Is Making Too Much Profit a Crime? The Real Logic Behind India’s Heavy Penalty on Wall Street Giant

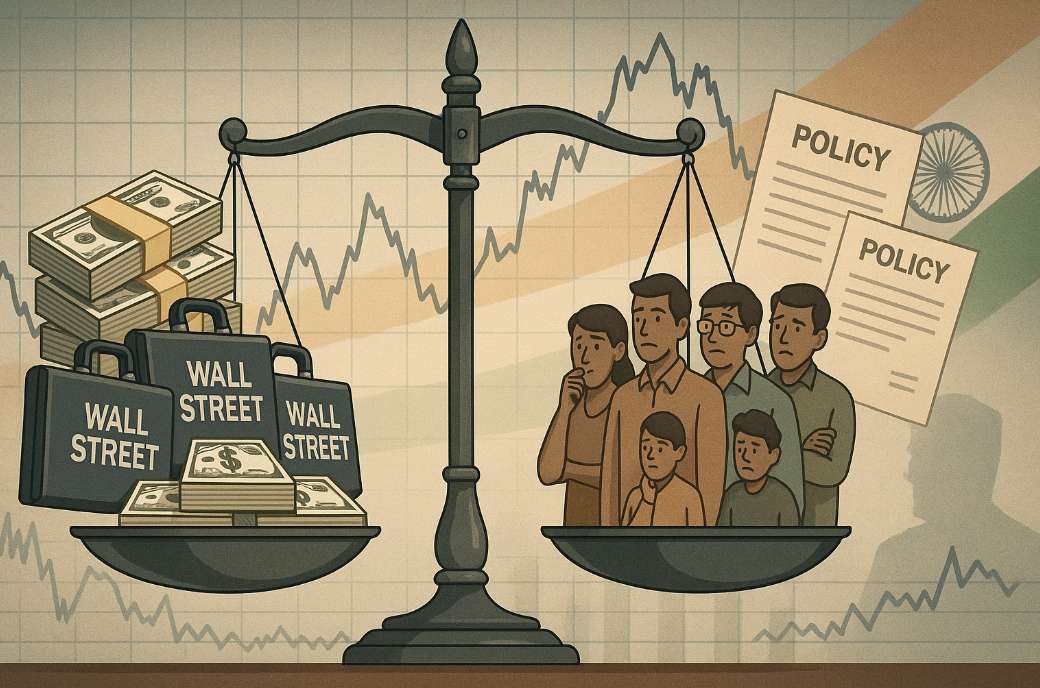

A surprising development recently rocked India’s financial markets: the Securities and Exchange Board of India (SEBI) slapped Wall Street quantitative investment giant Jane Street with a massive fine of ₹484 billion (approximately $580 million USD). The reason? The firm allegedly used high-frequency trading strategies to earn “excessive profits,” which regulators claimed undermined market fairness.

At first glance, this may appear to be a justified regulatory crackdown on capital overreach. But what lies beneath this dramatic move? And what does it reveal about the deeper regulatory anxieties and institutional dilemmas faced by emerging markets?

1. An Odd Phenomenon: Too Much Profit Gets You Penalized?

In early July, SEBI accused Jane Street of deploying quantitative strategies that generated “abnormally high returns” and caused “market disruption.” The firm was ordered to exit the Indian market and pay a staggering ₹484 billion fine.

According to official data and Indian media reports, Jane Street allegedly made around ₹365 billion in profits from India’s stock markets over the past two years using high-frequency trading (HFT) and arbitrage strategies. Though such profits are routine in institutional trading, Indian regulators and media viewed them as excessive.

Over the same period, over 90% of Indian retail investors reportedly suffered losses. Regulators attributed this to what they called “predatory arbitrage” by foreign HFT firms—Jane Street being the primary target.

Market reactions were mixed. Some backed the regulators, while others questioned the logic of “punishing success.” As one trader quipped: “The crime of foreign capital is that it made too much money and upset losing retail investors.”

This controversy is not merely a regulatory dispute—it reflects deeper structural and policy contradictions within emerging markets.

2. A Classic Dilemma: Regulatory Anxiety in Emerging Markets

India’s move highlights a long-standing dilemma faced by many emerging economies:

On one hand, these markets actively court foreign capital, especially from technologically advanced, deep-pocketed institutions. They hope this will bring efficiency, valuation uplift, and global visibility to their markets.

On the other hand, when foreign investors actually generate outsized profits—especially during periods of volatility and domestic losses—regulatory sentiment shifts. Calls to “protect local investors” gain traction, and foreign capital is often portrayed as a threat rather than an asset.

India’s penalty on Jane Street illustrates this tension perfectly: the government wants foreign money and technology, but fears the market disruption that may come with it. In this climate, “earning too much” can become an original sin.

3. India’s Unique Approach: “Foreign Capital, Know Your Place”

This is not the first time Indian regulators have cracked down on global giants. Over the past decade, numerous international financial and tech firms have encountered regulatory roadblocks in India:

- In 2016, Morgan Stanley’s quantitative division was investigated for allegedly disrupting markets with its trading models. The firm eventually scaled down its operations.

- In 2019, Facebook’s Libra project clashed with India’s regulators over digital payments, leading to its withdrawal from the market.

- Tech behemoths like Amazon and Google have also faced stiff regulatory headwinds in India.

The underlying reasons are complex yet consistent:

India’s capital markets have grown rapidly, with over 120 million new retail investor accounts opened in the past three years. However, investor education remains poor, and retail losses are common. This puts immense pressure on regulators to take visible action during turbulent times.

From a regulatory standpoint, penalizing “overly successful” foreign firms can help ease public anger and project authority, even if the legal or economic rationale is tenuous.

4. Global Quant Titans Face Local Backlash

This episode serves as a warning for global quantitative firms:

What works in mature markets—high-frequency, algorithm-driven strategies—often faces suspicion in emerging economies. These markets typically have less-developed financial ecosystems and limited understanding of complex trading methodologies.

India is not alone. In recent years, countries like China, Indonesia, and Brazil have also introduced restrictions or barriers to quantitative and high-frequency trading. Foreign firms in these markets face high compliance costs and the constant risk of being legislated out.

In short, emerging markets apply much stricter scrutiny to quant strategies than developed ones. For foreign quant firms, “quietly profitable” may be the only sustainable strategy.

5. Why Emerging Markets Punish Profit: The Underlying Logic

India’s massive fine against Jane Street may seem extreme, but it exposes three core regulatory challenges common across emerging markets:

- Regulatory Volatility: These markets often begin with open arms toward foreign investment but quickly reverse course once local backlash builds. This policy inconsistency deters long-term capital.

- Retail Vulnerability: A surge in retail participation, without adequate financial literacy, means regulators face mounting pressure when markets dip. Harsh punitive actions become a convenient, populist response.

- Sovereignty over Price Discovery: Emerging market regulators are particularly sensitive to the idea of foreign firms “controlling” local market pricing. Even when there’s no legal wrongdoing, foreign investors making large profits during retail losses are an easy scapegoat.

Ultimately, this is not just about Jane Street or quant trading—it reflects a structural tension between global capital flows and localized political-economic realities. Until regulatory institutions in emerging markets mature, foreign investors will need to tread carefully and manage both financial and political risks.

Disclaimer: This article is based on publicly available sources and SEBI announcements. It does not constitute investment advice. Investing carries risk. Please conduct thorough due diligence before entering any financial markets.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Scan to download

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*