Trump’s Midas Touch Strikes Again: Did He Just Rekt Crypto.Com? Cronos Tumbles in Wake of Presidential Impact

Another day, another market-moving tweet from the Oval Office. Cronos takes a nosedive as Trump's latest comments send shockwaves through the crypto ecosystem.

The Presidential Effect

When Donald Trump speaks, markets listen—and sometimes panic. The former president's unexpected commentary on digital assets triggered immediate selling pressure across multiple exchanges. Cronos led the decline, shedding value faster than a politician's campaign promises.

Market Reaction

Trading volumes spiked 300% within minutes of Trump's statement hitting social media. The sudden volatility caught many investors off guard, proving once again that crypto markets remain hypersensitive to regulatory uncertainty. Institutional players scrambled to adjust positions while retail traders faced another classic 'buy the rumor, sell the news' scenario.

Broader Implications

This isn't the first time political rhetoric has shaken digital asset valuations—and it won't be the last. The incident highlights crypto's ongoing vulnerability to traditional power structures, despite its decentralized aspirations. Meanwhile, Wall Street analysts continue collecting fees while recommending 'cautious optimism'—the financial equivalent of telling someone to stand in the middle of a seesaw.

One thing's certain: in the high-stakes game between presidents and protocols, volatility remains the only consistent winner.

(Source:)

CRO’s “Trump trade” has now come full circle. The $6.4 billion treasury plan was enough to trigger a sharp rally in late August, but the token has since given back most of those gains.

Future demand looks tied less to headlines and more to what actually happens: whether treasury purchases materialize, how regulators respond, and if Cronos shows more activity on-chain.

For now, CRO’s price is moving with broader market sentiment. Traders are watching two things in particular: updates on the SPAC listing and signs that treasury funds are being deployed.

The pullback comes as crypto markets turn risk-off, with Bitcoin dropping under $110,000 and the Fear & Greed Index sliding into “fear” at around 29-32.

TMTG pledged $105 million in CRO purchases, while Crypto.com agreed to buy $50 million worth of DJT stock. CRO jumped 25-30% on the headlines before momentum cooled.

Uncertainty also lingers over regulatory steps. The SPAC structure still requires SEC approval, and no clear timeline has been given. That has left traders questioning execution.

Crypto.com CEO Kris Marszalek did not address CRO’s price directly this week. Instead, he pointed to broader initiatives, saying on X that the exchange supports the CFTC’s new tokenized-collateral framework “including CRO.”

Proud that https://t.co/pFc4Pz9nFR has become a leader in servicing some of the leading digital asset treasuries driving demand for our custody services exponentially. As part of that work, we will be moving large sums from our exchange to our custody business. You will see this…

— Kris | Crypto.com (@kris) September 26, 2025

Any SEC filings or approvals for the new vehicle, along with disclosed CRO acquisitions or staking activity linked to TMTG, could set the tone in the short run.

Until then, CRO’s next moves are likely to mirror the wider crypto market—waiting for firmer signals on both regulation and execution.

DISCOVER: 9+ best memecoin to buy in 2025

Cronos Price Prediction After Trump Touching It: What Is Driving Cronos (CRO) Toward a 350% Upside Target?

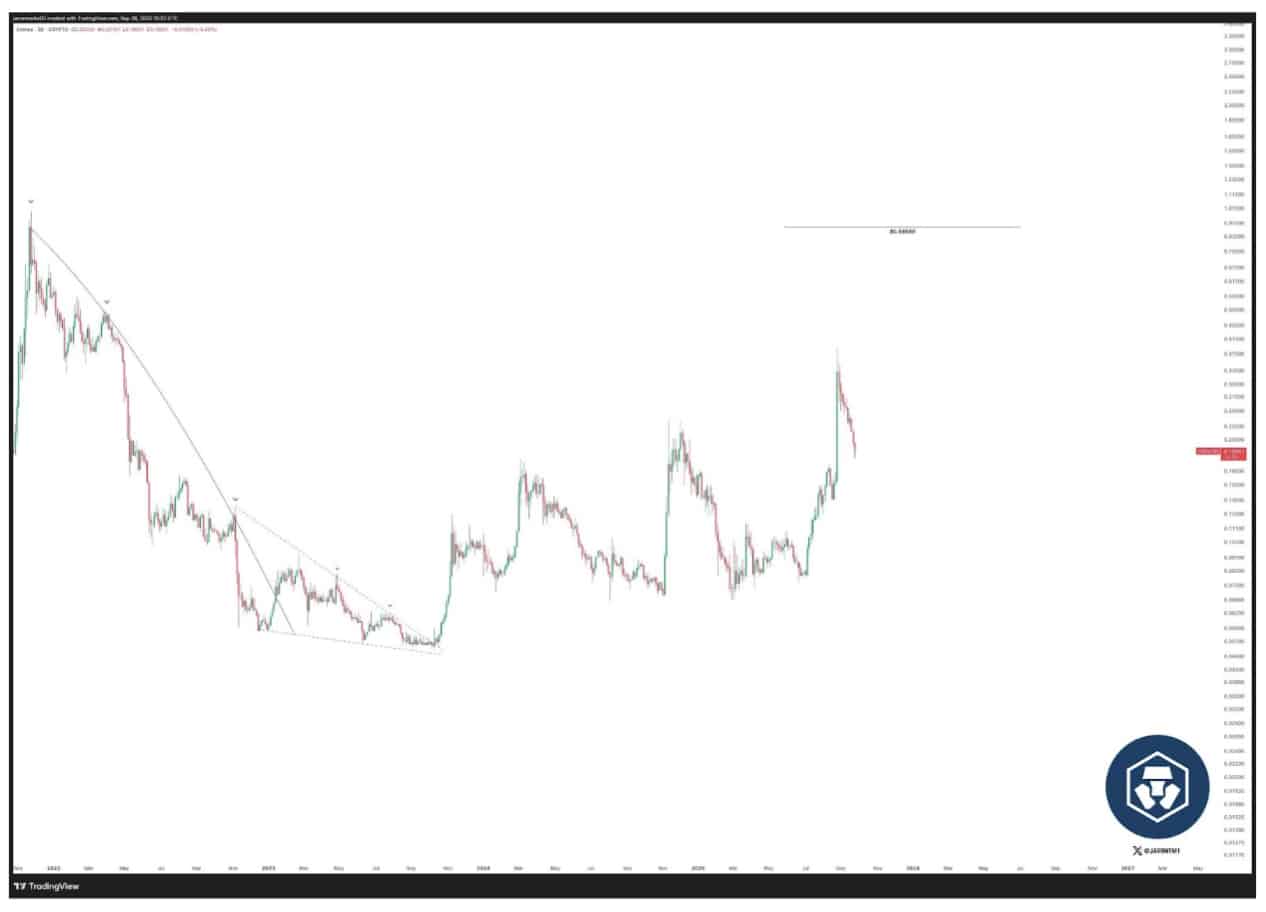

Analyst Javon Marks sees room for a big move. His target is $0.8868, which is more than 350% above current prices. His chart points to fresh bullish momentum after a long buildup.

$CRO (Cronos) –

Target @ $0.8868 (Over +350% Upside) https://t.co/LhX2NVLLeq pic.twitter.com/ps9vVA1iUM

— JAVON![]() MARKS (@JavonTM1) September 26, 2025

MARKS (@JavonTM1) September 26, 2025

![]() CRO ▼-0.85% fell hard from its 2021 peak, then spent most of 2022–2023 going sideways. It broke out of a descending wedge, a pattern that often marks the end of heavy selling.

CRO ▼-0.85% fell hard from its 2021 peak, then spent most of 2022–2023 going sideways. It broke out of a descending wedge, a pattern that often marks the end of heavy selling.

Since then, it has made higher lows and steadily higher highs.

The token recently ran to the $0.30 area and pulled back. That looks like a normal pause after a strong push. The bigger trend still points up.

(Source:)

The analysis sets $0.8868 as the major long-term target, a level that aligns with resistance from earlier cycles. On the downside, support sits in the $0.16-$0.18 range, an area where buyers have previously stepped in to defend the price during pullbacks.

Between these zones, CRO faces interim hurdles around $0.40-$0.50, a region that has historically acted as a supply zone and could test bullish momentum before any larger MOVE higher.

As long as CRO holds above the $0.16-$0.18 band, the bullish structure stays intact. Momentum tools still lean upward despite the dip.

![]()

Exchange-linked and utility tokens are getting fresh attention as risk appetite stabilizes. Technical breakouts like CRO’s can attract volume and liquidity. That can fuel follow-through moves.

The path won’t be smooth. Expect volatility around $0.40-$0.50. Failure to hold the $0.16-$0.18 area WOULD weaken the setup.

The chart favors upside while supports hold. If momentum builds and interim resistance gives way, CRO could work toward Mark’s $0.8868 target. If the key breaks, that view changes fast.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates