BTCC Crypto Daily (7.25)|“Altcoin Season” Starts with Divergence and Emerging Risks; Bitcoin Tests Support in Wide-Range Volatility

Why Trust BTCC

1.Overview

- EU approves €93 billion counter-tariff plan against the U.S.

- “Altcoin season” kicks off with weak performance in the crypto market

- Trump’s second son reposts and agrees with the view that “ETH is significantly undervalued”

2.Macro & Policy Outlook

Key Events Today

- Eurozone June M3 money supply YoY to be released today (previous: 3.7%)

- UK July GfK consumer confidence index (previous: -18; current: -19)

- Bank of Russia to announce interest rate decision today

Global Macro Developments

1.EU Approves €93 Billion Counter-Tariff Plan Against the U.S.

On July 24 local time, EU member states overwhelmingly passed a decision to impose retaliatory tariffs on €93 billion worth of U.S. products. The plan merges two lists: an earlier €21 billion list from April targeting U.S. soybeans and motorcycles, and a newly approved €72 billion list covering aircraft, automobiles, and electrical equipment. EU Commission spokesperson Olof Gill stated on July 23 that the tariffs would take effect on August 7 if negotiations with the U.S. break down.

2.Trump Personally Urges Powell to Cut Rates

U.S. President Donald Trump, during a visit to the Federal Reserve headquarters, reiterated his call for interest rate cuts and expressed this directly to Fed Chair Jerome Powell. He also criticized budget overruns in the Fed’s renovation project, stating that if a project manager exceeded budget under his watch, they would be fired. After the visit, Trump described the interest rate discussions as “productive” and not tense, adding that firing Powell would be a major move but is unnecessary.

3.Altcoin Season Starts with Weak and Divergent Performance

According to Bloomberg, the crypto market’s “altcoin season” has gotten off to a disappointing start, with inconsistent rather than broad-based gains. Although Bitcoin hit an all-time high and has since consolidated, the market had hoped for a breakout by Ethereum and a rebound in NFTs to signal a turnaround. However, altcoins have shown divergent performance—XRP, for instance, surged over 60% in early July but fell 11% on Wednesday. Many popular altcoins fall into the “low circulating supply, high Fully Diluted Valuation (FDV)” category, making them susceptible to manipulation. While traders are aware of this dynamic, expectations remain high.

4.White House to Allow 401(k) Investment in Crypto

The White House is preparing an executive order to provide legal protection for 401(k) plan managers, allowing them to include alternative assets such as private equity and cryptocurrencies. Blackstone President Jon Gray noted that this shift will create opportunities for private equity firms and offer more diversified investment channels to everyday investors, potentially transforming the U.S. retirement savings landscape.

5.U.S. and South Korea Reaffirm Plans to Reach Trade Deal Before Tariff Deadline

According to South Korea’s Ministry of Trade, Industry, and Energy, U.S. Commerce Secretary Luttig and South Korean Minister Kim Jung-kwan discussed reciprocal tariffs and agreed to strengthen manufacturing cooperation. Kim also met with U.S. Energy Secretary Wright to discuss clean energy and energy security. Additionally, South Korea’s Chief Trade Negotiator Yeo Han-koo will meet with U.S. Trade Representative Katherine Tai.

Traditional Asset Correlation

- Nasdaq +0.18%, S&P 500 +0.07%, Dow Jones -0.70%

- Spot gold -0.37% at $3,357.63/oz

- WTI crude oil (USOIL) +0.61% at $66.49/barrel

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(As of 14:00 HKT on July 25, 2025)

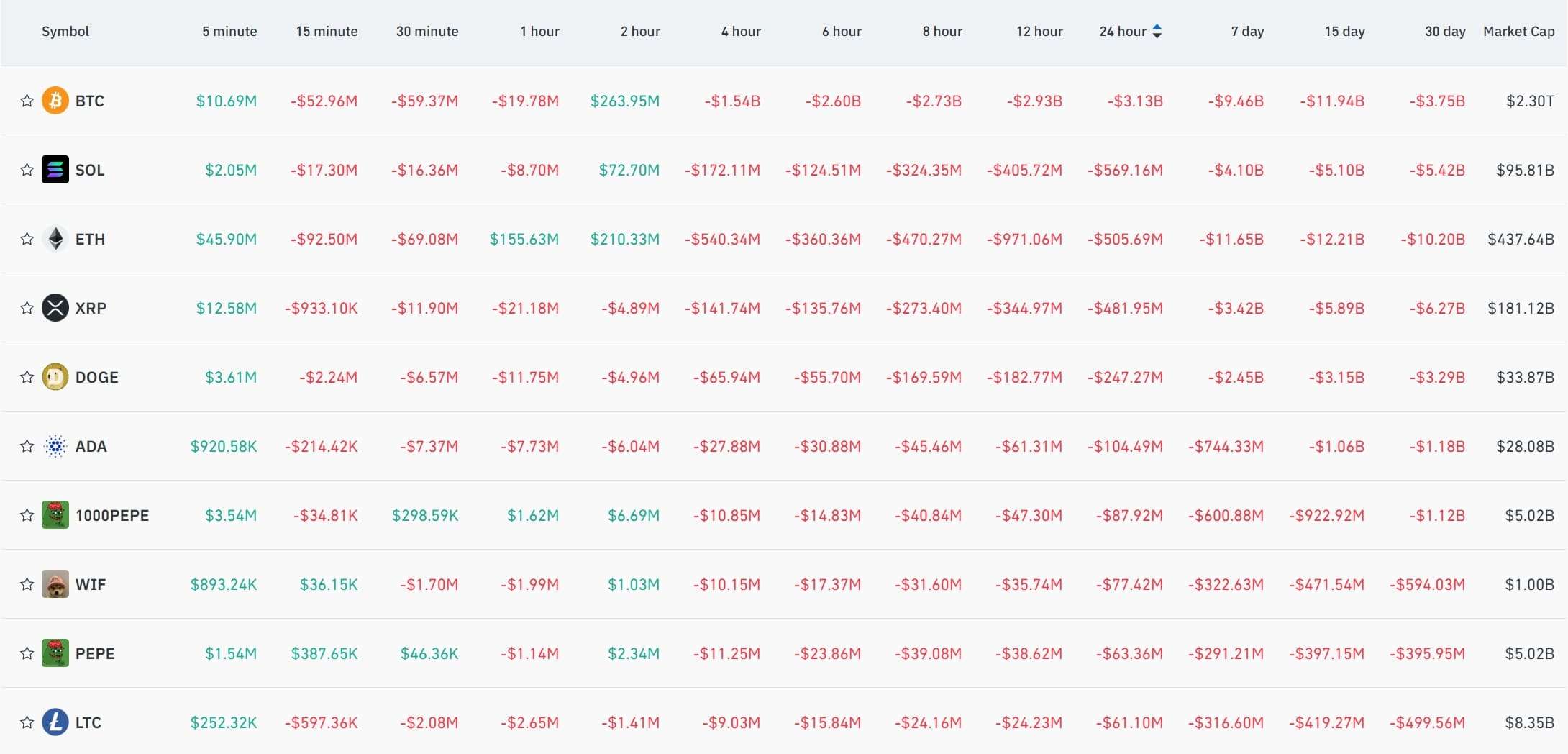

2.Futures Capital Flow Analysis

According to Coinglass on July 25, contracts for BTC, SOL, ETH, XRP, DOGE, and ADA showed significant net outflows over the past 24 hours, indicating potential trading opportunities.

3. Bitcoin Liquidation Map

On July 25, according to Coinglass data, based on the current price of $115,333, if Bitcoin breaks below $113,000, the cumulative long liquidation intensity of major CEXs will reach 2.451 billion. Conversely, if Bitcoin breaks above $118,000, the cumulative short liquidation intensity of major CEXs will reach 2.214 billion. It is advisable to reasonably control leverage ratios to avoid triggering large-scale liquidations amid price fluctuations.

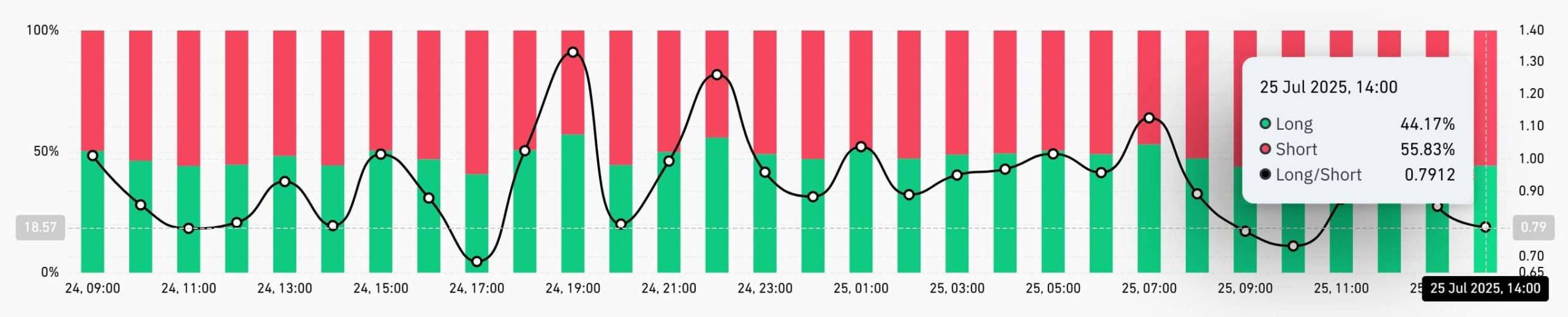

4. Bitcoin Long/Short Ratio

According to Coinglass (as of 14:00 HKT, July 25), the current BTC long-short ratio is 0.7912, with longs at 44.17% and shorts at 55.83%.

5. On-Chain Monitoring

- According to Lookonchain, three new whale wallets purchased another 74,207 ETH (worth $273 million) in the past 10 hours. Since July 9, eight new wallets have accumulated 540,460 ETH (worth $1.99 billion).

- Lookonchain also reports that ‘Maji Dage’ Jeffrey Huang is still increasing long positions in PUMP on Hyperliquid, despite unrealized losses: $8.14 million in contracts and $2.17 million in spot.

- Analyst @ai_9684xtpa observed that a 14-year BTC “fossil hand” moved 14,273 BTC (~$1.67 billion) to major exchanges in the past 12 hours, with 5,690 BTC transferred in the last hour alone. Some exchanges reported over 10,000 BTC traded within one hour, indicating potential sell pressure.

4.Blockchain Headlines

- Public company Windtree announces $520 million in new financing to expand its BNB capital strategy

- REX-Osprey’s Solana staking ETF to integrate JitoSOL and distribute 100% of rewards to shareholders

- Galaxy Digital may have completed Bitcoin sell-off, withdrawing 200 million USDT from CEXs within 15 minutes

- Ethereum spot ETFs see $231 million net inflow yesterday, marking 15 consecutive days of inflows

- CICC: Stablecoins could become a new type of financial infrastructure

- KB Kookmin Bank (South Korea) files trademarks for USD and JPY stablecoins

- 90-day correlation between Bitcoin Volatility Index and S&P 500 VIX hits record high

- Tether releases XAUT audit report, backed by over 7.66 tons of physical gold

- Elon Musk’s xAI to integrate Grok LLM with prediction market Kalshi

- IMF: El Salvador’s strategic BTC reserve fund is progressing as planned; government wallet holdings unchanged

- Christie’s subsidiary establishes crypto real estate division

- Deribit: Over $15.4 billion in BTC and ETH options are set to expire

- Trump’s second son reposts and agrees with view that “ETH is significantly undervalued”

- Crypto industry urges Trump to block JPMorgan from imposing punitive fees on data access

- Ripple co-founder Chris Larsen transferred ~$140 million in XRP to exchanges over the past week

5.Institutional Insights · Daily Picks

- JPMorgan: $60 billion in YTD inflows into the crypto market, with increasing interest in altcoins—Ethereum being the biggest beneficiary.

- Tom Lee: Based on Circle’s current valuation, a $15,000 price target for ETH is reasonable.

- Greeks.Live: Market sentiment is notably bearish. Despite significant losses, traders continue to hold short positions and focus on downside scenarios, particularly around 30% volatility.

6.BTCC Exclusive Market Analysis

Bitcoin is currently trading at $115,474. On the 4-hour chart, the price is in a wide-range volatile and slightly bearish structure—oscillating around the Bollinger Band midline, with MA10 and MA20 converging and diverging. Price candles are testing both the upper and lower bounds of the channel, indicating intensified long-short conflict.

Technically, the MACD fast and slow lines have turned from converging to a death cross, with the green energy column gradually expanding, releasing bearish momentum; the CCI has fallen below the lower edge of the neutral range and hit the oversold threshold, reflecting concentrated short-term selling pressure but indicating a potential rebound; the Bollinger Bands channel has first narrowed and then expanded, with significantly increased price volatility, and the breakthrough direction will determine the short-term trend.

Trading Strategy:

Short-term traders: If BTC falls below $116,000 and MACD death cross strengthens, consider light short positions. If BTC breaks above the midline (~$118,000) and a MACD golden cross forms, consider light long positions. Position sizing should remain ≤30% during volatile periods, with shorts managed cautiously.

Mid-term traders: Wait for clear MA divergence and MACD reversal. Focus on breakout + retest confirmation between $115,000–$118,000. A firm hold above $118,000 with CCI back to neutral supports long entries. A breakdown below $115,000 raises risk of testing $112,000.

The crypto market remains in a short-term tug-of-war, but long-term fundamentals are intact—driven by institutional inflows, regulatory clarity, and technological progress. Investors are advised to focus on compliant assets (e.g., Bitcoin and Ethereum spot ETFs) and DeFi protocols with real revenue models (e.g., Hyperliquid), while being cautious of high-leverage trading risks.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download