Ethereum Treasuries Dethrone Bitcoin: When Will $5K ATH Hit?

Ethereum just flipped the script—corporate treasuries are abandoning Bitcoin's digital gold narrative for ETH's smart contract dominance.

The Great Rotation

Institutional money isn't just dipping toes anymore—it's diving headfirst into Ethereum's ecosystem. Treasury managers finally woke up to yields beyond HODLing.

Network Effects Accelerating

Developers keep building, DeFi keeps innovating, and now Fortune 500 companies are allocating serious capital. The flywheel's spinning faster than a Bitcoin maximalist's excuse for why their coin's getting left behind.

Price Trajectory Heating Up

With this institutional stampede, the path to $5K looks less like speculation and more like inevitability. Wall Street's late as usual—but at least they're finally using the right on-ramp.

Funny how the 'safe' asset suddenly looks riskier than the one actually building the future.

(Source: @JasonYanowitz)

Yes, it is a slim margin, but it signals a seismic shift in that ETH treasuries have tripled their stack since July this year, while BTC holdings have flatlined.

A publication quoted Max Shanon, Senior Research Associate at Bitwise, stating, “I think the percentage of supply accumulated by Ethereum treasuries continues to outpace Bitcoin over the short term.”

The last few months have been a wild ride with crypto treasury companies starting to target crypto other than BTC. ETH treasury companies weren’t even on the map six months ago, and suddenly, 71 companies now hold $22 Bn in Ether per Strategic ETH Reserve data.

Why are ETH treasuries accumulating as aggressively as they are, you ask? Well, simply put, it’s all about the yield.

Shanon explained, “Ether generates compounding returns through staking and DeFi real yield — trading, borrowing and lending — while Bitcoin offers no native yield in comparison.”

The 3% staking yield creates a compounding loop where treasury firms stake ETH, earn more ETH and use those gains to justify a higher stock valuation. With higher valuations, treasury firms can raise more capital, buy more ETH, and stake again in a never-ending growth hack.

BTC treasuries can’t do that. They buy, they hold, and that’s it.

With ETH Getting Scooped, Is $5K ATH Loading?

ETH price has held steady above the $4,000 level in the last 24 hours and is looking cautiously optimistic, currently trading at $4,143.

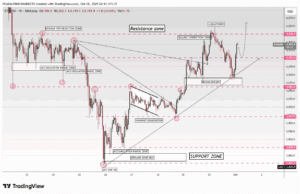

On the daily chart, ETH is trading slightly below its short-term moving averages, with the 20-day moving average at $4,263 and the 50-day at $4212.

(Source: TradingView)

The RSI too has held neutral at 51. A daily close above $4200 WOULD help revive the short-term bullish sentiment that could see its price action climb towards $4600-$4800 in October and possibly even hit the coveted $5000 mark if momentum picks up.

(Source: TradingView)

However, a slide down from here to $3,850-3,865 might result in the price action moving sideways again.

What’s Driving Ethereum Treasuries Into A Hoarding Frenzy?One main reason why ETH is gaining traction is its flexible supply. BTC has a fixed limit of 21 Mn coins. That scarcity boosts its value, but it also means there is only so much a company can buy. Once big players like Strategy lock in their holdings, the available supply shrinks.

ETH, on the other hand, has no such limitation. There is no cap on how much ETH can exist. New coins are issued continuously, so treasury firms can keep accumulating without running into a ceiling.

SEP 30: BlackRock’s ETH ETF added 30,260 $ETH (~$127.5M) in a single day.![]()

— Coin Headlines (@coinheadline) October 1, 2025

As Shannon puts it, “With no hard cap like BTC, ETH can be steadily accumulated.” This also helps boost metrics like market NAV (Net Asset Value) as investors factor in long-term growth.

This key structural difference allows ETH treasuries to scale indefinitely, while BTC treasuries will eventually hit a wall.

Another key reason for ETH’s growing institutional traction is stablecoins. Over half of the $300 billion stablecoin market runs on Ethereum, so banks and financial firms are building on its network by default.

Ethereum just added about $6.3B of stablecoins in the past 7 days.

That’s equivalent to:

1. More than half of all the stablecoins solana has managed to capture in over 5 years.

2. More than the entire stablecoin supply on Hyperliquid.

3. About 35 times the amount of… pic.twitter.com/pSiEA0UWDw

— AdrianoFeria.eth![]()

![]()

![]() (@AdrianoFeria) August 29, 2025

(@AdrianoFeria) August 29, 2025

That said, just because ETH treasuries are growing faster doesn’t mean this trend will last forever. Bitcoin’s fixed supply and design make it a strong candidate for long-term reserves, especially if governments keep printing money to cover large deficits.

Key Takeaways

- ETH treasury companies have edged past BTC treasuries in holding 3.5% of all ETH compared to 3.4% of BTC

- 71 companies are holding $22 Bn in Ether per Strategic ETH Reserve data

- ETH treasuries have tripled their stack since July this year, while BTC holdings have plateaued