Powell’s 2025 Speech Ignites Market: Bitcoin Girds for Fed-Induced Volatility Amid Policy Rift

Jerome Powell's podium becomes crypto's ground zero as Federal Reserve divisions send tremors through digital asset markets.

THE POLICY SPLIT

Fed governors clash over inflation strategy—creating the perfect storm for Bitcoin's trademark volatility. Trading desks brace for whipsaw action as monetary uncertainty triggers algorithmic responses across crypto exchanges.

BITCOIN'S PRESSURE POINTS

Traditional finance's indecision fuels digital asset skepticism. Yet seasoned crypto traders recognize these Fed divisions as potential catalysts for decentralization narratives. The very policy uncertainty that rattles equities often drives capital toward non-sovereign assets.

MARKET MECHANICS

Liquidity providers adjust spreads while derivatives markets signal heightened expectations for price swings. This institutional positioning reveals professional traders treating Fed communication as critical crypto variables—not mere background noise.

Of course, watching central bankers debate monetary policy while Bitcoin's code executes predictably? The ultimate irony in modern finance.

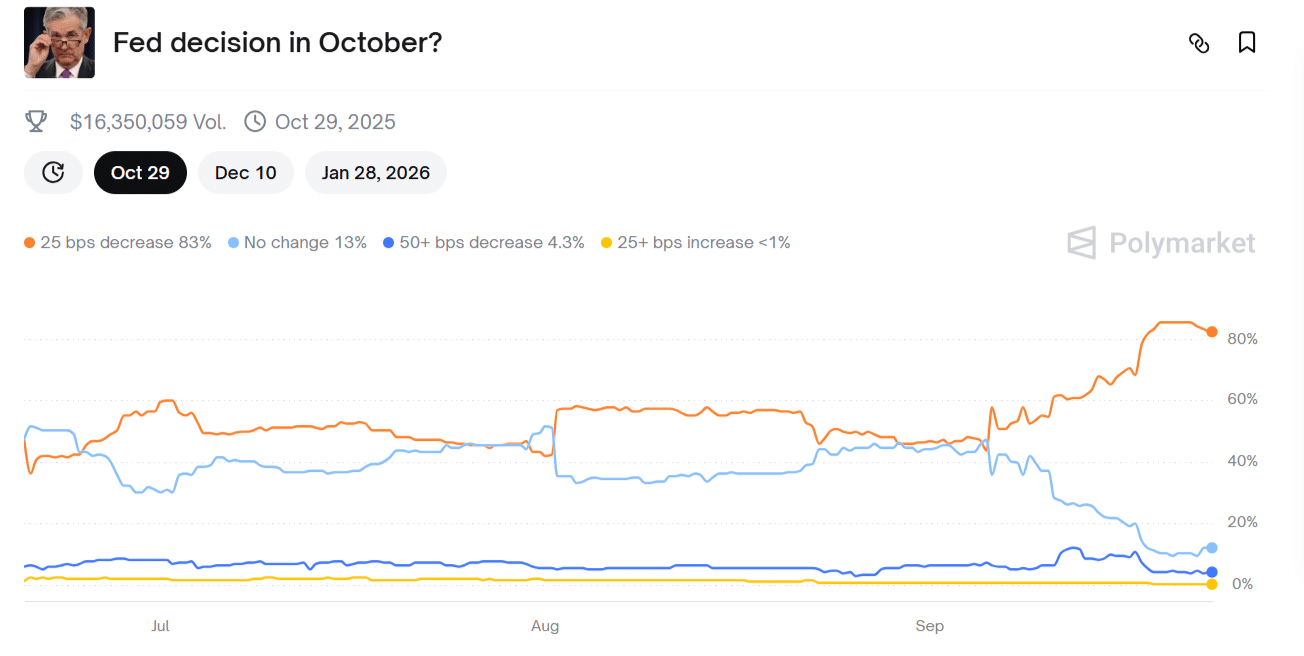

(Source – PolyMarkets)

Powell Speech Today: Powell’s Post-FOMC Tightrope Explained

The Fed’s policy rate currently sits at 4.00%–4.25% after last week’s 25 bps cut. That move, framed as a “risk management” adjustment, has divided investors on what comes next.

Powell must navigate the Fed’s dual mandate with conflicting signals: inflation remains stubbornly above target in several Core metrics, while job growth shows signs of fatigue.

Some policymakers, including St. Louis Fed President Alberto Musalem, warn against moving too quickly on easing. Others argue that weakening employment data justifies more cuts.

No doubt, pundits at Polymarkets will be following Powell’s tone closely today, as it will decide whether the market leans toward cautious patience or accelerated loosening after the rate cut.

Bitcoin Price in the Crosshairs: Will Jerome Powell Trigger BTC USD Reversal?

Crypto markets are already on edge. Spot bitcoin ETFs recorded $363M in net outflows on September 23, led by Fidelity’s FBTC. Ether ETFs joined the exodus with $76M in withdrawals.

These flows suggest institutional investors are hedging against the possibility that Powell strikes a hawkish note.

Bitcoin price is holding above $113,000, though the market remains fragile after Monday’s $285M in long liquidations, the heaviest single-day wipeout since June.

Traders are eyeing $110,000 as key support; a dovish Powell could trigger a relief rally back toward $117,500–$118,000 resistance, while any emphasis on inflation risks could send BTC deeper into correction territory.

Macro Context Overhangs BTC USD Price: Dollar and Bonds In Play

The broader macro backdrop adds weight to today’s remarks. The U.S. Dollar Index (DXY) is firm NEAR 97.40, while 10-year Treasury yields hover around 4.15% after a sharp climb.

Both reflect investor caution ahead of Powell, with higher yields and a stronger dollar typically pressuring Bitcoin and other risk assets.

Meanwhile, gold continues to make new highs as capital rotates away from crypto, a signal that traditional SAFE havens are winning the inflation hedge narrative, at least for now.

What to Watch For In Powell Speech Today

Markets will parse Powell’s every phrase. If he reinforces last week’s “risk management” framing, it could mean steady but slow cuts, a scenario that keeps pressure on Bitcoin in the near term.

If instead he acknowledges economic softness and signals readiness for faster easing, BTC could benefit from a renewed risk-on bid.

Either way, the Powell speech today is a volatility event for Bitcoin. With institutional flows already flashing red, traders should expect sharp moves in both directions as the Fed chair shapes expectations for the rest of 2025.