What is Crypto Fear and Greed Index? – The Beginner’s Guide

The market’s emotion is gauged by the Crypto Fear and Greed Index, which classifies cryptocurrency sentiment from extreme fear to extreme greed. This article delves deeper into the Index, examining its definition, operation, and potential applications for investors.

Because of the extreme volatility of the cryptocurrency market, investors frequently exhibit emotional responses. Investors can follow these feelings and learn about the mood of the market by using the Crypto Fear and Greed Index.

Trade on BTCC with 10 FREE USDT.

Signup today to redeem your bonus.

What is the Crypto Fear and Greed Index?

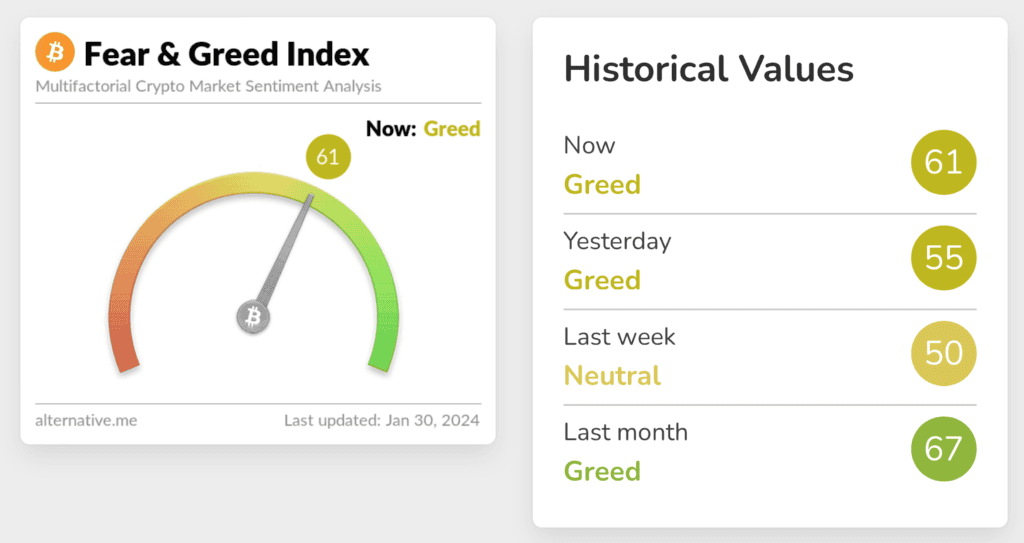

There are four sections in the index:

0–22: Extreme fear

23–49: Fear

50–74: Greed

75–100: Extreme greed

About the Index

Origins and Adaptation: CNNMoney originally created the index to examine stock market mood. In order to better represent the distinct dynamics and emotional tendencies of bitcoin traders and investors, Alternative.me adapted it for the cryptocurrency industry.

Components and Calculation: A variety of indicators, such as market volatility, momentum/volume, sentiment on social media, the dominance of Bitcoin in the market, and data from Google Trends, are combined to create the index. Each of these elements contributes 25% to the index score; volatility and market momentum/volume have distinct weights. In addition to Google Trends data, sentiment on social media and the dominance of Bitcoin are taken into account to provide a complete picture of market sentiment at any given time.

Market Sentiment Insights: The index’s primary goal is to gauge how much the cryptocurrency market is dominated by greed or fear. A high score implies a high level of greed, which raises the possibility that the market is overpriced or on the verge of a bubble. On the other hand, a low score denotes fear, which could be a symptom of undervaluation or a distressed market.

How to Use the Crypto Fear & Greed Index?

Investors can use the Crypto Fear and Greed Index to track industry trends and determine the best times to enter or exit the crypto market.

While it is not always the case, a fall in cryptocurrency prices occurs when investors are afraid. Investors can often take advantage of opportunities to get into the market and open a position during times of fear, which can indicate overselling.

Normally, investors utilize the Fear and Greed Index to find short-term possibilities. However, when fear is going strong, they may use the Index to think about longer-term positions.

Conversely, periods of excessive greed can cause prices to rise or indicate a trend in the market toward an upward trajectory. If market greed persists for an extended length of time, it may be a warning that the market is overbought; as a result, investors should exercise caution, liquidate holdings, or seize opportunities for short-term gains.

Warren Buffett thinks investors might benefit from going against the grain of the Fear and Greed Index. Keep in mind that you should not take the Index at face value. To avoid being emotionally manipulated when investing in crypto, many seasoned investors advise against trying to timing the market and instead recommend dollar-cost averaging or technical analysis as investment tactics.

Risk Control

Investors can really utilize the Fear and Greed Index to help with risk management when they understand it, even though it shows how the cryptocurrency market can behave in surprising and chaotic ways.

Investors can diversify, or counterbalance, their own portfolio by using the Index as a signal. Extreme greed can make investors more cautious, while prolonged optimism can warn investors to get ready for a possible impending market

correction.

The Index also acts as a helpful reminder to investors to stay true to their own investment ideas and not get carried away by the feelings that come with either a positive or negative market.

Conclusion

An intriguing window into the psychological forces influencing the cryptocurrency market is provided by the Crypto Fear & Greed Index. It provides investors with a quantitative measure of greed and fear, which helps them comprehend the dynamics of market emotion. Like any analytical tool, investors must utilize the index as part of a larger strategy and take into account additional fundamental and technical analysis in order to make well-informed selections.

FAQs

In the Crypto Fear & Greed Index, what does a “fear” score mean?

A “fear” score indicates a pessimistic outlook for the market and possible asset undervaluation.

What is the formula for the Crypto Fear & Greed Index?

The indicator is computed by combining data from Google Trends, social media sentiment, market volatility, volume, and momentum, and the dominance of Bitcoin in the market.

Can market crashes be predicted by the Crypto Fear & Greed Index?

The index is a tool to measure market mood rather than a perfect prediction of market crashes, even though it might reveal severe fear or greed in the market.

Does the Crypto Fear & Greed Index exclusively apply to cryptocurrency?

The index initially mainly used data pertaining to Bitcoin, but it intends to eventually incorporate data about other significant cryptocurrencies.

How frequently is the Index of Crypto Fear & Greed updated?

The index provides a current perspective on market sentiment and is updated every day.

Scan to download

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*