CRYPTO CRASH OVER? $22 Billion Bitcoin & Ethereum Options Expire Today - Top Picks for High Volatility

Massive derivatives expiry shakes crypto markets as traders brace for impact.

Options Avalanche Hits

Twenty-two billion dollars worth of Bitcoin and Ethereum contracts mature today—creating a pressure cooker scenario for digital assets. Market makers scramble to hedge positions while volatility spikes to quarterly highs.

Buying Opportunities Emerge

Seasoned traders eye oversold blue-chips as institutional money waits on sidelines. Historical data shows major options expirations often precede sustained rallies when open interest resets.

Survival Strategy

Stick to projects with proven utility during turbulence—DeFi fundamentals outperform speculative assets when liquidity tightens. Remember: Wall Street still prices crypto like a casino while collecting fees on both sides of the trade.

$21 BILLION WORTH OF $BTC AND $ETH OPTIONS WILL EXPIRE TODAY.

EXPECT HIGH VOLATILITY! pic.twitter.com/FbkITm1V06

— Max crypto (@MaxCryptoxx) September 26, 2025

BitcoinBTC ▼-2.15% is currently priced around $109,426, while Ethereum

ETH ▼-2.48% trades near $3,922. Both have seen losses in recent sessions, triggering over $275 million in liquidations of Leveraged long positions.

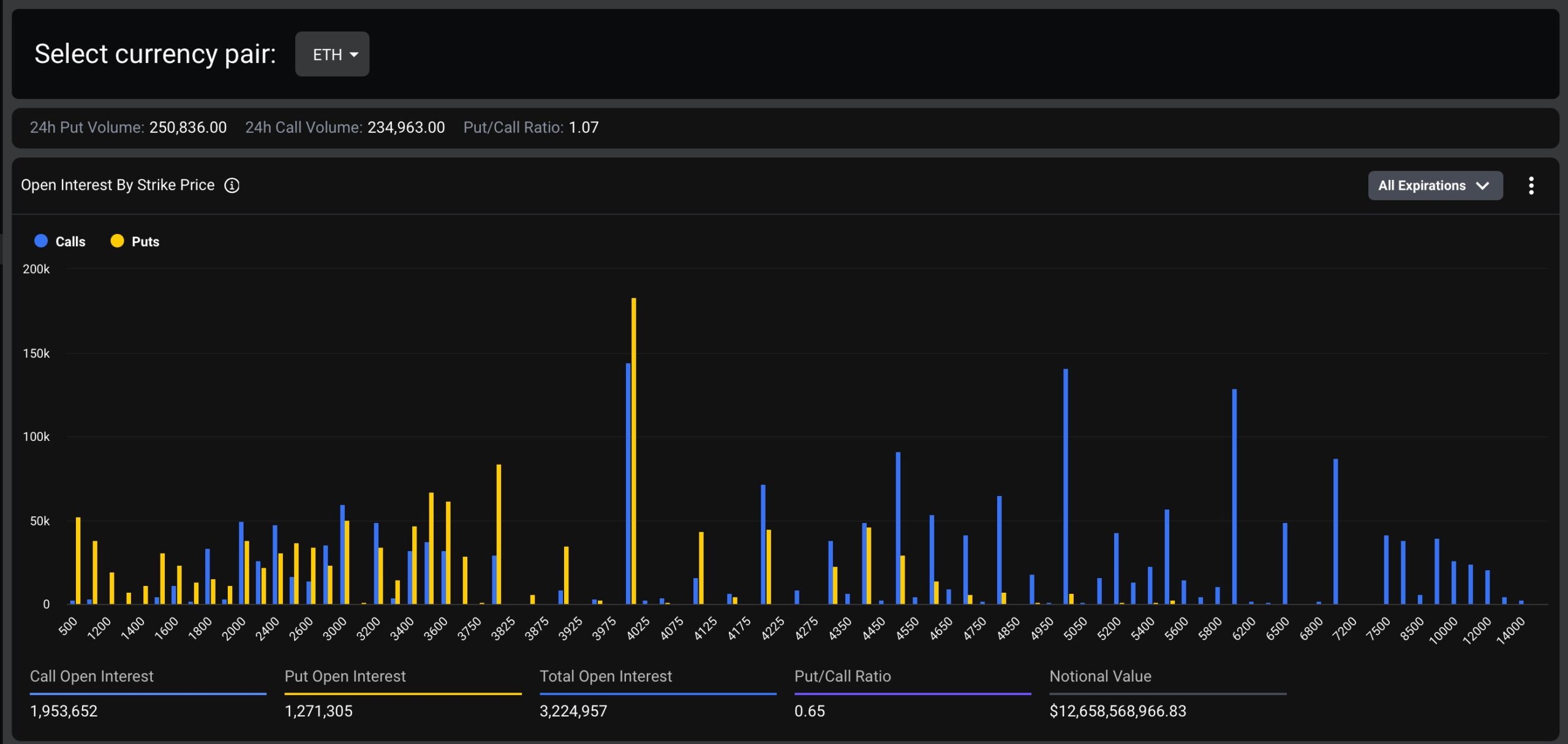

ETH options are heavily clustered around $3800–$4000. That makes this range a likely “magnet” for price into expiry. A decisive move above $4000 or below $3800 WOULD create momentum, but staying in the middle benefits the option sellers most.

Data shows that if BTC closes below $110,000, sellers could gain a $1 billion advantage from expiring put options. However, Bitcoin ETFs recorded $241 million in inflows this week, suggesting ongoing institutional interest despite market pressure.

Best Crypto to Buy Amid High Volatility – Plasma’s XPL Token Launch

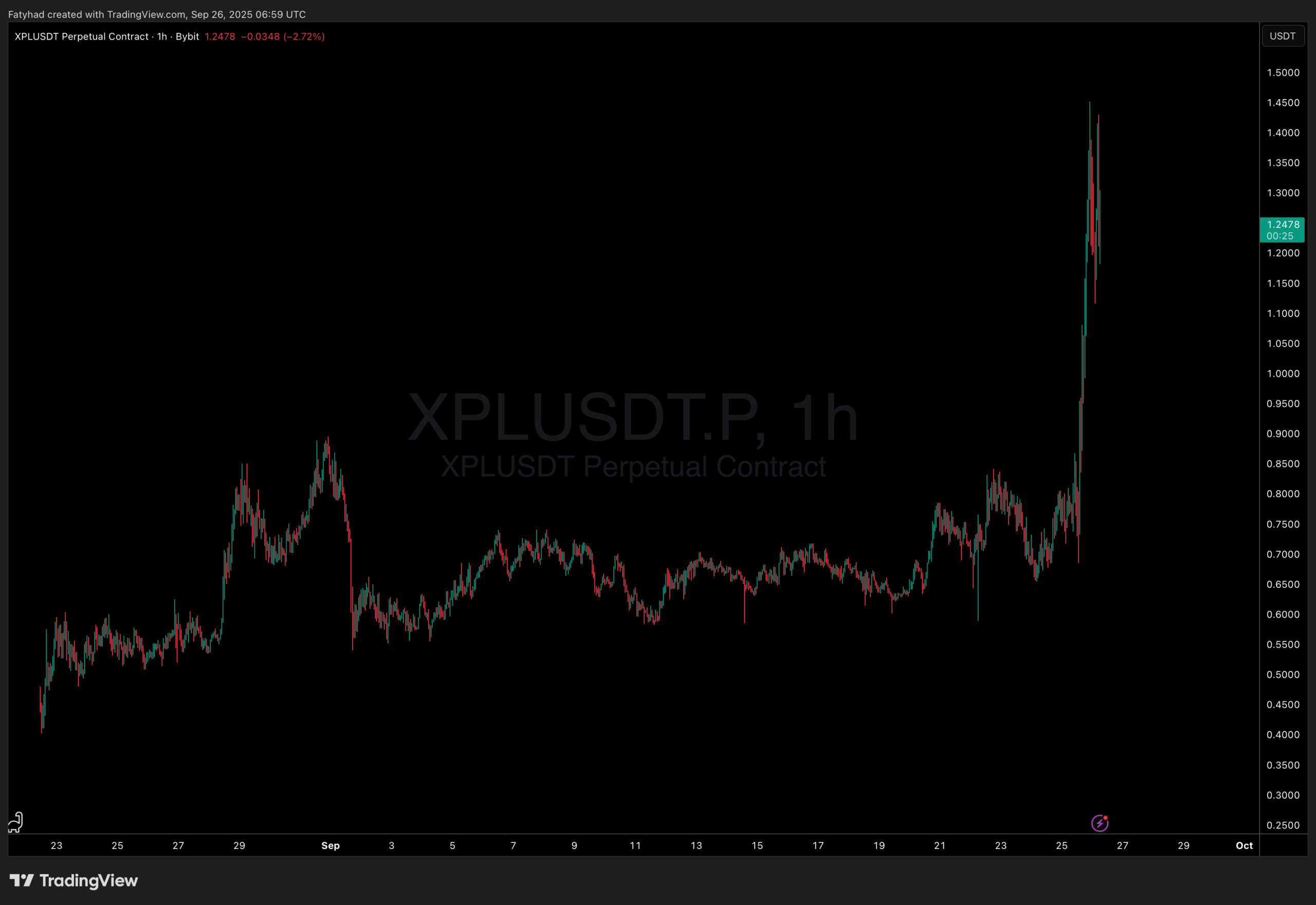

Even in this red market, some projects are printing green candles. One new project drawing attention is Plasma’s XPL token, which debuted this week on Binance and OKX with a market capitalization above $2.4 billion. XPL is designed as a multifunctional asset: it powers transactions as a gas token, secures the network through staking, and rewards validators. Alongside the token launch, Plasma introduced Plasma One, a stablecoin-native neobank aimed at broadening access to digital dollar payments and savings.

The wider market has yet to confirm a recovery. Ongoing concerns about global economic conditions, including the potential U.S. government funding lapse and monetary policy uncertainty, continue to weigh on sentiment.

While selling pressure could ease after Friday’s expiry, traders should be prepared for continued fluctuations. For now, careful positioning and watching early-stage projects like Plasma may help investors navigate the coming weeks.

24 minutes ago

Plasma TVL Erupts After Mainnet: XPL Price Prediction For October?

![]()

When Stablecoin L1 Plasma goes live, billions in liquidity follow, putting new pressure on XPL’s first-month trading range.

Plasma, a Bitfinex-backed LAYER 1 blockchain built for stablecoins, launched its mainnet beta and native token XPL on Sept. 25. The rollout included integrations with major DeFi protocols and immediate listings on leading exchanges, signaling a strong market entry.

The new global financial system is here. pic.twitter.com/pkpXia30FS

— Plasma (@PlasmaFDN) September 25, 2025