Bitcoin Plunge: Crypto Whale Bets $250M Against BTC - Has The Market Topped Out?

Billionaire whale makes quarter-billion dollar bearish Bitcoin wager as markets tumble

The Whale Move That Shook Crypto

While retail investors panic-sell, one billionaire just placed a massive $250 million bet against Bitcoin. The timing couldn't be more dramatic - right as BTC experiences one of its sharpest corrections this year.

Market Psychology vs Fundamentals

Traders are scrambling to decode whether this is smart money positioning or just another rich guy's gamble. The whale's move screams institutional skepticism, yet Bitcoin's core adoption metrics continue climbing. Classic case of Wall Street logic clashing with crypto reality.

Technical Breakdown

Support levels are crumbling faster than a leveraged trader's portfolio. The $250 million short position represents one of the largest bearish bets we've seen this cycle - enough to make even the most diamond-handed HODLer sweat.

Where From Here?

History shows whales often get it wrong too - remember when billionaires shorted Amazon in 2014? Bitcoin's network fundamentals remain robust despite price action. Sometimes the 'smart money' is just money with a louder microphone.

As always in crypto, the only certainty is volatility - and the occasional billionaire making a splash while traditional finance guys still struggle to pronounce 'wallet'.

Blockchain data indicate that the trader opened a $235M Leveraged short position on BTC earlier this week, signaling that big money may be hedging for another leg lower amid tariff fears and the ongoing US government shutdown.

Why is Bitcoin Dropping? Whale Reenters With $235 Million Short Bet

According to Hypurrscan, the position was entered when bitcoin was trading near $111,190, using 10x leverage, which would effectively print billions if BTC USD price continues to crash. The short is currently in the profit as BTC trades around $108,000.“The whale who made $200M shorting the Bitcoin crash to $100K has now moved $30M to Hyperliquid and is shorting AGAIN,” wrote Arkham Intelligence in a post on X.

BREAKING: The insider Bitcoin whale who profited from last week’s crash, currently short $235M with 10x leverage. pic.twitter.com/xX8gADLB5j

— Jacob King (@JacobKinge) October 21, 2025

Just a week ago, the same wallet reportedly booked over $200 Mn in profit after accurately timing Bitcoin’s sharp drop to $100,000. It appears that he might be right again, with BTC stuck in what feels like a perpetual cycle of decline.

Whale Movements Signal Institutional-Level Strategy Underpinning BTC Mega Short

The investor, who first emerged in September, made headlines after rotating roughly $5Bn worth of BTC into ethereum (ETH). This move briefly made the Whale one of the largest non-corporate ETH holders, surpassing even Sharplink’s treasury exposure.

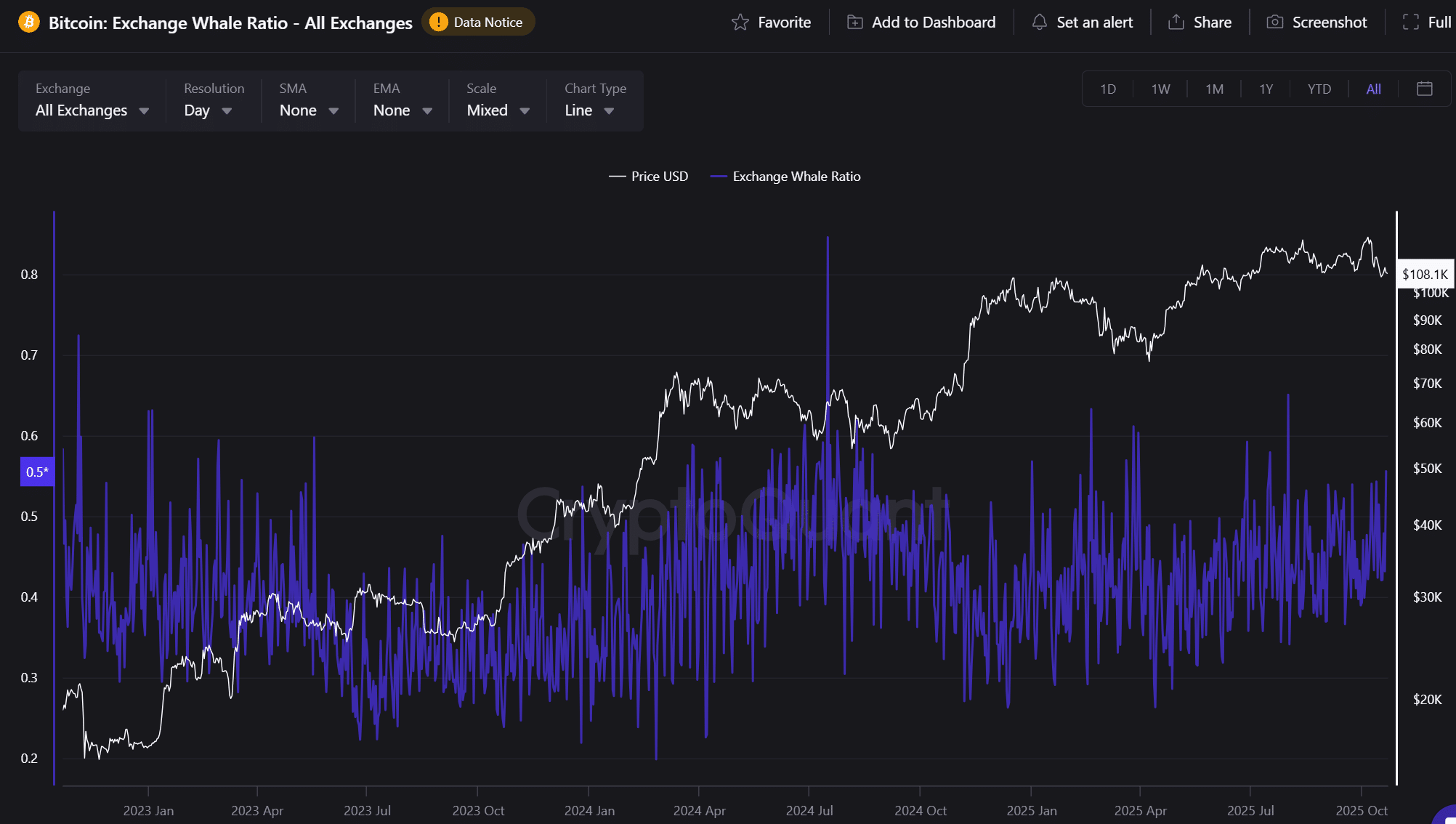

Meanwhile, newer Bitcoin whales aren’t faring as well. According to CryptoQuant, these large investors now face $6.95 Bn in unrealized losses after Bitcoin slipped below its average cost basis of $113,000.

“Bitcoin is trading below its average cost basis, leaving whales with the largest unrealized loss since October 2023,” CryptoQuant wrote on X.

Glassnode data reinforces that picture, showing that short-term holder supply, typically more speculative, has increased, indicating that traders are re-leveraging after a cleanup of overextended long positions.

Chart Check: Volatility or the Start of Something Bigger?

99Bitcoins analysts say the latest turbulence looks less like panic and more like a purge. We’re shaking off excess leverage but there’s also no gurantee we breakout of this mess. Bitcoin’s next test sits around $112,000, where liquidation clusters could spark violent intraday swings.

If the move fails, support lines up NEAR $108,000 and $104,000, backed by the 200-day moving average, according to TradingView.

Whether this whale is early, lucky, or prescient, his trades have become a proxy for sentiment among high-cap investors.

Key Takeaways

- Why is Bitcoin dropping? The mysterious $11 Bn Bitcoin whale is back and this time, he’s doubling down on another massive short.

- If the move fails, support lines up near $108,000 and $104,000, backed by the 200-day moving average, according to TradingView.