BTCC Market Watch: Accelerating Global Compliance Drives Stablecoin Boom

Recently, favorable signals regarding stablecoin-related policies and industry developments have emerged intensively. From the full implementation of the EU’s MiCA regulatory framework and the completion of Hong Kong’s “Stablecoin Regulation” legislation, to the official approval of the U.S. “GENIUS Act,” the compliant status of stablecoins in global markets is rapidly improving.

Meanwhile, traditional giants such as Walmart, Amazon, and JPMorgan are reportedly entering the stablecoin space. New stablecoin projects are also emerging, attracting significant market attention.

Additionally, Circle—the issuer of USDC—successfully listed on the New York Stock Exchange (NYSE) recently, with its stock price continuing to rise. This marks the official entry of stablecoins into the mainstream financial system.

As the “digital cash” of the crypto market, stablecoins are increasingly seen as a vital bridge connecting traditional finance with on-chain ecosystems due to their low volatility and high liquidity. With favorable policies and institutional participation accelerating, stablecoins are entering a new phase of compliance and scale.

U.S. and Hong Kong Bring Policy Tailwinds – Stablecoins March Toward Regulatory Mainstream

On the policy front, the United States and Hong Kong are pushing forward stablecoin regulatory frameworks, injecting clear compliance signals into the market and providing institutional and capital participation with regulatory assurance.

The U.S. “GENIUS Act” was officially passed on June 18, 2025, marking a key milestone in stablecoin regulatory legislation. Even U.S. President Donald Trump praised the legislation in a post, stating that it would help the U.S. become the “undisputed leader in the digital asset sector,” and urged the House to accelerate the legislative process, “no delays, no extra conditions.”

Key provisions of the Act include:

• Allowing issuers approved by national or equivalent regulatory authorities to legally issue stablecoins, provided they maintain 1:1 high-liquidity reserves;

• Defining stablecoins as “digital cash” rather than securities;

• Prohibiting unauthorized institutions from issuing payment-related stablecoins;

• Mandating federal oversight for stablecoins with a market capitalization exceeding $10 billion, while smaller ones may choose state-level oversight;

• Prohibiting interest-bearing stablecoins and other products with potential systemic risks;

• Strengthening anti-money laundering, information disclosure, and technical compliance requirements.

The establishment of this regulatory framework marks the transition of stablecoins from “marginal assets” to regulated financial instruments, laying the institutional foundation for deeper integration into the U.S. financial system. However, for major stablecoin players like Tether (USDT), it may also require significant adjustments in reserve transparency and registration credentials to meet future U.S. regulatory standards.

In Hong Kong, the “Stablecoin Regulation” legislation has completed its legislative process and will officially take effect on August 1, 2025. According to the ordinance, any institution seeking to issue stablecoins in Hong Kong must obtain a license from the Hong Kong Monetary Authority (HKMA) and comply with its regulatory standards.

Compared to the U.S., Hong Kong provides greater flexibility in fiat currency pegs. The ordinance allows stablecoins to be pegged to major fiat currencies beyond the U.S. dollar, such as Hong Kong dollar–denominated stablecoins, offering policy room for serving different regional markets and expanding cross-border payment use cases.

Financial Secretary Paul Chan previously wrote that with the ordinance’s imminent implementation, the HKMA will expedite license processing for qualified institutions and promote the early rollout of compliant stablecoin projects. He emphasized that Hong Kong would continue to leverage its “one country, two systems” institutional advantage to gain more leadership in the global stablecoin race.

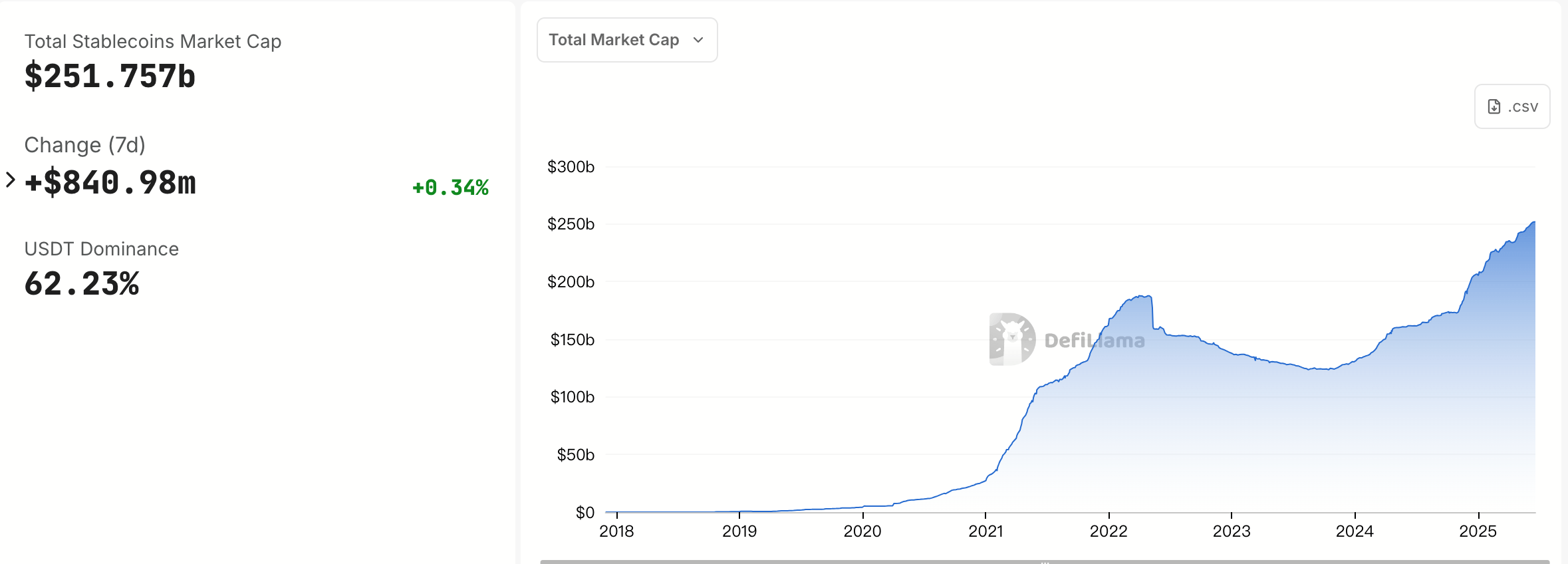

Global Stablecoin Market Surges 60-Fold in 6 Years

According to DefiLlama data, as of June 23, 2025, the total global market capitalization of stablecoins has reached $251.7 billion—an increase of 60 times compared to $4.17 billion at the end of 2019. This makes stablecoins one of the fastest-growing sectors in the cryptocurrency industry.

Currently, Tether (USDT) remains firmly in the lead, with a market dominance of 62.23%. It plays a critical role in trading pair matching, capital hedging, and on-chain applications. Closely following is USDC, issued by Circle, with a current market capitalization of approximately $60.8 billion—ranking second globally. USDC is widely used in global payments and financial services.

Stablecoin Use Cases Continue to Expand

Stablecoins are a type of cryptocurrency whose value is pegged to fiat currencies (primarily the U.S. dollar). They combine the programmability of crypto assets with the price stability of traditional money. Supported by 1:1 reserve backing, stablecoins function as “digital cash” in scenarios such as trading, payments, and settlements—minimizing volatility risk and enhancing liquidity efficiency.

Beyond serving as high-liquidity base assets on centralized exchanges, stablecoins have also become a critical component of the decentralized finance (DeFi) ecosystem. Leading stablecoins like USDT and USDC are widely used in on-chain lending, collateral staking, liquidity mining, and cross-chain bridges, helping stabilize DeFi systems.

At the same time, stablecoins are gaining importance in cross-border payments and settlement systems. Thanks to their programmability and on-chain transparency, they allow for 24/7 real-time transfers, bypassing traditional banks’ complex processes and drastically reducing both time and cost—making them ideal for enterprise-level global settlements and frequent personal remittances. This is why more tech giants and traditional financial institutions are actively exploring the issuance of their own stablecoins.

With regulatory frameworks taking shape, sovereign governments and financial institutions are showing growing recognition of compliant stablecoins. Combined with technological maturity and expanding institutional demand, the stablecoin market is entering a new phase of structural growth. In the future, stablecoins are expected not only to continue playing a central role in the crypto market but also to become a vital supplement to the global payments system.

Stablecoins Are Rapidly Entering the Compliance Era — How to Participate?

As stablecoins gain traction and value recognition in the market, they are now entering an unprecedented window of opportunity.

As the pioneer of the stablecoin sector, Tether (USDT) has, since its launch in 2014, introduced a low-volatility digital trading medium supported by fiat reserves and a 1:1 USD peg. Today, USDT is not only the world’s largest and most widely circulated stablecoin, but also a standard bearer of the “digital dollar” across the crypto ecosystem.

Currently, USDT is broadly used in key crypto scenarios such as asset trading, capital hedging, arbitrage settlements, and cross-border payments. Its high liquidity and global acceptance make it the top stablecoin choice for both new and seasoned users.

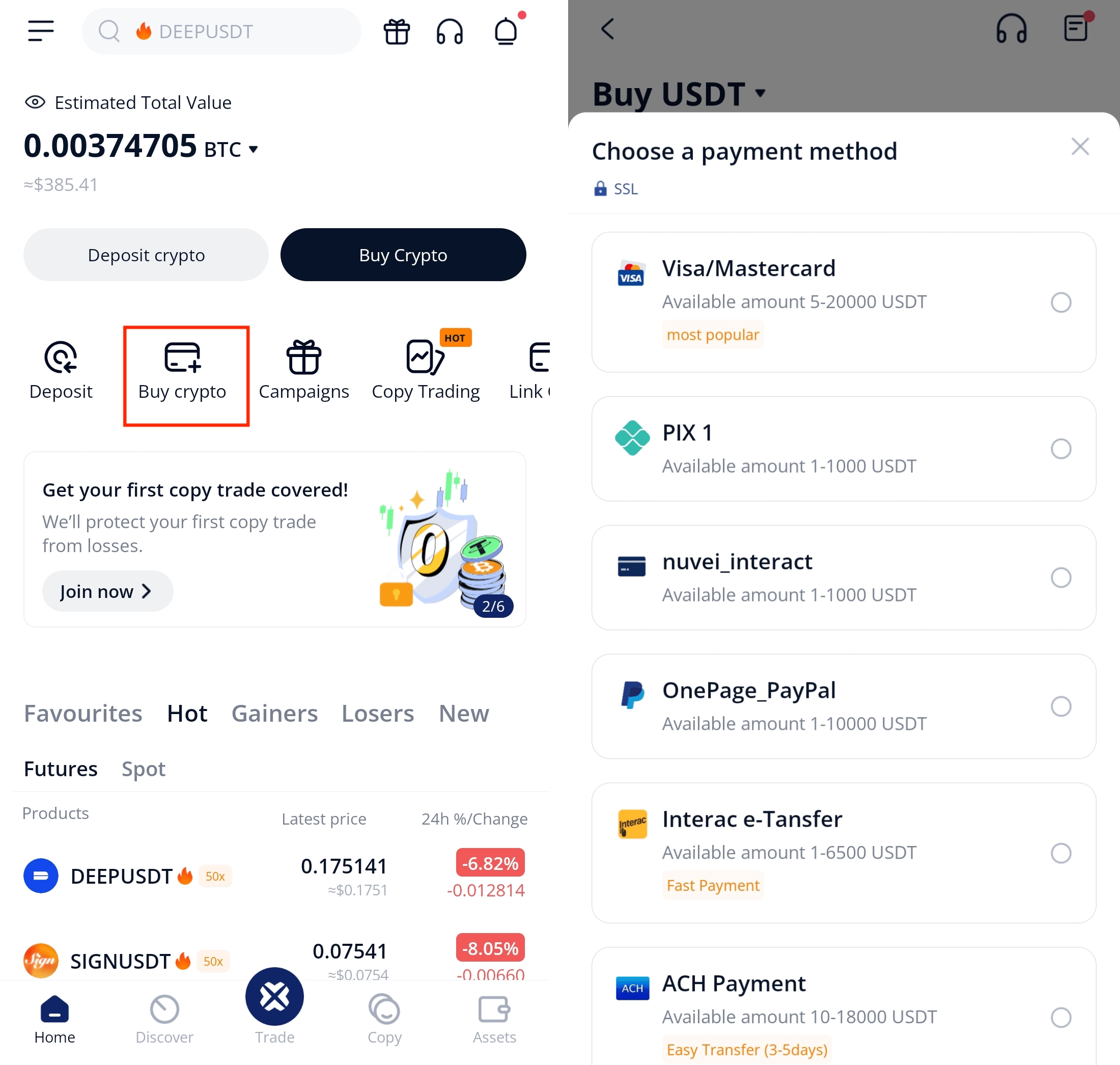

For newcomers entering crypto trading, selecting a compliant, secure, and user-friendly platform is critical. Take BTCC Exchange as an example—it supports fiat deposits in multiple countries and regions, including credit cards, bank transfers, and third-party payments, covering mainstream user needs. At the same time, BTCC enforces strict KYC (Know Your Customer) identity verification procedures. Once users complete registration and identity verification, they can easily purchase USDT, seamlessly converting fiat into crypto assets and starting their crypto trading journey with ease.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Scan to download

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*