside targets he marked are $103,000 and, in a deeper drop, roughly $100,700.

(Source: X)

Recent trading has been messy. bitcoin pushed above $123,000 but slipped soon after, leaving a line of lower highs. That signals some short-term weakness. Sellers stepped in again around $118,000–$119,500, keeping the price capped.

Trading volume looks steady, meaning there’s no strong buying pressure during this pullback.

There’s still a key breakout zone near $119,500. A move back above that level would show that momentum is improving. For now, the broader view remains upbeat. Van de Poppe still expects strength in November and says dips can be worth watching. However, if bitcoin price falls below the $107,000 area, the downside risk increases.