XRP’s Flare Integration: Can DeFi Spark an October Price Revival?

XRP finally lands on Flare Network—unlocking DeFi capabilities that could rewrite its price trajectory.

DeFi Integration Unleashed

The bridge to Flare gives XRP holders access to lending, borrowing, and yield farming for the first time. This moves the asset beyond pure payments into the explosive DeFi ecosystem.

October Price Catalyst?

With traditional finance still dragging its feet on crypto adoption, DeFi might be XRP's ticket to relevance. The timing couldn't be more critical—October has historically been a volatile month for crypto markets.

Market analysts watch closely whether this technical upgrade translates into actual demand. Because let's be honest—the finance world loves blockchain innovation almost as much as it loves quarterly bonuses.

Will DeFi functionality finally give XRP the utility boost it needs? The network upgrade is live—now we see if the market cares.

Why Did Flare Cap FXRP Minting at 5M in the First Week?

The FAssets protocol converts non-smart-contract tokens such as XRP into ERC-20 assets on Flare. Security relies on agents, collateral pools, and Flare’s native data feeds (FTSO and the Flare Data Connector).

Users mint FXRP by sending XRP on the XRP Ledger and can redeem it back to native XRP crypto anytime.

According to Flare, the launch follows months of testing on its canary network, Songbird, where FXRP v1.2 passed its final security milestone.

To manage risk, minting is capped at 5M FXRP during the first week. Users can mint directly through supported portals or buy FXRP on Flare’s decentralized exchanges, including SparkDEX, BlazeSwap, and Enosys.

Flare is offering rFLR incentives to boost activity: around 5% APR on Kinetic lending markets and up to 50% APR for FXRP/USDT liquidity pools.

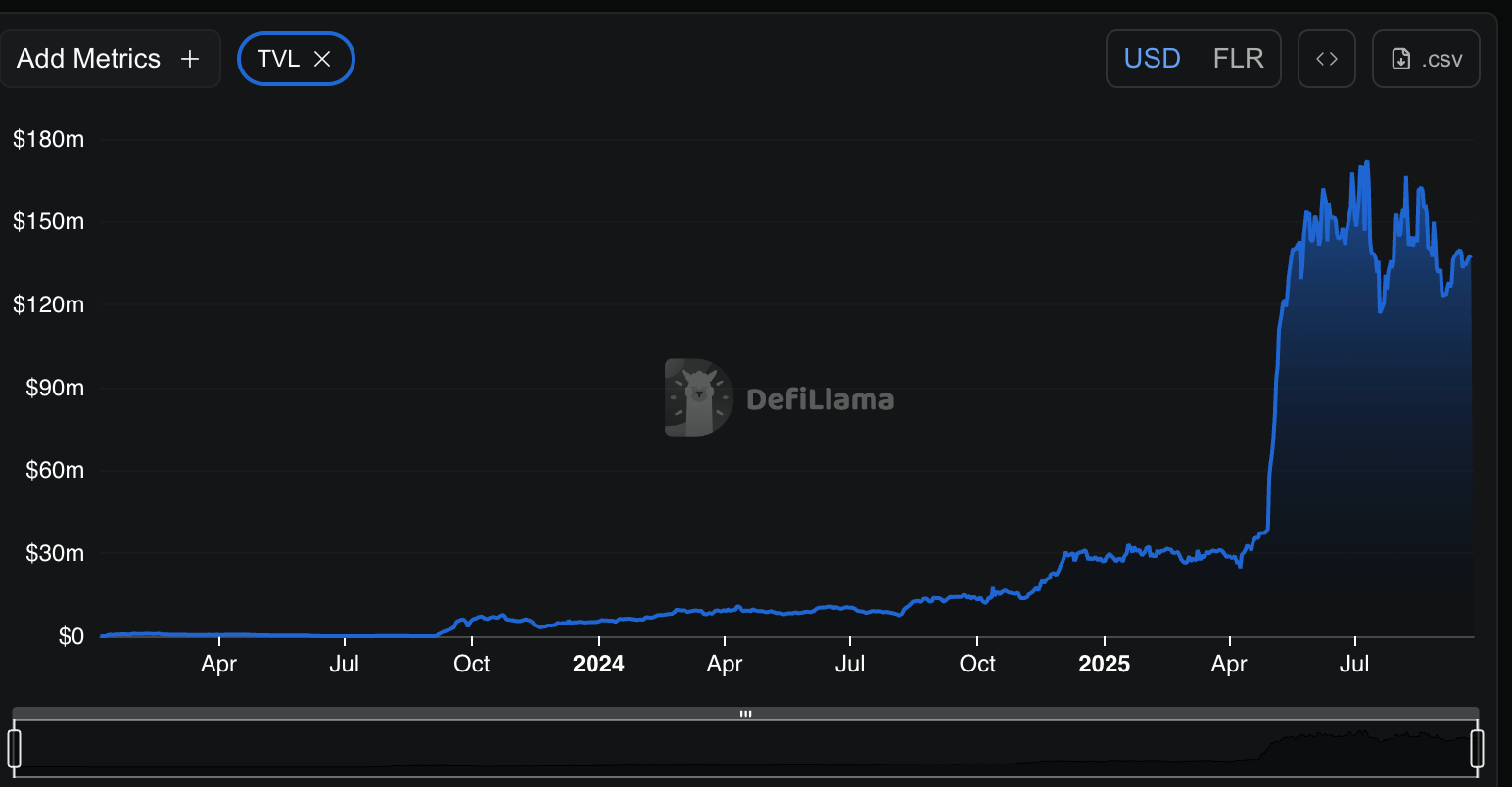

On-chain activity on Flare has already been trending higher in 2025.

Data from DeFiLlama shows $4.17M in daily DEX volume and a stablecoin market cap of about $121M.

(Source: DeFiLlama)

Whether FXRP pushes those figures higher will depend on minting demand, liquidity depth, and total value locked in the coming weeks.

XRP Price Analysis: How Strong Is the Bullish Case for XRP Price Prediction in 2025?

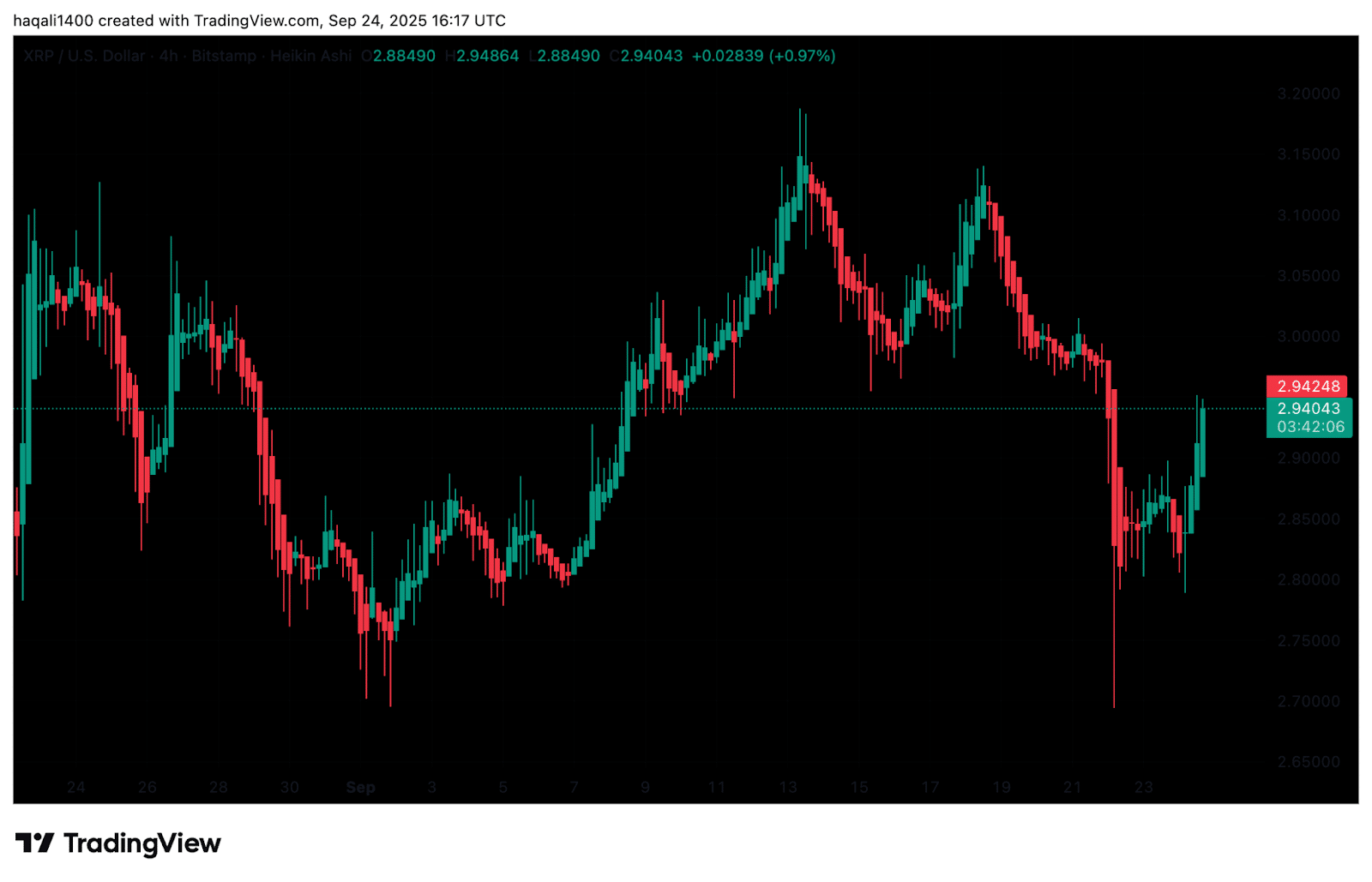

XRP recovered on Tuesday after a sharp sell-off briefly pushed the token below $2.75.

The MOVE came as the market tested a key support level, with buyers stepping in to lift the price back toward the $2.90 zone.

On the 4-hour TradingView chart, the rebound from $2.80 coincided with analysts’ marked support band. Momentum indicators now show renewed interest from buyers, with green candles starting to outweigh recent declines.

(Source: XRPUSDT, TradingView)

The daily chart adds more context. XRP has been moving against diagonal resistance lines for weeks, consolidating before each breakout.

Earlier this month, the token cleared a descending trendline, dipped back for a retest, and now shows strength around $2.87 to $2.90.

Analysts describe the setup as a classic “retest and pump” move, in which a breakout is confirmed by a pullback that turns old resistance into new support.

$XRP – Retest of support complete. Reaction at this level and we are pushing for new highs #XRP![]() https://t.co/WwSQMrL6CW pic.twitter.com/CE6rwsNhip

https://t.co/WwSQMrL6CW pic.twitter.com/CE6rwsNhip

—![]() WAGMISAURUS REX

WAGMISAURUS REX![]() (@wagmisaurus) September 24, 2025

(@wagmisaurus) September 24, 2025

If the pattern holds, the next resistance levels are NEAR $3.20 to $3.30, possibly extending toward $3.60 to $3.80.

Traders say a daily close above $2.95 WOULD strengthen the bullish case. On the downside, a break below $2.80 could shift momentum back toward $2.65, putting pressure on bulls.

The comment reflects Optimism that XRP may be setting up for another rally, provided it holds the current floor.

The coming sessions will show whether buyers have enough strength to carry XRP beyond major resistance and open the door to higher levels. For now, $2.80 remains the line traders are watching.

Join The 99Bitcoins News Discord Here For The Latest Market Updates