Gold Surpasses Bitcoin as Powell Stokes Inflation Worries: Are Rate Cuts Just Fantasy?

Powell's inflation warnings send traditional safe-haven asset soaring past digital gold.

The Great Divergence

While Bitcoin stumbles, gold charges ahead—proving that when economic uncertainty hits, old-school shiny metal still outshines cryptographic code. Powell's hawkish tone triggers a flight to centuries-proven stores of value.

Market Reality Check

Traders betting on imminent rate cuts face sobering prospects. The Fed's inflation battle continues, forcing investors to reconsider their portfolios. Gold's surge signals deeper market anxieties than crypto volatility can capture.

The Institutional Perspective

Wall Street's love affair with Bitcoin faces temporary cooling as traditional risk metrics reassert dominance. Yet crypto veterans know these divergences create buying opportunities—because nothing fuels digital asset rallies like renewed monetary uncertainty. After all, what's more cynical than betting against central banks while they actively devalue their own currencies?

Why Is The Gold Price Still Dominating Reserve Strategy? What About Bitcoin?

Gold remains the bedrock of official reserves. In September, prices surged to an all-time high of $3,783 per ounce, fueled by central bank purchases and geopolitical risk.

According to FRED data, gold demand from central banks has climbed for five consecutive quarters, the longest stretch since the 1970s.

The Gold Price is Wrong

Gold is actually cheap relative to the global currency fiat money supply.

And the setup for much higher prices is staring us in the face.

At $3,600, everyone knows that gold is at nominal all-time highs.

But relative to M2, it’s well below historical… pic.twitter.com/98QMsyCuxl

— Katusa Research (@KatusaResearch) September 20, 2025

On one hand, we know it’s beaten to death, but going on the gold or any other financial subreddit is mind-blowingly vapid.

Hell, just the whole site is:

- Well ACHTUALLY the US govt data is wrong

- An ad hominem attack on famous investors rather than addressing their argument

But with that said, gold can’t stop winning.

Henry Allen, strategist at Deutsche Bank, put it bluntly:

“Whilst gold prices have many drivers, one is the perception that it operates as a haven that investors buy in times of fear.”

The rally echoes the Volcker era of the 1980s, when tight money policy triggered demand for SAFE havens.

Can Bitcoin Be the “Digital Gold” Central Banks Embrace?

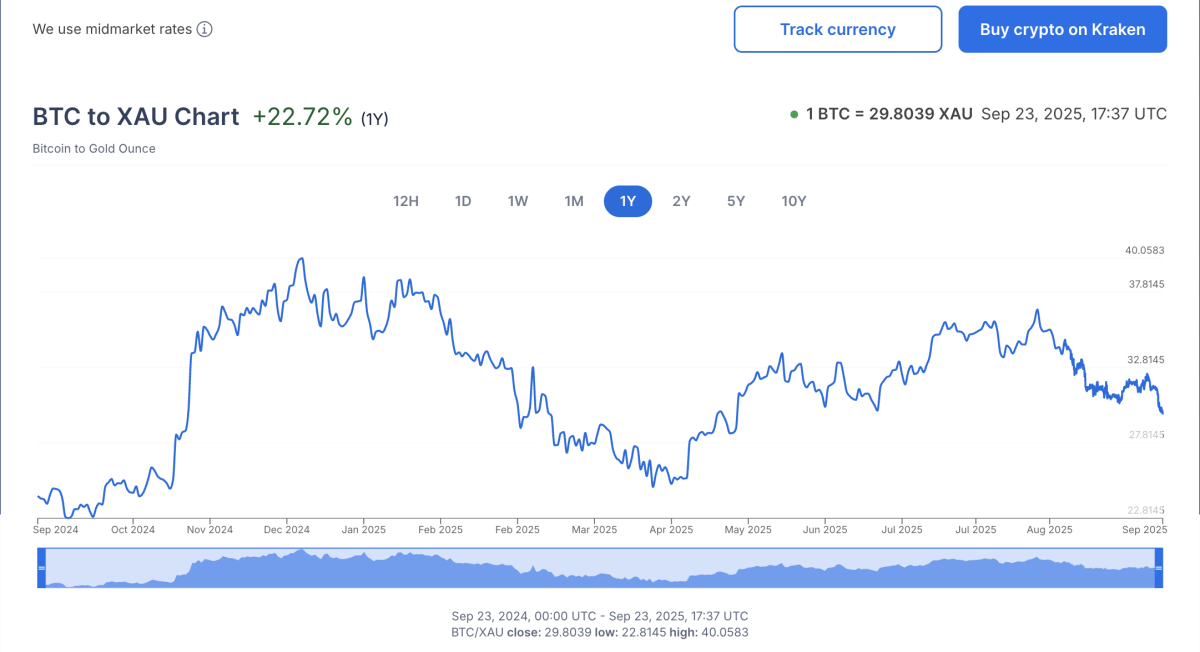

Bitcoin is still far more volatile than gold, but its momentum is undeniable. BTC USD prices touched $123,500 in August, and according to CoinGecko, BTC has gained +22.7% more than gold over the past 12 months.

Changpeng Zhao, Binance co-founder, argued the portability edge is decisive: “Gold is great if you can carry it everywhere… If only someone could invent digital gold.”

Bitcoin’s capped supply, independence from governments, and ease of verification will always give it an advantage. For private reserves and alternative funds, that’s an attractive package in a world still wrestling with inflation.

Why This Debate Matters for Investors Beyond Crypto

Central banks don’t just manage reserves but set the tone for global markets. Even modest Bitcoin allocations on their balance sheets could trigger trillions in new institutional flows.

From a macro view, Bitcoin looks like a growth hedge, while gold is the fear hedge. Both may sit side by side in the decade ahead, but recent history still shows that Bitcoin is a stronger performer than gold.

Key Takeaways

- A new Deutsche Bank study asks whether Bitcoin could sit alongside the surging gold price in central bank reserves by 2030.

- Bitcoin’s capped supply, independence from governments, and ease of verification will always give it an advantage.