Ethereum’s Bleak Week: Outflows Signal Potential Downturn for ETH USD

Ethereum faces mounting pressure as sustained outflows paint a concerning picture for the second-largest cryptocurrency.

Market Analysis

The week's outflow pattern suggests institutional investors might be repositioning their portfolios amid broader market uncertainty. Trading volumes dipped alongside the capital flight, indicating weakening momentum.

Technical Outlook

Chart patterns show ETH testing key support levels that haven't been challenged since last quarter. A breach below these levels could trigger automated selling from algorithmic traders—because nothing says 'rational markets' like machines panic-selling based on arbitrary lines.

Broader Context

While short-term sentiment appears bearish, Ethereum's fundamental network activity remains robust. The ecosystem continues to onboard new developers despite the price action—proving once again that crypto valuations have about as much correlation with actual utility as Wall Street bonuses have with performance.

The coming days will determine whether this outflow pattern represents a temporary setback or the start of a broader trend reversal.

Could Institutional Buying Push Ethereum Beyond $4,000?

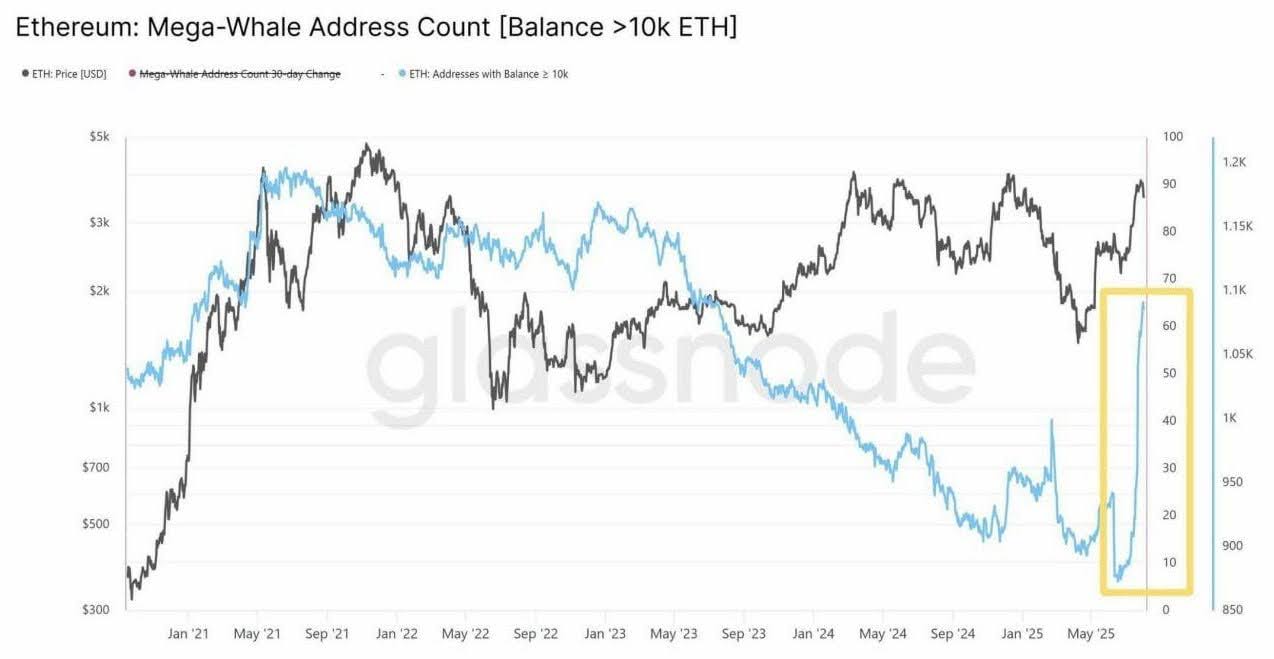

According to Glassnode, Ethereum’s biggest holders are back in buy mode. Wallets with 10,000 ETH or more, often called mega whales, have grown at one of the fastest clips in years.

(Source: Glassnode)

More than 60 of these addresses appeared in recent weeks, a pace last seen in early 2021.

The shift came after ETH reclaimed the $4,000 mark. It points to renewed confidence from institutions and long-term holders who tend to buy when they see value.

In past cycles, a rising share of coins in large wallets has lined up with accumulation phases that preceded major moves. These entities often include funds, custodians, and high-net-worth investors.

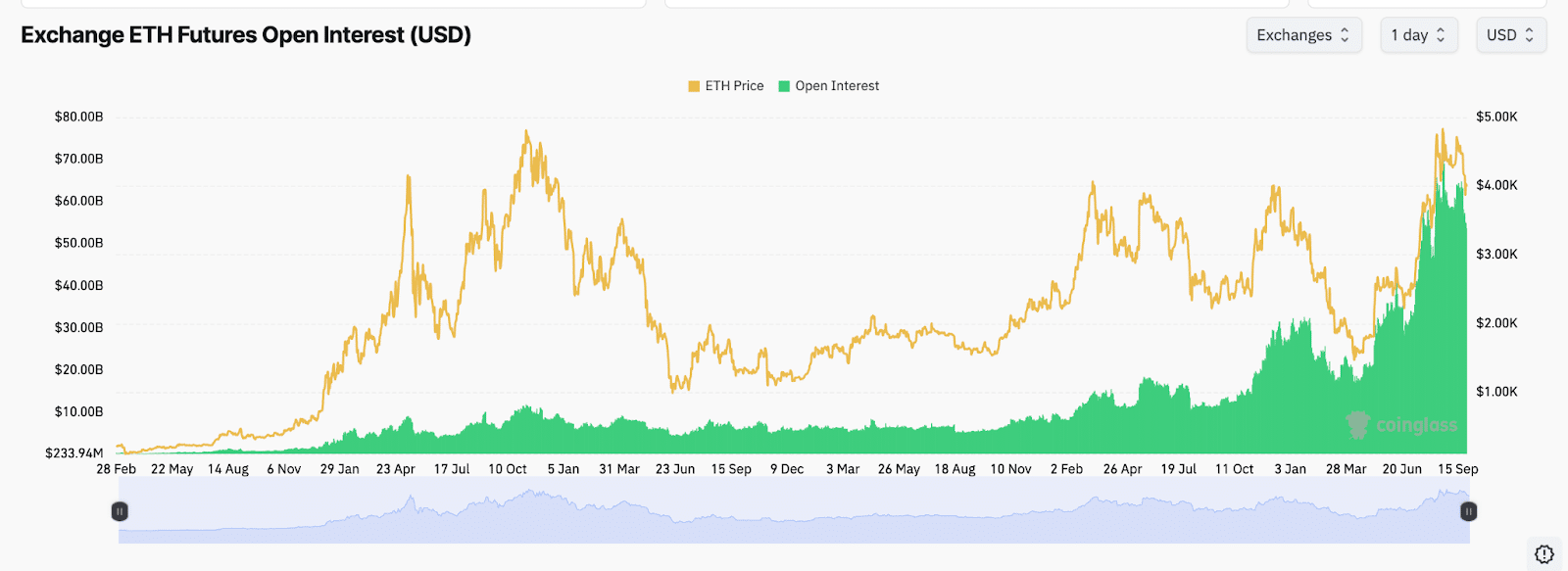

Derivatives add to the picture. Ether futures positioning has swelled alongside spot buying, hinting that big players are building exposure across markets.

That can attract retail later but also make swings sharper if positions flip.

Yes, whales have a history of taking profits near tops. However, the speed and size of the recent additions look more like long-term positioning than short-term trading.

For now, the data suggests deep-pocketed buyers still see ETH as a Core asset heading into known catalysts such as broader staking use and any progress on ETF plans.

CoinGlass data shows Ethereum futures open interest nearing $70Bn, close to readings seen near the 2021 peak.

(Source: Coinglass)

The jump tracked ETH’s push above $4,000 and signals fresh money entering the market through derivatives.

Rising open interest tells us that more traders have active contracts. It doesn’t say who will be right, only that a bigger MOVE can follow.

When positioning is crowded, funding and liquidations matter. If longs dominate, a sharp dip can snowball. If shorts lean too hard, a squeeze can run fast.

Ethereum Price Prediction: Can Ethereum Close Above the $4,300-$4,400 Resistance?

Trader Merlijn says ETH is pressing against a long-standing ceiling near $4,300-$4,400. His chart shows repeated failures at that band since 2021.

$ETH IS SQUEEZING AGAINST RESISTANCE.

One clean move and price discovery will follow.

Targets: $10K+ and beyond.

The rally won’t be big.

It’ll be legendary.

Only catch? You need steel balls to survive the FUD. pic.twitter.com/rBvJMVSn85

— Merlijn The Trader (@MerlijnTrader) September 27, 2025

He argues that a clean daily close above it WOULD push ETH into price discovery, opening a path to far higher levels.

(Source: X)

He even calls the potential move “legendary,” framing it as a structural break rather than a slow grind.

The risk is noise around the breakout: sentiment can flip quickly, and wicks above resistance have failed. The setup is simple, hold below and range; close through with strength and momentum could expand fast.

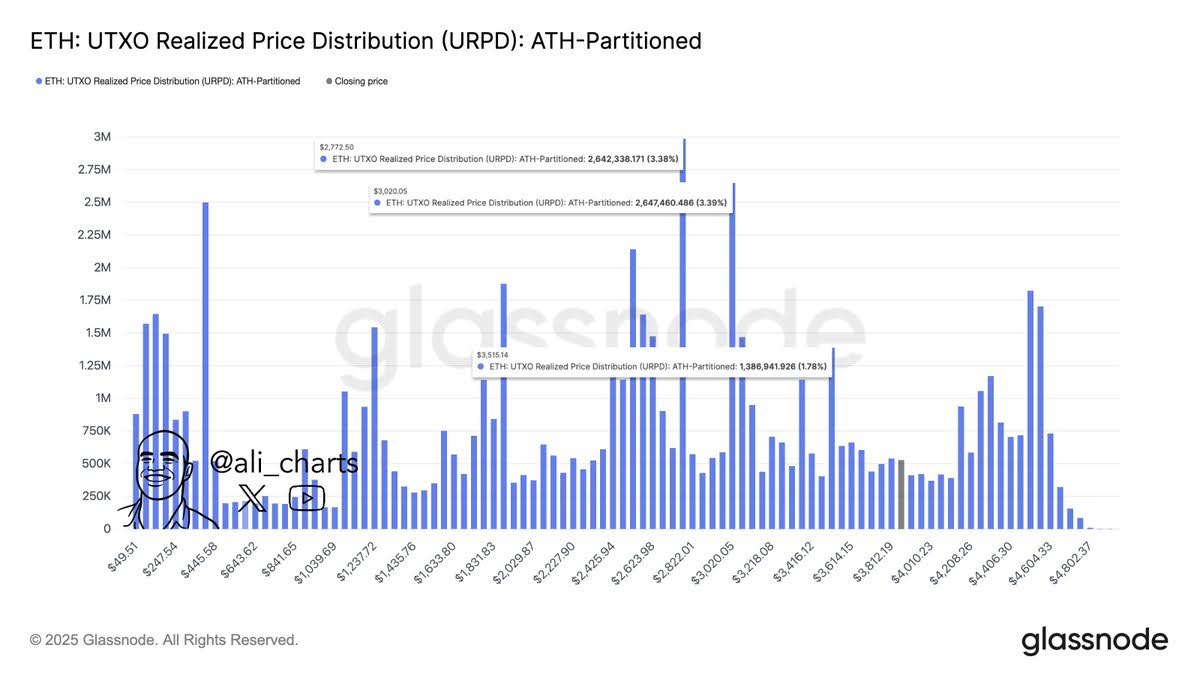

Analyst Ali Martinez flags three areas to watch on the way down: $3,515, $3,020, and $2,772.

Three support levels to watch for Ethereum $ETH: $3,515, $3,020, and $2,772. pic.twitter.com/M6UiTUGvjz

— Ali (@ali_charts) September 27, 2025

His view draws on realized price distribution, which maps where many addresses last bought ETH.

These clusters often act like speed bumps for sell-offs. The $3,020 zone stands out, given the heavy past buying there.

(Source: X)

Holding that shelf would keep the trend constructive and limit downside after sharp moves. Lose it, and the market could retest deeper layers of support as late longs unwind.

In short: respect $3,515 on pullbacks, treat $3,020 as the pivot, and see $2,772 as the failsafe in a stress event.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates