SoFi vs. Robinhood: Which Fintech Stock is a Better Buy Now?

Digital bank SoFi Technologies and online brokerage Robinhood Markets are two standout disruptors in the evolving financial services landscape. Both companies have leveraged innovative, tech-driven platforms to challenge traditional banking and investing models—earning the attention of investors seeking growth in the fintech sector.

Their momentum has been reflected in their stock performance: SoFi shares have surged 95% over the past year, while Robinhood stock has soared an impressive 246%. These gains have raised an important question for many investors: Can these rallies continue, or is now the time to lock in profits?

In this article, we’ll take a closer look at the fundamentals, growth drivers, and future prospects of both companies to determine which fintech stock may be the better addition to your portfolio right now.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Market Performance of SoFi Technologies

| Stock | SoFi Technologies, Inc. |

| Last Price | $ 26.54 |

| Rank | 452 |

| Market Cap | $ 31.8B |

| 24H Trading Volume | $ 0 |

| Exchange | NASDAQ |

| Open | $ 26.10 |

| Previous Close | $ 26.10 |

| High | $ 26.92 |

| Low | $ 26.01 |

| ATH | $ 30.27 / 2025-09-22 |

| Website | |

| CEO | |

| Total Employees | |

| Industry | |

| Address | |

| City | |

| State | |

| Country | |

| Zip | |

| Phone | |

| Update Time | 2025-10-19 23:59:01 |

SoFi Technologies has successfully transformed itself from a student loan specialist into a comprehensive digital banking platform. Its “one-stop-shop” model—offering services such as banking, credit cards, personal and student loans, and investment options—is clearly resonating with consumers. The platform now boasts 10.9 million members, nearly doubling its user base over the past two years.

In the first quarter of 2025—what CEO Anthony Noto called a “tremendous start to the year”—SoFi’s adjusted net revenue jumped 33% year over year, while adjusted earnings per share (EPS) soared 200% to $0.06. This growth underscores the company’s strategic shift from being primarily a lender to increasingly monetizing fee-based services. Members are engaging more with SoFi’s full suite of financial products, from high-yield savings accounts to credit cards and investment tools.

With this growing adoption, SoFi is now positioned for sustainable profitability and strong cash flow generation. Management is projecting full-year adjusted EPS between $0.27 and $0.28, almost double the $0.15 EPS reported in 2024. This guidance highlights one of SoFi’s key advantages over Robinhood Markets, which remains more dependent on trading volumes and market volatility—factors that can lead to earnings instability.

For investors confident in SoFi’s ability to continue executing its expansion strategy and capturing market share from traditional financial institutions, the stock presents a compelling long-term investment opportunity.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Market Performance of Robinhood Markets

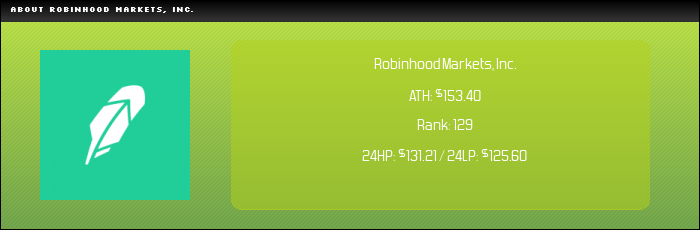

| Stock | Robinhood Markets, Inc. |

| Last Price | $ 129.91 |

| Rank | 129 |

| Market Cap | $ 115.4B |

| 24H Trading Volume | $ 0 |

| Exchange | NASDAQ |

| Open | $ 128.34 |

| Previous Close | $ 128.34 |

| High | $ 131.21 |

| Low | $ 125.60 |

| ATH | $ 153.40 / 2025-10-10 |

| Website | |

| CEO | |

| Total Employees | |

| Industry | |

| Address | |

| City | |

| State | |

| Country | |

| Zip | |

| Phone | |

| Update Time | 2025-10-19 00:11:01 |

As impressive as SoFi’s operational and financial performance has been, Robinhood’s recent momentum has been even more striking. In the first quarter, net revenue surged 50% year over year, while earnings per share (EPS) more than doubled, climbing from $0.17 to $0.37. The company that revolutionized retail investing with its pioneering commission-free trading model is now capitalizing on its expansive base of 25.8 million funded accounts, where users are not only trading more frequently but also allocating a larger share of their total assets to the platform.

A significant driver of this growth is the ongoing cryptocurrency market boom. Crypto transactions now account for 43% of Robinhood’s total trading volume and contribute 27% of overall revenue. However, Robinhood is no longer just a trading app. The company is broadening its ecosystem with professional-grade trading tools, banking services, wealth management features, and its premium Robinhood Gold subscription, all of which are increasing customer wallet share and deepening user engagement.

Wall Street has cheered Robinhood’s traction, sending the stock up 94% year-to-date to a high that surpassed the pandemic-era peak it set in 2021.

Looking ahead, Robinhood is setting its sights on international growth. It plans to enter the Asia-Pacific market and strengthen its footprint in the digital asset sector following its acquisition of cryptocurrency exchange Bitstamp. This global expansion, paired with strategic diversification, positions Robinhood to continue evolving from a trading platform into a comprehensive financial services provider.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Final Verdict: Which Fintech Stock Is a Better Buy?

While Robinhood’s innovative platform has undeniably transformed retail investing, its business model remains more vulnerable to market volatility. The company’s revenue is still largely dependent on trading activity—thriving during bull markets when retail participation is high, but facing headwinds during quieter periods when investor engagement wanes. This makes its earnings more cyclical and unpredictable.

In contrast, SoFi is better positioned to benefit from a resilient macroeconomic environment. Continued demand for lending and financial services could drive strong revenue and earnings growth in the coming quarters, providing solid catalysts for further upside in the stock. Meanwhile, Robinhood faces the challenge of meeting high investor expectations following its dramatic share price surge. Any sign of slowing momentum or softer performance could trigger renewed stock price volatility.

For investors comparing these two fintech leaders, the choice largely hinges on stability versus volatility. While both stocks have posted impressive gains, SoFi offers a clearer path to sustainable profitability, backed by its diversified business model, strong user growth, and expanding suite of financial services.

Given these factors, SoFi Technologies (SOFI) emerges as the more compelling long-term investment for those seeking predictable growth and reduced earnings risk. Its robust earnings guidance and expanding product ecosystem make it a more resilient bet in an uncertain financial landscape—especially when compared to the transaction-sensitive nature of Robinhood’s revenue streams.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Why Choose BTCC?

Fully licensed and regulated in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

You May Like:

Robinhood Markets (HOOD) Stock Analysis & Forecast: Is HOOD Stock a Buy Now?

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

Top Free Bitcoin Mining Apps & Cloud Mining Platforms For Effortless BTC Earnings In 2025

Best Binance Alternatives In 2025

Best Crypto Futures Trading Platforms In June 2025

Best Crypto Trading Bots In Canada For June 2025

Best Non KYC Crypto Exchanges In June 2025

Best AI Agent Coins To Buy In 2025

WUMP Airdrop Guide: Everything You Need To Know

Web3 AI ($WAI) Review & Analysis: Next Big Gem To Explode?

Solaxy ($SOLX) Coin Review & Analysis: Next Big Gem?

Pepe Hunt ($hPEPE) Meme Coin Review & Analysis: Next 100x Gem?

FloppyPepe ($FPPE) Meme Coin Review & Analysis: Next 100x Meme Coin?

Bitcoin Pepe ($BPEP) Meme Coin Review & Analysis: Next 100x Token?

Wall Street Pepe ($WEPE) Meme Coin Review & Analysis: Next 100x Frog-Themed Meme Coin?

MIND of Pepe ($MIND) Meme Coin Review & Analysis: Next 100x Frog-Themed Token In 2025?

Pepeto Vs. Wall Street Pepe Vs. MIND of Pepe: Which One Is The Best Frog-Themed Meme Coin In 2025?

Bybit Hack: Everything You Need To Know About It

What Is XRPTurbo ($XRT): Everything You Need To Know About It

Coldware (COLD) Coin Review & Analysis: Next 100x Coin?

8 Types of Crypto Scams to Avoid in 2025

Rollblock ($RBLK) Coin Review & Analysis: Next Big Token To Explode?

Scan to download

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*