Best Solana Wallet Tracker (2025 Update): Top 7 Tools to Track SOL Portfolios & On-Chain Data

Why Trust BTCC

Introduction: Why Solana portfolio tracking matters in 2025

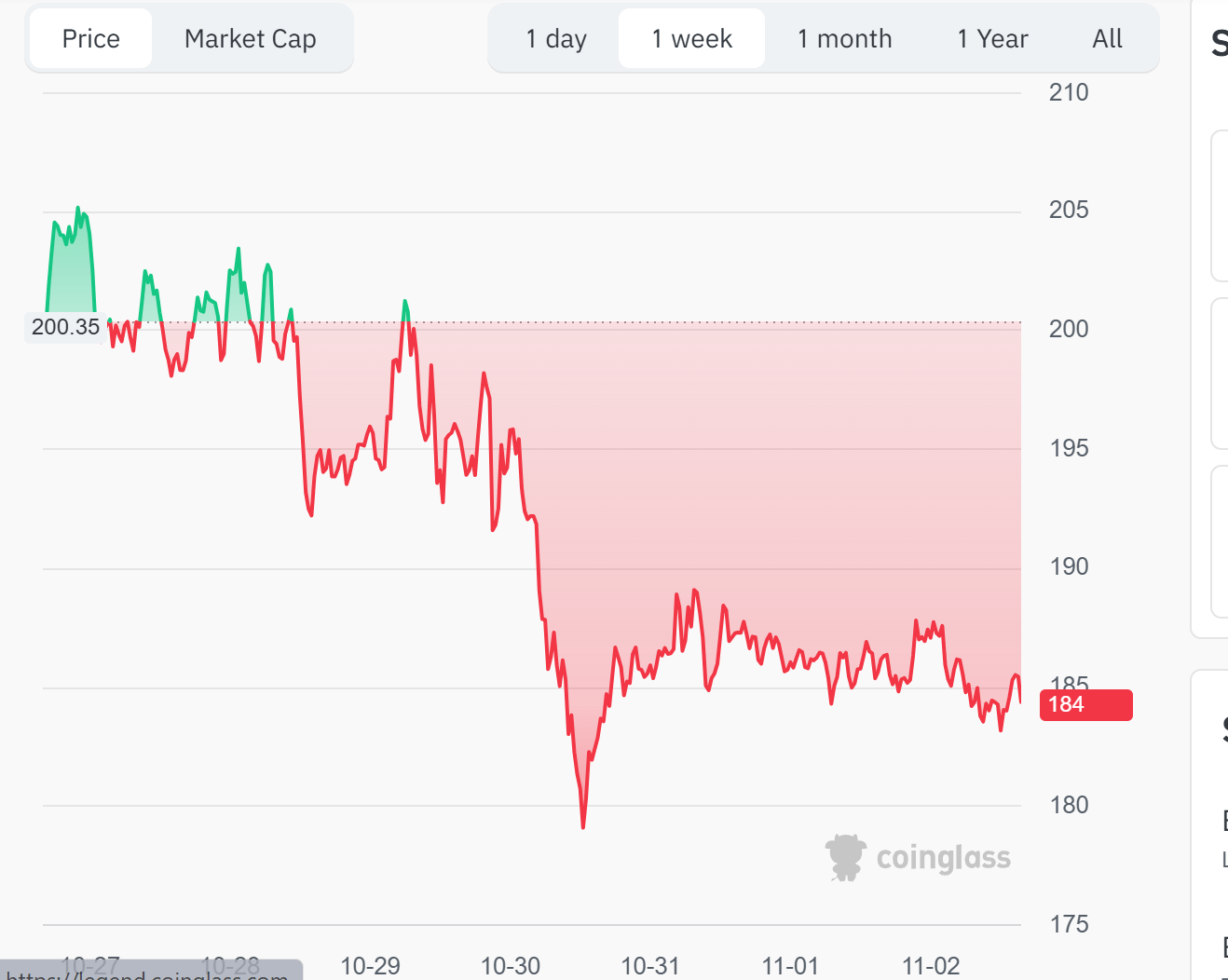

Solana (SOL) continues to rank among the top ten cryptocurrencies by market capitalization, buoyed by strong network growth that has influenced ecosystem adoption, as well as bullish price predictions that forecast SOL to trade around $190 by the end of 2025. Consequently, top crypto analytics firms have issued a buy rating for Solana, resulting in a notable surge in Sol’s trading activity.

However, the continued influx of retail, whale and institutional buyers necessitates the need to properly monitor Solana wallet activities, holdings and on-chain transactions. This raises a key question: Which Solana wallet tracker offers the best and most reliable portfolio tracking experience for crypto investors in 2025?

This article reviews Solana’s current performance alongside factors influencing SOL’s price. The article takes a look further to examine what a wallet tracker is, their functions and the idiosyncrasies factors that determine what kind of Solana wallet tracker you should opt for.

![]()

Table of Contents

- What is a Solana Wallet Tracker?

- Top 7 Tools to Track SOL Portfolios & On-Chain Data

- Takeaways – What is the best Solana Wallet Tracker in 2025?

- How to Trade Crypto on BTCC?

- BTCC FAQs

/ You can claim a welcome reward of up to 10,055 USDT\

Solana’s All-Time Highs (ATHs) and Future Price Movement

Solana reached its ATH on January 19, 2025, when Sol peaked at $294.33 during the bull run that also sent the price of other popular cryptos and altcoins alike soaring. Despite subsequent market corrections and dips occasioned by President Trump’s tariffs, which affected both the crypto market and capital markets, Solana’s price has somewhat stabilized, with SOL trading at $185.52 as of the time of writing this article.

Solana continues to demonstrate resilience, with analysts forecasting that continued ecosystem growth hints that SOL still has the potential to surge past its previous ATH. However, investors need to track their SOL portfolio, on-chain data, trading activity and price movements to stay aligned with their investment goals and reduce the risk of losses occasioned by regular market volatility.

With an efficient Solana wallet tracker, investors can monitor their portfolio to make informed, data-driven buy, sell, or hold decisions, as well as ensure compliance with tax and regulatory laws for investors in jurisdictions with capital gains tax on crypto assets.

Let’s take a look at the best Solana wallet tracker in 2025 and the top 7 Tools to track SOL portfolios & on-chain data.

What is a Solana Wallet Tracker?

A Solana wallet tracker, like every other wallet tracker, is a tool or software designed to provide analytics, data and updates in real-time to Solana investors which affords crypto investors an opportunity to monitor their SOL portfolio, DeFi usage, transaction history and NFTs exposure on-the-go.

This typically includes wallet balance(s), updated SOL price, transaction history, and token holdings. Solana wallet trackers commonly utilize large datasets to provide users with real-time information on wallet movements, whale transactions, and gain or loss analysis.

Solana wallet trackers can range from simple browser extensions to telegram bot services or entire software stacks optimized for various trading and on-chain activities, including token transfers, DeFi interactions, NFT trades.

What are the functions of a Solana Wallet Tracker?

Top crypto analysts have identified several key functions of a Solana wallet tracker to include;

1. Transaction History Monitoring: Solana wallet trackers help monitor a wallet’s assets across chains, and also track a snapshot of the total portfolio value.

2. Real-time Updates: Solana wallet tracker functions as a source of real-time alerts and notifications for transactions, token transfers involving significant SOL amounts, and on-chain activity.

3. Whale Monitoring: Solana wallet trackers help keep a tab on large-scale SOL holders and their on-chain activity, which may serve as an indicator of subsequent price movements.

4. Portfolio Analysis: Solana wallet trackers are essential for analyzing YTD performance of SOL and offer data-driven analysis to guide investment decisions, such as buy, sell or hold.

Top 7 Tools to Track SOL Portfolios & On-Chain Data

Solana is a mainstream cryptocurrency with a vast amount of on-chain data and trading activity, which necessitates tools built to handle its high throughput and unique account structure. Tracking SOL portfolios and on-chain data is very important in crypto because on-chain data provides a clear, real-time view of all transactions and wallet activity on the Solana network.

This allows investors to track market trends, whale movements, liquidity flows, and genuine project usage. By analyzing this data, users can spot emerging opportunities and make more informed trading decisions.

Let’s examine the top 7 Tools to track SOL portfolios & on-chain data

1. Nansen: Nansen is a leading on-chain analytics tool for Solana, offering AI-enhanced wallet labelling and smart money tracking. Nansen identifies the wallets of funds, whales, institutions, and top traders, allowing users to follow influential capital flows. With real-time dashboards covering TVL, liquidity, volume, and token performance, Nansen helps users understand on-chain market behavior at a glance.

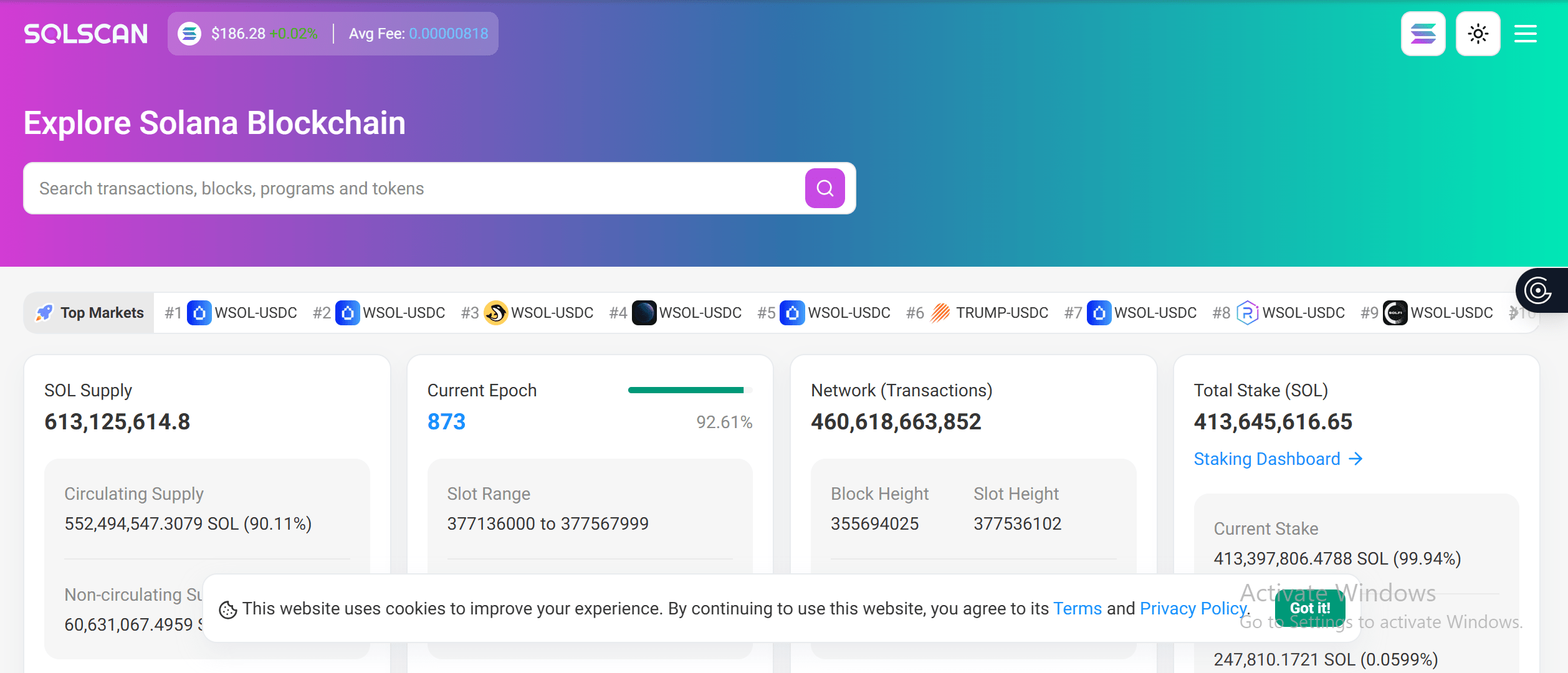

2. Solscan Summary:

Solscan is one of the most widely used blockchain explorers for Solana, offering a clean interface for checking transactions and wallet activity. Solscan allows users to view fees, addresses involved, token balances, NFTs, and transaction history. Solscan is ideal for verifying transactions, researching tokens, monitoring wallets, and troubleshooting network interactions.

3. Dune Analytics Summary: Dune Analytics is a powerful data platform for users who want deeper insights through customizable queries and dashboards. It uses SQL to pull specific blockchain data, enabling users to build or view detailed analytics on Solana DeFi, NFTs, DEX activity, and network trends. Dune is best for advanced users who need tailored metrics, benchmarking, and shareable on-chain insights.

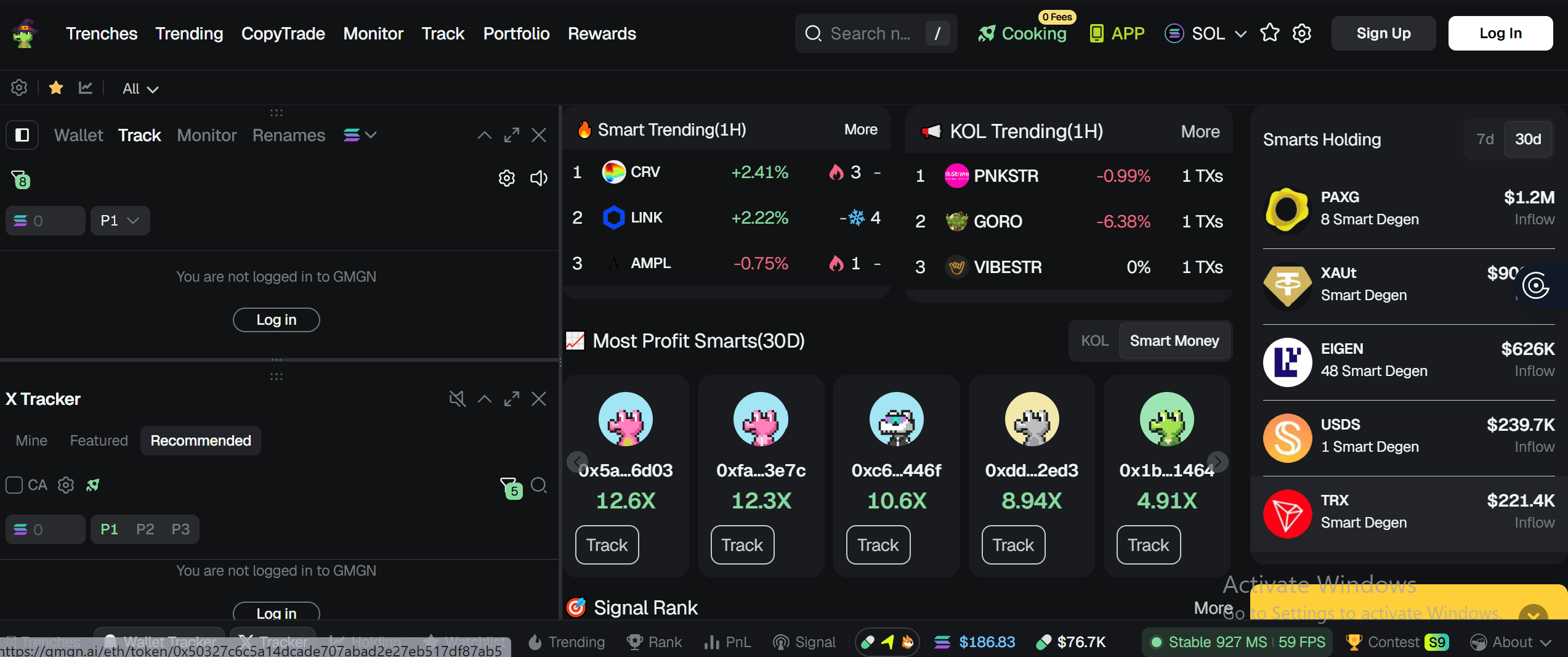

4. GmGn Wallet Tracker:

GmGn wallet features a tracker that is customizable for Solana with access to smart wallet tracking, on-chain data analysis, instant token purchases, community insights.

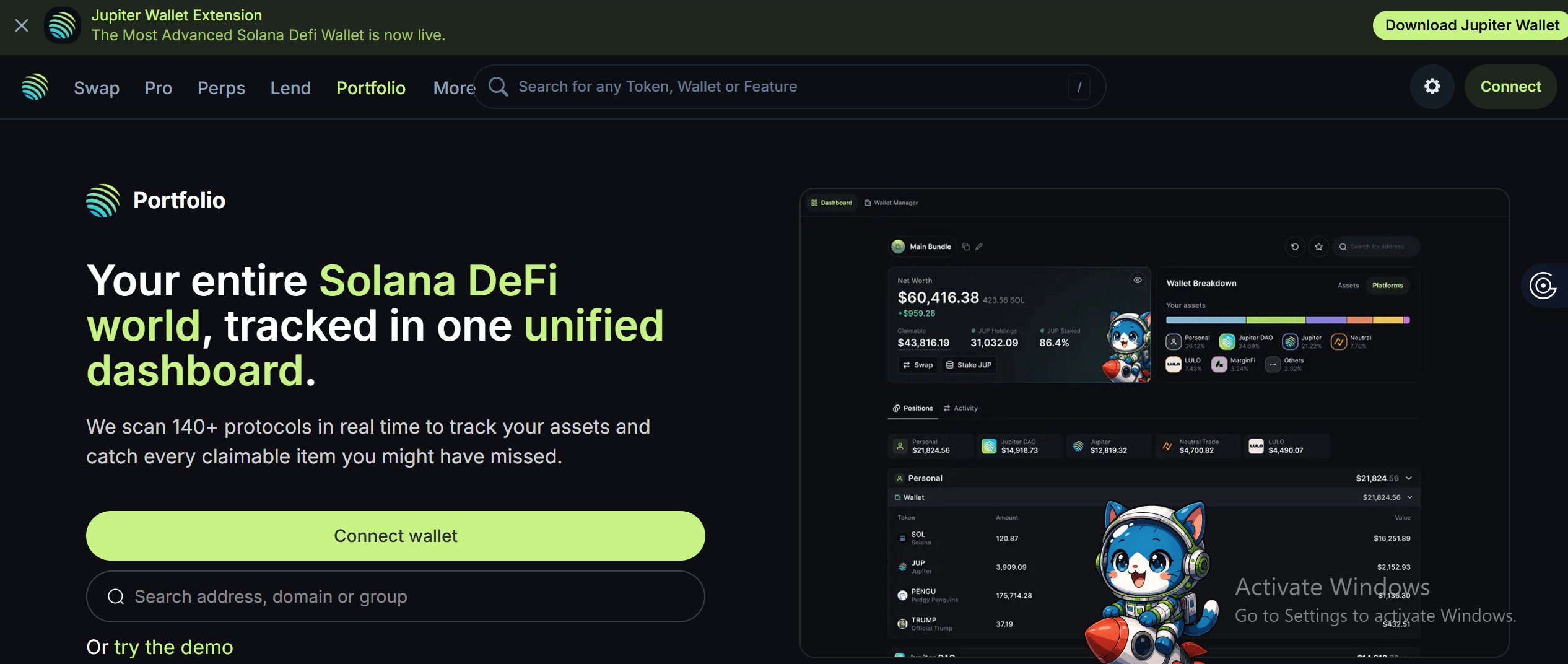

5. Jupiter Portfolio:

Jupiter portfolio offers backend integrations into the broader Jupiter exchange ecosystem, which provides real-time access to trading activities, swaps, Dollar-Cost Averaging (DCA), and perpetual contracts.

6. Step Finance: Step Finance offers a Solana wallet tracker that can be customized to keep a tab on transaction flows, enabled through API integrations. Crypto analytics firms often recommend Step Finance as the ideal tool for tracking SOL portfolios and on-chain data for DeFi enthusiasts and NFT collectors.

7. AssetDash:

AssetDash appeals to Solana investors who are professional analysts with the need to keep a tab on updated margins for SOL’s price to manage or rebase clients’ portfolios. Assetdash provides access to the entire NFT portfolio across Solana, featuring live floor prices and cost basis.

/ You can claim a welcome reward of up to 10,055 USDT\

Takeaways – What is the best Solana Wallet Tracker in 2025?

The choice of the best Solana wallet tracker in 2025 is relative to the end user’s investment preferences, goals and risk tolerance. For multi-chain investors, Solscan and Nansen offer broad compatibility across chains, while active Solana traders should consider the Jupiter portfolio for their Solana wallet tracker.

Nansen also provides real-time on-chain analytics for professional analysts, while Step Finance would appeal to regular Solana enthusiasts who are very keen on tracking liquidity pools and NFTs.

By following this comprehensive guide and staying up to date, investors can make informed decisions and select the best Solana wallet tracker for their SOL portfolios and on-chain data in 2025 and beyond.

For topnotch resources and free informative trading strategies, explore BTCC Academy.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Scan to download