Sharpbet’s Stock Tokenization Gamble Intensifies as Ethereum Crashes Below $4,000

Sharpbet just doubled down on its controversial stock tokenization play—right as Ethereum's foundation crumbles beneath it.

The Price Plunge

ETH's catastrophic drop below the $4,000 psychological barrier sends shockwaves through DeFi markets. Trading desks scramble while leverage positions get liquidated en masse.

High-Stakes Gambit

Sharpbet barrels ahead with tokenized securities expansion, betting blockchain infrastructure will withstand the market turmoil. The timing couldn't be more dramatic—or more dangerous.

Regulatory Roulette

Traditional finance sharks circle the bloodied waters. 'Another crypto fantasy meeting reality,' quips one Wall Street veteran who's seen this movie before. Meanwhile, the SEC sharpens its knives.

Make or break moment for tokenization advocates. Either this becomes the ultimate validation case—or another cautionary tale for the finance textbooks.

Why Did Ethereum Drop Below $4,000 Amid Heavy Liquidations?

Ether dropped below $4,000 on Thursday, as derivatives markets saw heavy unwinding.

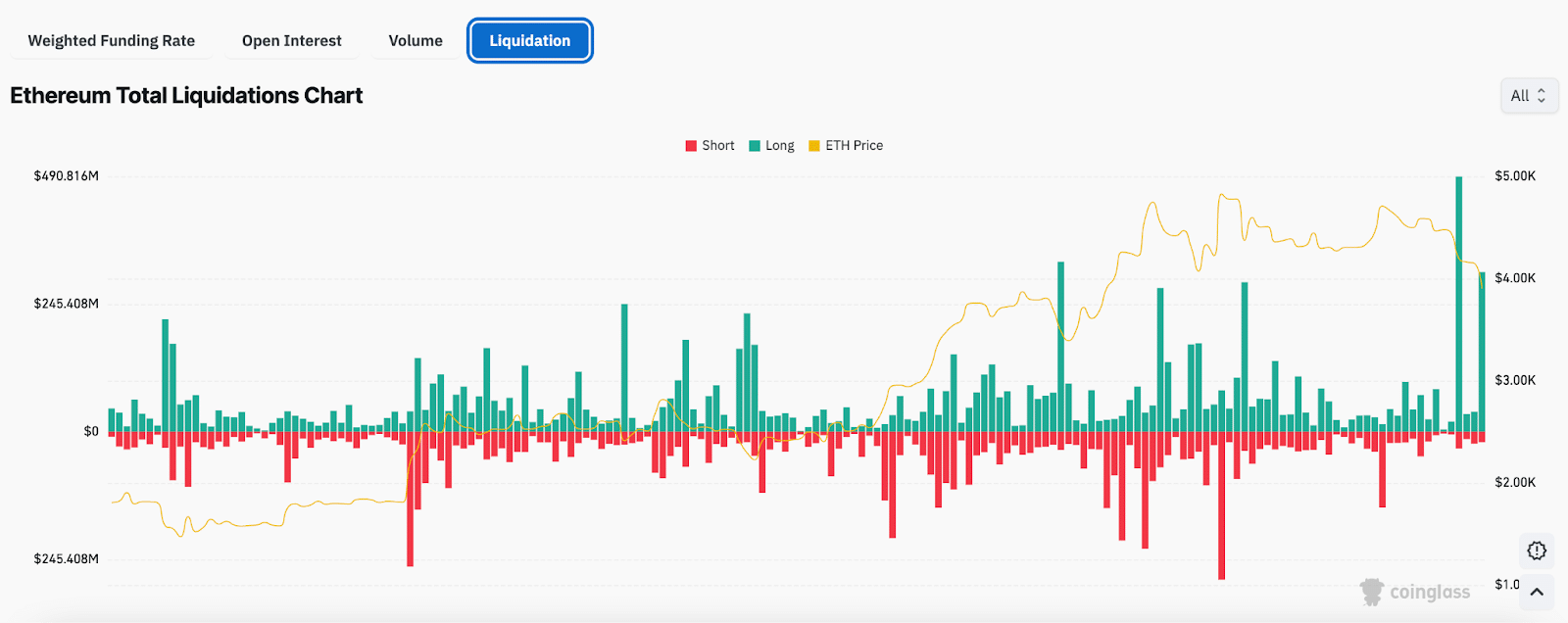

CoinGlass data shows that in the past 24 hours, long traders faced about $332M in liquidations, adding to nearly $718Min losses this week.

(Source: Coinglass)

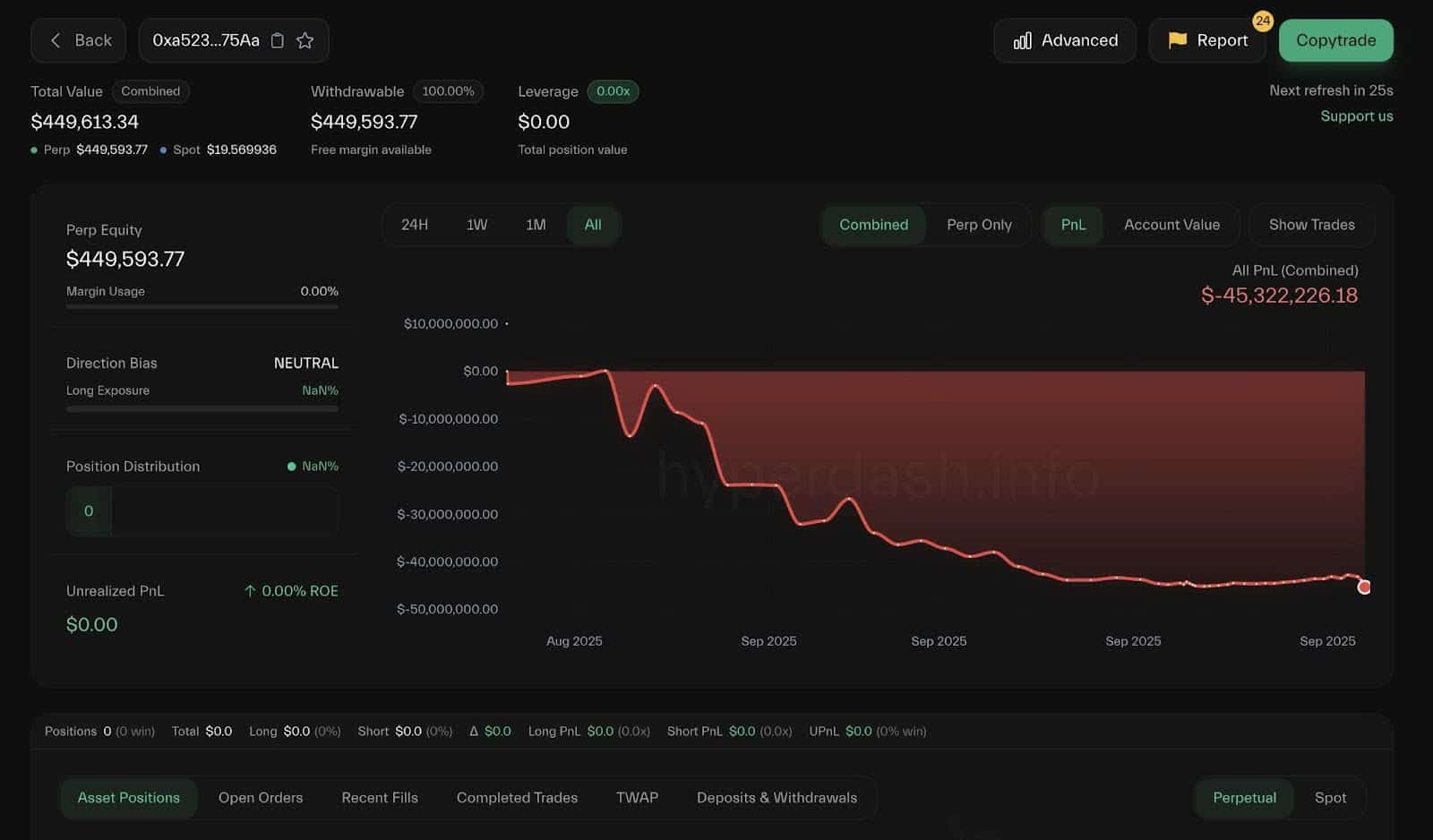

According to Lookonchain data, one large wallet, “0xa523,” took a single $36.4M hit.

ETH just dropped below $4,000!

The biggest loser, 0xa523, just got WIPED.

His entire 9,152 $ETH($36.4M) long position was fully liquidated.

His total losses now exceed $45.3M, leaving him with less than $500K in his account.https://t.co/8C3XNE5tMS pic.twitter.com/JplqJl0cPy

— Lookonchain (@lookonchain) September 25, 2025

Charts now suggest ETH could revisit the $3,600-$3,400 range if pressure continues.

At the same time, SharpLink is moving ahead with an unusual experiment: tokenizing SEC-registered equity directly on Ethereum.

Source: X

The plan tests whether regulated shares can be held in self-custody wallets and eventually traded on automated market makers without violating securities rules.

The company says the effort is meant to “modernize capital flows” and tie its business closer to Ethereum’s financial infrastructure.

SharpLink has also been building an ETH-heavy treasury since June. It holds over 838,000 ETH and has earned over 3,800 ETH in staking rewards through late September.

A Bitget note this week said the firm collected 509 ETH in staking rewards last week, with no new purchases or buybacks, a sign it is focusing on treasury management as it develops on-chain market tools.

Beyond Ethereum, new infrastructure work continues across the sector.

A feature from The Block spotlighted Goat Network’s push for a Bitcoin Layer 2 using zero-knowledge rollups, showing how scaling tech is spreading to bring faster settlement and broader functionality.

Ethereum Price Prediction: Can ETH Price Recover Above $4,000 After Heavy Selling Pressure?

Ethereum’s sharp pullback has drawn two contrasting but hopeful takes from market watchers on X.

Crypto analyst Merlijn The Trader said ETH has slipped about 16% from recent highs, landing in what he calls a familiar “buy zone.”

$ETH IS BLEEDING!

But look closer: this is the exact buy zone we ripped from last time.

Weak hands panic.

Strong hands load.

We’ve seen this playbook before

This is where massive gains are secured. pic.twitter.com/lXst5sUAet

— Merlijn The Trader (@MerlijnTrader) September 25, 2025

His chart shows the token testing the 100-day moving average (100 MA), a level that has previously marked strong rebounds.

(Source: X)

He argued that while short-term traders may be panicking, long-term holders could view this correction as a chance to accumulate. “Weak hands panic. Strong hands load,” he said, adding that a past bounce from this zone led to a significant rally.

Despite recent volatility, ETH remains above its 50 MA and 100 MA, suggesting the broader uptrend is still intact.

Meanwhile, Mister crypto highlighted a different signal: a bullish divergence between Ethereum’s price and the Relative Strength Index (RSI).

BULLISH DIVERGENCE ON $ETH! pic.twitter.com/6KlLVW1WhC

— Mister Crypto (@misterrcrypto) September 25, 2025

ETH recently dropped below $4,000, printing lower lows, while the RSI climbed off oversold levels around 27.37.

He said that divergence often marks the end of a selloff and the start of a relief rally.

(Source: X)

If momentum holds, ETH could attempt to retest nearby resistance, though analysts cautioned that broader sentiment will decide whether the rebound sticks.

Together, the two analyses frame the current drop as a possible turning point: one suggesting patient accumulation, the other pointing to a technical setup for a bounce.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates