How SingularityNET (AGIX) Kept Pace During The Rise of ChatGPT

- During the past week, AGIX has seen the highest social volume of any asset.

- Despite being overbought, the token direction may keep going up.

As a result of ChatGPT‘s widespread use, the value of the blockchain-based AI token SingularityNET (AGIX) has skyrocketed by 680% in the past 30 days. It’s not unprecedented for tokens associated with new industries to have a price increase as a result of the news.

It’s interesting to note that other AI-related tokens, including Fetch.ai [FET] and Ocean Protocol [OCEAN], have followed a similar pattern.

AI tokens are here to be recognized

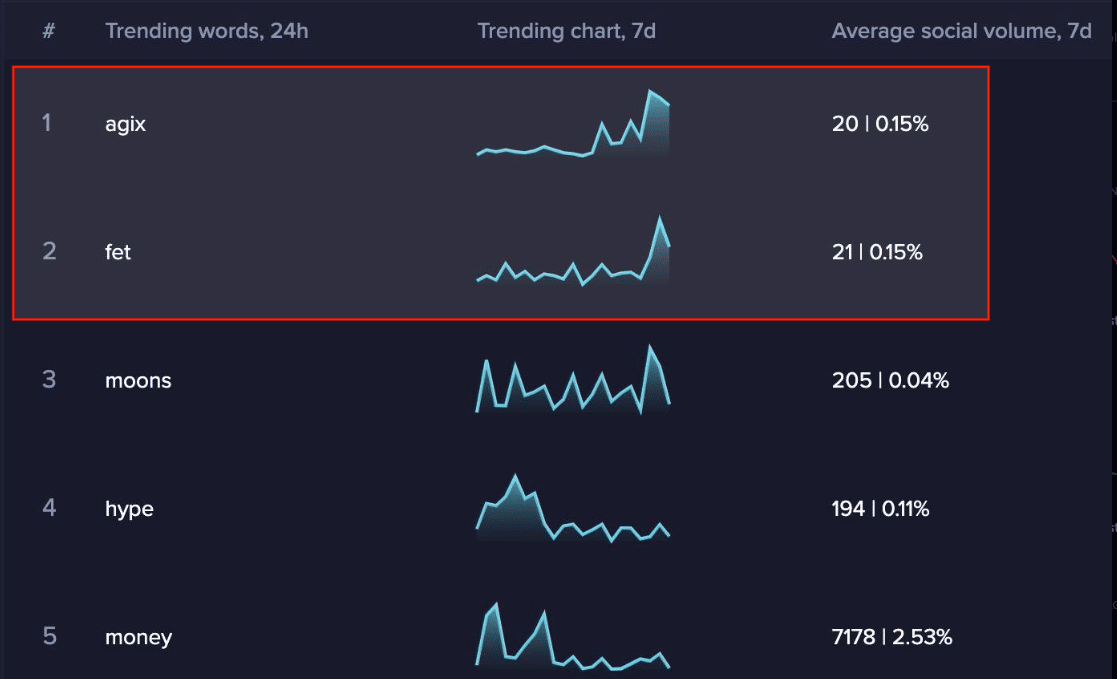

By researching popular trends in user behavior, Santiment predicted that AGIX might not disappear from the spotlight very soon. The on-chain analytical platform shows that, relative to the volume of conversation about it on social media, AGIX has been trending at the top for the past day.

Santiment also said that a number of investors have added AGIX to their “watch lists,” indicating that the token has garnered some attention. The on-chain analysis, however, cautioned buyers to keep their eyes open, as there could be more favorable times to buy the token in the future.

It’s worth noting that SingularityNET provides a marketplace where users can develop, distribute, and sell AI-based services to customers all over the world. AGIX token holders will have voting and staking rights in the network.

Approximately $345 million in tokens were held by the top 20 token holders, per Lookonchain. This was equivalent to 55.4% of the available AGIX.

5.

And the public token sale price is $0.072.https://t.co/tAklxrXA0w

— Lookonchain (@lookonchain) February 7, 2023

Consequently, the buying and selling pressure on the AGIX is largely determined by whales. Some “whales,” or extremely wealthy investors, have not sold any of their stock. Does this, however, suggest that AGIX is poised for rapid growth?

FET: Are you still going for the moon?

The Bollinger Bands (BB) at the time of writing indicated that AGIX’s volatility was exceptionally high. Since the token’s price had reached the upper volatility zone, however, there was a possibility that it had been overbought.

Santiment’s assessment that investors should exercise caution in anticipating more gains is consistent with the current conditions. As a result, it’s possible that prices will begin to fall.

However, the technical indicators suggested that AGIX’s direction was heading in a different route. At the time of publication, the Directional Movement Index (DMI) indicated an upward trend rather than a reversal.

This chart shows that the DMI was 52.18 (green) and that this is a positive indicator. The strength of a trend was also shown by the ADX, or Average Directional Index.

The ADX (yellow) was 62.59 at the time of writing, indicating exceptional strength for a further AGIX uptrend. Having a negative DMI (red) of 3.71 indicated that a possible drop in value was unlikely.

The AI token excitement may not go down anytime soon, what with Microsoft’s investment in ChatGPT and the proliferation of additional AI tools.

Related Posts:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

Here is a Cryptocurrency Scammer List of 2022

Free Crypto No Deposit Bonus For Signing Up 2022

Terra Classic Price Prediction- Will LUNC Hit $1?

Binance Learn and Earn Quiz Answers – LDO, WOO, QI Quiz Answers

Terra Classic Burn: The Reason Behind LUNC and LUNA Recent Spike