AAVE Buyback Bombshell: Will This Game-Changing Proposal Send Prices Soaring?

DeFi giant Aave drops governance bombshell with revolutionary token buyback plan.

The Buyback Breakdown

Community voting kicks off this week on whether to deploy treasury reserves for aggressive AAVE repurchasing. The proposal aims to create artificial scarcity while rewarding long-term holders.

Market Mechanics Unleashed

Reduced circulating supply typically triggers bullish momentum. Historical crypto buybacks have generated 30-50% price surges within weeks. Aave's massive treasury could supercharge this effect.

The Regulatory Tightrope

SEC scrutiny looms over DeFi token economics. Will regulators classify this as securities manipulation? Traditional finance would already be facing subpoenas.

Trader's Dilemma

Front-run the proposal or wait for confirmation? Early birds might capture the biggest gains, but risk voting failure. Because in crypto, even 'sure things' have a habit of blowing up spectacularly.

(Source: Aave Governance)

The plan, to be introduced by the Aave Chan Initiative (ACI), suggests purchasing between $250,000 and $1.75 million every week or so.

They would be managed by TokenLogic and the Aave Finance Committee (AFC), and the sum would vary depending on market conditions, liquidity, and earnings.

This would become a standard part of the Aave operation, granting buybacks a permanent place, rather than the pilot program they are currently.

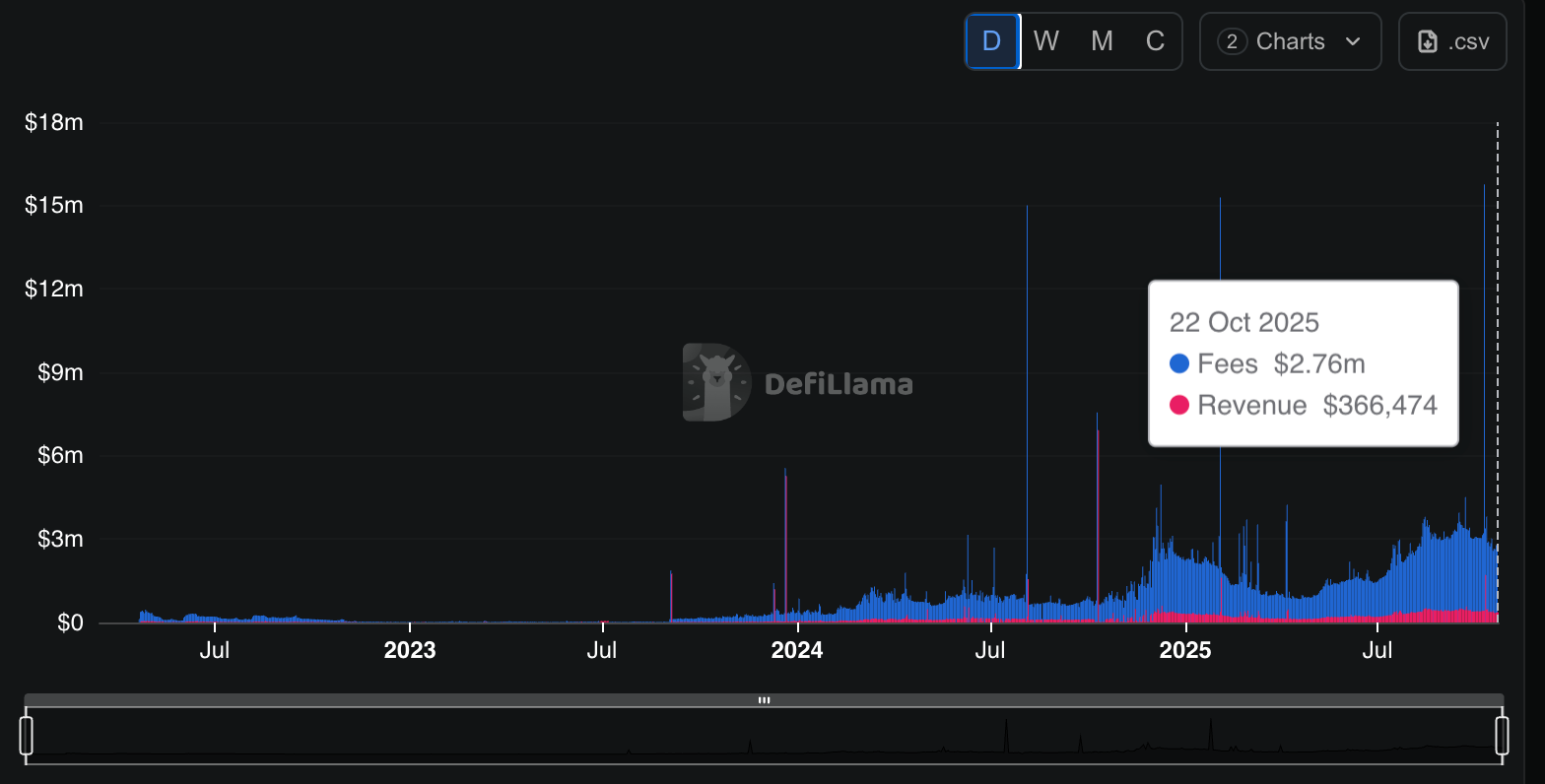

Can Aave’s $169M Annual Revenue Sustain a $50M Buyback?

The proposal suggests that the program would establish a long-term repurchase of AAVE with the help of revenue generated through the protocol.

There would be a range of flexibility in the AFC, between 75% of the weekly amounts, subject to available funds and market trends.

The second step involves a Snapshot poll, followed by an on-chain vote to implement the policy, in the event of a successful poll.

DeFiLlama data indicate that the protocol has received approximately $13.9M within the past 30 days and a rate of roughly $169M per year.

(Source: DeFiLlama)

That level of revenue would comfortably fund a $50M yearly buyback even after covering other operational expenses.

Early community feedback has been mostly positive. Aave founder Stani Kulechov stated that he supports increasing the buyback target to $50 million per year.

As of press time, AAVE was trading NEAR $218, down approximately 5% for the day, with prices fluctuating between $215 and $231.

Market reactions remain mixed, but the governance update has drawn attention to whether consistent buybacks can help steady the token amid broader volatility.The proposal comes just before the Aave v4 rollout expected in late 2025.

The upgrade will introduce a “hub and spoke” framework aimed at pooling liquidity more efficiently and managing risk across smaller market modules, a structure that could affect the protocol’s revenue and, in turn, its ability to sustain buybacks.

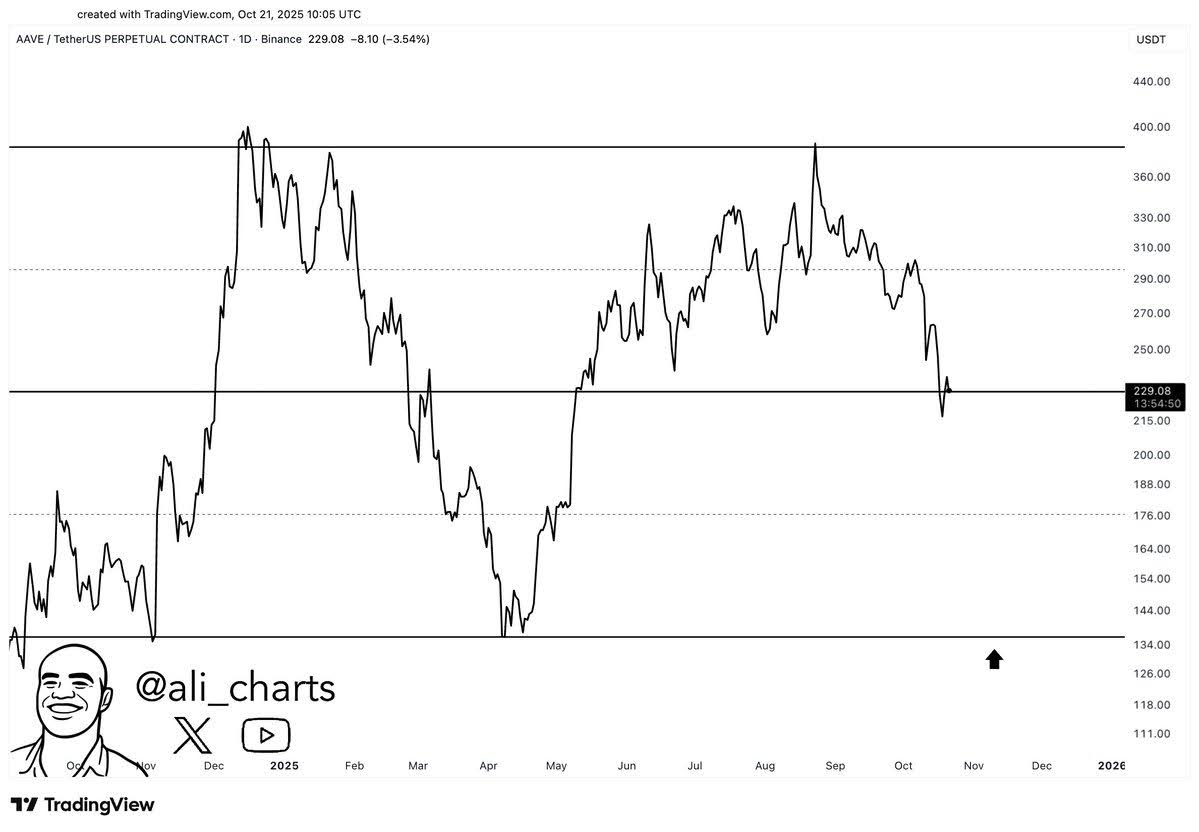

AAVE Price Prediction: Is AAVE Heading Toward the $135 “Magnet” Zone Highlighted by Analysts?

Technically, AAVE’s price chart signals pressure. The token is struggling to hold key support levels.

Analyst Ali Martinez described $135 as a “magnet” for AAVE, suggesting that a breakdown below current levels could trigger a deeper pullback.

The token collapsed below its mid-range support of $250, which had received significant purchase support earlier this year.

(Source: X)

On a technical level, a lower-high and lower-low pattern is now apparent in the chart, indicating a short-term decline.

The second support is close to $215, but the introduction of the zone of $135 by analyst Ali Martinez indicates that a greater correction may occur should the sentiment remain weak.

That is a level that has traditionally been in high demand and is an area worth following in the future.

Resistance is located near $360, where past rallies have stalled. A steady break above $250–$270 would flip the setup and allow a rebound.

For now, momentum is weak, and repeated failures to retake $270 show buyers aren’t in control.

Liquidity is thin, and traders continue to rotate into Bitcoin and Ether. If AAVE can’t reclaim its former support, a move toward $135–$150 in the coming weeks is on the table.

The trend remains bearish as long as the price remains below $250. Traders are watching to see if AAVE can base here or slip toward the lower demand zone flagged by Martinez.