Solana Labs Enters Perp DEX Arena - But Justin Sun’s Chinese DEX Strategy Is The Real Game-Changer

Solana makes its move in the perpetual DEX wars - while Justin Sun quietly builds China's answer to decentralized derivatives trading.

The Hidden Dragon Strategy

While Solana Labs publicly flexes its scaling capabilities for perpetual exchanges, Justin Sun's team operates with Eastern subtlety - constructing a Chinese DEX ecosystem that could reshape global crypto flows. No flashy announcements, just strategic positioning in the world's largest potential market.

Infrastructure Wars Heat Up

Blockchain foundations now battle not just for NFT and token supremacy, but for dominance in the lucrative perpetual futures market. Solana's high throughput versus Ethereum's established ecosystem creates the perfect battleground for next-generation trading platforms.

The Regulatory Chess Match

Chinese crypto projects navigate with calculated precision - building decentralized infrastructure while maintaining plausible deniability. It's the financial innovation equivalent of walking through a minefield in ballet slippers.

Market Impact and Positioning

Perp DEX volume surges as traders seek leverage outside traditional exchanges. The race isn't about who builds fastest, but who captures regulatory arbitrage opportunities while maintaining decentralization principles.

As Western projects battle for technical supremacy, Eastern strategies focus on market access and regulatory navigation - because in crypto, sometimes the quietest moves make the loudest impact. Just ask any hedge fund manager who missed the last bull run while waiting for 'proper regulation.'

Is Percolator the Solana New Weapon in Dex Wars?

The solana blockchain, long known for its speed and scalability, is making another ambitious push into decentralized finance. Solana Labs’ co-founder Anatoly Yakovenko recently unveiled technical plans for Percolator, a decentralized perpetual DEX built directly on

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}Solana

SOL

$185.06

0.43%

Solana

SOL

Price

$185.06

0.43% /24h

Volume in 24h

$6.49B

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $('.cwp-graph-container svg').last();

if (svg.length) {

var originalWidth = svg.attr('width') || '160';

var originalHeight = svg.attr('height') || '40';

if (!svg.attr('viewBox')) {

svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight);

}

svg.removeAttr('width').removeAttr('height');

svg.css({'width': '100%', 'height': '100%'});

svg.attr('preserveAspectRatio', 'xMidYMid meet');

}

});

Learn more

. Designed for performance and self-custody, Percolator introduces “shared matching engines”, meaning separate liquidity slabs can process orders in parallel, reducing network congestion while maintaning global price consistency.

![]() LATEST: Solana founder Anatoly Yakovenko is building a new perp DEX called Percolator. pic.twitter.com/3xKTFqL2LI

LATEST: Solana founder Anatoly Yakovenko is building a new perp DEX called Percolator. pic.twitter.com/3xKTFqL2LI

— Cointelegraph (@Cointelegraph) October 20, 2025

In short: every market runs on its own lane, but a single router ensures atomic settlement and margin safety. This could solve one of DeFi’s most significant problems – bottlenecks in on-chain order matching. Percolator’s design already has working code on GitHub, with data structures and order-book logic completed.

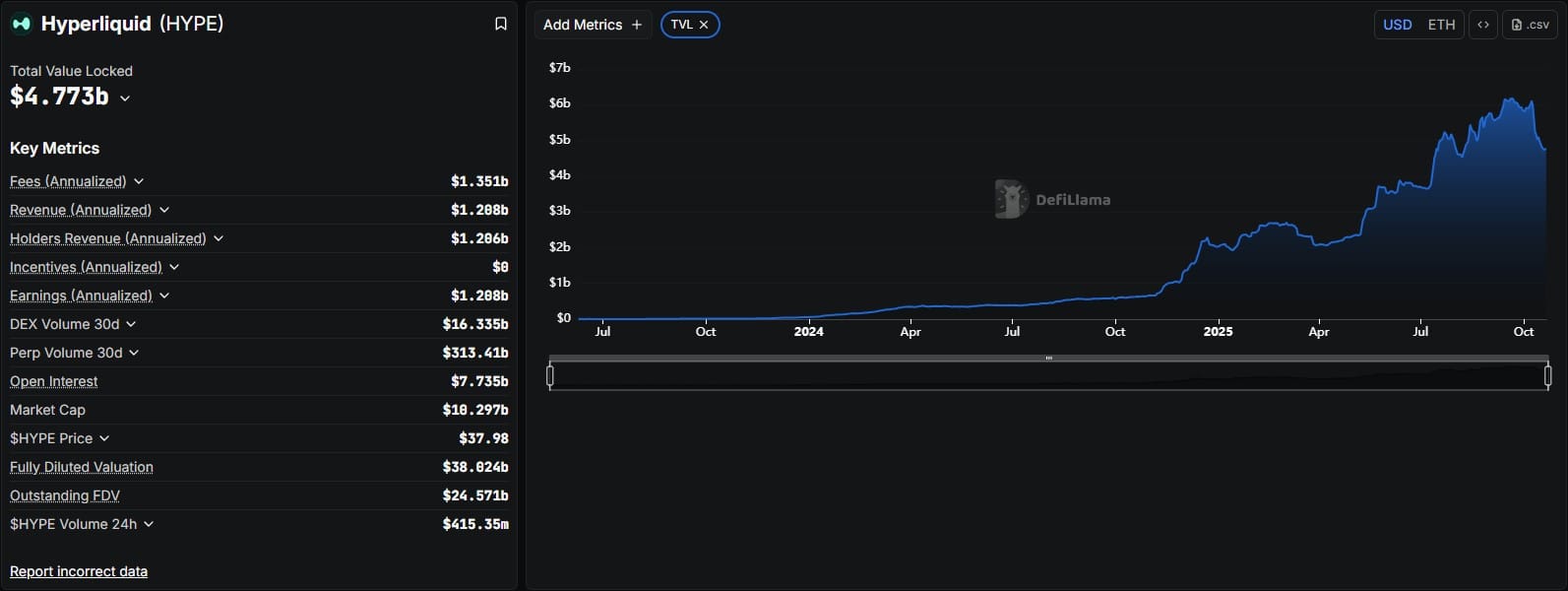

While no launch date has been set, the project represents Solana’s most precise shot at reclaiming dominance from Hyperliquid, whose recent 30-day trading volume hit $313Bn, according to DefiLlama.

If Percolator DEX launches smoothly, it could become the first Solana Dex to challenge centralized exchanges on speed and liquidity head-to-head.

Can Justin Sun’s SunPerp Outshine Solana’s DeFi Push?

While Solana builds its DEX from the ground up, Justin Sun’s SunPerp has taken the opposite route – expanding rapidly through capital and community power. On October 15, 2025, SunPerp doubled its trading depth and announced a massive $100M “Sail Together” fund, co-financed with HTX, to compensate traders hit by recent market crashes. Bonuses range from 5 USDT to 5,000 USDT, open to users from any exchange, making this one of the most significant relief funds ever launched by a DeFi project.

$100 Million "Sail Together" Initiative Now Open for Registration!

Register Now: https://t.co/u06UHKpb27

(or scan the QR code) pic.twitter.com/hn3OIoR4f9

— SunPerp (@SunPerp_DEX) October 16, 2025

SunPerp has also integrated TRON, Ethereum, BNB Chain, and Arbitrum, promising to add two more blockchains each week. Its new multi-stablecoin trading allows users to open perpetual positions in USDC and USDD, enchancing liquidity flexibility.

Technical data shows market depth doubling across BTC and ETH pairs (up ~250%) while SunPerp maintaned full uptime during October’s volatility. With ultra-low fees (up to 55% off), 12% APY auto-earn, and upcoming Trade-to-Earn incentives, the DEX is quietly positioning itself as the Chinese-language market’s flagship perpetuals platform.

Analysts call SunPerp the “Sun Perp Effect”: a DEX designed to bridge Asian liquidity with Western leverage demand, a MOVE that could reshape derivatives trading entirely.

Who Wins the DEX Race – Solana’s Percolator or Sun’s SunPerp?

THe Solana DEX landscape and the Chinese DEX expansion are converging into the same arena, one defined by performance, depth, and multi-chain reach. Solana’s Percolator is building trust through open-source innovation and high-speed architecture, while SunPerp is executing with aggressive growth, funding, and inclusivity.

But here’s the twist: SunPerp’s immediate liquidity and user-centric design could give it a real-world advantage long before Percolator fully launches. Meanwhile, Solana’s technological edge may ensure it wins in the long run, if it can sustain developer momentum and integrate cross-chain support.

In this battle of Solana Crypto vs. SunPerp, both sides are redefining what a modern decentralized derivatives exchange looks like. Wether you’re a Solana maximalist or a TRON believer, one thing is clear – the perp DEX wars are just beginning, and global traders are the ultimate winners.