Core PCE Data Fails to Shake Bitcoin: Grok’s Bold Monthly Close Prediction

Bitcoin shrugs off inflation data as AI model Grok forecasts decisive monthly close.

Market Resilience

Core PCE numbers landed with a thud—yet BTC barely flinched. The flagship cryptocurrency continues trading like it's playing a different game entirely.

AI's Crystal Ball

Grok's prediction cuts through the noise, bypassing traditional analysis with pure data-crunching power. The monthly close becomes a technical battleground while Wall Street scratches its head.

Digital gold proving more stable than economic indicators—another day in decentralized finance.

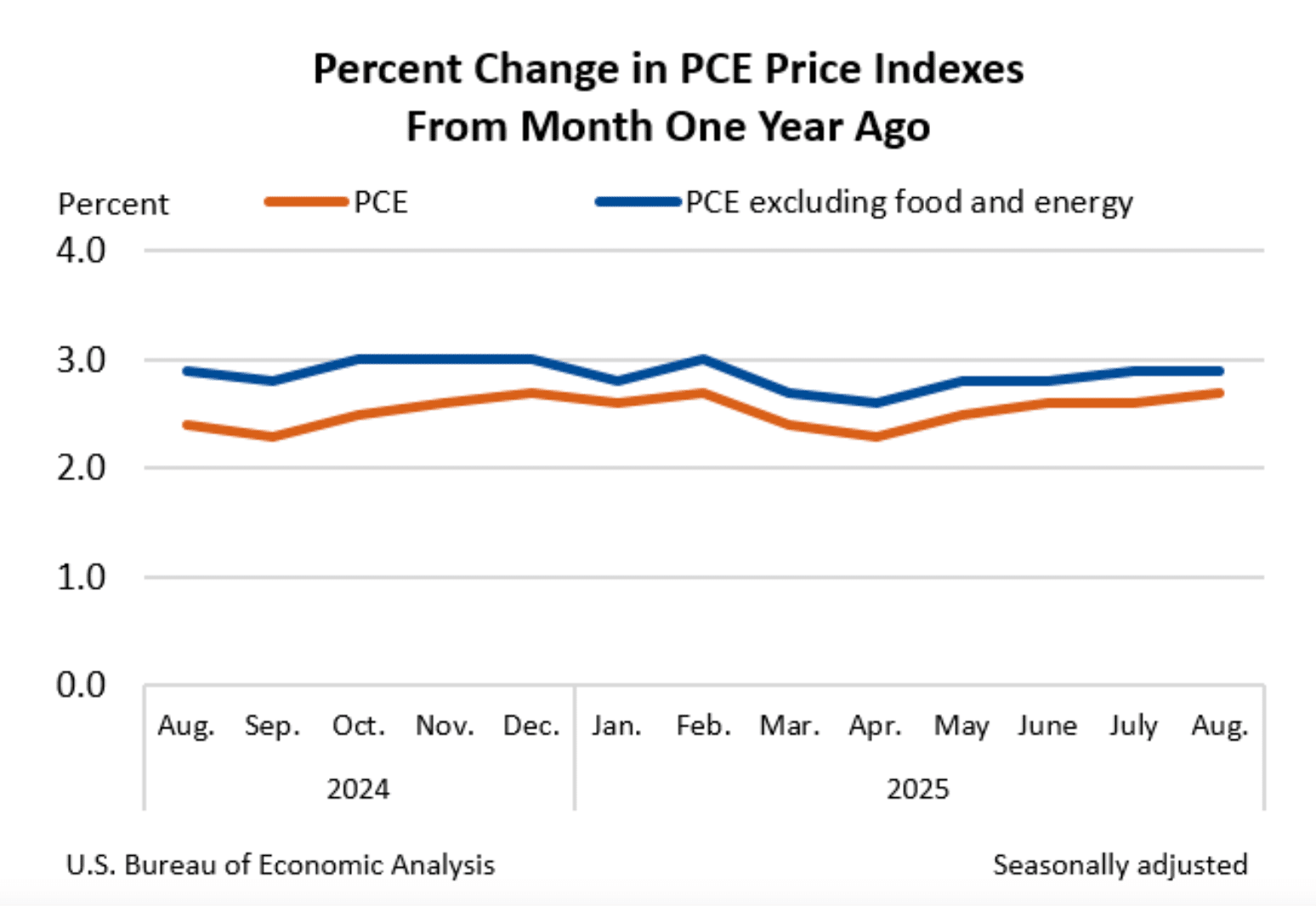

(Source: US PCE index change: US Beaurea)

The lack of surprise muted market reaction. Traders said the reading, though above the Fed’s target, still allows room for a possible October rate cut.

That prospect helped limit downside but failed to spark fresh buying after a week of heavy liquidations.

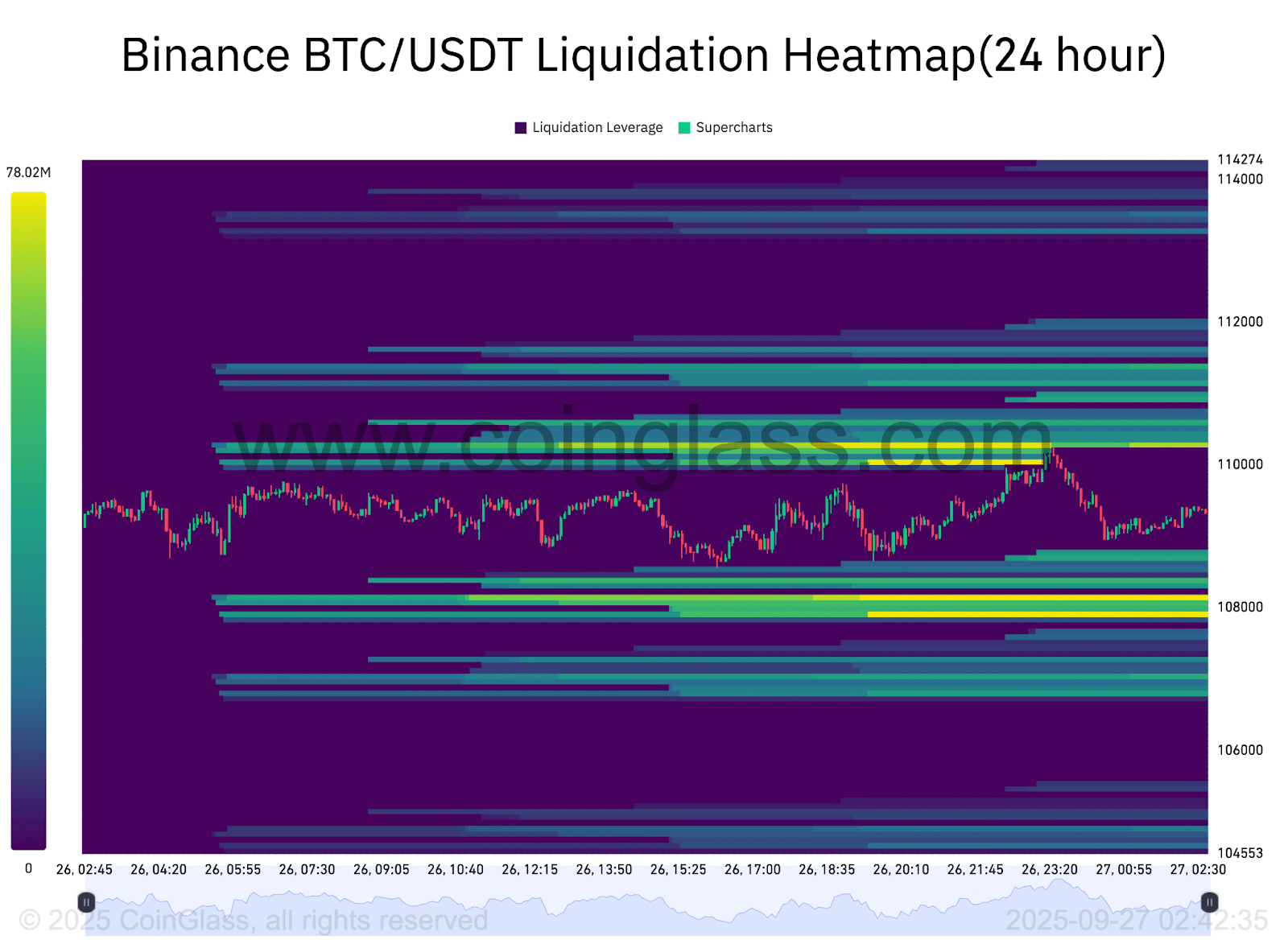

According to CoinGlass, order-book data showed bid support clustering around $108,200 on Binance, while liquidation levels sat just above $110,000.

(Source: Coinglass)

Glassnode reported “another wave of long liquidations” when BTC dipped below $111,000 earlier in the session, calling the slide part of an ongoing deleveraging cycle.

#Bitcoin futures saw another wave of long liquidations as price moved below $111k.

This flush of leverage reflects a broad deleveraging event, often resetting market positioning and easing the risk of further cascades.

![]() https://t.co/uEVHqia78z pic.twitter.com/Kmdo52vVxj

https://t.co/uEVHqia78z pic.twitter.com/Kmdo52vVxj

— glassnode (@glassnode) September 26, 2025

Intraday, BTC stayed pinned near $109,000, with bears grinding through local support.

Analysts flagged $107,000–$108,000 as the next test below and $112,000-$117,000 as resistance above, following what has been the largest deleveraging event of 2025 so far.

The Kobeissi Letter noted that even with PCE at a seven-month high, “the Fed is still expected to continue cutting rates.” That backdrop eased pressure on the downside but left markets without momentum for a rebound.

BREAKING: August PCE inflation, the Fed's preferred inflation measure, rises to 2.7%, in-line with expectations of 2.7%.

Core PCE inflation was 2.9%, in-line with expectations of 2.9%.

PCE inflation is at its highest since February 2025.

Yet, the Fed will keep cutting rates.

— The Kobeissi Letter (@KobeissiLetter) September 26, 2025

Bitcoin Price Prediction: Is BTC USD Entering Its Biggest Bear Market as MicroStrategy Faces Risk of Forced BTC Sales?

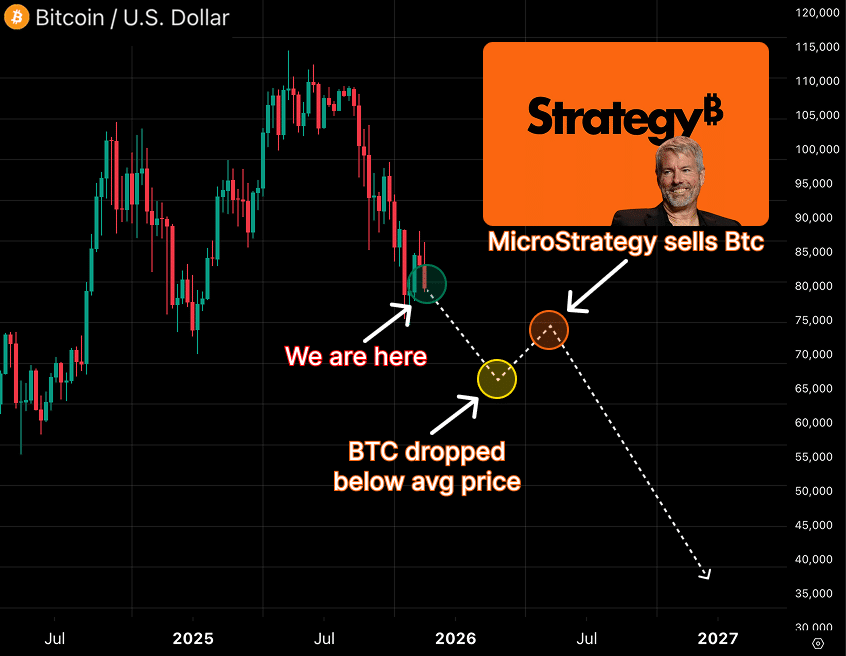

A crypto analyst has warned that Bitcoin may be entering its largest bear market to date, with MicroStrategy’s holdings at the center of concern.

![]() The BIGGEST Bear Market has just STARTED

The BIGGEST Bear Market has just STARTED

MicroStrategy will be forced to sell 639,835 BTC

I warned about this months ago, but nobody listened

Here’s why and when MicroStrategy will COLLAPSE![]()

![]() pic.twitter.com/tGA5Z35VTH

pic.twitter.com/tGA5Z35VTH

— Atlas (@crptAtlas) September 26, 2025

The analysis points to bitcoin trading in the mid-$80,000 range, below its estimated average cost basis. A chart shared alongside the warning outlines a path where prices could weaken further into 2026.

If Bitcoin fell toward $65,000 or even $45,000, the analyst suggests MicroStrategy could be forced to sell part of its 639,835 BTC stash.

The company, led by executive chairman Michael Saylor, has built the largest corporate Bitcoin treasury over the past four years. Its aggressive use of leverage has been both praised and questioned.

(Source: X)

With an average purchase price of nearly $70,000, extended losses below that level could place heavy pressure on its balance sheet.

The analyst said he had mentioned this scenario months earlier, arguing that leverage magnifies downside risks in a prolonged slump.

Market observers added that any forced liquidation by MicroStrategy WOULD not just hit its own finances but also shake confidence in Bitcoin as a corporate reserve asset.

For years, Saylor promoted Bitcoin as “digital gold,” framing it as a long-term hedge for institutional balance sheets.

A DEEP correction could test that claim. While the projection remains speculative, it adds to unease among traders already wary after sharp retracements in recent sessions.

“BTC”Price“BTC”24h7d30d1yAll timeThe key question now is whether MicroStrategy can withstand further price pressure or if its holdings could become the flashpoint for a broader downturn.

What Do Glassnode’s MVRV Pricing Bands Reveal About Bitcoin’s Risk Levels?

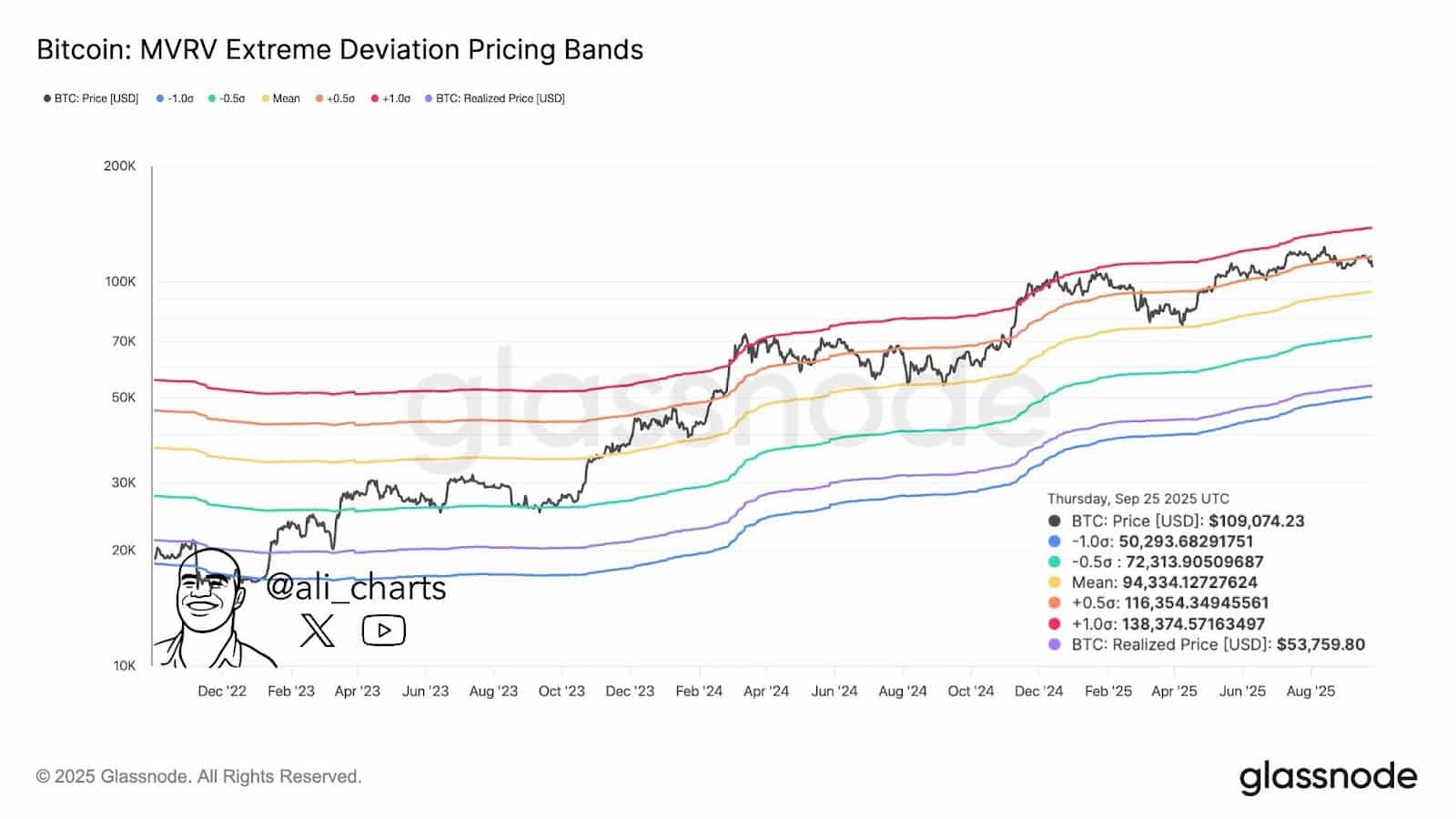

According to analyst Ali Martinez, Bitcoin’s price faces renewed pressure after on-chain data flagged $116,354 as the critical level to watch.

In a post on X, Martinez cited Glassnode’s MVRV Extreme Deviation Pricing Bands, noting that Bitcoin was trading at $109,074 on September 25, 2025, below the +0.5σ band and edging closer to mean support.

Failing to reclaim $116,354 puts Bitcoin $BTC at risk of a drop to $94,334, based on Pricing Bands! pic.twitter.com/ZrUTEAld2J

— Ali (@ali_charts) September 26, 2025

The model sets out several thresholds. The mean band sits at $94,334, while the-0.5σ deviation lies at $72,313. Martinez stressed that unless Bitcoin climbs back above $116,354, which acts as upper resistance, the coin risks sliding toward the mean at $94,334.

The analysis casts $116,354 as a pivot point: a recovery above it could revive bullish momentum, but rejection may deepen bearish sentiment.

(Source: X)

The warning comes amid heavy volatility, with traders digesting macro uncertainty and liquidation waves in derivatives markets.

Glassnode’s chart also shows Bitcoin’s realized price at $53,759, a marker that hints at the potential for a deeper correction if risk-off sentiment grows.

For now, Martinez’s signal leaves traders focused on whether Bitcoin can hold the $100,000 region or risk slipping into lower valuation bands.