Ripple’s Western Union Deal Ignites Fierce Competition With Solana - XRP Price Outlook

Ripple just landed the Western Union partnership that could reshape the entire payments landscape - and put Solana on notice.

The Battle for Payments Supremacy

While Solana's been chasing retail traders with meme coins and NFT hype, Ripple's executing the boring-but-brilliant strategy of actually building real-world financial infrastructure. The Western Union deal isn't just another partnership - it's a direct shot across the bow of every payment-focused blockchain.

XRP's Make-or-Break Moment

Price predictions are flying as traders weigh whether this institutional adoption will finally translate to sustained momentum. The crypto market loves a good narrative, but let's be real - Wall Street still treats most digital assets like speculative casino chips while quietly building the actual plumbing.

One partnership won't settle the Ripple vs Solana war, but it sure makes the established financial players look twice at who's actually building something useful versus who's just running a high-tech popularity contest.

Western Union already uses Ripple’s tech… just not directly.

Western Union recently acquired International Money Express (Intermex), a company that already uses Ripple’s On-Demand Liquidity on the XRP Ledger. So by buying Intermex, Western Union basically gained access to Ripple’s infrastructure and XRP’s rails.

Now, sure, XRP doesn’t have the same massive DeFi and dApp ecosystem that Solana has. Solana dominates there. But Ripple is laser-focused on payments and financial institutions. That specialization gives XRP a unique advantage in the high-stakes world of bank settlement.

Millions MOVE money.![]()

Trillions move the world.![]()

WesternUnion & Solana handle millions…$XRP and @Ripple are built for trillions.

Different league. Different purpose. #XRP #Ripple pic.twitter.com/bqa7XxCqz4

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) October 29, 2025

Ripple’s CEO has been saying for a while that banks WOULD eventually adopt XRP, and he kind of called it. The race is still wide open. Solana’s stablecoin partnership is a significant move, but Ripple has established deep integrations with actual financial players.

This competition isn’t just “payments vs. payments.” It’s payments + tokenized assets + cross-border settlement + global finance + consumer rails. If Ripple executes, it keeps its crown in banking. If not, Solana, and maybe others, could start taking over the value chain.

When It Comes To Technicals, XRP Is Elite: Price Prediction

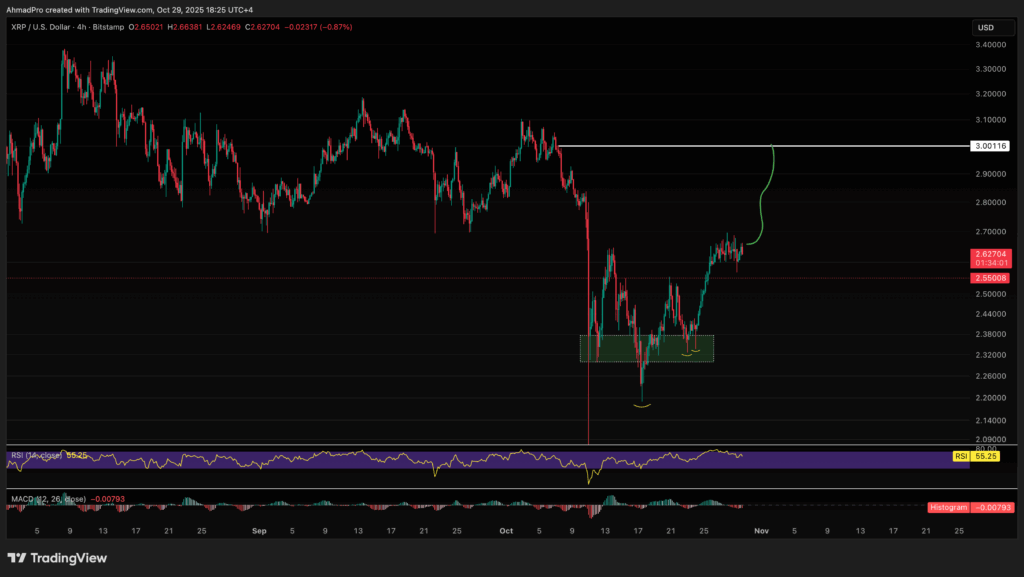

(TradingView)

XRP found a solid floor around 2.20 and built a clean double-bottom in that green demand area. Every dip into that zone was bought up quickly, and now the bounce is finally kicking in. The price pushed through 2.55 and is holding above it, which is the first real sign that the trend might be flipping back up.

The next big stop is the 3.00 zone, where a ton of liquidity sits and where the price dumped from before. RSI NEAR 55 indicates decent strength without being stretched, and the MACD appears poised to flip bullish soon. As long as XRP keeps closing above 2.55, the setup is still pointing toward a move into the 3 dollar area over the next leg up.

Key Takeaways

- XRP still holds a strong advantage in banking and payments despite Solana’s new Western Union deal.

- Price action stays bullish as long as XRP holds above 2.55, with a clean path toward the 3 dollar target.