BTCC Crypto Daily (7.28) | U.S.-EU Trade Agreement Concluded, Macro “Super Week” Kicks Off, ETH Nears Critical $4,000 Level

1.Overview

- Donald Trump announces a US-EU tariff and trade agreement

- Fed decision + nonfarm payrolls kick off the macro super week

- Ethereum futures open interest exceeds $60 billion network-wide

2.Macro & Policy Outlook

Key Events Today

- US July Dallas Fed Business Activity Index to be released today (Previous: -12.7)

- OPEC+ Joint Ministerial Monitoring Committee (JMMC) meeting today

- China and the US to hold trade talks in Sweden

Global Macro Developments

1. Trump announces US-EU trade deal: 15% tariff + $600 billion investment

On July 28, US President Donald Trump announced a new trade deal with the EU, under which the EU will increase investment in the US by $600 billion, agree to tariff-free trade between nations, and open its markets to US exports. Additionally, the EU will purchase hundreds of billions worth of military equipment from the US, and both parties agreed to impose a unified 15% tariff on automobiles. EU Commission President Ursula von der Leyen confirmed the agreement and endorsed the implementation of the unified tariff system.

2.Fed resolution + nonfarm “super week” arrives

A number of major macro news will hit the market this week:

Monday: China-U.S. economic and trade talks in Sweden (July 27-30), U.S. July Dallas Fed Manufacturing Activity Index

Tuesday: U.S. June wholesale inventories monthly rate (initial), U.S. July Conference Board Consumer Confidence Index

Wednesday: U.S. Q2 GDP data series, Fed rate resolution and Powell’s press conference

Thursday: U.S. June PCE price index annual rate, U.S. initial jobless claims for the week ending July 26

Friday: Trump’s tariff deadline, U.S. July nonfarm payroll report, Eurozone July CPI data

3.TRM Labs: Russian entities using Kyrgyzstan’s cryptocurrency ecosystem to evade international sanctions

A report from UK blockchain intelligence firm TRM Labs shows that Kyrgyzstan’s crypto platforms are mostly linked to Russian exchanges (such as the closed Garantex), facilitating ruble-crypto transactions via stablecoins like A7A5. Russian-related activities account for almost the entire share of its crypto industry. Relevant platforms may assist Russia in obtaining dual-use military materials such as semiconductors and drones. Currently, 126 crypto service providers in the country have obtained licenses, and a local USD stablecoin USDKG is under development.

4.South Korean Democratic Party submits first dedicated stablecoin bill

According to the Chosun Ilbo, lawmakers from South Korea’s Democratic Party will officially submit the “Bill on the Issuance and Circulation of Value-Stable Digital Assets” today. This is South Korea’s first systematic legislative proposal covering the entire process of issuance, circulation and supervision of KRW-denominated stablecoins. Compared with the stablecoin provisions in the June “Digital Assets Basic Law”, it is more targeted, with a particular emphasis on reserve transparency and investor protection mechanisms.

5.U.S. Commerce Secretary Raimondo: Tariff hike deadline of August 1 will not be extended

U.S. Commerce Secretary Raimondo stated in an interview that the U.S. will not extend the deadline for tariff hikes on August 1. Additionally, Raimondo noted that the U.S. will finalize tariff policies on chips within two weeks.

6.Probability of Fed keeping rates unchanged this week stands at 97.4%

According to CME “FedWatch”: The probability of the Fed keeping rates unchanged in July is 97.4%, with a 2.6% probability of a 25-basis-point rate cut. The probability of the Fed keeping rates unchanged in September is 35.9%, with a 62.4% probability of a cumulative 25-basis-point cut and a 1.6% probability of a cumulative 50-basis-point cut.

Traditional Asset Correlation

- Nasdaq +0.24%, S&P 500 +0.40%, Dow Jones +0.47%

- Spot gold -0.03% to $3,336.33 /oz

- WTI crude oil (USOIL) +1.17% at $65.75/barrel

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(As of 14:00 HKT on July 28, 2025)

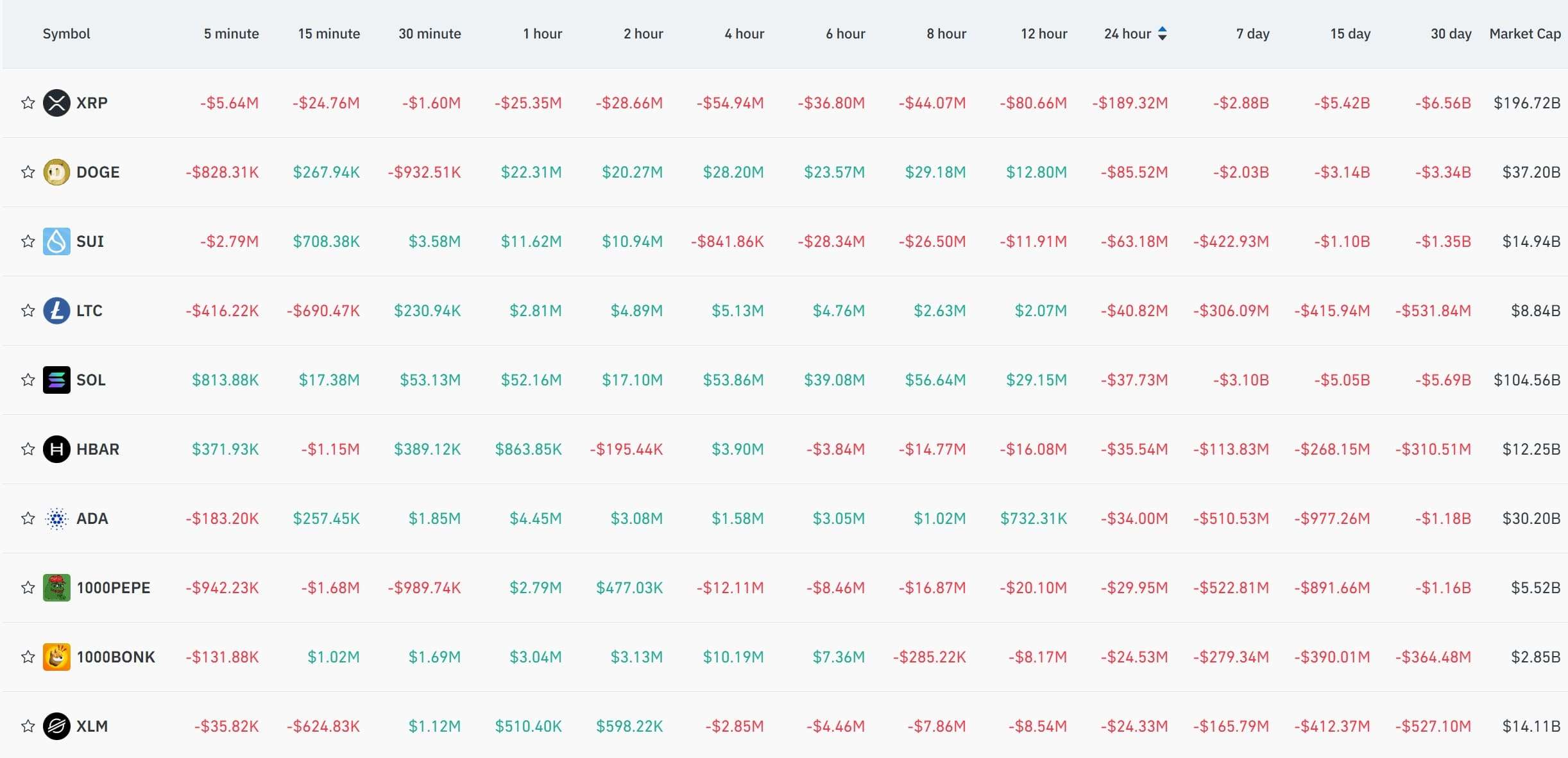

2.Futures Capital Flow Analysis

On July 28, data from Coinglass showed that in the past 24 hours, futures for XRP, DOGE, SUI, LTC, SOL, HBAR and other currencies led net outflows, potentially presenting trading opportunities.

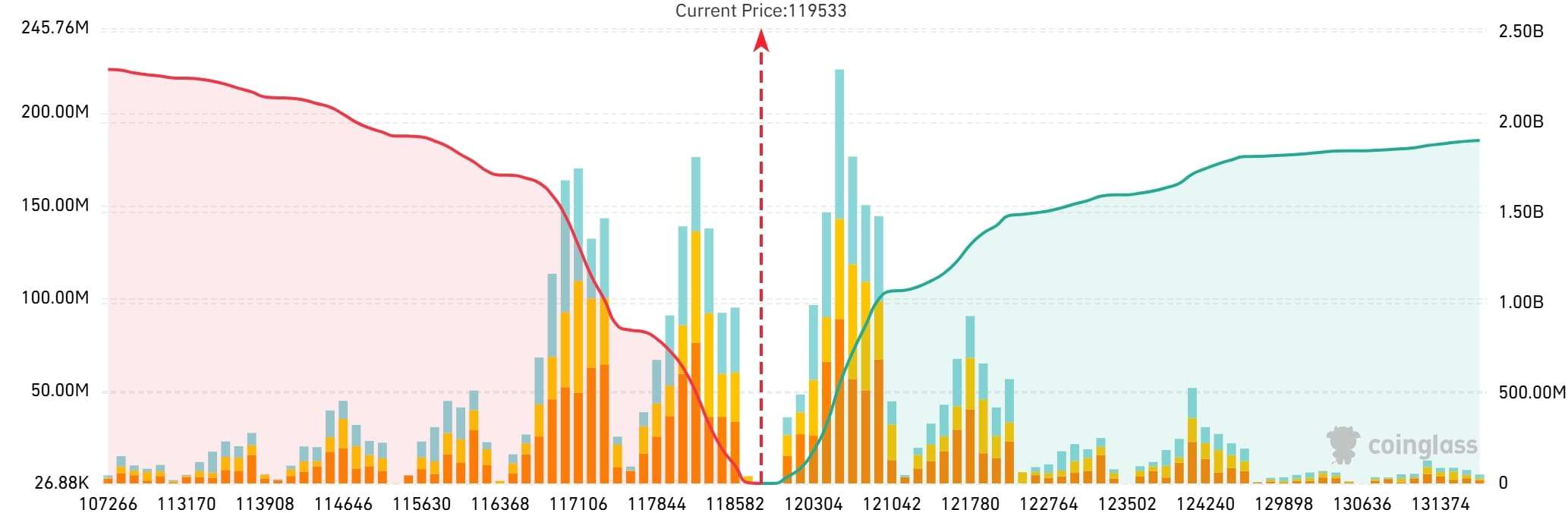

3. Bitcoin Liquidation Map

On July 28, according to Coinglass data, in the Bitcoin exchange liquidation heatmap, based on the current price of $119,533, if Bitcoin breaks below $117,000, the cumulative long liquidation intensity of major CEXs will reach $1.489 billion. Conversely, if Bitcoin breaks above $122,000, the cumulative short liquidation intensity of major CEXs will reach $1.433 billion. It is advisable to reasonably control leverage ratios to avoid triggering large-scale liquidations amid price fluctuations.

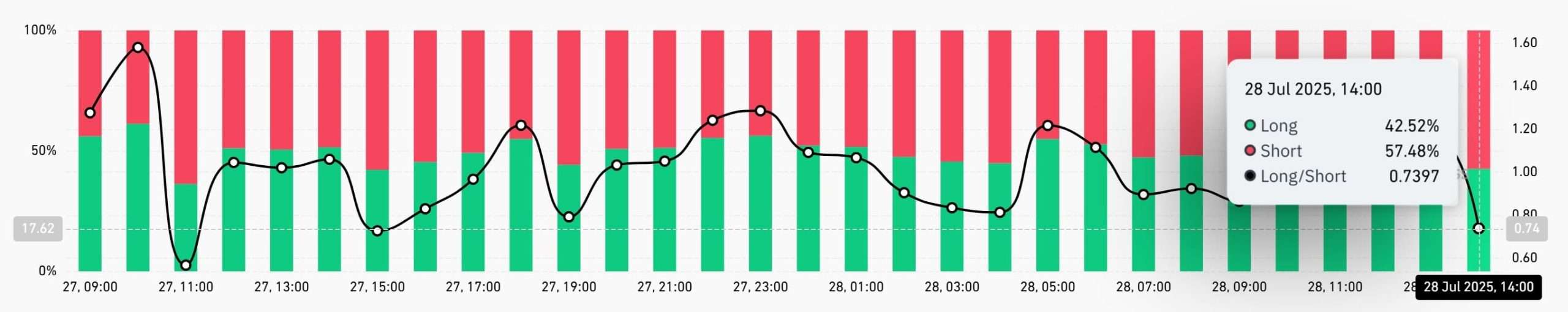

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on July 28, data from Coinglass showed that the global Bitcoin long-short ratio stood at 0.7397, with long positions accounting for 42.53% and short positions 57.48%.

5. On-Chain Monitoring

- @EmberCN: The “4-time ETH trader with a 75% win rate” transferred 4.68 million USDC to exchanges, shorting 20,000 ETH ($77.43 million) with 20x leverage at an entry price of $3,843 and a liquidation price of $3,997.

- @ai_9684xtpa: ZORA has surged 931% in a month, seemingly staging an independent altcoin rally, but there have been no on-chain transactions exceeding $500,000 recently, suggesting possible manipulation by CEX funds.

- Onchain Lens: A whale went long on BTC and ETH with 15x leverage, with the total position value exceeding $2.7 billion and current floating profit reaching $21 million.

4.Blockchain Headlines

- Ethereum futures open interest surpasses $60 billion, setting a new all-time high

- France’s Capital B acquires 58 BTC for €5.9 million, total holdings reach 2,013 BTC

- ETH spot ETFs saw $1.85B net inflow last week, second-highest in history

- Trump Media & Technology Group (TMTG) invests $300 million in BTC-linked options

- Japan’s Metaplanet adds 780 BTC worth approx. $92.5 million

- James Wynn: Bitcoin dominance drops to 60.76%, altcoin season signals emerging

- Pump.fun’s Solana token-launch platform market share drops to 9.01% in 24 hours

- Ethereum 10th anniversary livestream scheduled for July 30; Torch commemorative NFT minting to open

- Over $2.5B in ETH queued for PoS unstaking; additional $1B waiting to stake

- Ethena Foundation repurchased 83 million ENA on the open market

- Analysis: Crypto may benefit from the US-EU trade agreement framework

- Data: Stablecoin market cap grew by $4.269B last week

- Total crypto market capitalization surpasses $4 trillion

- Solana NFT total sales exceed $6 billion

- BTC treasury entities increased holdings by 29,500 BTC last week

- Analyst Andrew 10 GWEI accuses Starknet team of dumping 400M STRK tokens

- Gallup poll: 14% of American adults now own crypto

- US lender Divine Research utilizes World ID for unsecured crypto lending

5.Institutional Insights · Daily Picks

- LD Capital: The market has entered a long-term bull phase. The traditional 4-year cycle may be breaking down. The “crypto-equity model” is the new focus—avoid shorting.

- 10x Research: With key events (corporate earnings, White House digital asset report, FOMC) ending this week, August and September historically signal crypto weakness. Traders are torn between chasing rebounds or taking risk off the table.

6.BTCC Exclusive Market Analysis

Bitcoin is currently quoted at $119,437, showing a volatile rebound pattern on the 4-hour chart: The price has returned above the middle Bollinger Band, with short-term moving averages forming a golden cross. The K-line is testing upwards along the middle band, and bullish momentum is gradually recovering.

Technically, the MACD fast and slow lines have formed a golden cross with initial red energy bars, indicating continued attenuation of bearish momentum; the RSI has rebounded to the mid-to-high range, with market buying gradually picking up but short-term profit-taking risks needing caution; the Bollinger Band channel has slightly expanded after converging, with the upper band forming short-term resistance and the lower band providing strong support. The direction of the breakout will determine the rhythm of the volatile range extension.

This week, events such as the Fed rate resolution and nonfarm payrolls in the “super week” may further increase the volatility of cryptocurrency markets. Overall, the U.S.-EU trade agreement has stabilized risk appetite, and the Fed’s “preparations for an interest rate cut cycle” have released liquidity expectations, jointly driving Bitcoin’s valuation recovery. However, “black swan” events in super week data (such as an unexpectedly strong nonfarm report temporarily suppressing rate cut expectations) need to be guarded against. It is recommended to reduce leverage before key data releases and seize opportunities to trade the breakout of the volatile range.

For short-term trading, focus on price movements: If the price breaks above the upper Bollinger Band ($120,000), light positions can be added to chase the rally, with stop-loss set below the middle Bollinger Band ($117,000); if it pulls back to test the effective support of the middle Bollinger Band, accumulate positions on dips, with stop-loss near the lower Bollinger Band ($115,000). Position size is recommended to be ≤30%. Medium-term traders can wait for clear divergence between short-term moving averages and the MA20, and for the MACD to maintain a golden cross before increasing positions, focusing on the confirmation of a breakout in the $119,000-$120,000 range. A stable hold above $120,000 is regarded as a signal for the start of a medium-term rebound.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download