BTCC Crypto Daily (7.22)|Over 90% of ETH Addresses in Profit, BTC Dominance Falls Below 60% — Is an Altcoin Rally Coming?

Why Trust BTCC

1.Overview

- South Korea to apply stock market regulations to crypto exchange token lending services

- Sentora: Over 90% of Ethereum addresses are currently in profit

- QCP Capital: Altcoin market may have already started

2.Macro & Policy Outlook

Key Events Today

- RBA releases July monetary policy meeting minutes

- Fed Chair Powell to deliver welcome remarks at a regulatory conference

Global Macro Developments

1.South Korea to Regulate Token Lending on Exchanges Under Stock Market Rules

South Korean financial regulators plan to apply stock market-like regulations to token lending services offered by crypto exchanges. Currently, Bithumb provides up to 400% collateral-based token loans, while Upbit offers BTC loans up to 80% LTV. Authorities consider these akin to short selling and may include oversight in Phase II of virtual asset legislation.

2.RBA Minutes: Maintains Tightening Bias Amid Inflation and Global Risks

RBA’s latest meeting minutes show consensus to maintain a modest tightening bias despite some easing in financial conditions. Consecutive rate cuts are deemed inconsistent with a “prudent and gradual” approach. Inflation is seen trending toward target, labor market remains resilient, and global recession risks have receded — though U.S. tariff policies remain a drag. Caution is advised until clearer signs of inflation easing emerge.

3.U.S. Treasury Secretary Bessent: “Fed Should Cut Rates if Inflation Is Low”

Speaking to CNBC, Treasury Secretary Bessent stated the Fed should lower interest rates if inflation data remains soft. He emphasized current rates are too high and added that tariffs are not significantly inflationary. Bessent also called for a review of the Federal Reserve system’s performance.

4.Tariff Deadline Spurs Safe-Haven Demand, Gold Breaks $3,400

As the August 1 U.S. tariff deadline looms, gold surged over 1% on Monday to above $3,400/oz. Weakening USD and U.S. Treasury yields further lifted demand. Uncertainty over Fed leadership and earlier-than-expected rate cuts also drove investors to gold, according to High Ridge Futures.

5.White House Crypto Policy Report to Be Released by Month-End

Journalist Eleanor Terrett reports that while the crypto policy report will be finalized on July 22, White House officials plan to release it publicly by the end of the month.

6.Goldman Sachs: Fed Independence Perceived at Risk

Goldman Sachs says market participants increasingly doubt the Fed’s independence. The previously strong correlation between 5-year forward inflation swaps and 2-year Treasury yields has broken down, indicating heightened uncertainty about future inflation and monetary policy.

Traditional Asset Correlation

- Nasdaq up 0.38%, S&P 500 up 0.14%, Dow down 0.04%

- Spot gold fell 0.35% to $3,384.49/oz

- WTI crude dropped 0.6% to $65.30/barrel

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(as of July 22, 2025 14:00 HKT)

2.Futures Capital Flow Analysis

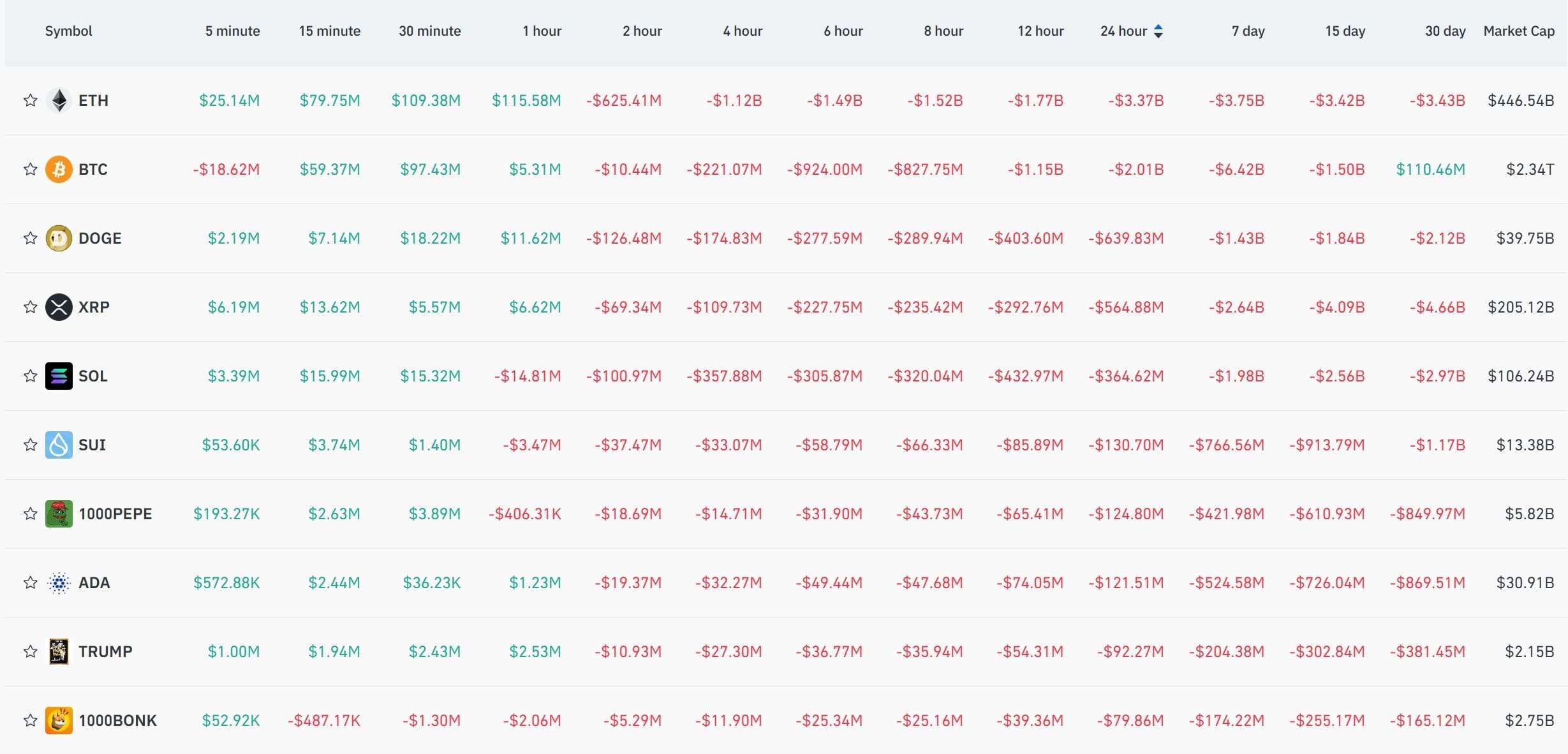

According to Coinglass (July 22), ETH, BTC, DOGE, XRP, SOL, and SUI saw the largest net outflows from derivatives trading, possibly indicating trading opportunities.

3. Bitcoin Liquidation Map

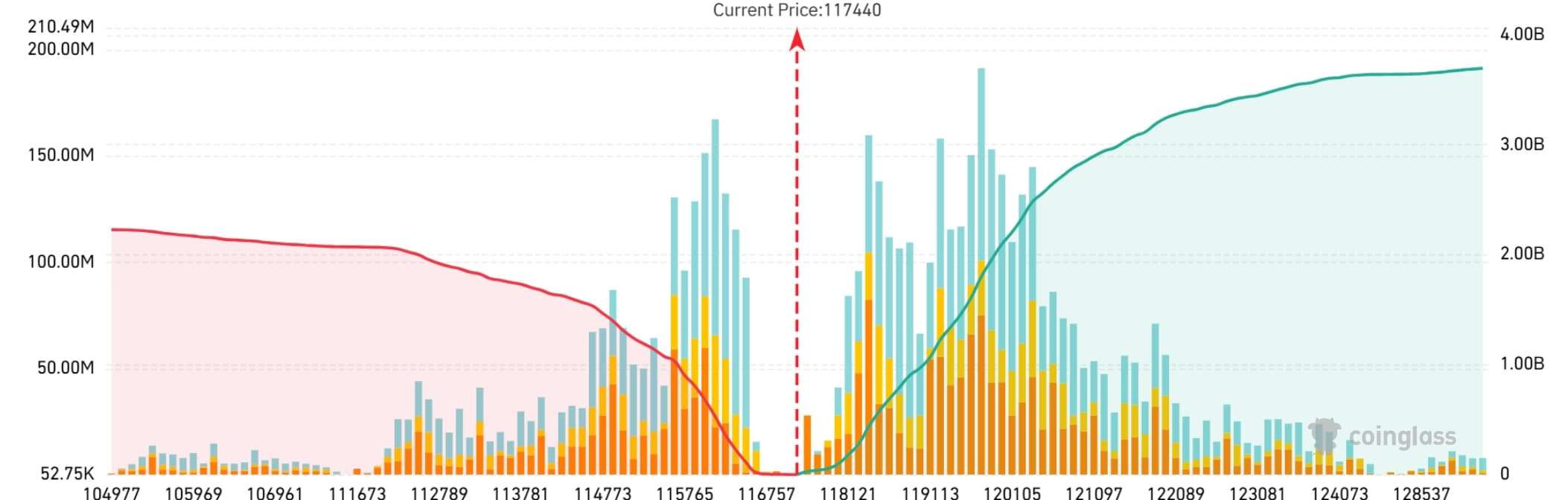

As of July 22, with BTC trading around $117440, Coinglass data shows that if BTC drops below $115,000, total long liquidations across major CEXs could reach $1.336 billion. Conversely, a breakout above $120,000 could trigger short liquidations of up to $2.457 billion. Traders are advised to manage leverage prudently to avoid mass liquidations during price swings.

4. Bitcoin Long/Short Ratio

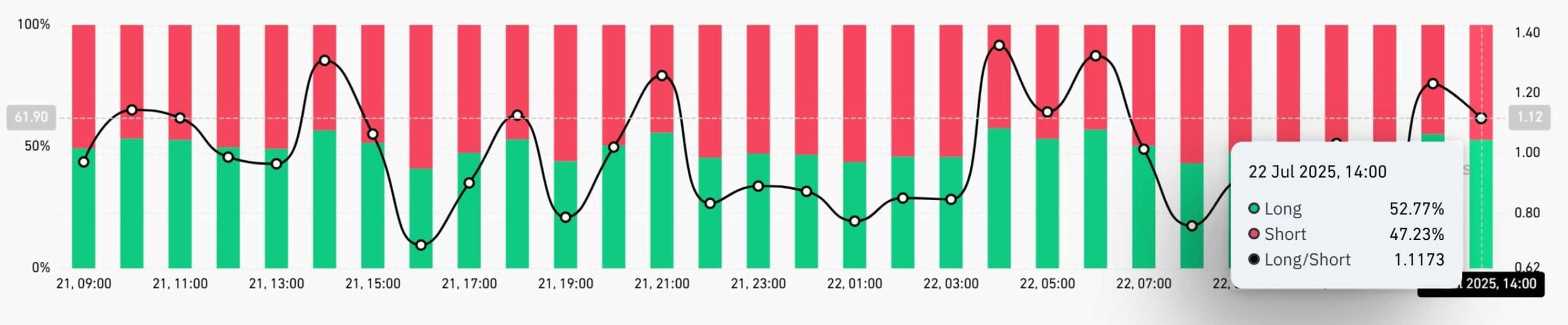

As of 14:00 HKT on July 22, the BTC long/short ratio stands at1.1173, with longs at 52.77% and shorts at 47.23% (Coinglass).

5. On-Chain Monitoring

- Sentora: Over 90% of ETH addresses are in profit — a new high since December 2024. On-chain resistance is weak, with first major resistance near $4,000. Around 2.39 million addresses remain underwater.

- @ai_9684xtpa: A wallet that bought 1,074 WBTC at ~$10,708 four years ago appears to have sold 700 WBTC at ~$117,697 over the past three days, netting $74.89 million. 800 WBTC remain in the wallet.

- Onchain Lens: Aguila Trades’ 15x leveraged ETH long position faced partial liquidation involving 7,160 ETH ($26.17M). After previously recovering $35M, losses have returned to $31M.

4.Blockchain Headlines

- BTC dominance falls below 60%, now at 58.5%

- ETH ETF saw record inflows last week, BTC ETF had its 7th largest weekly net inflow

- SPACEX moves $152M in BTC for the first time in 3 years

- Fundstrat co-founder: ETH could reach $10K–$15K by year-end

- Trump Media & Tech Group holds $2B in BTC reserves

- JPMorgan eyes crypto-backed lending in 2026

- ETH firm Ether Machine plans $1.6B IPO

- Grupo Murano to build $10B BTC vault in Mexico

- xTAO gets Canadian listing approval

- BitGo files for U.S. IPO

- GameSquare allowed to inject $150M into crypto treasury and added 8,351 ETH

- Volcon purchases 280.14 BTC, raises over $500M for crypto investments

- Mercurity Fintech signs $200M SOL deal with Solana Ventures

- Trader Eugene exits PUMP due to prolonged consolidation

- Coinbase launches perpetuals trading in the U.S.

- SEC Chair Gensler: “I never said ETH is a security”

5.Institutional Insights · Daily Picks

- QCP Capital: Altcoin rally may have started; approval of staking-based spot ETFs could boost institutional ETH accumulation.

- Fundstrat: BTC’s recognition as “digital gold” is rising — $1M per coin could be achieved in the coming years.

- Matrixport: ETH strength driven by Asian demand, institutional allocation, and DeFi activity.

- LD Capital: $4,000 is a key resistance level for ETH; Wall Street buy-in critical for new rally.

6.BTCC Exclusive Market Analysis

Today, Bitcoin is fluctuating around the $117,000 level, exhibiting a tug-of-war pattern. The price is repeatedly oscillating near the middle band of the Bollinger Bands, with both bullish and bearish forces in a temporary stalemate. A clear trend has yet to form, and overall market sentiment remains cautious.

From a technical indicator perspective, the moving average system is tightly packed, showing a lack of clear short-term guidance. The Bollinger Bands are flattening, with price movement contained within the channel and volatility decreasing. The MACD indicates a weakening of bearish momentum, but directional bias remains unclear. RSI is in a neutral-to-weak range, with no significant skew in buying or selling pressure.

For short-term traders, focus on breakout signals. If the price effectively breaks above $119,100 (near the upper Bollinger Band) with supportive indicators, a light long position may be considered, with a stop loss set below $116,865 (lower Bollinger Band). If the price falls below $116,865 and indicators strengthen the bearish signal, a light short position may be taken, with a stop loss above $119,100. During the consolidation phase, reduce trading frequency.

For medium-term traders, it is advisable to wait for a clear trend. Enter swing trades only after a breakout from the aforementioned range and confirmation from indicators. Meanwhile, pay close attention to the battle between support at $115,000 and resistance at $120,000, and strictly manage stop-loss settings.

It is worth noting that Bitcoin’s market dominance has recently fallen below 60%, indicating capital outflows. Institutions believe the altcoin rally may have started, and market sentiment is turning optimistic. Ethereum has performed notably, with record-high ETF inflows and over 90% of addresses in profit.

As institutional capital continues to flow in, the expansion of Ethereum’s applications in smart contracts and DeFi is expected to accelerate, which will likely support its price through growing demand. Investors may watch for breakout opportunities at key levels and shifts in market sentiment.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download