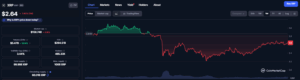

XRP Battles Resistance as Sell Signals Flash: Can Bulls Still Charge Toward $3?

XRP faces critical resistance levels as technical indicators turn bearish—but the $3 dream isn't dead yet.

The Technical Standoff

Sell signals emerge across multiple timeframes, creating headwinds for the digital asset. Resistance levels hold firm, testing bulls' conviction amid market uncertainty.

Bull Case Intact

Despite current pressures, the $3 target remains mathematically plausible. Historical patterns suggest breakout potential if key support levels maintain.

Market Psychology

Traders balance technical warnings against XRP's proven volatility profile. The asset's history of dramatic moves keeps hope alive—because in crypto, fundamentals sometimes take a backseat to pure speculation.

Will XRP defy the charts and rally, or succumb to technical reality? The battle between indicators and ambition continues.

(Source: CoinMarketCap)

CoinGlass’s data shows that open interests have increased by 0.42%, amounting to $4.55 billion. Meanwhile, the derivatives volume fell by 3.18% to $8.46 billion. This suggests that traders are reducing their aggressive short-term bets while holding on to their open positions, a frequent sign of consolidation before a decisive move.

(Source: Coinglass)

(Source: Coinglass)

A technical indicator called the TD Sequential, which tracks momentum and trend changes, has just flashed a sell signal. The tool has been pretty accurate in predicting XRP’s price action recently. Based on this signal, XRP might find it hard to rise above $2.70 in the short term.

The TD Sequential has been remarkably accurate at spotting $XRP trend reversals over the past three months.

It now flashes a sell signal! pic.twitter.com/rZqKU12cAF

— Ali (@ali_charts) October 29, 2025

Analysts believe that there’s a 95%-100% chance of an XRP ETF getting approved, which can bring in $4-$10 million of new investments.

XRP Price Analysis: Can Its Momentum Make $3 Possible?

XRP has been moving within a tightening price range since July this year. This pattern, also known as a triangle, suggests that the price is getting ready to make a big move, either up or down, as trading activity becomes more compressed.

On the daily chart, XRP has moved up from $2.58 to , however, it is unable to breach the $2.70 resistance level. The 20-day and 100-day exponential moving averages (EMA) at $2.69 and $2,73 have formed a resistance zone, while the 200-day EMA at $2.61 provides nearby support.

(Source: TradingView)

This tight cluster of averages reflects market uncertainty since XRP’s price action is continuing to compress towards an eventual breakout.

If XRP manages to close above $2.73, it could signal a strong MOVE toward $3.00 or even $3.20. This is especially true because of a growing interest from big investors. However, if the price falls below $2.55, it could drop further to around $2.30, which could potentially put a damper on its current bullish trajectory.

![]() #XRPUSDT | Liquidation Heatmap

#XRPUSDT | Liquidation Heatmap

![]() The price is consolidating around 2.65, moving sideways.

The price is consolidating around 2.65, moving sideways.

Below, there’s a strong liquidity zone between 2.54 and 2.57, where buyers could step in if price retests that area.

Above, the 2.70–2.74 region shows a large block of selling… pic.twitter.com/P7lZCKibrQ

— Trading Different (@tradingdiff) October 29, 2025

Moreover, the Relative Strength Index (RSI) is sitting at 61 indicates that the market still has a bit of a headroom before it enters overbought territory. The next few trading sessions will be particularly important to analyze which way XRP’s price action will skew.

XRP Long Term Picture Boosts Confidence

XRP is designed to help banks and other financial institutions move money faster and more efficiently across borders. It reduces the need to keep cash in foreign accounts and makes it easier to follow financial regulations when sending money or managing assets.

Ripple’s network already operates at a large scale. It handles 90% of daily foreign exchange markets with more than 90 payout corridors and has processed over $70 billion in total volume.

Because of its mix of speed, flexibility and regulatory support along with its growing use cases, XRP has a strong chance of gaining value over time, since few other crypto platforms offer a full package for financial institutions.

Key Takeaways

- XRP trades near $2.65 with rising volume but faces resistance around $2.70

- TD Sequential indictor flashed sell signal, suggesting limited short-term upside for XRP

- Whale accumulation and ETF optimism support long-term bullish outlook for XRP