BTCC Crypto Daily (6.26) | Physical Redemption for Crypto ETFs Approaching, BTC Challenges $108K Level

1.Overview

- The U.S. Central Intelligence Agency claims that several key Iranian nuclear facilities have been destroyed.

- Physical redemption for cryptocurrency ETFs may be approaching.

- Weekly active users of Ethereum-based stablecoins have exceeded 750,000, setting a new record.

2.Macro & Policy Outlook

Key Events Today

- U.S. Initial Jobless Claims (in 10,000s); previous: 24.5

- U.S. Core PCE Price Index Annualized QoQ Final (Q1); previous: 3.40%

Global Macro Developments

1.CIA: Several Key Iranian Nuclear Facilities Destroyed

The U.S. Central Intelligence Agency released a statement confirming that Iran’s nuclear program has been severely damaged in recent U.S. strikes. Intelligence suggests several key Iranian nuclear facilities were destroyed and may take years to rebuild. The CIA continues to gather reliable information to inform policymakers and oversight bodies.

2.Fed Proposes Easing Enhanced Supplementary Leverage Ratio (ESLR) for Big Banks

The Federal Reserve has proposed revisions to the Enhanced Supplementary Leverage Ratio (ESLR), which applies to major U.S. banks such as JPMorgan and Goldman Sachs. The proposal would lower the capital requirement at the holding company level from 5% to a range of 3.5%–4.5%, and reduce the requirement for subsidiary banks from 6% to the same range. However, Fed Governors Barr and Kugler opposed the proposed changes.

3.Trump Says U.S.-Iran Talks May Happen Next Week

At the NATO summit in The Hague, President Trump made a major statement, saying that the U.S. will hold high-level talks with Iran next week to resolve long-standing nuclear disputes through diplomacy. He welcomed the recent ceasefire between Iran and Israel and described the targeted strikes on Iranian nuclear sites as “a victory for all.”

4.Powell: Tariffs May Be One-Time Shock, Fed Must Manage Persistent Inflation Risks

Fed Chair Jerome Powell told the Senate Finance Committee that the Trump administration’s proposed tariffs may lead to a one-off price increase, but the risk of sustained inflation is high enough to warrant caution when considering further rate cuts. He added that the effects of tariffs “could be large or small.”

5.SEC Commissioner: Physical Redemption for Crypto ETFs Likely Coming

SEC Republican Commissioner Hester Peirce said that physical redemption mechanisms for cryptocurrency ETFs may be on the way. During a Bitcoin Policy Institute panel discussion on Wednesday, Peirce said, “It’s under review. At some point, in-kind creation and redemption will certainly arrive. I can’t predict the outcome, but we’ve heard that many firms are interested in this.”

Traditional Asset Correlation

- U.S. equities closed mixed: S&P 500 down 0.02%, Nasdaq up 0.21%, Dow Jones down 0.25%

- Circle shares plunged 10.79%, marking over 20% decline over two days

- Spot gold fell 0.05% to $3,331.80/oz

- WTI crude (USOIL) rose 0.49% to $65.21/barrel

- U.S. Dollar Index (DXY) hit its lowest level since February 2022, now at 97.47, down 10.1% year-to-date

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(As of June 26, 2025, 12:00 HKT)

2.Futures Capital Flow Analysis

According to Coinglass on June 26, over the past 24 hours, net inflows were led by BTC, ETH, BANANAS31, BCH, MOVE, XRP, and INJ, suggesting potential trading opportunities.

3. Bitcoin Liquidation Map

As of June 26, Coinglass data shows that at the current price of $108,058, if BTC falls below $106,000, long liquidations across major CEXs could reach $1.241 billion. Conversely, if BTC breaks above $109,000, short liquidations could total $1.432 billion. Traders are advised to manage leverage carefully to avoid triggering large-scale liquidations due to market volatility.

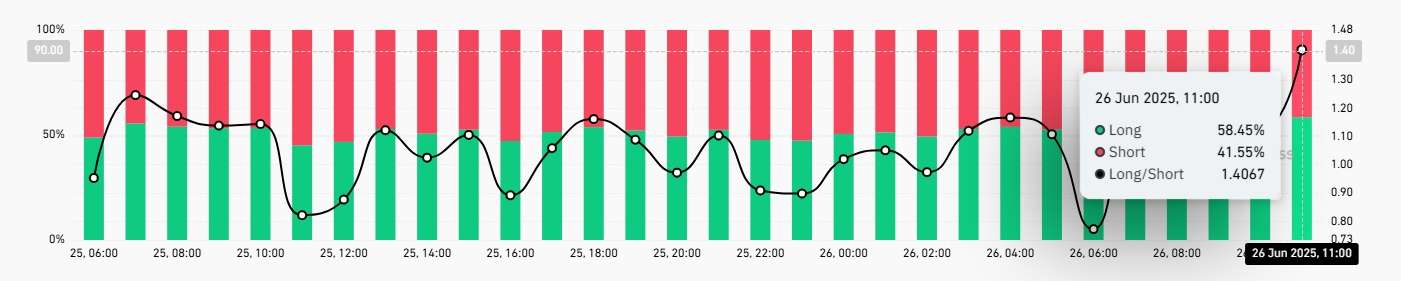

4. Bitcoin Long/Short Ratio

As of 11:00 HKT on June 26, Coinglass data shows the global BTC long/short ratio at 1.4067, with 58.45% long positions and 41.55% short.

5. On-Chain Monitoring

According to EmberCN on June 26, Nasdaq-listed SharpLink Gaming (ticker: SBET) purchased another 5,989 ETH via Galaxy Digital OTC, worth approximately $14.47 million. The company has now invested about $507 million to accumulate 194,000 ETH at an average cost of $2,611 per ETH, with an unrealized loss of around $36 million.

4.Blockchain Headlines

- WLFI to enable token transfers soon; related updates to follow

- GameStop raises an additional $450 million to increase its Bitcoin holdings

- U.S. housing regulator urges Fannie and Freddie to prepare for crypto as mortgage collateral

- Ethereum-based stablecoins surpass 750,000 weekly active users, setting a new high

- Whale deposits 274,788.6 SOL into Hyperliquid — platform’s largest-ever spot deposit

- Trump family partners with Hut 8 to build and operate its Bitcoin mining operations

- Ethena Labs reaches agreement with German regulators on USDe redemption plan

- Ledger CEO advocates lighter regulation to support crypto innovation

- SWIFT APAC President: Neutral stance on stablecoins

- Tether CEO: Focused on long-term, investing in AI and decentralized infrastructure

5.Institutional Insights · Daily Picks

- Standard Chartered: Expects stablecoin issuers to become the second-largest holders of U.S. Treasuries after the Fed within 3 years

- Matrixport: Liquidity indicators return to the spotlight as a key market focus

6.BTCC Exclusive Market Analysis

On June 26, Bitcoin retreated slightly after testing resistance at $108,000 and is now trading at $107,960, with a daily gain of around 0.5%. The 4-hour chart shows bullish momentum weakening, and the rally may stall if $106,000 fails to hold as support. A successful defense of this level could enable BTC to challenge $109,000 as the next major resistance.

From a technical perspective, the structure remains biased to the upside. If trading volume expands further, the rebound could continue. Traders should monitor the validity of the $106,000 support and whether BTC can break above the $109,000 level.

Risk Warning: The above content is for informational purposes only and does not constitute investment advice or a trading recommendation. Markets carry risks. Please exercise caution and manage your risks accordingly.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download