Spot Ethereum ETFs Register Over $1 Billion Inflow On Debut Day

On the inaugural day, Ethereum ETFs witnessed a noteworthy trading volume, recording a net inflow of $107 million. BlackRock emerged as the frontrunner, while the Grayscale Ethereum Trust (ETHE) played the bigger spoilsport. Thus, the Grayscale Ethereum Trust seems to be making similar moves to the ones we saw with GBTC after the Bitcoin ETF launch in January.

BTCC supports trading for 300+ cryptocurrencies. If you are interested in crypto trading, you can register for BTCC to make a purchase.

\Trade On BTCC With 10 FREE USDT!/

Ethereum ETF Flows

On the inaugural day, the BlackRock Ethereum ETF (ETHA) surged ahead of its competitors, amassing a total of 265 million ininflows,thereby establishing itself as the market leader.

Bitwise Asset Management also managed to steal the limelight with the Bitwise Ether ETF (ETHW) seeing more than $200 million worth of inflows. This has been a pretty good beginning for the asset manager as it gives them an early lead in comparison to other market players like Fidelity.

However, it’s worth noting that Grayscale’s ETHE ETF experienced a significant setback, recording staggering outflows of $484 million, representing 5% of the fund’s total $10 billion in assets under management. This outflow occurred just a day after the asset manager transferred $1 billion to the Grayscale Ethereum mini-Trust to provide seed capital for its anticipated launch.

ETH USDT-margined perpetual futures contract with a leverage of up to 500x is available on BTCC, you can directly click the button below to trade Ethereum (ETH)⇓

[TRADE_PLUGIN]ETHUSDT,ETHUSDT[/TRADE_PLUGIN]

Trading Volumes Surpass $1 Billion on Debut Day

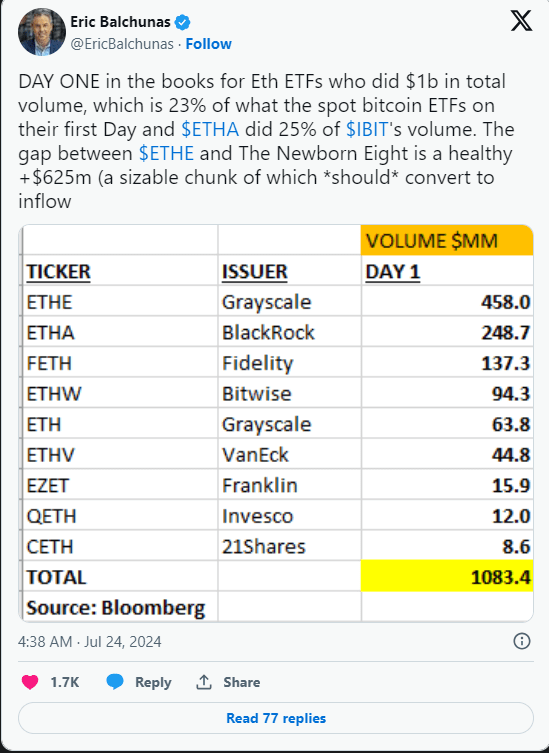

Bloomberg analyst Eric Balchunas reports that Ether ETFs achieved a significant milestone on their first day of trading, with a total volume of $1 billion. This figure represents 23% of the volume that spot Bitcoin ETFs recorded on their debut. On the first day of launch, the spot Bitcoin ETFs registered nearly $5 billion in trading volumes.

It is worthnoting that the BlackRock Ether ETF (ETHA) independently contributed 25% of the trading volume witnessed by BlackRock’s Bitcoin ETF (IBIT) on its first trading day.

Where & How To Buy Ethereum (ETH)?

BTCC offers Ethereum (ETH) Perpetual Futures with leverage up to 500×, you can trade Ethereum (ETH) Perpetual Futures Contract on BTCC at the most competitive price and highest security.

The following sets forth the guidance for trading Ethereum (ETH) Perpetual Futures Contract on cryptocurrency exchange BTCC:

Step One: go to the BTCC homepage and log in to your BTCC account. If you do not have an account, you need to register first.

Step Two: on the BTCC official homepage, choose “Deposite” > “Fiat Deposit”, and then fund your account.

Step Three: go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find the Ethereum (ETH) trading pair.

You can also click the button below to directly enter the Ethereum (ETH) trading page⇓

\Trade On BTCC With 10 FREE USDT!/

You May Like:

Ethereum ETFs Obtain Approval For Trading Tuesday After SEC Greenlight

Ethereum ETFs Review & Analysis: Spot Ethereum ETFs Likely To Launch On July 23

Spot Ethereum ETFs Likely To Launch On July 23, Bloomberg Analyst Say

ETH Surges 20% After SEC Asks For New Filings: Analysts See 75% Chance of Spot Ethereum ETF Approval

How To Buy Ethereum (ETH) In Canada: A Updated Guidance For 2024

Is China’s Gold Buying Frenzy a Catalyst for Bitcoin’s Next Big Rally?

Oil Price Analysis & Forecast For 2024

New Meme Coin NotWifGary (NWG) Launched to Oppose SEC Crawdown: NotWifGary (NWG) Review & Analysis

Top Metaverse Cryptocurrencies To Buy In 2024

Best Crypto Tools For Research&Analysis In 2024

Solana Meme Coin GameStop (GME) Spikes 2,727% In Two Day: All You Need To Know About GameStop (GME)

Bitcoin Price Spikes To Over $66,000: Next Bull Market Come?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download