Recommended

BTCC Crypto Daily (7.16)|Crypto Week Setback in U.S. House Sends Mixed Signals to Bitcoin

1.Overview

- Procedural vote on key crypto bills stalls in U.S. House during “Crypto Week”

- Collins: Core inflation expected to remain around 3% through year-end

- Ethereum surpasses Johnson & Johnson in market cap, now ranks 30th globally

2.Macro & Policy Outlook

Key Events Today

- 2026 FOMC voter & Cleveland Fed President Loretta Mester to speak

- Fed Vice Chair Michael Barr to deliver remarks on financial regulation

- U.S. June Core PPI (YoY) to be released today (previous: 3%)

Global Macro Developments

1. U.S. House Crypto Bills Face Setback in Procedural Vote

As part of the “Crypto Week” agenda, the U.S. House held a procedural vote on three major bills — the GENIUS Act (stablecoin regulation), the Clarity Act (digital asset market structure), and the Anti-CBDC Surveillance Act. The vote failed to pass with 196 against and 223 in favor, largely due to internal GOP opposition. House Speaker Mike Johnson stated he would coordinate within the party to quickly relaunch the legislative process. Former President Trump later posted on social media that 11 out of 12 lawmakers supporting the GENIUS Act have pledged to vote in favor of the bill the following morning.

2. Fed’s Collins: Core Inflation Likely to Stay Around 3% Through Year-End

Boston Fed President Susan Collins warned that recent tariff policies could elevate price pressures in H2 2025. She expects core inflation to stay around 3% by year-end and emphasized the need to closely monitor inflation risks before determining future monetary policy direction.

3. UK Boosts Blockchain Finance Push, But BoE Governor Questions Stablecoins

The UK Treasury announced plans to advance the use of Distributed Ledger Technology (DLT) and tokenization in wholesale financial markets. A regulatory sandbox will be launched to test stablecoin and digital payment mechanisms. However, BoE Governor Andrew Bailey voiced skepticism over the real value-added of stablecoins and CBDCs, stressing the need for stronger oversight to ensure financial and compliance stability.

4. Trump: Small Nations May Face Universal Tariff Above 10%

U.S. President Donald Trump stated he is satisfied with the current tariff framework and will soon issue a tariff directive targeting smaller countries, potentially imposing a universal rate exceeding 10%.

5. U.S. Energy Secretary: AI Race is the “New Manhattan Project”

Energy Secretary Jennifer Granholm compared the global AI arms race to the Manhattan Project, stating that securing dominance in AI is as crucial as the development of the atomic bomb during WWII. She urged for urgent national action and resource investment to protect U.S. industrial and national security interests against fierce competition from countries like China.

Traditional Asset Correlation

- Nasdaq +0.18%, S&P 500 -0.40%, Dow -0.98%

- Spot gold +0.3% at $3,334.20/oz

- WTI crude (USOIL) +0.13% at $66.72/bbl

3.Crypto Market Snapshot

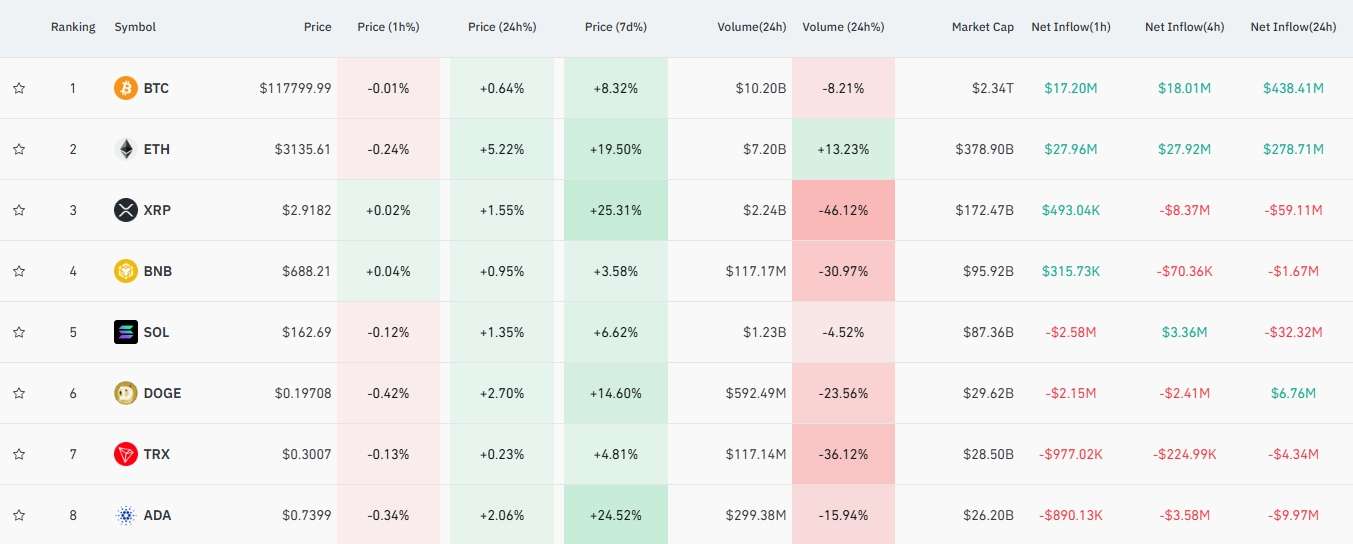

1. Spot Performance of Major Cryptocurrencies

(as of July 16, 14:00 HKT)

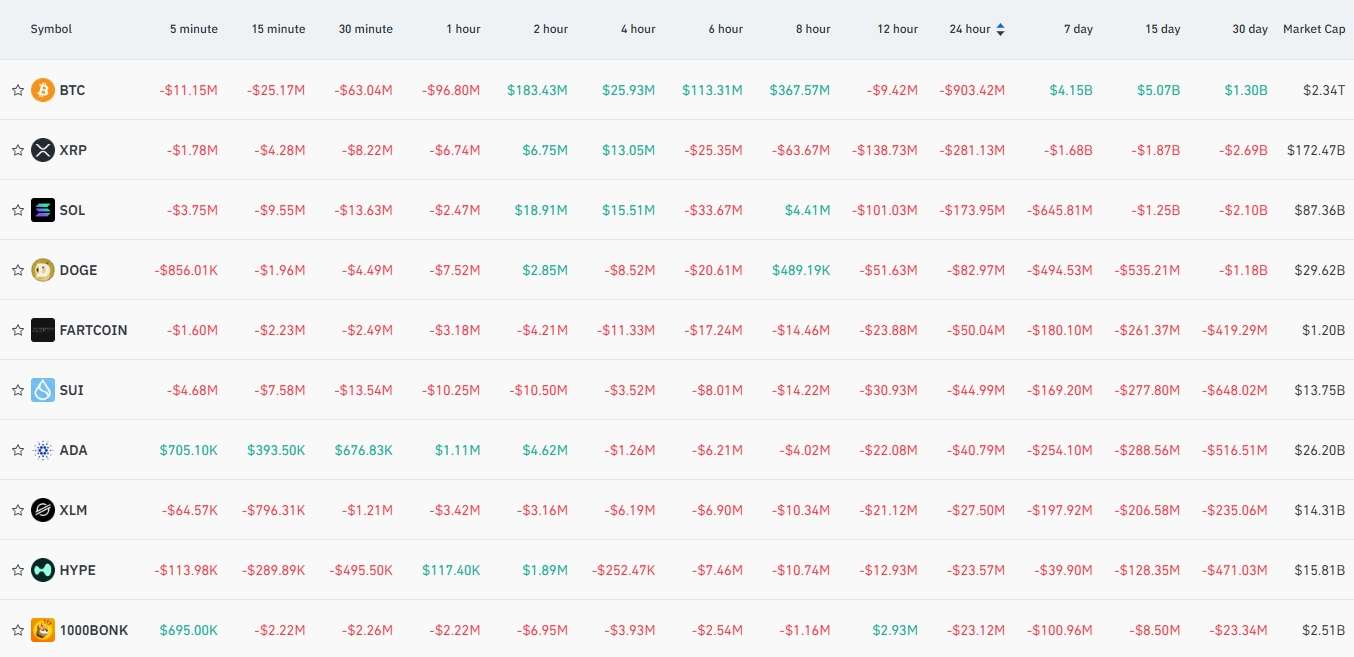

2.Futures Capital Flow Analysis

According to Coinglass data on July 16, BTC, XRP, SOL, DOGE, FARTCOIN, and SUI saw the highest net outflows from futures contracts over the past 24 hours — signaling potential trading opportunities.

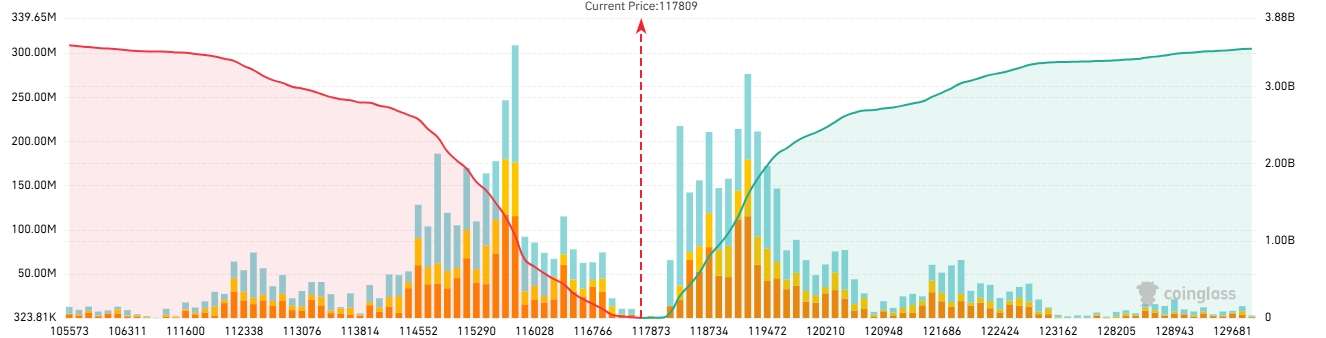

3. Bitcoin Liquidation Map

Per Coinglass data, at the current price of $117,809, if BTC falls below $115,000, total long liquidations across major CEXs could reach $2.158 billion. Conversely, a break above $120,000 could trigger $2.402 billion in short liquidations. Leverage users are advised to manage risk accordingly.

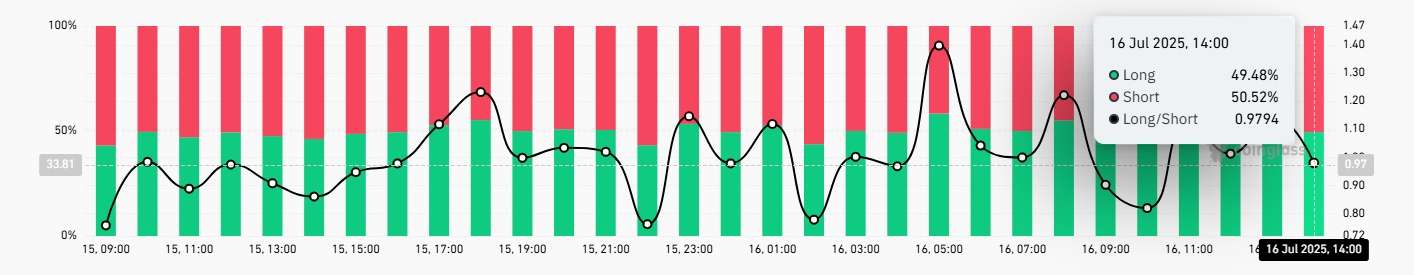

4. Bitcoin Long/Short Ratio

As of July 16 at 14:00 HKT, the BTC long/short ratio stands at 0.9794, with 49.48% long vs. 50.52% short positions (Coinglass).

5. On-Chain Monitoring

- Arkham data shows SharpLink Gaming acquired an additional 5,188 ETH (~$15.86M), bringing its total to 300,000 ETH since early June, with an average purchase price of $2,701. The firm’s unrealized profit now stands at ~$130M.

- A dormant BTC whale, inactive for 14 years, moved 10,000 BTC (~$1.16B). The address still holds 40,000 BTC. Receiving address: bc1qklv9x7qpmvkrjpxhjelcsz06y7zr0szwxr35j9

4.Blockchain Headlines

- Tornado Cash co-founder Roman Storm’s trial begins; accused of aiding North Korean hackers in laundering funds

- pump.fun initiates first round of PUMP token buybacks worth ~$18.34M

- New Bitcoin proposal seeks to freeze Satoshi-era BTC vulnerable to quantum attacks

- Donald Trump Jr.: Crypto industry will grow into a multi-trillion-dollar sector

- Cantor Fitzgerald nears $4B SPAC deal with Bitcoin pioneer Adam Back

- JPMorgan and Citigroup exploring stablecoin issuance; TradFi accelerates crypto payments push

- Nasdaq-listed Snail Games explores developing a USD stablecoin; shares surge over 20%

- ProShares launches 2x daily leveraged ETFs for XRP and Solana

- SharpLink Gaming raised ~$413M last week, entirely allocated to ETH accumulation

- Bitcoin spot ETFs recorded $404.85M in net inflows yesterday, up 36% day-over-day

- Arbitrum (ARB) to unlock 92.65M tokens on July 16, accounting for 1.87% of supply

- Ethereum overtakes Johnson & Johnson in market cap; now ranks 30th globally; 7 institutions now hold >100,000 ETH

- Solana ecosystem enters “super cycle” in 2025, now accounts for 46% of on-chain revenue

- Analysts: ETH’s strength may signal BTC dominance peak; capital rotating toward ETH and altcoins

- Arthur Hayes: “It’s Ethereum Season” — DeFi and NFT sectors to benefit

5.Institutional Insights · Daily Picks

- 21Shares: Due to structural supply-demand imbalance, Bitcoin is “increasingly unlikely” to see prolonged pullbacks. New ATHs during summer low-liquidity periods reflect strong fundamentals.

- Matrixport: BTC facing resistance at $122,000; heavy short positioning observed.

- Deutsche Bank: As mainstream adoption rises, BTC volatility may continue to decline due to growing institutional and retail adoption.

6.BTCC Exclusive Market Analysis

On July 16, Bitcoin experienced a technical pullback after briefly breaking above $120,000. The 4-hour chart shows a drop below both the MA5 and mid-Bollinger band, with a low at $117,164. A continued MACD bearish crossover and widening red histogram bars indicate growing bearish momentum and short-term technical weakness.

While Bollinger Bands remain wide, two consecutive solid bearish candles have breached key short-term support zones, suggesting buyer exhaustion. If BTC fails to reclaim the MA20 and mid-Bollinger band, further testing of support near $115,500 is expected.

Trading Strategy: Aggressive traders may observe the $115,000 level for potential entry if MACD bars shrink and price stabilizes. Strict stop-losses are recommended if this level breaks.

Macro Risks to Watch: The failure of initial procedural votes on crypto legislation in the U.S. House raises concerns about the pace of regulatory progress. Meanwhile, Fed’s Collins reaffirmed 3% inflation expectations, and Trump’s tariff threats weigh on risk assets. Volatility from such policy uncertainties warrants close attention.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

- Online Customer Support

- Report an Issue

- [email protected]

- [email protected]

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved