U.S. Government Makes Historic $14 Billion Bitcoin Move for Strategic Reserves

Washington shifts treasury strategy with massive crypto allocation

The Digital Gold Rush Goes Official

Federal reserves just got a whole lot more interesting. The U.S. government is locking down a staggering $14 billion Bitcoin position as part of its strategic reserve overhaul. This isn't just diversification—it's a fundamental rethinking of what constitutes national wealth in the digital age.

Breaking from Traditional Assets

While gold bars gather dust in vaults, Bitcoin moves at the speed of light. The Treasury Department's pivot signals that digital assets now represent strategic national value—enough to allocate taxpayer funds toward what many traditional bankers still call 'magic internet money.'

Strategic Implications

This move positions the U.S. alongside countries that already treat cryptocurrency as sovereign assets. It creates a massive, liquid position that could influence global markets while providing hedge capabilities against currency fluctuations and traditional financial system risks.

Wall Street's worst nightmare—the government becoming better at crypto than they are—just inched closer to reality. Because nothing says financial innovation like watching bureaucrats outperform hedge funds while paying themselves government salaries.

A Web of Scams, Trafficking, and Hidden Bitcoin

According to court filings, Chen Zhi built a complex and disturbing empire combining crypto fraud, political corruption, money laundering, and even human trafficking. His network operated out of several compounds in Cambodia, including one called Golden Fortune and another tied to the Jinbei Hotel and Casino.

Victims were reportedly trafficked into these sites and then forced to take part in elaborate romance and investment scams known as “pig butchering.” These scams often involved weeks or even months of contact, luring victims into fake relationships or business opportunities before draining their savings.

The funds from these scams were then scattered across shell companies, crypto wallets, gambling platforms, property deals, and mining setups. Reports suggest many victims were threatened, isolated, and sometimes physically abused.

Executive Order Lays the Groundwork

The legal basis for the U.S. to hold on to this bitcoin instead of selling it comes from an Executive Order signed in early 2025, which formally established the Strategic Bitcoin Reserve. The order requires that any crypto assets forfeited through criminal or civil cases be transferred into the new reserve rather than auctioned or converted to fiat.

That sounds straightforward, but there are still legal steps to go through. Courts have to approve the forfeiture, and there’s a chance that Chen Zhi or others connected to the funds may challenge the ruling. Even if those hurdles are cleared, the government must still determine how to securely store and manage more than $14 billion in Bitcoin.Several agencies are now working together to manage this process, including the Department of Treasury, FinCEN, and OFAC, each playing a role in tracking, evaluating, and safeguarding the assets.

Bitcoin as a State Asset?

The decision to hold rather than sell could carry serious weight. It suggests that the government sees value in treating Bitcoin as a reserve asset, much like gold. By keeping the coins off the market, officials can help prevent the sharp sell pressure that often drives prices down when large amounts are dumped at once.

If this approach sticks, it could inspire other countries to think twice before automatically liquidating seized crypto. It might even kick off broader discussions about how digital assets fit into national reserves.

Still a Lot to Prove

The outcome hinges on how officials handle this. A successful rollout could reshape how the U.S. treats high-value crypto seizures and influence how other governments follow suit. It could set new norms for custody, regulation, and asset classification.

But it could also backfire. If the legal process drags, if custody systems fail, or if internal mismanagement becomes an issue, it could erode public and market trust.

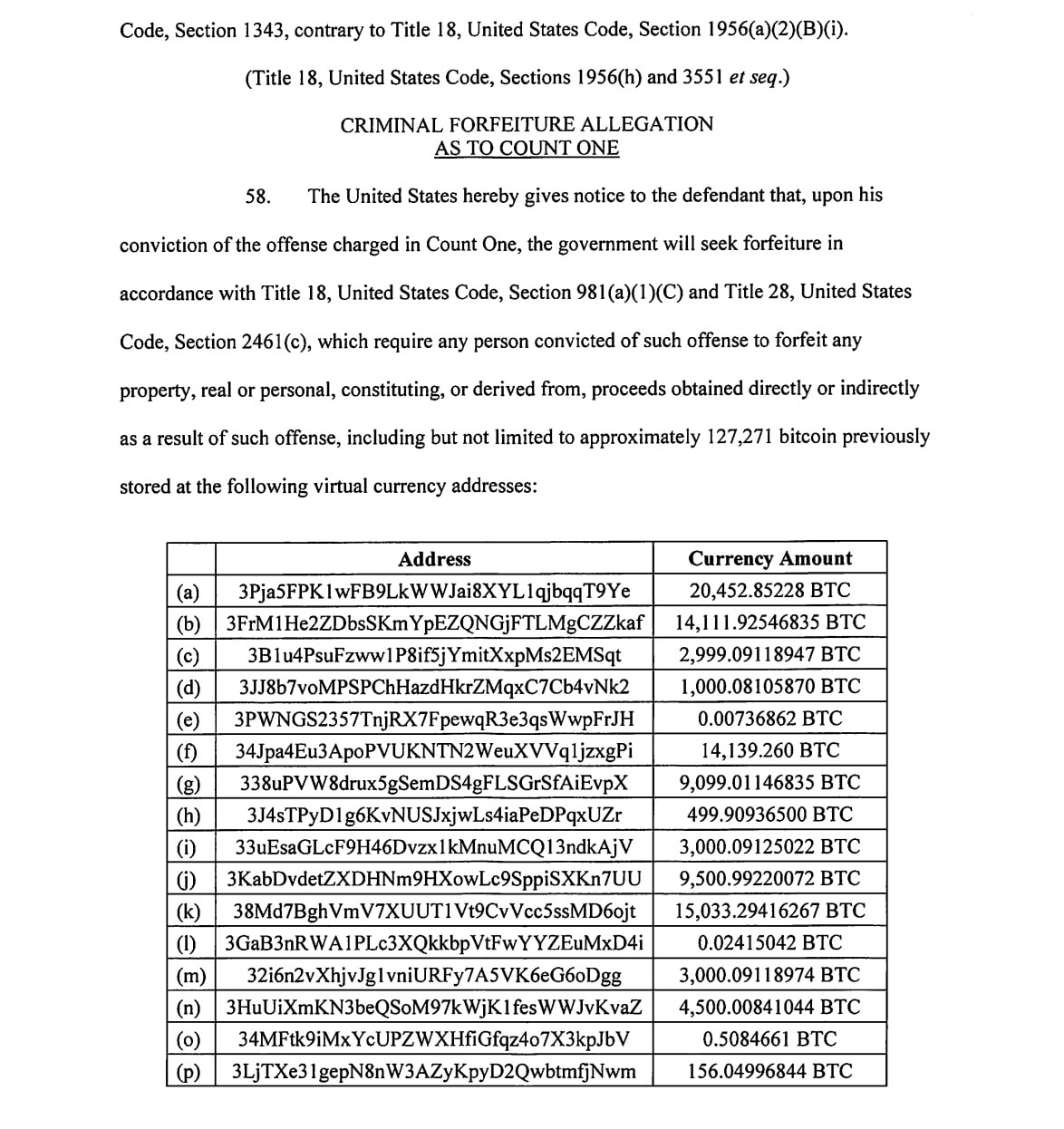

For now, those 127,271 BTC are sitting still. What happens next could shape the future of state-level crypto policy.

Key Takeaways

- The U.S. government plans to hold 127,271 bitcoin, worth about $14.2 billion, as part of a new Strategic Bitcoin Reserve instead of selling it.

- Authorities seized these assets from Chen Zhi’s criminal network, which combined crypto fraud, human trafficking, and large-scale money laundering.

- An Executive Order signed in early 2025 established the legal foundation for the Strategic Bitcoin Reserve, directing authorities to hold seized crypto instead of auctioning it.

- Keeping the bitcoin could help the U.S. treat it like a reserve asset, reduce market sell pressure, and signal a major policy shift at the state level.

- The outcome will depend on how well the government handles legal challenges, custody, and coordination between agencies to manage the $14 billion stash.