Rivian Automotive (RIVN) Stock Forecast & Prediction 2024, 2025, 2030

Since its November 2021 IPO (NASDAQ: RIVN), Rivian stock price has been in a downward spiral. While many analysts are calling it a classic bubble burst, some still believe in the long-term vision of the company. In this article, we’ll discuss the Rivian stock price prediction for 2024, 2025 and 2030, and determine if Rivian stock is a good buy at the current price.

Rivian stock has immensely underperformed in the ongoing stock rally. The stock started 2024 with a continued downtrend as it fell 38% below its yearly opening. Since then, the shares of the EV maker have rebounded strongly and is now trading slightly below their yearly peak.

About Rivian Automotive Inc

Rivian is an American electric vehicle and adventure travel firm that designs and produces electric cars. It was Founded in 2009 and is located in Plymouth, Michigan. In the long run, Rivian intends to provide mobile adventure gear and expand to a global market.

In September 2021, Rivian started delivering its R1T pickup truck. This was a massive moment for the company and an edge over its competitors like Ford and Tesla. It was the first ever completely electric pickup truck. Shortly after this feat, Rivian had a successful IPO in November 2021 at a $66.5 billion valuation. Rivian IPO price was $78, and the stock was listed as a RIVN symbol on Nasdaq.

Rivian has attracted substantial investment from Amazon and Ford, among others, and aims to become a leader in sustainable transportation.

Rivian Automotive (RIVN) Stock Review

| Stock | Rivian Automotive, Inc. |

| Last Price | $ 13.03 |

| Rank | 741 |

| Market Cap | $ 15.8B |

| 24H Trading Volume | $ 0 |

| Exchange | NASDAQ |

| Open | $ 12.90 |

| Previous Close | $ 12.90 |

| High | $ 13.22 |

| Low | $ 12.87 |

| ATH | $ 179.47 / 2021-11-16 |

| Website | |

| CEO | |

| Total Employees | |

| Industry | |

| Address | |

| City | |

| State | |

| Country | |

| Zip | |

| Phone | |

| Update Time | 2025-10-20 10:08:01 |

Rivian Automotive (RIVN) Stock Price Performance

| Price Change 1H Percent | 0.00% |

| Price Change 1D Percent | 0.00% |

| Price Change 7D Percent | -0.46% |

| Price Change 30D Percent | -9.01% |

| Price Change 90D Percent | -4.89% |

| Price Change 365D Percent | 27.18% |

Rivian Automotive (RIVN) Stock Technical Analysis

Daily Simple Moving Average (SMA) & Daily Exponential Moving Average (EMA)

Date Calculated:2025-10-20

| 3_SMA | $ 13.12 | 3_EMA | $ 13.03 |

| 5_SMA | $ 13.11 | 5_EMA | $ 13.05 |

| 10_SMA | $ 13.13 | 10_EMA | $ 13.20 |

| 20_SMA | $ 14.05 | 20_EMA | $ 13.55 |

| 21_SMA | $ 14.06 | 21_EMA | $ 13.57 |

| 50_SMA | $ 13.57 | 50_EMA | $ 13.66 |

| 100_SMA | $ 13.53 | 100_EMA | $ 13.52 |

| 200_SMA | $ 13.20 | 200_EMA | $ 13.35 |

Weekly Simple Moving Average (SMA) & Weekly Exponential Moving Average (EMA)

Date Calculated:2025-10-20

| 21_SMA_weekly | $ 13.53 | 21_EMA_weekly | $ 13.43 |

| 50_SMA_weekly | $ 12.88 | 50_EMA_weekly | $ 13.34 |

| 100_SMA_weekly | $ 13.38 | 100_EMA_weekly | $ 15.08 |

| 200_SMA_weekly | $ 0.00 | 200_EMA_weekly | $ 0.00 |

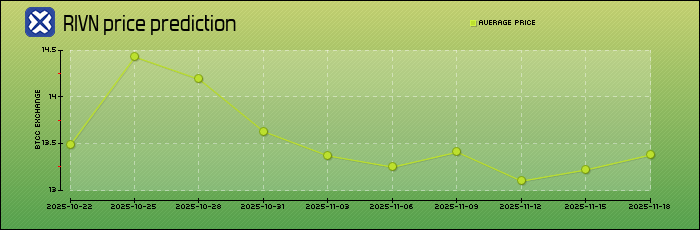

Rivian Automotive (RIVN) Stock Price Forecast for Today, Tomorrow and Next Week

| Date | Price Prediction | Change |

| 2025-10-20 | $ 13.03 | 0.00% |

| 2025-10-22 | $ 13.49 | 3.52% |

| 2025-10-25 | $ 14.43 | 10.74% |

| 2025-10-28 | $ 14.19 | 8.92% |

| 2025-10-31 | $ 13.63 | 4.59% |

| 2025-11-03 | $ 13.37 | 2.61% |

| 2025-11-06 | $ 13.25 | 1.67% |

| 2025-11-09 | $ 13.41 | 2.90% |

| 2025-11-12 | $ 13.10 | 0.50% |

| 2025-11-15 | $ 13.22 | 1.43% |

| 2025-11-18 | $ 13.38 | 2.68% |

Rivian Automotive (RIVN) Stock Price Prediction 2024

The average analyst forecast for Rivian stock is $115.16 in 2024, with potential upside of $154.28. If the value does change, it will likely stay within this range.

But according to one set of projections, Rivian stock will be worth $85 in 2025. Shares of Rivian will be worth $37.28 per share by 2025, according to Nasdaq.

Rivian Automotive (RIVN) Stock Price Prediction 2025

Experts predict that Rivian’s share price will range from $185.34 to $236.45 in 2025. This wide range is informed by the interest of investors and the future demand for electric cars. Keep in mind that the market decides the actual price of a stock, even though some experts have predicted a lower price due to the stock’s lack of aggressiveness.

Rivian Automotive (RIVN) Stock Price Prediction 2030

In 2030, analysts expect Rivian stock to be worth $845. The increasing demand for electric automobiles and other technological developments are expected to lead to a gradual but steady increase in the value of Rivian stock. Share prices, like those of any stock transaction, are subject to rapid and unpredictable changes in response to changes in the market.

Rivian share prices are expected to increase by 50% each year, according to investment analysts. Prominent figures in the field have expressed optimism, and this trend is likely to continue next year.

Rivian Automotive (RIVN) Stock Earnings History

| Report Date | Forecasted EPS | Reported EPS | Last Year’s EPS | EPS YoY Change |

| 2025-08-05 | - -0.65 | - -0.80 | - -1.21 | -33.88% |

| 2025-05-06 | - -0.77 | - -0.41 | - -1.19 | -65.55% |

| 2025-02-20 | - -0.69 | - -0.52 | - -1.36 | -61.76% |

| 2024-11-07 | - -0.96 | - -1.03 | - -1.19 | -13.45% |

| 2024-08-06 | - -1.24 | - -1.21 | - -1.08 | 12.04% |

| 2024-05-07 | - -1.15 | - -1.19 | - -1.25 | -4.80% |

| 2024-02-21 | - -1.39 | - -1.36 | - -1.73 | -21.39% |

| 2023-11-07 | - -1.36 | - -1.19 | - -1.57 | -24.20% |

| 2023-08-08 | - -1.41 | - -1.08 | - -1.89 | -42.86% |

| 2023-05-09 | - -1.51 | - -1.25 | - -1.43 | -12.59% |

Conclusion

Looking ahead to 2030, Rivian’s path seems to be heading in the right direction. Rivian is well-positioned to become a major participant in the electric vehicle market thanks to its forward-thinking management, state-of-the-art technology, and a global demand for environmentally friendly transportation options. Our prediction represents Rivian’s potential for growth and good trajectory, while stock prices are susceptible to many events and uncertainties. Before making any investment selections, it is important for investors to do their research and talk to financial advisors.

FAQs

Is Rivian stock a good investment?

Rivian stock has already plunged 90% from its November 2021 peak of $179.47. It is highly unlikely that the price can have a similar downward rally in the near future. Therefore, I consider Rivian a good investment for at least a short term in anticipation of a relief rally.

Will Rivian stock go up or down?

Based on the predictions provided by CNN, Rivian stock may show an upward movement. However, you should conduct in-depth research before making any decision.

What will Rivian stock be worth in 5 years?

Our Rivian stock price prediction 2025 forecasts that Rivian stock price may be $111.07(low) and $120.79(high) by 2025. Also, the average price may be around $115.93.

Should I buy Rivian stock?

Rivian is a high-risk stock with a speculative outlook. Competition in the EV market will continue to increase, and Rivian needs to prove it can outrun its rivals and manage the growth of its business cost-effectively.

If you believe in Rivian’s vision and consider its technology better than Tesla, then Rivian stock at its current price could be a nice buy. However, the stop loss must be kept under January 2024 low of $15.28. The company will announce its Q4 2022 earnings on 28th Feb. A positive earnings report can send the stock price above $25, however, a significant drop in revenue could make things really ugly.

When can I buy Rivian stock?

You can buy Rivian stock at the current price as it has very little downside but massive upside potential. This provides a great risk-reward ratio, which investors often consider before investing in any stock. Tesla’s current market cap is $597 billion, so Rivian, at $18 billion, seems to be a good buy.

How much is Rivian stock worth?

Rivian stock is worth $19.24 right now. Due to the recent correction in US equities and higher interest rates, Rivian stock has lost 90% of its value in price since its all-time high of $179.47. The current market cap of Rivian Automotive, Inc. is 18 billion. At its peak, the company was valued more than $100 billion. The 2022 Rivian R1S adventure model price starts from $78,000 and the base Explore model costs $72,000.

What is the trading time for Rivian stock?

As mentioned earlier, Rivian stock trades on the NASDAQ stock exchange, which is the second largest exchange in the world. NASDAQ trading hours are 9:30 am to 4:00 pm Eastern Standard Time and no trades on weekends. Rivian is listed on the exchange under the ticker symbol RIVN.

What factors may impact Rivian stock price?

Factors that could impact Rivian stock price include overall economic conditions, changes in consumer preferences and demand for vehicles, competition within the automotive industry, and government regulations related to emissions and safety standards.

Where To Trade Tokenized Stock?

You can trade tokenized futures on BTCC Now. Over 300 USDT-margined perpetual trading pairs are available for users to trade, including many popular altcoins and meme-coins.

You can deposit and receive up to 10,055 USDT now when you sign up and verify your account on BTCC Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

About BTCC

BTCC is a leading cryptocurrency trading platform that is distinguished by its ability to balance the simplicity of use with advanced features. It provides a comprehensive educational program through the BTCC Academy, 24/7 customer support, and robust security to both novices and experts. BTCC is a top choice for digital asset investors due to its emphasis on user contentment, which fosters a secure and informed trading environment across a variety of cryptocurrencies.

BTCC is one of the few exchanges in the market that offers high-leverage options for investors and concentrates extensively on futures trading. Users have access to more than 300 USDT-margined perpetual trading pairs, which encompass numerous prominent altcoins and meme-coins. Additionally, the platform has recently implemented spot trading to facilitate novice users who may not be acquainted with futures trading.

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Scan to download

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*